Markets, investing and what matters most: Quarter in review Q1 2025

The Private Investment Counsel team reviews market performance during the first quarter of the year, looking at how the Compass Portfolio and ATBIS Pools have performed.

The economic landscape of the first quarter of 2025 presented a tale of two phases. January started on a positive note for many markets, but this optimism was largely overshadowed by the escalating trade tensions and the implementation of new tariffs by the United States as the quarter progressed.

Positive Start in January

- US markets: January saw a strong start for US equities. The Dow Jones Industrial Average rose significantly, followed by solid gains in the S&P 500 and the Nasdaq Composite. Investor sentiment was buoyed by a relatively healthy job market and some signs of moderating inflation data from the previous month. There was also optimism surrounding the initial phases of the new administration's economic policies.

- Global markets: Many global equity markets also experienced positive returns in January, with developed international markets showing particular strength. This suggested a broad-based positive sentiment at the beginning of the year.

Escalating Trade Tensions and Tariffs (February and March)

- US markets: The positive momentum from January reversed as the Trump administration aggressively implemented new tariffs on key trading partners. This sparked fears of a global trade war, leading to significant market volatility and a stock market correction that erased the earlier gains.

- Canadian markets: Canada faced direct negative consequences from US tariffs, which weakened business and consumer sentiment. The Bank of Canada responded to rising economic risks by lowering its key interest rate.

- Global markets: The US trade policies had a widespread negative impact, increasing uncertainty and volatility. While January saw positive performance in some areas, the subsequent trade developments led to concerns about disruptions to global trade and supply chains, overshadowing the initial optimism.

For more insights on Tariffs, please visit the following ATB website.

Keeping a long-term view

When markets decline quickly and uncertainty is high, it might be tempting to sell to stem further losses. You might think, “I’ll sit out until things get a bit better.” But by the time markets are less volatile, you’ll have often missed part of the recovery.

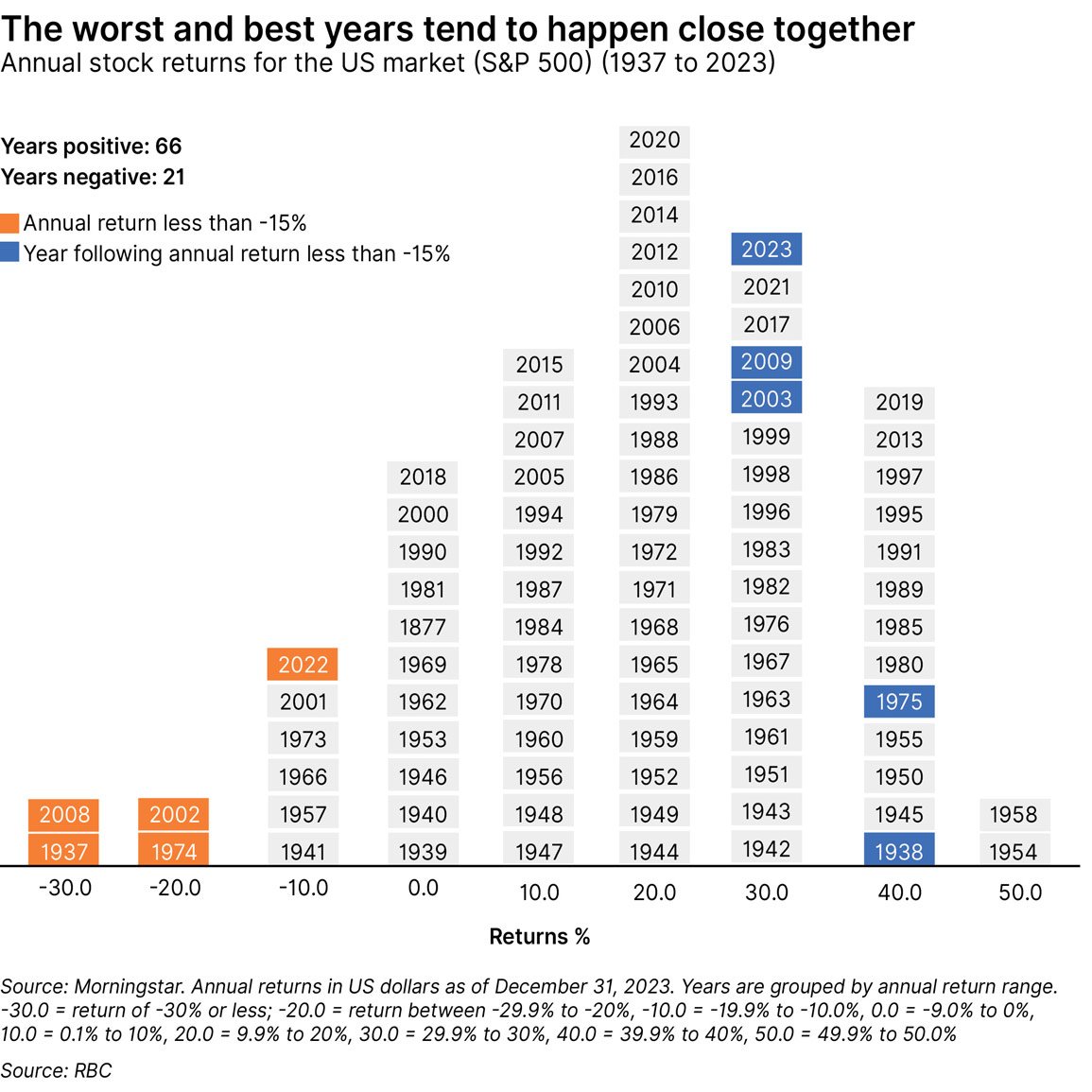

"Buy low, sell high" is hard to do in reality, even for experts, because emotions often get in the way. History shows the stock market tends to rebound quickly. The following chart shows the yearly returns of the US stock market from 1937 to 2023. The chart colours shows:

- Orange years - years that had a return less than -15% (which are record lows).

- Blue years – the year following an orange year (which have delivered some of the highest returns in the market).

Key Takeaways

- Staying invested usually pays off: The S&P 500 has had many more positive years than negative ones.

- Bad years are often followed by strong rebounds: In the span of 20 years, if the S&P 500 dropped by -15% at any time during the year, the following year's annual returns were never negative (average +30%).

- Small losses are typically recovered quickly: When the market has a small loss (-10% or less), it usually recovers fully the next year (average +14%).

Reminder

If deciding to take more risk in downturns to be opportunistic, it’s important to adhere to your predetermined risk tolerance or make sure it fits your investment objectives

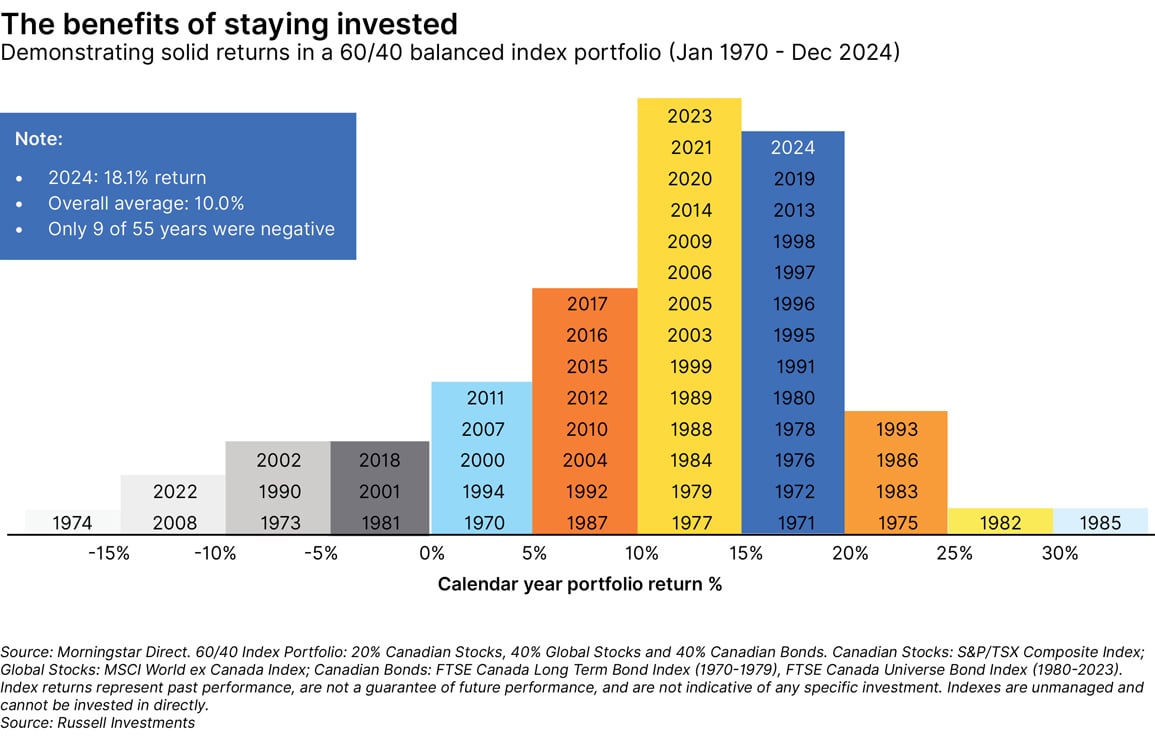

The historical tendency for the S&P 500 to recover swiftly following downturns underscores the importance of staying invested. This principle of resilience is further demonstrated when examining a more diversified approach, such as a balanced portfolio consisting of 60% equities and 40% fixed income. Over the past 55 years, a balanced 60/40 stock and bond portfolio has been profitable in 84% of the years. Even the worst loss years (like 2008 and 2022) were followed by strong gains.

How our funds performed

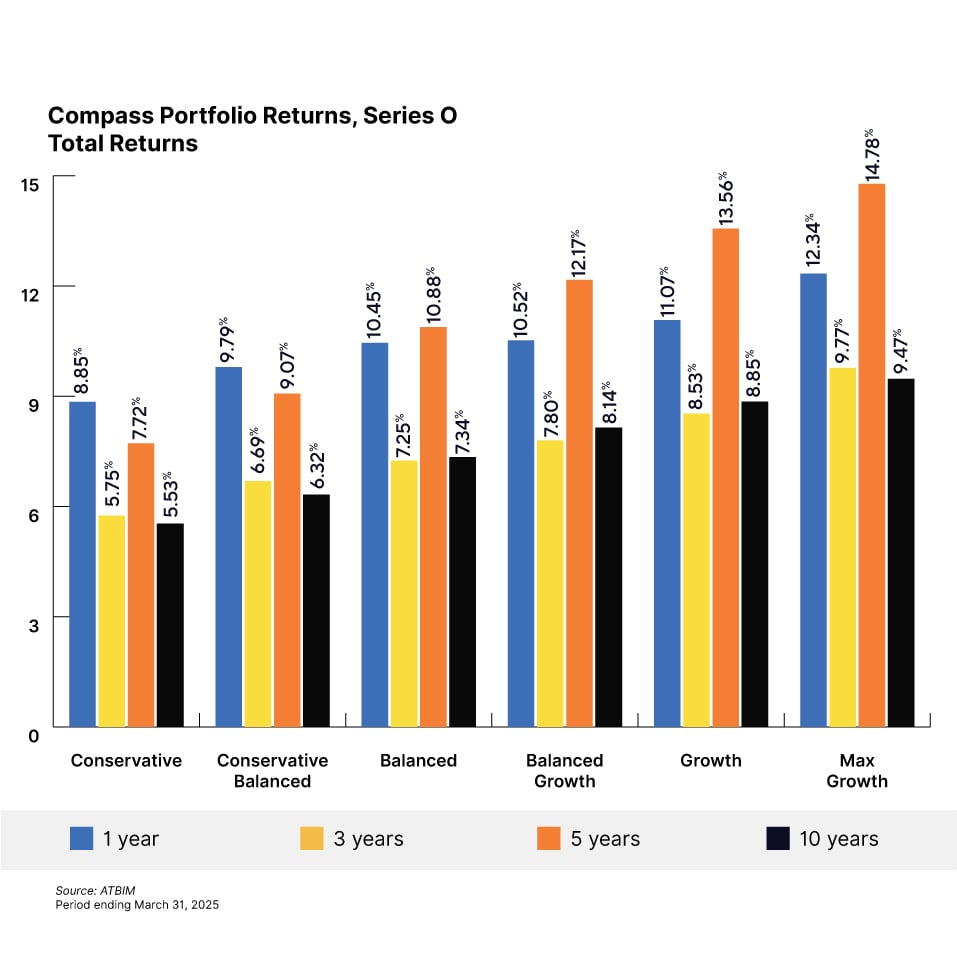

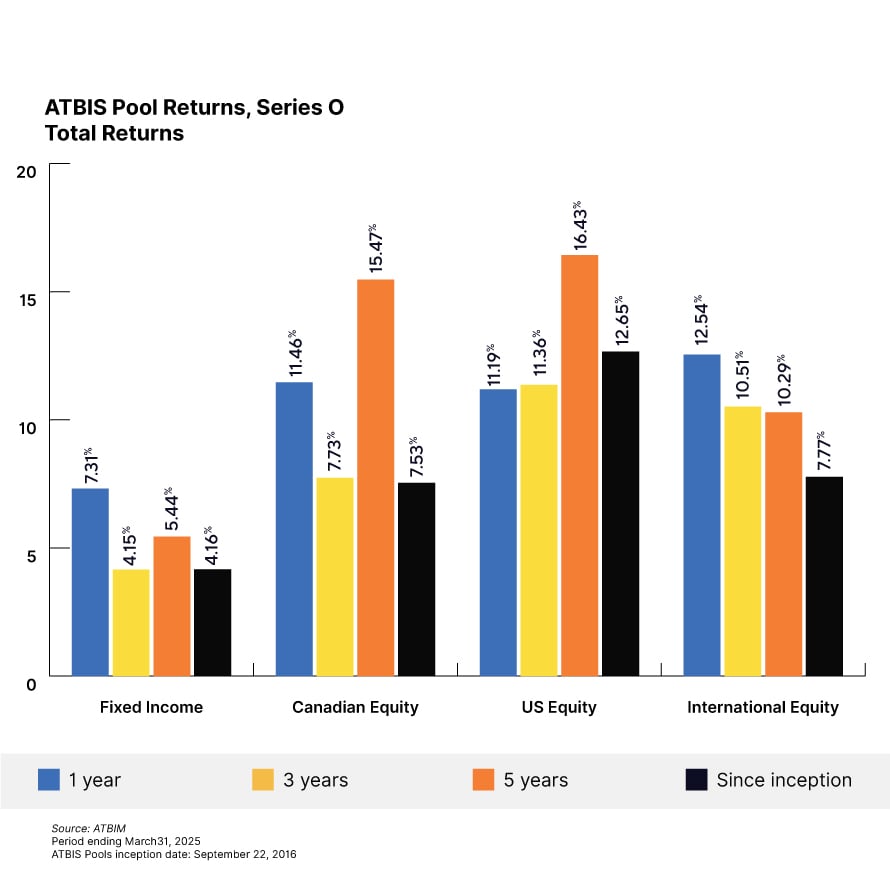

Against the backdrop of a challenging first quarter, the Compass Funds achieved notable results. All the Compass Portfolios delivered positive returns, ranging from 1.83% to 3.34%. The ATBIS pools, while more varied, also saw a significant range of performance, from -0.99% to a high of 7.9%.

Please see the charts below for a full breakdown of ATB Compass Portfolios and ATBIS Pools performance.

Conclusion

Despite a positive start to the quarter, we expect continued volatility in 2025 but believe staying invested is important. Market downturns are temporary and a long-term focus is key. Strong company financials and attractive valuations offer future growth potential. We're confident our portfolios are built to handle volatility and meet long-term goals. Please contact your Investment Counselor if you have any questions.

What we’re reading, watching and listening to

In this episode, Calgary-based portfolio manager Peter Lampert discusses international equities and tariff impacts, explaining his team's proactive strategy of favoring domestically-focused companies with strong management and exiting trade-dependent positions, while also offering insights on navigating market volatility and finding unexpected positives related to tariffs.

***

Saying goodbye to Canada’s oldest company. Here is a timeline of the Hudson's Bay Company's History And Insolvency proceedings.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

The material in this document is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.

© 2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.