Longevity pessimism & inflation

Members of our Private Investment Counsel team discuss the impact of these two under-appreciated risks to financial planning.

Ensuring clients have sufficient resources for their lifetime is a principal objective in the financial planning we do for clients. While every client’s situation is unique, inflation and tax efficiency are universal considerations. Life expectancy directly impacts the effects of inflation and tax efficiency over time.

Underestimating longevity

Research shows people tend to materially underestimate their life expectancy, on average by 4.7 years. Clients often push back against planning for ages like 90 or 95, perceiving them as too unlikely.

However, life expectancy actually increases with age:

- For a 70-year-old couple, there's a 50% probability that at least one lives to 94.

- For an 80-year-old couple, a 50% probability extends to age 95.

- For a 90-year-old couple, the 50% probability reaches age 97.

A healthy 65-year-old couple likely has a 30+ year time horizon, with around a 50% chance one lives past 95. The number of Canadian centenarians actually grew by 43% from 2018 to 2022.

Planning only to age 90 or earlier is likely too conservative for most, and could jeopardize later-life financial security. The good news is that you'll probably live longer than you think!

Inflation's impact

As investment counselors with ATBIM Private Investment Counsel, our mission is to protect, preserve, and grow a lifetime’s accumulated wealth on an after-tax, after-inflation basis. The cumulative effect of inflation is a slow but persistent headwind that will erode purchasing power over time. It’s why a $4 cup of coffee today will likely be over $8 in 30 years.

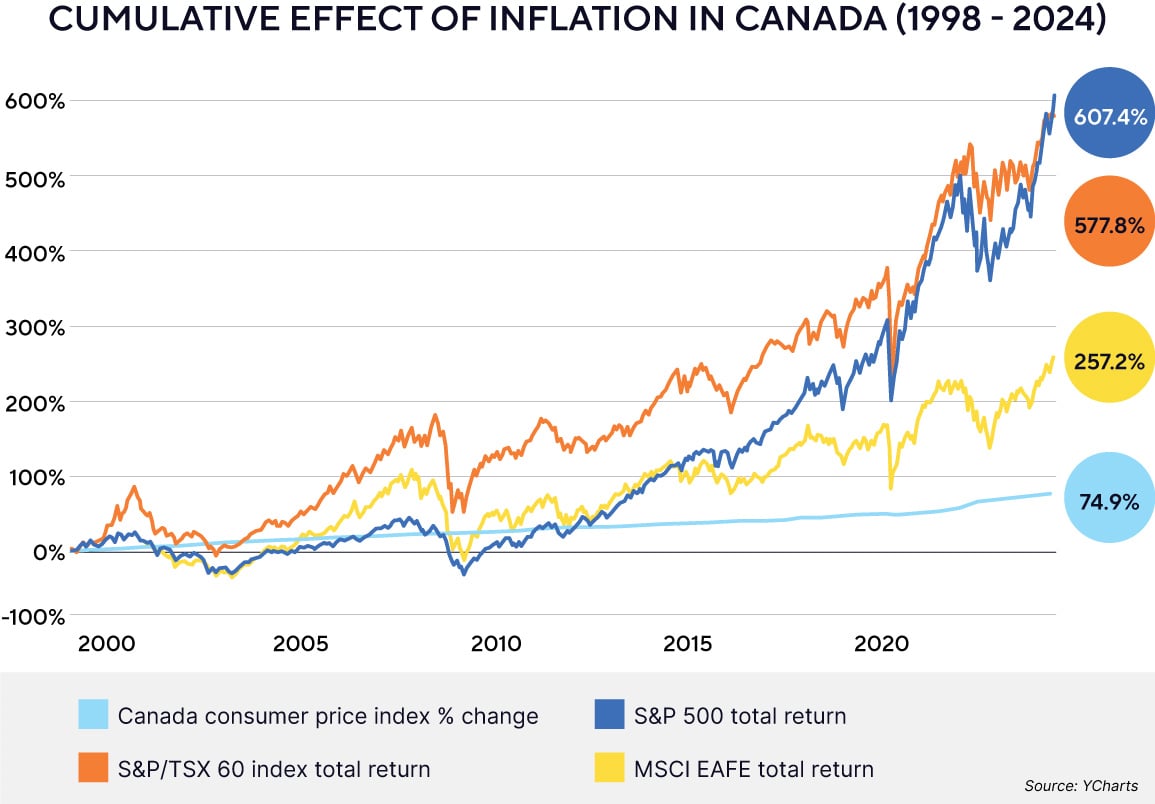

The cumulative effects of inflation from 1998 to2024 in Canada have been significant, as shown here:

The good news is that purchasing power risk can be effectively managed through a well-structured, diversified portfolio strategy.

Tax efficiency matters

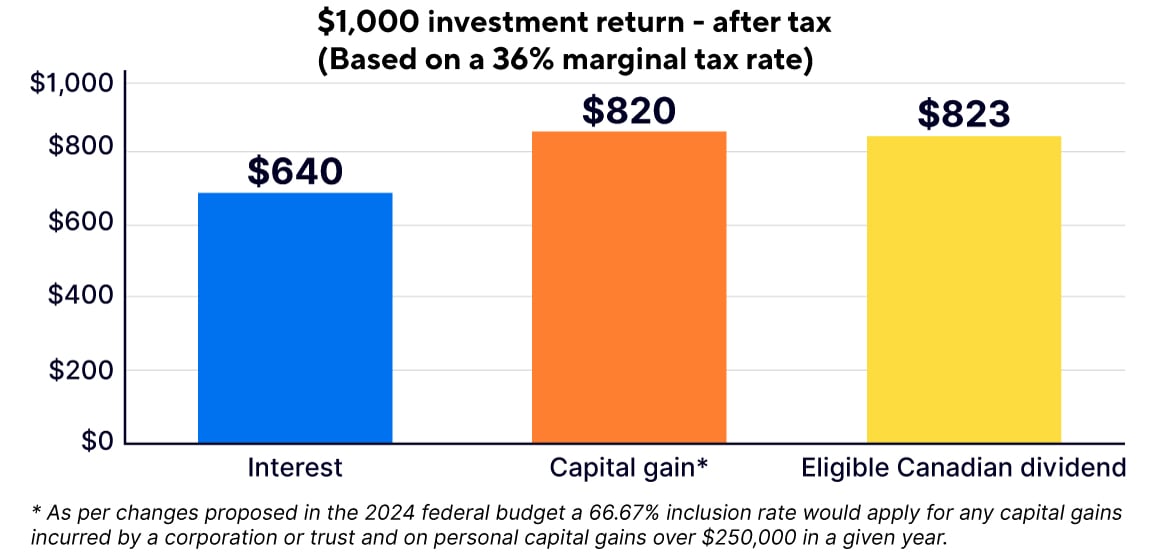

Not all investment income is taxed equally. Interest income is fully taxed at the highest marginal rates, making GICs tax-inefficient despite their recent attractive rates.

Even with the latest changes to capital gains inclusion rates, capital gains and eligible Canadian dividends still receive preferential tax treatment, allowing investors to keep more after-tax income reinvested and compounding in their favour.

Each type of distribution is treated differently for tax purposes, some more efficiently than others as the following chart shows:

Minimizing taxes paid has a major impact on long-term wealth growth, especially over extended time horizons.

Optimal strategy

Our approach constructs diversified portfolios tailored to each client's risk tolerance and goals. The mix of fixed income and equities aims to maximize tax-efficient growth by holding different types of investments that behave differently in different market environments.

This approach serves to protect, preserve, and grow real wealth, after accounting for inflation and taxes, over appropriate multi-decade time horizons.

Conclusion

In summary, longevity risk and inflation are two critical factors that must be accounted for in financial planning. Most people underestimate their life expectancy, so planning too conservatively for longevity can put their long-term financial security at risk. At the same time, the corrosive effects of inflation over long periods of time can significantly erode purchasing power if not mitigated through a well-constructed, tax-efficient investment strategy.

A holistic, tailored approach that maximizes after-tax and after-inflation returns unique to every one of our clients is our specific area of expertise. We help clients ensure sufficient wealth preservation and growth to meet lifelong needs—and it’s a financial plan that drives optimal decision-making to ensure we are proactively addressing longevity pessimism and inflationary forces to achieve long-term success.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

The material in this document is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.