Investing is a journey

Just like a cross-country trip, a long-term approach to investing involves navigating through various market cycles, economic shifts, and unforeseen challenges.

Investing for the long term is akin to embarking on a cross-country road trip. Imagine driving across diverse landscapes, facing changing weather conditions, unexpected detours, and occasional bumps in the road. Similarly, in the investing world, a long-term approach involves navigating through various market cycles, economic shifts, and unforeseen challenges.

In this metaphor for investing, your portfolio is the vehicle that propels you toward your financial goals. Now, consider judging the success of your journey by analyzing the performance of every kilometre rather than evaluating the overall progress toward your destination. If you constantly scrutinize each twist and turn, every rise and fall in the road, you might become anxious and react impulsively to short-term fluctuations.

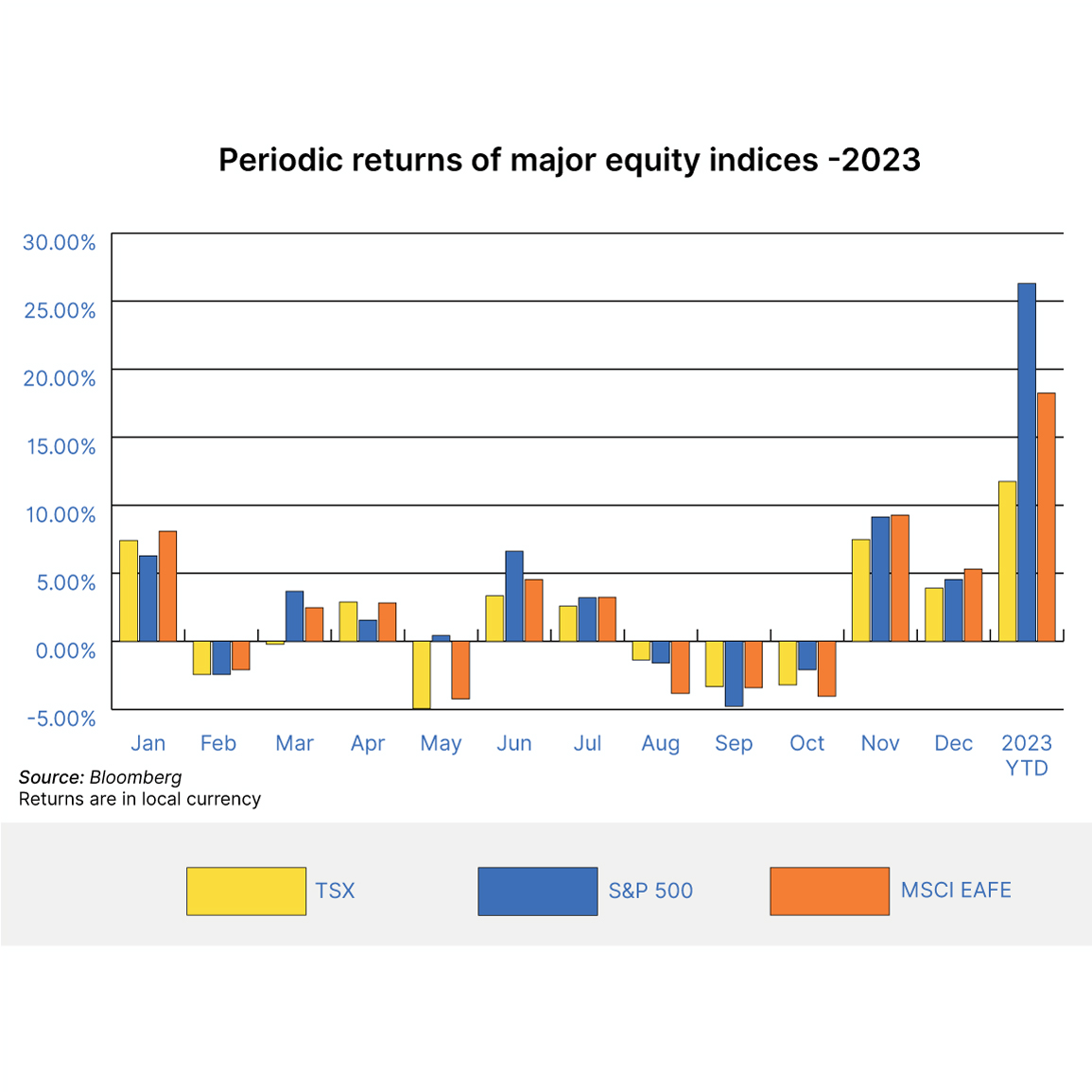

Investors often hope for consistent, positive returns, but the reality is that market returns are rarely a smooth, linear progression. 2023 was a great example of this, with the TSX, S&P 500, and MSCI index generating the most positive returns year-to-date in January and November, respectively.

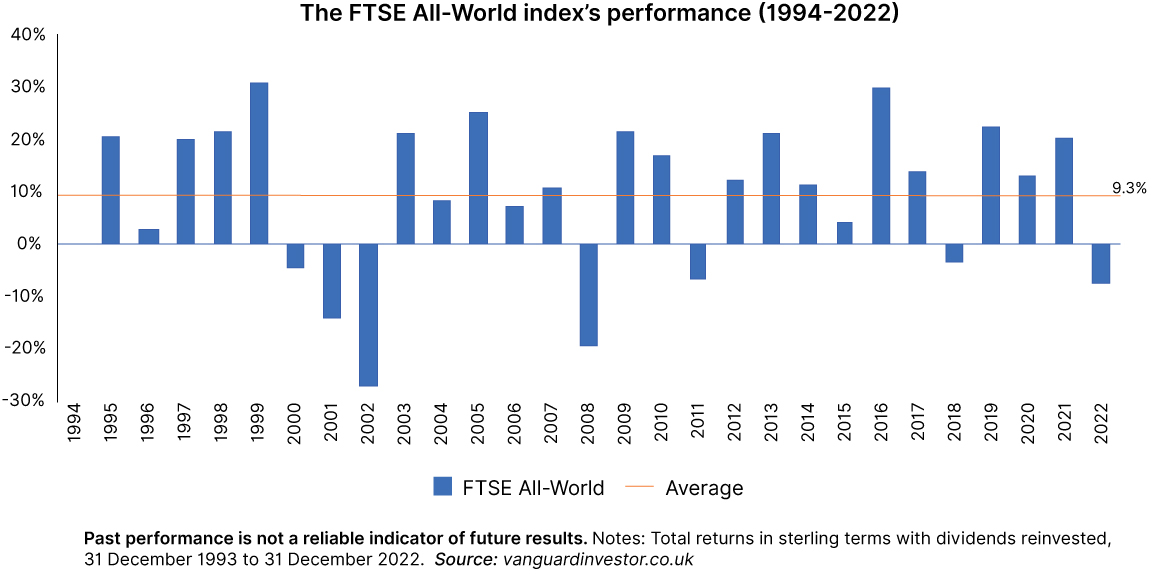

Even over the long term, calendar year returns can deviate significantly from a portfolio's annualized return. The chart below, the FTSE All-World Index (1994-2022), illustrates that calendar year returns are rarely close to the long-term average return in a given year.

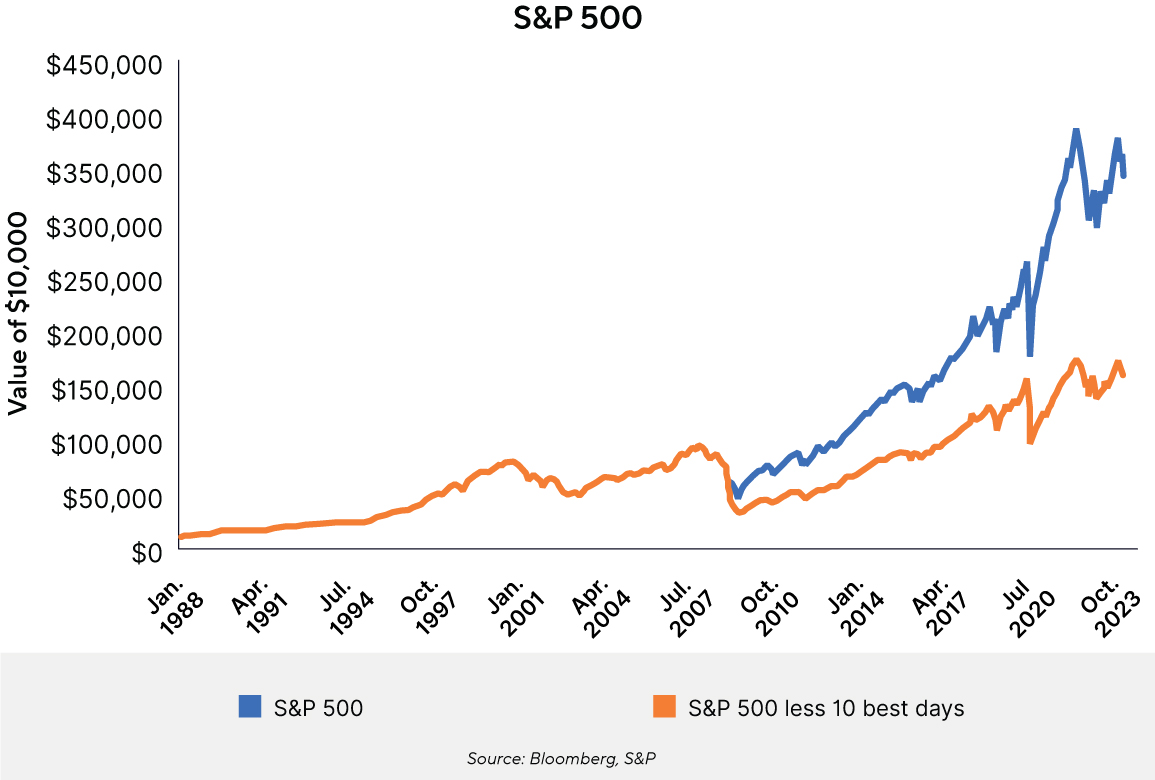

While the lumpy nature of returns is inherent in financial markets, the consequences of missing the best market return days can be profound.

Many of us have been to a new travel destination, where we can witness breathtaking sights every day. However, you can unintentionally bypass the most awe-inspiring sights due to an impulse to fast-forward or take detours.

In the world of investments, the best days in the market are like those breathtaking moments on your journey. These are the days when the market experiences significant upswings, contributing disproportionately to the overall growth of your portfolio.

Consequently, a disciplined, long-term investment approach that remains invested through market ups and downs is crucial for capturing the full benefit of positive market movements.

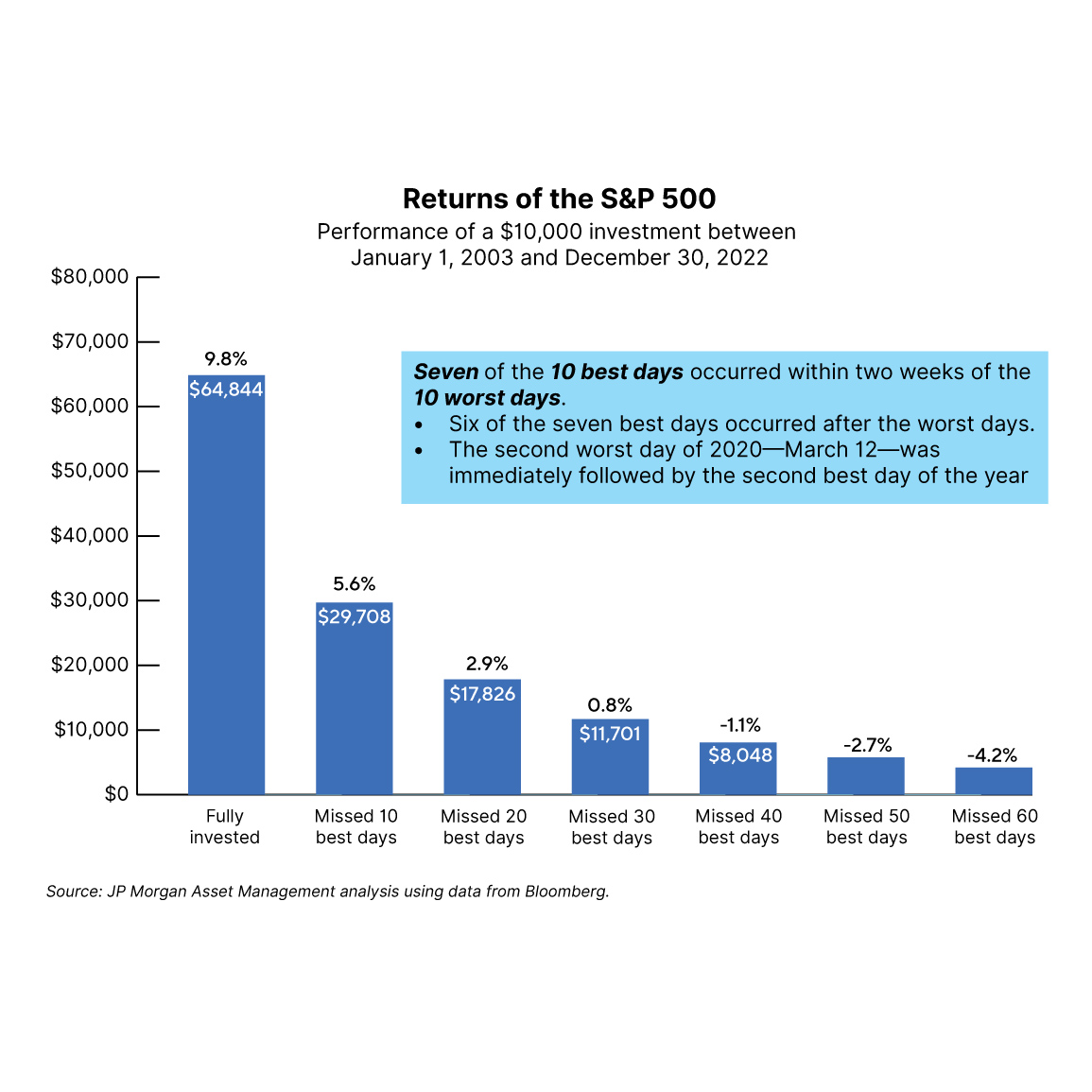

The best market return days are often concentrated in periods of market turmoil, and if you are not invested at this time, you may miss out on substantial gains. Here are a few key points to consider:

Market timing is difficult: Trying to time the market by getting in and out at the most opportunistic times is challenging. Even experienced investors and professionals cannot consistently predict market movements.

Impact on long-term returns: Missing just a few of the best days in the market may notably impact your long-term investment returns. Studies have shown that a substantial portion of market gains are concentrated in a small number of days.

Compounding effects: The power of compounding is crucial for long-term investors. If you miss out on the best days, you lose the potential gains on those days and the compounding growth that would have resulted from those gains over time.

Emotional impact: Trying to time the market can lead to emotional stress and anxiety. Making decisions based on short-term market movements is difficult, and emotional reactions can often result in poor investment choices.

Staying invested for the long term: Generally, a long-term buy-and-hold strategy is more effective for individual investors. By staying invested through market ups and downs, you are more likely to capture the market’s overall growth.

Diversification matters: Diversifying your investments across different asset classes can help reduce risk. Even if you miss out on the best days in one market, you may still benefit from positive performance in other areas of your portfolio.

It’s important to note that while missing the best days can be detrimental to returns, attempting to time the market carries its own risks. Consistency and discipline in your investment strategy, coupled with a focus on your long-term financial goals is the ideal strategy.

The true measure of success lies not in the daily or monthly fluctuations but in the overall progress made over the entire journey. Investors who consistently evaluate their portfolios with a long-term perspective are better equipped to weather the occasional storms, make informed decisions, and ultimately reach their financial destinations with greater confidence and success.

If you have concerns or questions about your investment strategy, it’s advisable to consult with your Investment Counselor, who can provide personalized advice based on your individual circumstances and goals.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.