Forecasting follies and successful investing

As the latest economic uncertainties—tariffs, trade wars, etc.—rage across the headlines, there is plenty of content being published predicting where the world is headed. Which begs the question—how much effort should we expend on thinking about these forecasts? Or worse, reacting to these events instead of acting on your plan?

Near term forecasting is neither a science nor an artform. Its most successful use is in generating headlines and gaining attention. Its least successful use is in guiding successful investment decision making. One of the most important first principles of investing is defining your investment time horizon. Focusing on the short term (as all too many forecasters do) belies this principle and exposes your portfolio to hazardous risk.

This quote captures this essential fact and the following recent examples highlight it fully.

There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.

In this article we hope to illustrate the inherent risks of the routine forecasts the public is exposed to and then lay out the specific prerequisites for successful investing.

With inflation rampaging at multi-decade highs, many of the world's central banks began a rate hiking cycle commencing in early 2022. In Canada, 10 rate hikes in a year and a half took the Bank of Canada overnight rate from 0.25% in January of 2022 to 5% by July 2023. The almost unprecedented rapidity of these rate hikes globally led to widespread predictions that the global economy would certainly enter into a recession. These headlines were just a couple of examples circulating in late 2022 and early 2023:

How did things turn out in 2023? Well—hardly disastrous. The global economy grew by close to 3% while the S&P 500 total return exceeded 26% and Canada’s S&P/TSX stock index had a respectable return just shy of 12%. It would seem forecasts were not just wrong but wildly pessimistic.3

Enter the Wall Street pros

The average 2024 year end price target for the S&P 500 index by strategists at some of the largest, most sophisticated financial institutions in the world was roughly 4,800 (table below) which would imply a very modest gain of less than 1% in the index (dividends not included). Indeed, even the most bullish of the ten forecasts in the table with a year end price target of 5,100 (for a gain of just under 7%) would prove to be too pessimistic.

Wall Street's predictions for the S&P 500

|

Bank |

2024 year-end target |

|

JPMorgan Chase |

4,200 |

|

Morgan Stanley |

4,500 |

|

Wells Fargo Securities |

4,625 |

|

Jefferies |

4,700 |

|

UBS Global Wealth Management |

4,700 |

|

RBS Capital Markets |

5,000 |

|

Bank of America |

5,000 |

|

Citigroup |

5,100 |

|

Deutsche Bank |

5,100 |

|

Goldman Sachs |

5,100 |

Source: Company reports, FactSet. By The New York Times.

Where did the S&P 500 index end the year? 5,882. In other words, while the average Wall Street strategist forecast was largely for no gain whatsoever in 2024, the index rose a remarkable 23.3%.

But surely, someone out there must have a good track record of forecasting?

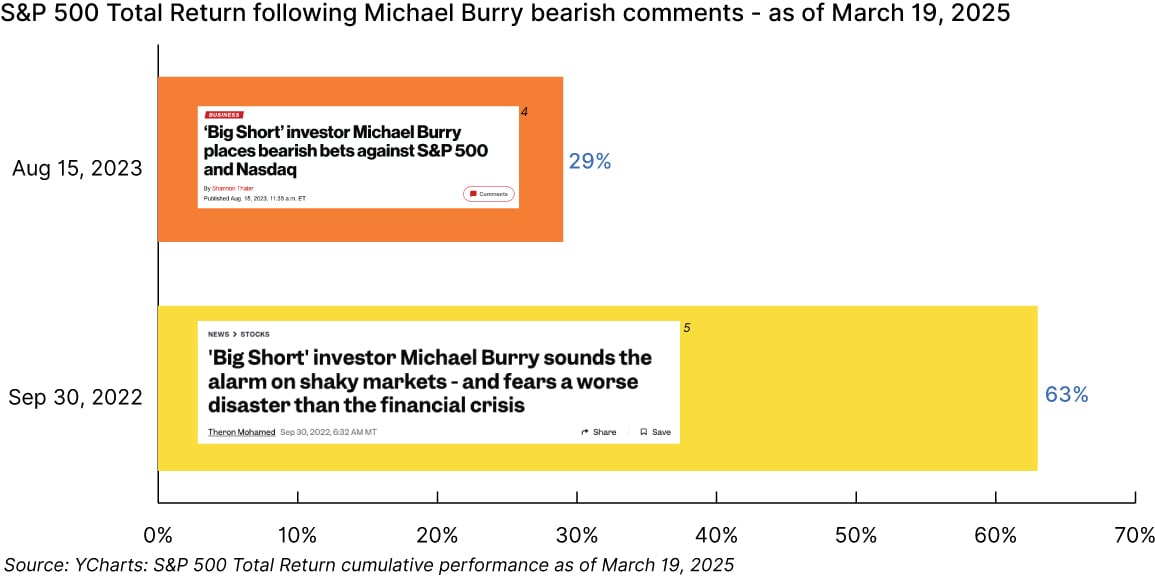

Michael Burry became famous for his prescient call on the sub-prime mortgage collapse that led to what is known as the Great Financial Crisis (GFC) in 2008. To this day, the crisis led to one of the steepest bear markets in history with a decline of 57% in the S&P 500 between its peak in October 2007 and trough in early March 2009. Burry was a central character in Michael Lewis’ best seller, The Big Short, which was also turned into a film of the same name. Not one to rest on his laurels, Burry continued to provide his forecasts over the years, which of course, were covered by major news media. Alas, Burry’s forecasting record since has not been nearly so prescient. As this chart shows, had an investor sold at any one of these two negative calls, they would have missed out on significant gains.

As the saying goes, "a broken clock is right twice a day." In a world where there are likely hundreds if not thousands of forecasts being widely announced, some of them are bound to turn out correct. However, knowing which ones will be correct ahead of time is impossible. History is full of examples of what appeared to be highly prescient forecasters who successfully made a single forecast, only to discover that their future forecasting abilities were less than perfect. Did they really see the future, or were they just lucky?

It should be obvious that no one individual would possess the knowledge to foresee events and their impacts to the global economy and markets. The world is a highly complex, interconnected place, and it is rarely the worries that everyone is talking about that lead to world shaking events. To illustrate this point, consider the World Economic Forum’s Global Risks Report 2020. The report contained this table summarizing the percentage of respondents and the types of risks they were expecting to see increase in 2020.

Source: The Global Risks Report 2020, World Economic Forum

See anything missing? What about a global pandemic brought about by COVID, the millions of deaths, ensuing global lockdowns, and one of the fastest bear markets in history, all starting mere weeks after this report was released.

What’s an investor to do

During many (maybe most) of our client meetings, clients will often ask for our thoughts on:

- Where do you think the market is headed?

- Where is the Canadian dollar going?

- What do you think will happen with the economy if these proposed tariffs go through?

- Is the Bank of Canada done cutting interest rates?

The answers to these, often disappointingly from the client’s perspective, is something along the lines of "I/We just don’t know". We find no shame in that as we are confident no one else does either.

The good news is forecasting ability is not a prerequisite for successful investing. In fact, ignoring all market forecasts will likely lead to improved lifetime returns as following just one incorrect forecast could lead to dramatically lower returns as the Michael Burry example above indicates.

The backbone of our investment philosophy at ATB Investment Management, Private Investment Counsel, is built around the belief that globally diversified portfolios are likely to provide an investor with the highest odds of meeting their financial goals. This is an acknowledgement that we consider the near term future unknowable. After all, if we were certain that Canadian stocks, or US stocks, or bonds or any other asset class, for that matter, were going to provide the highest returns over the next short block of time, we would simply invest in that one asset class. In truth, the best asset mix will always only ever be known in hindsight.

Prerequisites for investing: essential elements

So if the short-term is unknowable, what could investors hang their hat on and what are some of the prerequisites for successfully investing? Likely first on the list would be "faith in the future". While the short-term gyrations of the economy and the markets are unknowable, over the long-term the global economy has proven to be highly resilient. Both the Canadian and US stock markets hit all time highs this year, implying that every crisis in the past, real or perceived, has eventually been overcome. The odds that you can succeed as an investor while always believing that the world is going to "heck in a handbasket" are exceedingly remote. After all, that investor will be scared out of the markets again and again as each new catastrophe appears looming around the corner.

A second prerequisite for successful investing is to avoid trying to time the market. If even the most knowledgeable, sophisticated investors with access to almost unlimited data and computing power can’t accurately forecast the markets, what chance does the average investor have? Market timing, or trying to get out of the market before it goes down and then getting back in just before it turns up, can’t be done. All common sense and evidence points to this leading to the saying "The market timer’s hall of fame is an empty room."

A third prerequisite for successful investing is not being surprised by what the markets do in the short term. It’s when the markets do something unexpected that often leads to making investment mistakes, therefore, surprise becomes the enemy of successful investing. Over the long term the stock market (equities) has been an exceptional way to build wealth and one of the easiest, most accessible ways to harness the power of human ingenuity. But the price for earning long-term returns well above those of bonds and cash, comes in the form of accepting near term uncertainty and volatility. Consider the S&P 500, which over the past 45 years has experienced an average intra-year decline of -14.1% and had positive returns in 34 of those 45 years (75% of the time). Despite the sizeable average intra-year drops and negative returns roughly one in every four years, the annualized returns over that period have been just over 12%.

Or consider our own Compass Balanced Portfolio (O-Series, gross of management fees), which over its 22-year history has experienced an average intra-year decline of -6.8% and had positive returns in 19 of those 22 years. Despite that, this moderate risk portfolio has generated an annualized 8.3% (before fees) since inception. As an investor, seeing your hard earned capital go down in value, however temporary, is never easy. It's ok to feel the fear, just not act on it. And once you learn to not be surprised by the market's actions, it will go a long way in improving your lifetime returns.

Ultimately, for the vast majority of investors, successful investing primarily comes down to the discipline of building a well constructed, properly diversified portfolio, and then sticking to it. In the words of the late Louis Rukeyser, host of Wall Street Week for over thirty years, "Don’t just do something, stand there."

Compass Portfolios - Series O returns net of fees

|

Feb 2025 |

1 year |

3 year |

5 year |

10 year |

|

|

Compass Conservative Portfolio |

0.64% |

10.82% |

5.66% |

6.59% |

5.56% |

|

Compass Conservative Balanced Portfolio |

0.56% |

12.40% |

6.77% |

7.72% |

6.35% |

|

Compass Balanced Portfolio |

0.33% |

13.66% |

7.67% |

9.16% |

7.40% |

|

Compass Balanced Growth Portfolio |

0.02% |

14.13% |

8.42% |

10.10% |

8.20% |

|

Compass Growth Portfolio |

-0.14% |

15.25% |

9.44% |

11.17% |

8.93% |

|

Compass Maximum Growth Portfolio |

-0.22% |

17.21% |

10.77% |

12.91% |

9.56% |

Source: ATBIM

1 Image source: Why a global recession is inevitable in 2023, Zanny Minton Beddoes, The Economist, November 18, 2022

2 Image source: Recession or no recession, Medora Lee, USA Today, June 15, 2023

3 Source: 2023 GDP growth rate: https://tradingeconomics.com/world/gdp. Index data: ATB Investment Management Inc., Bloomberg, FTSE TMX.

4 Image source: Big Short Investor Michael Burry Makes Bearish Bets Against Stock Market, Shannon Thaler, New York Post, August 15, 2023

5 Image source: Big Short investor Michael Burry sounds the alarm on shaky markets, Theron Mohamed, Business Insider, September 30, 2022

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future performance. The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATBSI, ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.