Cultivating health and wealth

The link between creating healthy habits and building wealth.

Summer is drawing to a close and children are returning to school, which reminds me that time is passing swiftly. The realization has set in that I now have a limited window to accomplish the goals I had set out for this year. Among these goals was an honest intention to enhance my health, which prompted me to read a book on health and longevity.

This book has led me to recognize two pivotal pillars in life: financial prosperity and physical well-being. Despite their significance, these topics often become confusing due to the vast amount of information, advice, and articles that frequently yield conflicting viewpoints.

So, it is not surprising that the recent bestseller “Outlive: The Science & Art of Longevity,” by physician Peter Attia, has garnered significant attention. Attia delves into contemporary scientific investigations related to aging, where he unveils strategies that not only extend lifespan but also enhance overall well-being. Most notably, discernible parallels surface between his discourse on health and the investment philosophy we champion as a firm.

Attia’s insightful observations regarding health encapsulate the following principles:

- The absence of a universal “magic solution,” as individual nuances play a pivotal role – i.e. what works for one does not necessarily work for another.

- The elusiveness of quick fixes – i.e. they never work.

- The proactive approach of prevention almost always outweighs reactive treatment.

In a similar vein, within the investment landscape, we uphold analogous principles:

- Customized investment solutions tailored to individual aspirations and risk profiles supersede one-size-fits-all strategies. The investment plan that yields optimal outcomes is one that resonates with an individual’s unique circumstances.

- “Quick wins” are infrequent and not a sustainable strategy. Historical world stock market average returns have consistently hovered around 10%, yet individual years often diverge considerably from this standard (take 2021 and 2022 for example). Furthermore, harnessing the compounding effect demands a sequential trajectory. Effective investment, akin to cultivating good health, mandates consistent

dedication and adherence over time. An article I wrote in 2019 highlighted the often-overlooked significance of time in markets as a key to investment success and risk management. Both wealth and health are rooted in habits, not mere outcomes. - Investors possess the agency to proactively shape their investment strategy by embracing uncertainty, constructing well-thought-out portfolios, and devising comprehensive plans that encompass a range of potential scenarios. The optimal potential for returns emerges when markets factor in risk and investors embrace it.

In parallel to Attia’s role as a medical interpreter, proficient financial professionals operate additionally as coaches and teachers, translating intricate financial concepts into practical implications for their clients. This process, grounded in empirical evidence and practicality, assumes both scientific and artistic proportions as it adapts to the distinctive needs of each client.

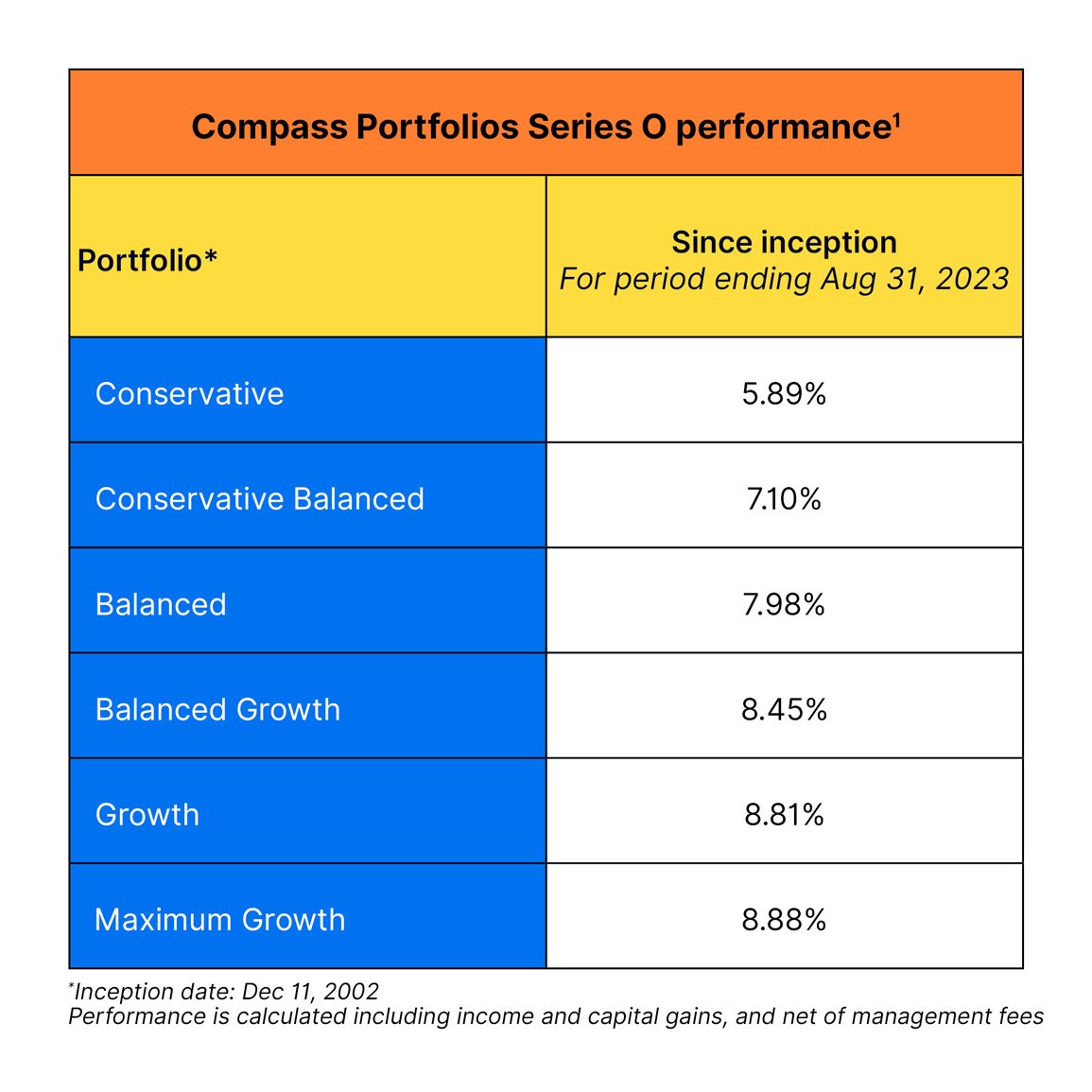

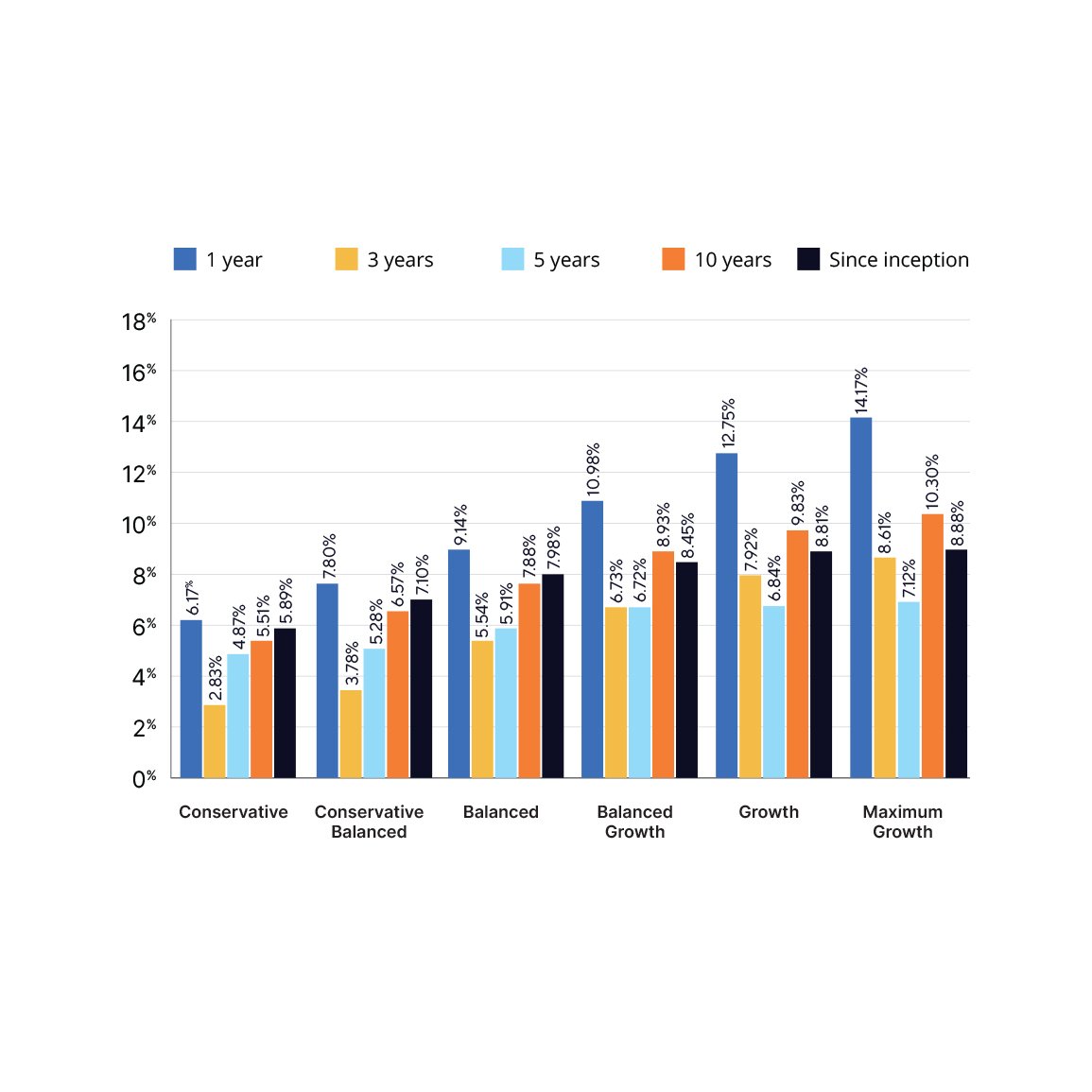

For over twenty years, ATB Investment Management (ATBIM) has been dedicated to constructing portfolios that achieve elevated returns with diminished risk. Despite the challenges posed by market fluctuations, our portfolios have generated compounded wealth since inception.

At ATBIM, our primary objective is to provide clients with exceptional investment experiences and help them attain their objectives. While unforeseen setbacks and events are inevitable, much like in 2022, our hope is that by sharing parallels between what we do and other professions, the clarity surrounding our approach becomes more pronounced, making it easier to feel confident about your financial plan.

As always, we are working hard to preserve and grow your wealth. If you have questions about anything referenced here, or your own portfolio, please do not hesitate to reach out.

1 Compass Portfolios Series O overall performance

Numbers are annualized returns. Performance is calculated including income and capital gains, and net of management fees.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.