Markets, investing and what matters most: Quarter in review Q1, 2024

The Private Investment Counsel team reviews market performance during the first quarter of the year, looking at how the Compass Portfolio and ATBIS Pools have performed and share a deeper insight into the bond market.

Overview of the quarter

On the heels of a great 2023, global markets continued their upward climb in the first quarter of 2024. Broadly speaking, investors were pleased that corporate earnings remained strong and inflation under control. That being the case, all eyes remain on central banks to see whether they will gradually decrease key interest rates starting this summer.

Year-to-date, the S&P 500 has led the charge with a staggering 13.3% gain. This is the eighth time since 1950 that the US index has posted back-to-back 10% quarters. While driven mostly by the ‘artificial intelligence revolution,’ energy-related names also saw nice gains in the quarter as crude oil prices climbed due to geopolitical tensions and supply constraints. The US economy continues to defy expectations with its robust GDP growth. Policymakers will soon have to decide how much they want to throttle down interest rates without causing the economy to overheat.

The MSCI EAFE Index (representing Europe, Asia and the Far East) rose 8.5% in Q1, with the technology sector also pacing the group. Relative to US markets, international equities remain attractive from a valuation perspective.

Closer to home, key Canadian economic figures remained healthy in the first quarter. Inflation came in below expectations at 2.8% in February. The unemployment rate stood at 5.8% in February, ticking up to 6.1% in March, and population growth was 3.2% on a year-over-year basis—the highest growth rate in decades. The S&P/TSX gained 6.62% in the quarter, with about a third coming from the energy sector.

In the bond market, the first quarter saw yields rise overall and, in turn, slightly push down bond prices in Canada.

A deeper dive into bonds

Central banks sharply increased interest rates between 2022 and 2023 to slow down the rapid increase in inflation stemming from the pandemic and supply chain impacts of geopolitical factors (e.g. the Russian-Ukraine conflict and China’s ‘dynamic zero-Covid’ policy). The spike in rates had the intended effect of dampening economic activity by making borrowing more costly for businesses and consumers. However, it also negatively affected bond returns in 2022 (interest rates and bond prices move inversely).

Fast-forward to 2024, and a reset to a higher level of interest rates means that investors are now enjoying the highest overall bond yields since 2008 (the combination of high coupon rates and implied capital gains from buying bonds under par).

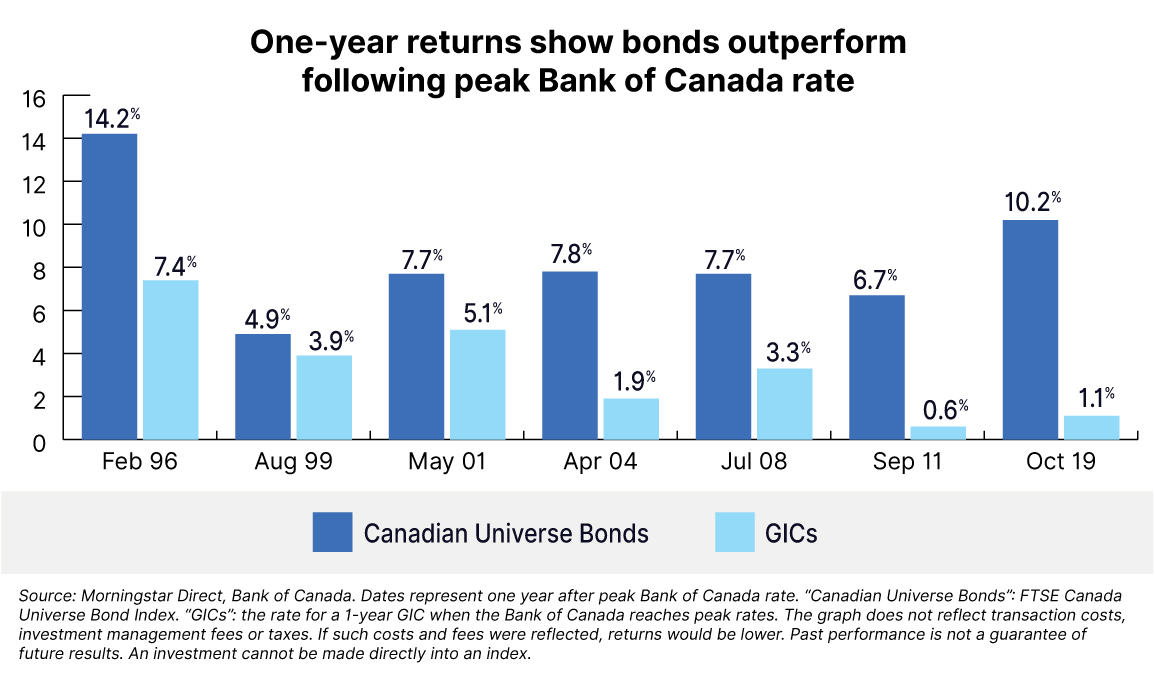

Now that it looks likely that the Bank of Canada will begin to reduce interest rates in the second half of 2024, we thought it would be timely to look at historical evidence of how bonds have performed after interest rate peaks:

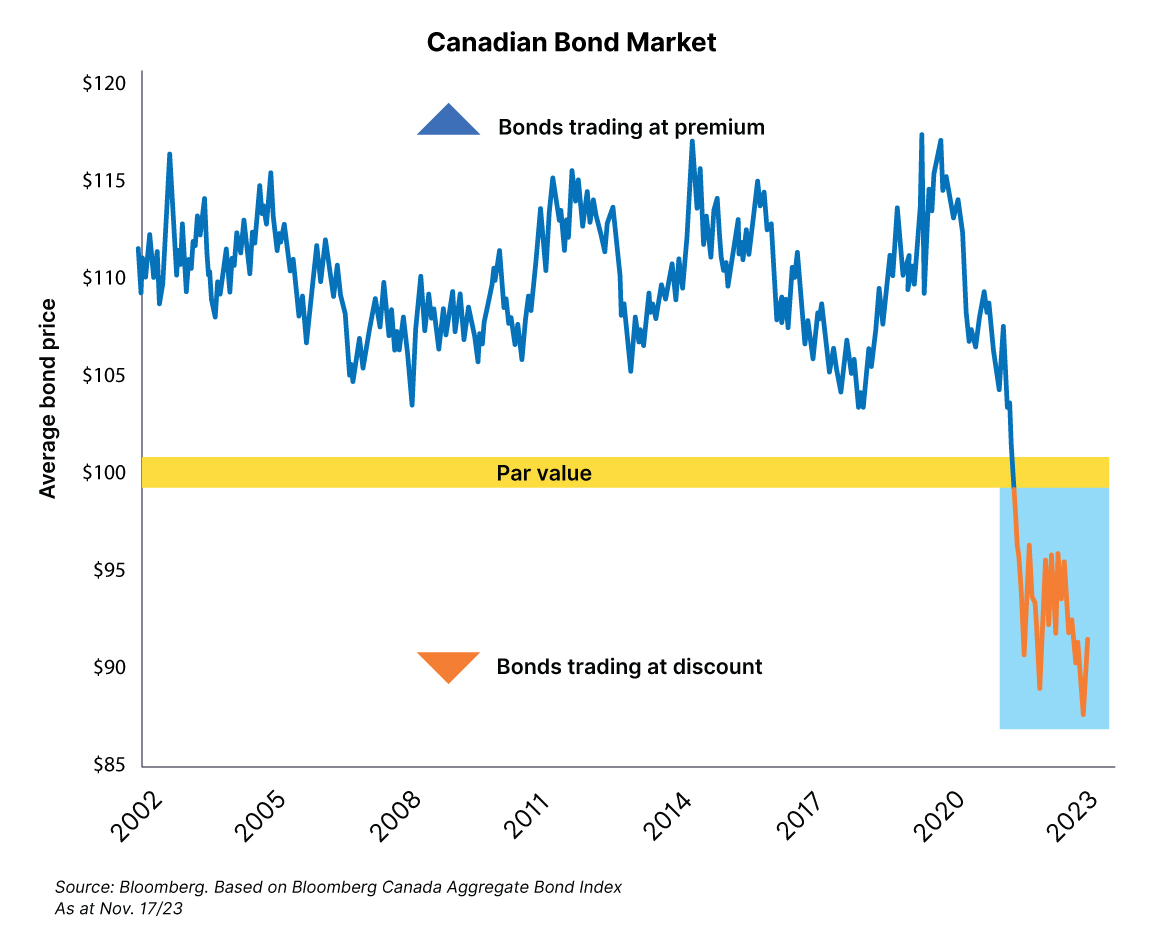

As you’ll see from the chart above, Canadian bonds have typically performed very well in the year following an interest rate peak, especially versus a 1-year GIC. Furthermore, for the first time in decades, most of the bonds on the Canadian bond market are currently trading at a level of discount to par not seen since the 1980s:

So what does this all mean for bond investors?

Firstly, the coupon payments (interest) paid on bonds being issued these days are healthier than they have been in years and will help add to overall bond returns moving ahead.

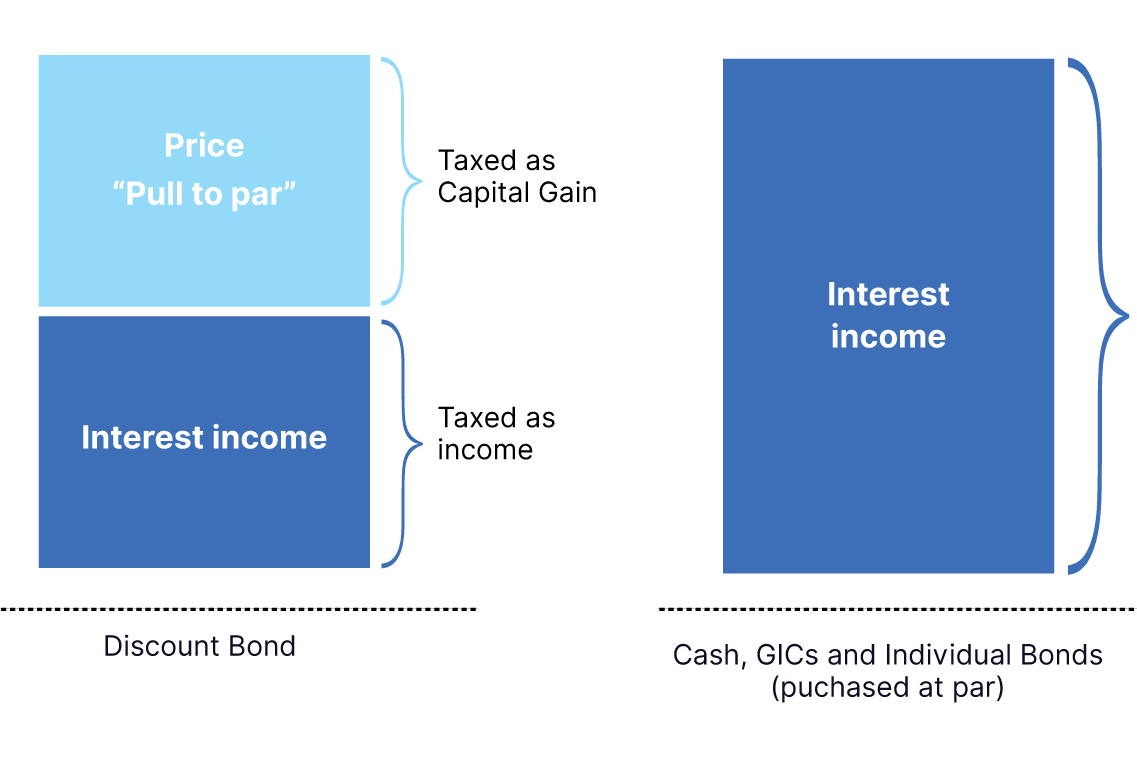

Secondly, with most bonds trading at a discount now and eventually maturing at par ($100), there is an opportunity for investors to earn a more ‘tax-advantaged’ overall return on bonds versus other types of fixed income (cash, GICs and bonds bought at par).

A portion of the overall return on bonds purchased at a discount will be taxed as a capital gain (as the price is ‘pulled to par’ at maturity), with the remaining portion taxed as interest income (the coupon payments):

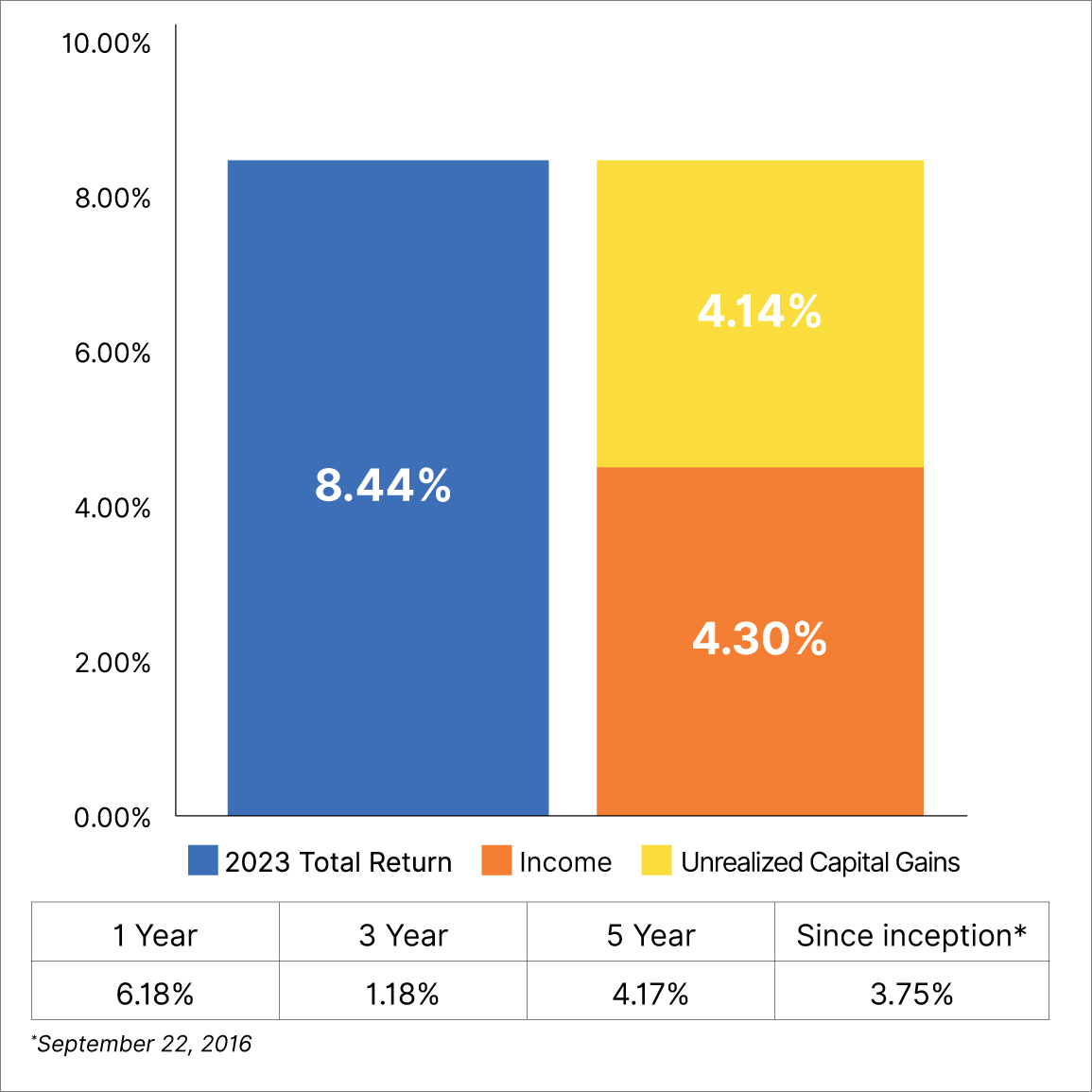

By way of example, as you’ll see from the chart below, the ATBIS Fixed Income Pool enjoyed a bounce-back return of 8.44% in 2023, with 4.14% of it coming from unrealized gains and the other 4.30% coming from interest income.

This attractive environment for bonds is leading to shifts in the asset mix in our client portfolios.

Portfolio positioning

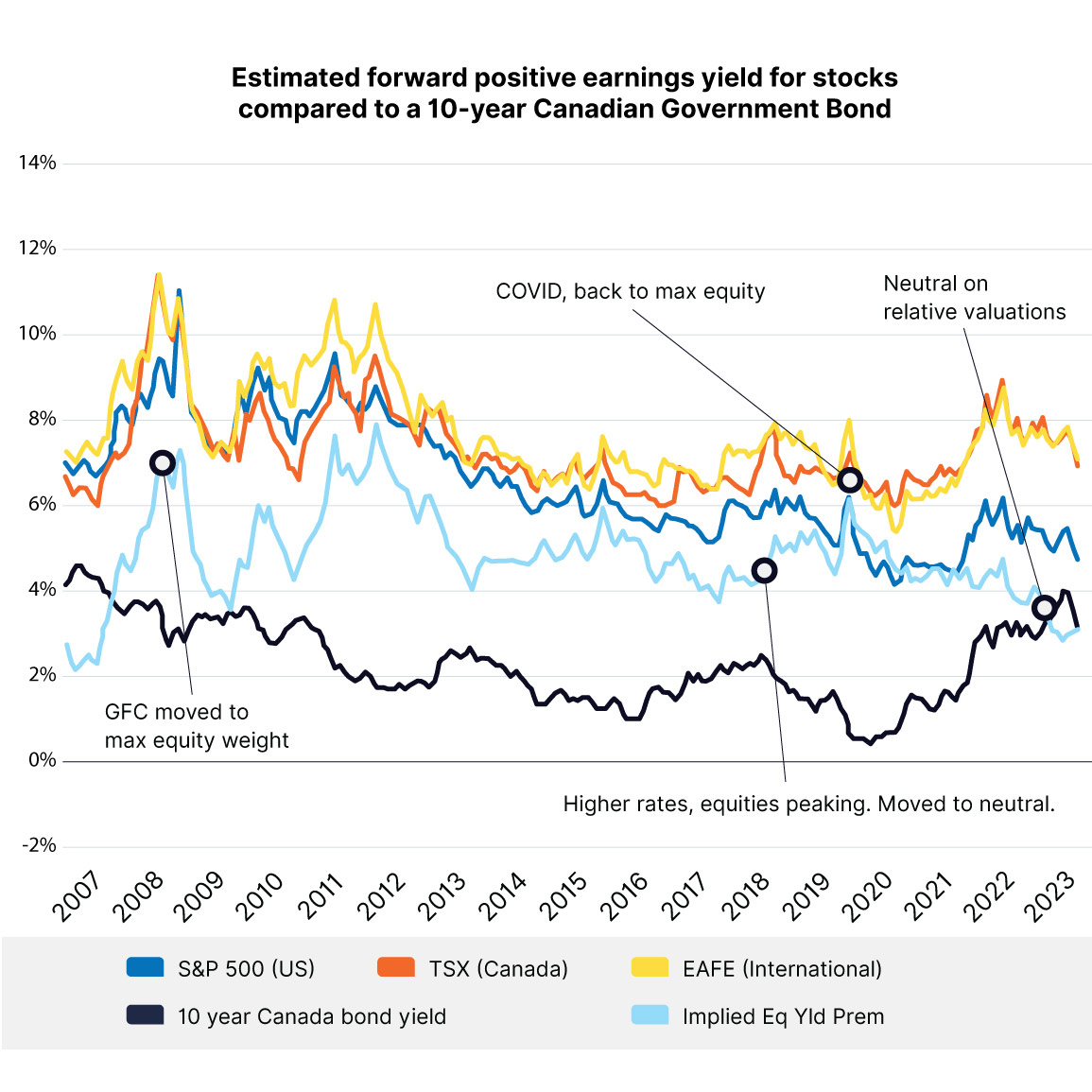

When looking at broad asset class decisions made in the first quarter by ATB Investment Management’s Portfolio Management team, there was very little change on the equity side compared to last quarter. We still favour international, US small- and mid-cap, and Canadian equities on relative valuations relative to US large-cap equities. US large-cap equities continue to become more expensive overall due to tech names like Nvidia. Through the first quarter, we actively rebalanced by reallocating profits from US equities mostly into the fixed income portion of the portfolios.

For our fixed income holdings, overall credit quality improved slightly, with the investment grade weight at its highest since the end of 2019. Interest rates climbed over the past quarter about 0.3%. The blended fixed income holdings continue to have a favourable yield to maturity of roughly 5.7%. Duration extended slightly to 4.5 years and is well situated to take advantage of potential rate cuts through to year-end, where the short and medium rates are impacted the most.

Lastly, a significant change to the US dollar equity hedge was made in the last quarter. For historical context, since 2007, the US dollar exposure through US stocks in the Compass Portfolios has been hedged to some degree—partially due to the erratic nature of currencies during the Global Financial Crisis. Moving forward for the Compass Portfolios, we will be selective in initiating any foreign currency hedges on equity positions—limited to periods when we believe both short- and long-term drivers point to an overvaluation of the foreign currency in question.

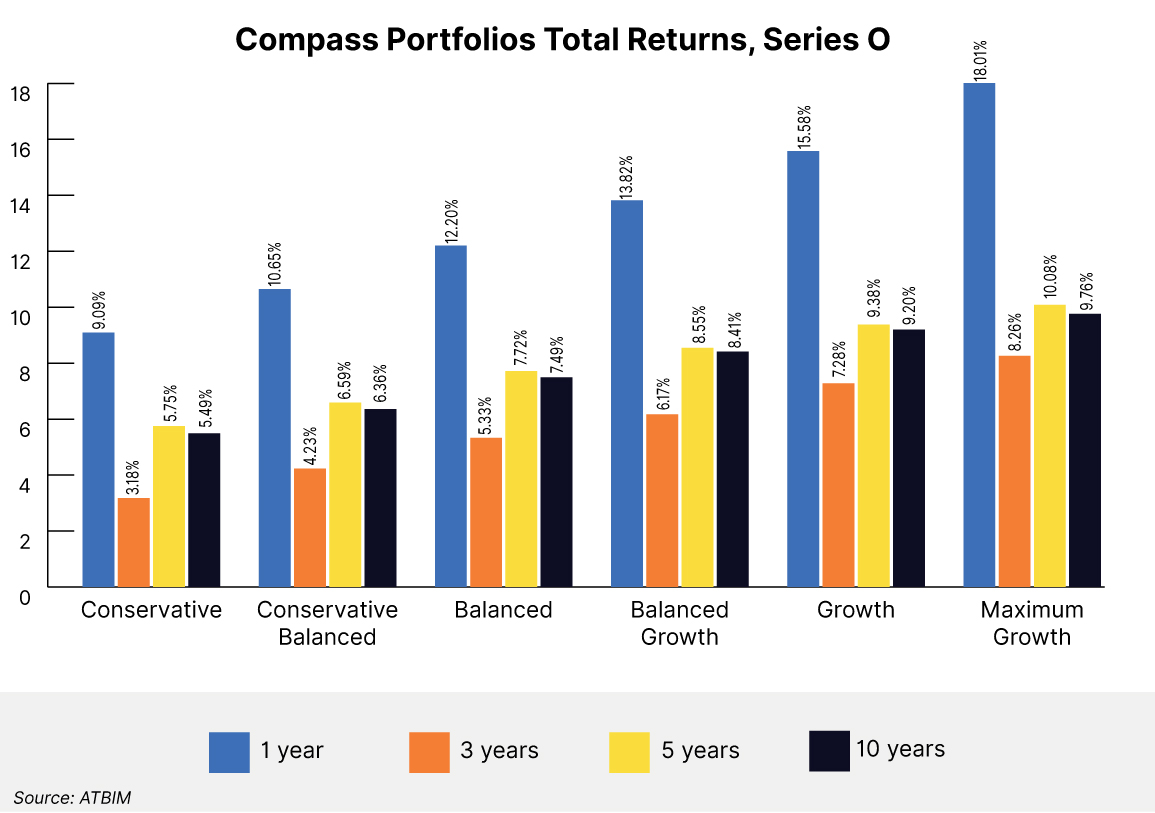

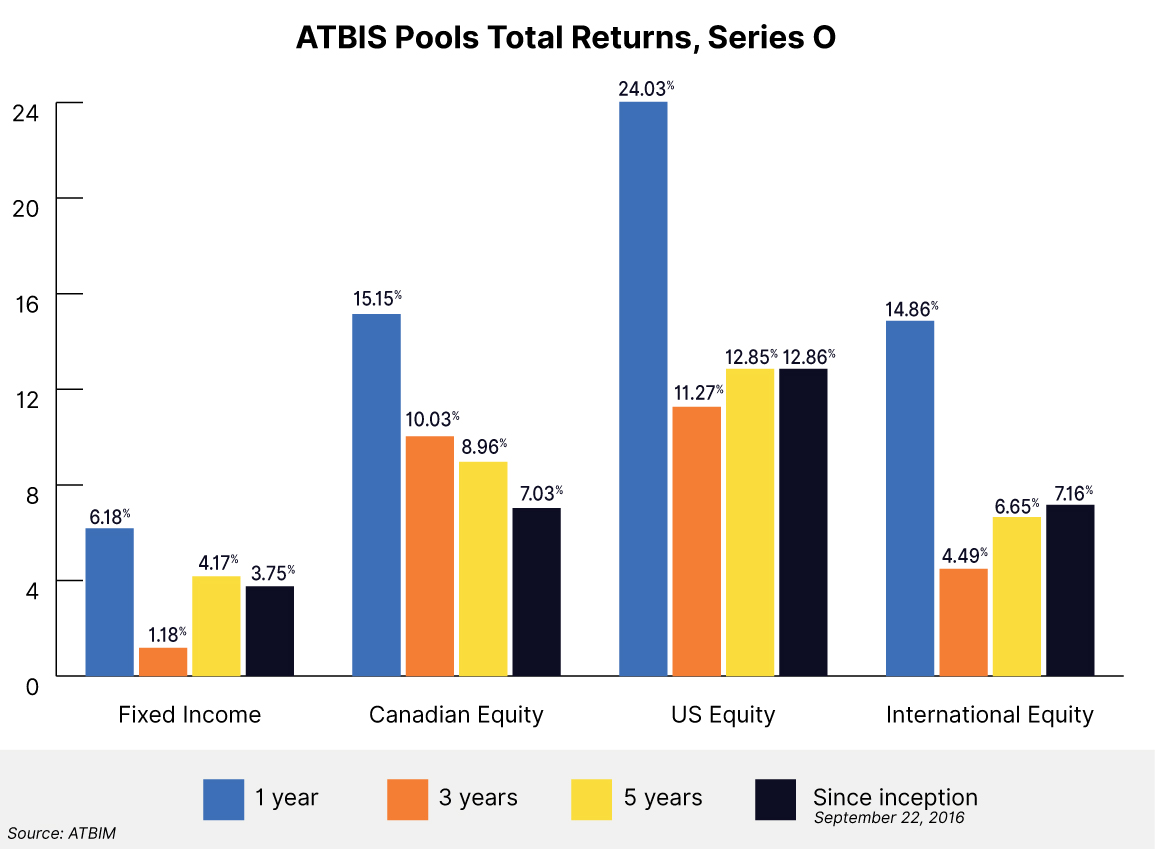

How our fund strategies performed

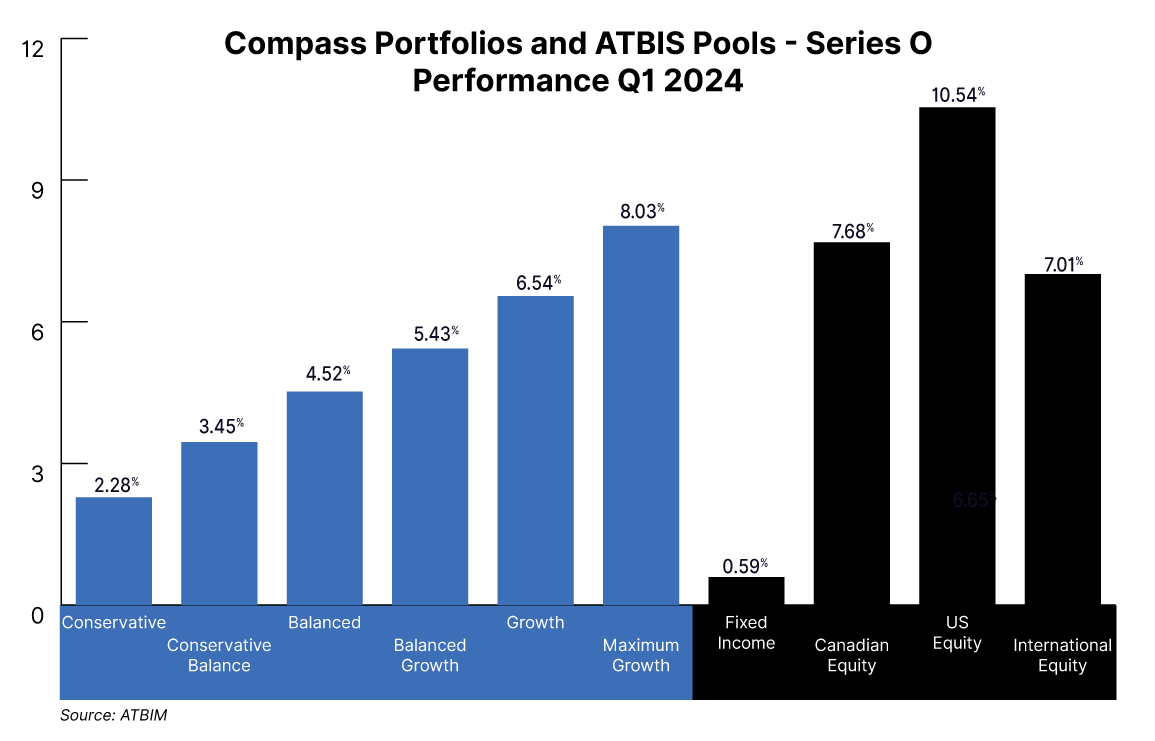

All Compass Portfolios and the ATBIS Pools saw positive performance for the first quarter of 2024. Total returns for the six Compass Portfolios (O-Series) ranged from +2.28% (Conservative) to +8.03% (Maximum Growth). The returns on the four ATBIS Pools ranged from +0.46% (Fixed income) to +10.31% (U.S. Equity).

Gold

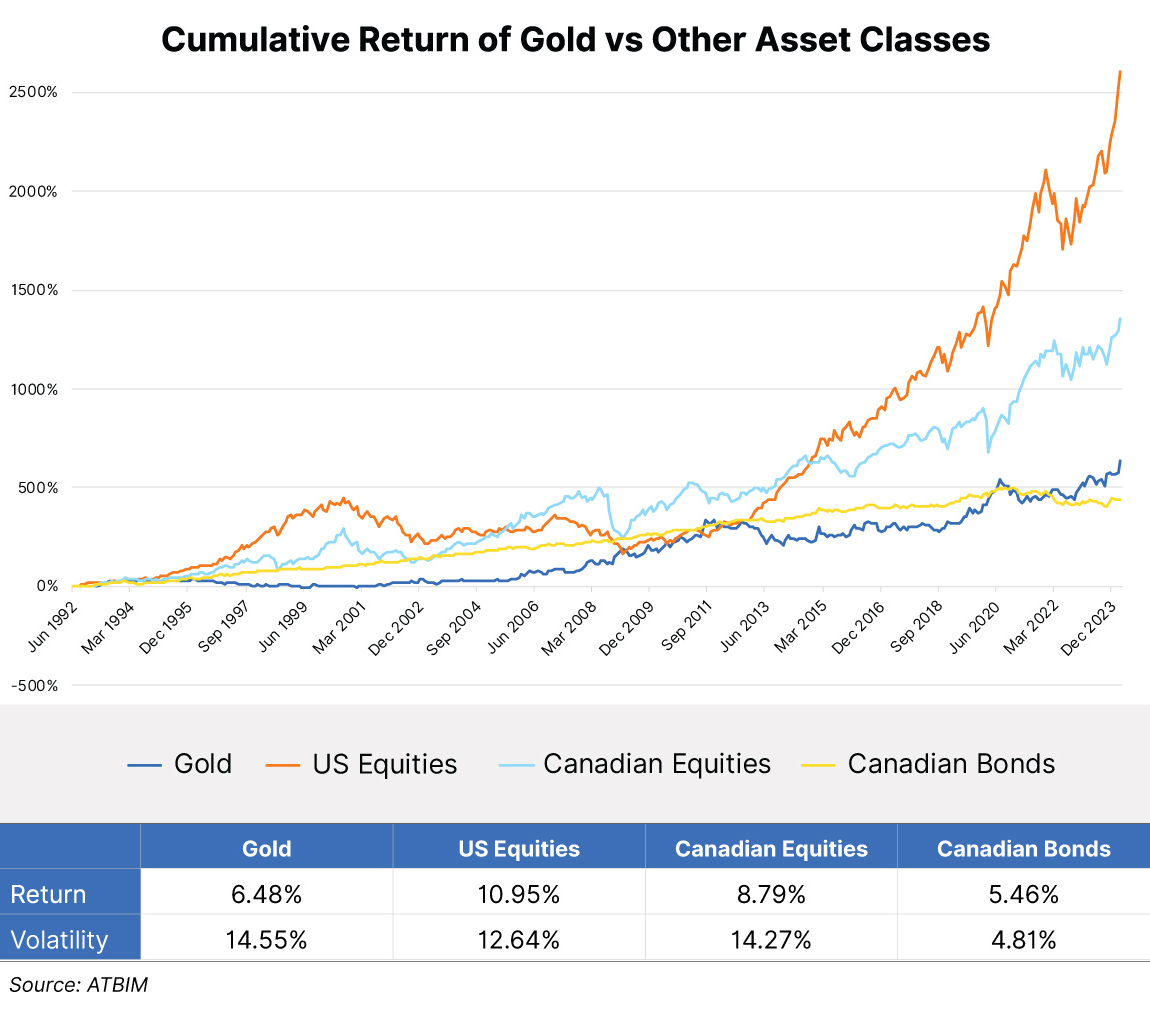

The price of gold recently hit an all-time high, and not surprisingly, there has been substantial buzz about it in the media. As you’ll see from the graph below, the annualized return on gold since 1992 has been approximately 6.5% per year, which exceeds that of long-term bonds.

It’s worth noting, however, that the historical volatility in the price of gold is over three times higher than that of bonds and slightly higher than that of Canadian and US equities. While often touted as a hedge against inflation and a store of value during turbulent times, it was striking to see that the price of gold barely budged between 2020 and 2022 - one of the most uncertain times in decades.

In contrast, the return profile and lower bond volatility add a very crucial element to portfolios. Not only do they provide ongoing steady income (unlike gold), they historically have a low correlation to the movement of stocks. During market corrections, investors can rebalance their portfolios by trimming their bond holdings and buying temporarily mispriced stocks—something that is much more difficult to do with physical gold.

Remembering Dr. Daniel Kahneman

Our Private Investment Counsel team would be remiss if we did not recognize the recent passing of a pioneer and legend in the investment industry. Winner of the 2022 Nobel Prize for Economics, Dr. Daniel Kahneman’s most famous work was his 2011 pop psychology book ‘Thinking, Fast and Slow’ - a groundbreaking view on understanding how humans (and investors) are susceptible to irrational biases. He and his research partner, Amos Tversky, were later profiled in Michael Lewis’ 2016 blockbuster book ‘The Undoing Project’. He will be greatly missed for his contributions to the fields of psychology and behavioural finance. RIP.

For your interest

Morgan Housel, author of team favourite ‘The Psychology of Money’ recently came out with his latest work called ‘Same as Ever: A Guide to What Never Changes’. Highly recommended and very entertaining.

‘Plain English’ with host Derek Thompson released a podcast episode on April 2nd entitled ‘What Evolutionary Biology Can Teach Us About Diet, Exercise and Staying Alive’. The guest is Harvard evolutionary biologist and author of ‘Exercised’, Daniel E. Lieberman. A great review of how diet and exercise have evolved since the days of our hunter-gatherer ancestors and how to build life-enhancing habits in an increasingly digital and automated world.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.