Markets, investing and what matters most: Quarter in review Q3 2024

The Private Investment Counsel team reviews market performance during the third quarter of the year, looking at how the Compass Portfolio and ATBIS Pools have performed.

Interesting fact

Saturday October 12, 2024 marked the official two-year anniversary of the bull market that started two years prior.

This bull market might be two, but it is still young.

S&P 500 bull markets (1950-current)

|

Bear market bottom |

Bull market peak |

S&P 500 change |

Years |

Bull start in October? |

|

Jun 13, 1949 |

Aug 2, 1956 |

267.1% |

7.1 |

No |

|

Oct 22, 1957 |

Dec 12, 1961 |

86.4% |

4.1 |

Yes |

|

Jun 26, 1962 |

Feb 9, 1966 |

79.8% |

3.6 |

No |

|

Oct 7, 1966 |

Nov 29, 1968 |

48.0% |

2.1 |

Yes |

|

May 26, 1970 |

Jan 11, 1973 |

73.5% |

2.6 |

No |

|

Oct 3, 1974 |

Nov 28, 1980 |

125.6% |

6.2 |

Yes |

|

Aug 12, 1982 |

Aug 25, 1987 |

228.8% |

5.0 |

No |

|

Dec 4, 1987 |

Mar 24, 2000 |

582.1% |

12.3 |

No |

|

Oct 9, 2002 |

Oct 9, 2007 |

101.5% |

5.0 |

Yes |

|

Mar 9, 2009 |

Feb 19, 2020 |

400.5% |

11.0 |

No |

|

Mar 23, 2020 |

Jan 3, 2022 |

114.4% |

1.8 |

No |

|

Oct 12, 2022 |

Sept 30, 2024* |

61.1% |

2.0 |

Yes |

|

|

Average |

180.7% |

5.5 |

5 of 12 Started October |

|

|

Median |

107.9% |

5.0 |

|

Source: Carson Investment Research, Y Charts Dec 7, 2024

*Most recent new all-time high was on Sept 30, 2024

Economics

Interest rate cuts were a major focus in Canadian markets, as the Bank of Canada (BoC) reduced its overnight rate by 0.25% in both July and September, bringing it down to 4.25%. The markets expected these cuts due to a steady decline in core and headline inflation, with the latter hitting 2% in August, close to the BoC’s target. While these cuts are designed to curb inflation, they may also fuel rising housing prices, potentially negating the benefits of lower mortgage payments. The Canadian economy continues to grow, though GDP per capita is declining as population growth outpaces economic activity, contributing to higher shelter costs.

In the US, the markets focused on how economic data would affect the Federal Reserve’s (Fed) rate decisions. Unlike Canada, the US economy has shown more persistent growth, with unemployment rising due to new workforce entrants rather than job losses. This prompted the Fed to cut its overnight rate by 0.5% in September, bringing it to 5%. The Fed’s future rate path remains uncertain in magnitude, though the direction is clear. Both the BoC and the Fed are dealing with rising shelter costs, but the US faces a more complex scenario due to its stronger economic growth.

Markets

Equity markets saw a shift from mega-cap AI stocks to small and mid-cap equities, particularly in the US, following favourable inflation data. The S&P 500’s equally-weighted index outperformed its capitalization-weighted counterpart by over 3%, as sectors like utilities and real estate—more sensitive to interest rates—outperformed, with returns of 17% and 19%, respectively. Despite a selloff in July caused by the unwinding of the Japanese yen carry trade, markets recovered, and most major developed markets ended the quarter on a positive note.

In Canada, equities outperformed their global peers, led by financials and materials stocks, which benefited from falling interest rates and rising gold prices. However, small-cap stocks underperformed compared to large-cap stocks, and consumer discretionary stocks faced challenges due to significant earnings declines in auto and leisure products. International equities, particularly in the UK and Asia (excluding Japan), also performed well, driven by strong earnings growth, although the Japanese market faced some turbulence from currency fluctuations. Overall, US holdings benefited from the shift away from mega-caps, while international stocks remained attractive due to their relative undervaluation.

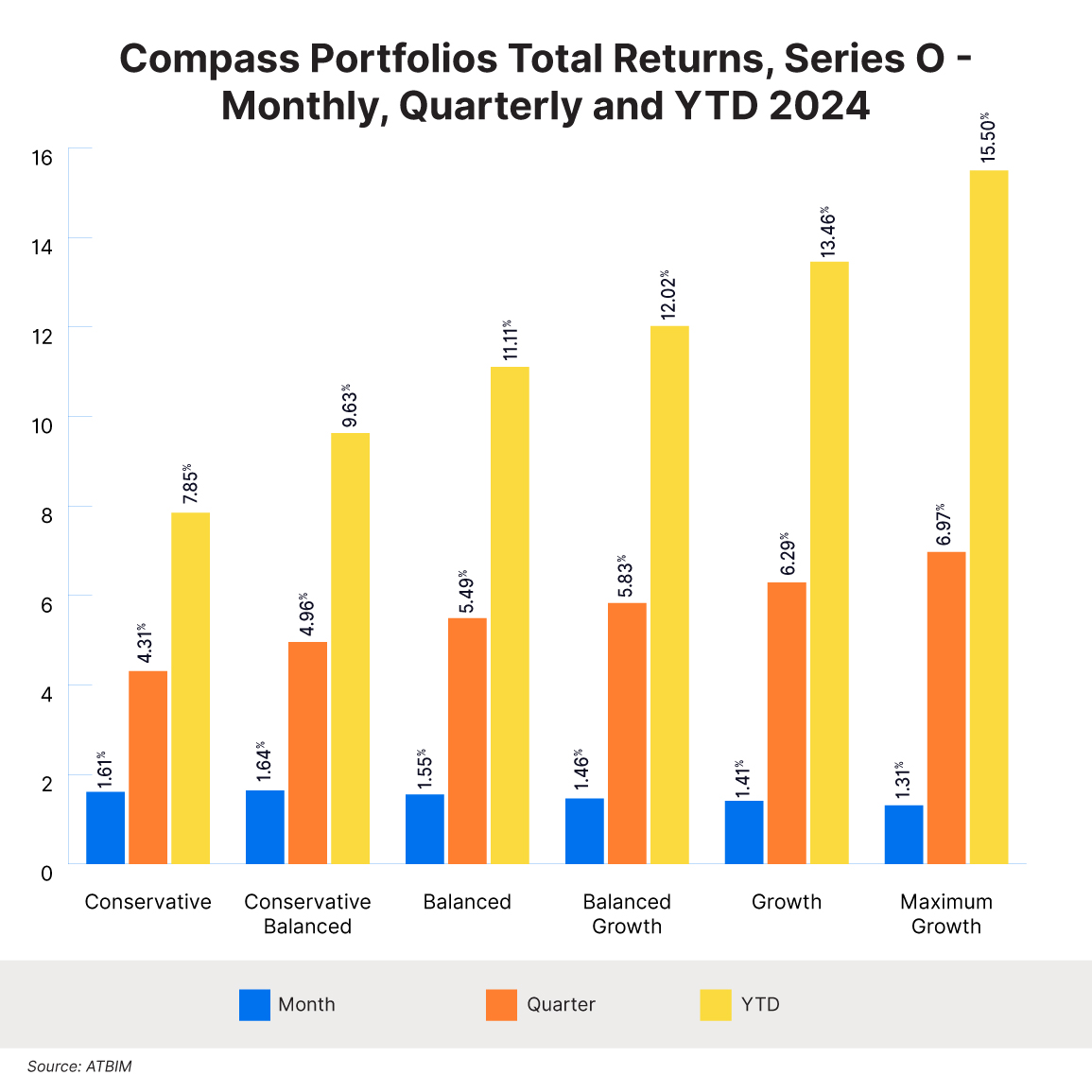

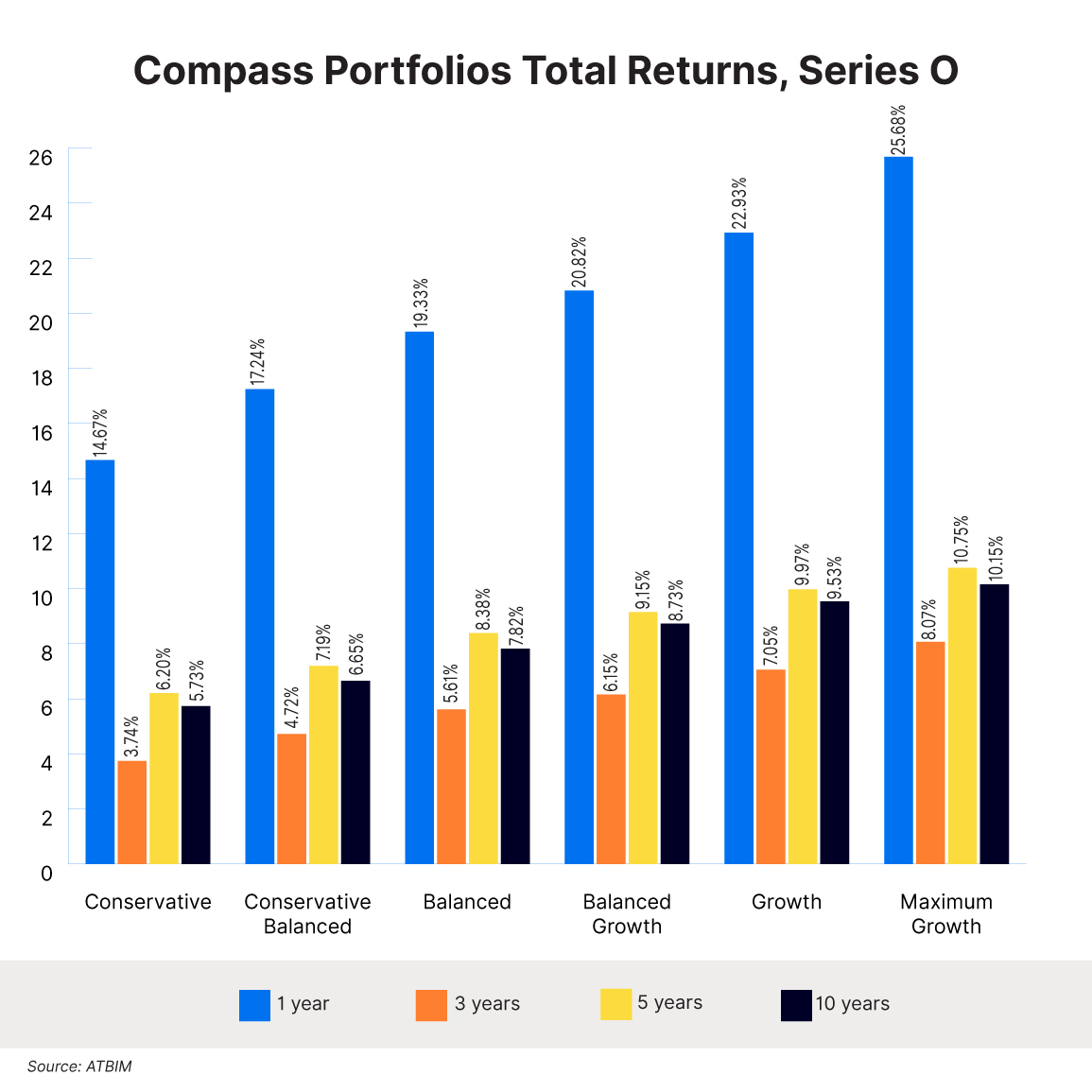

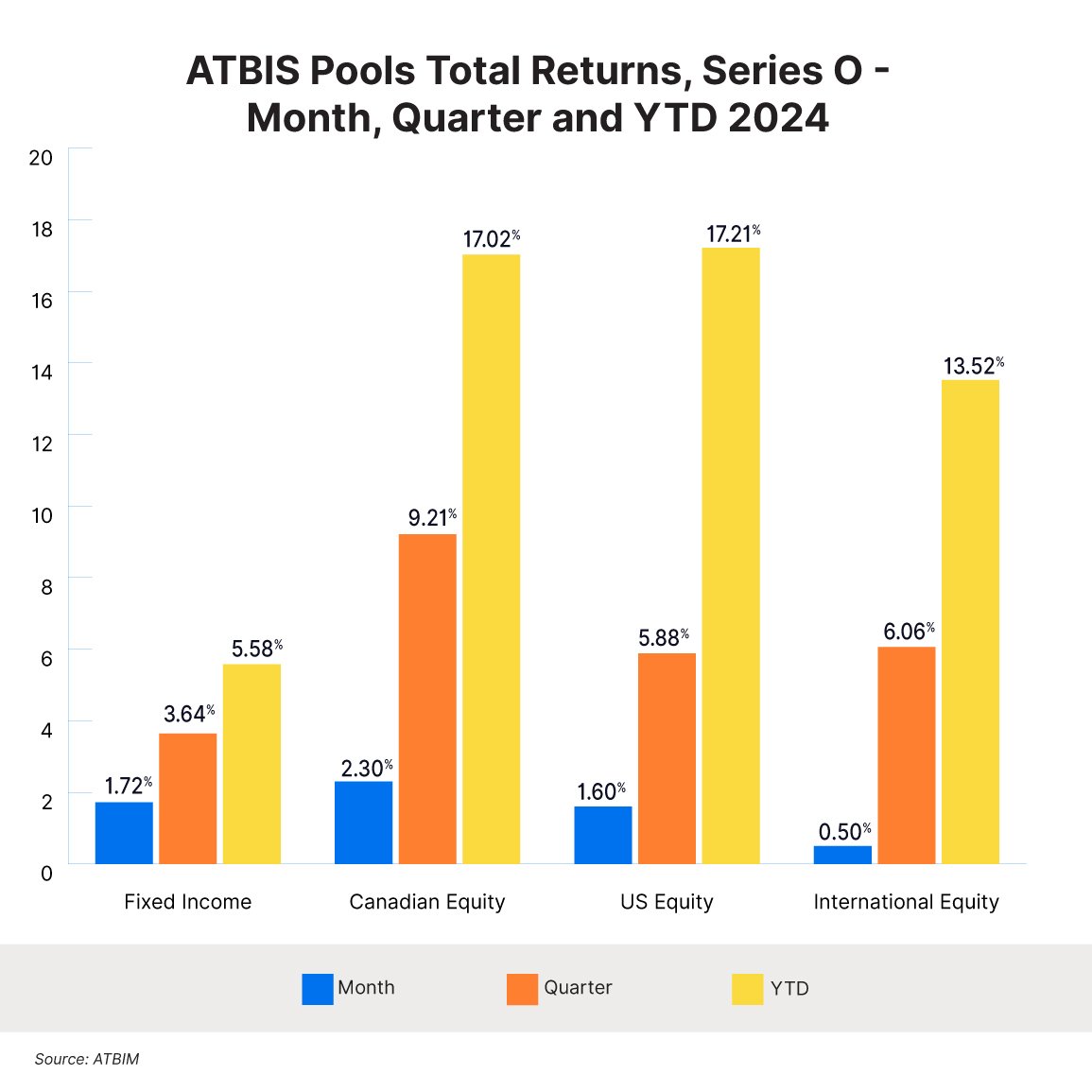

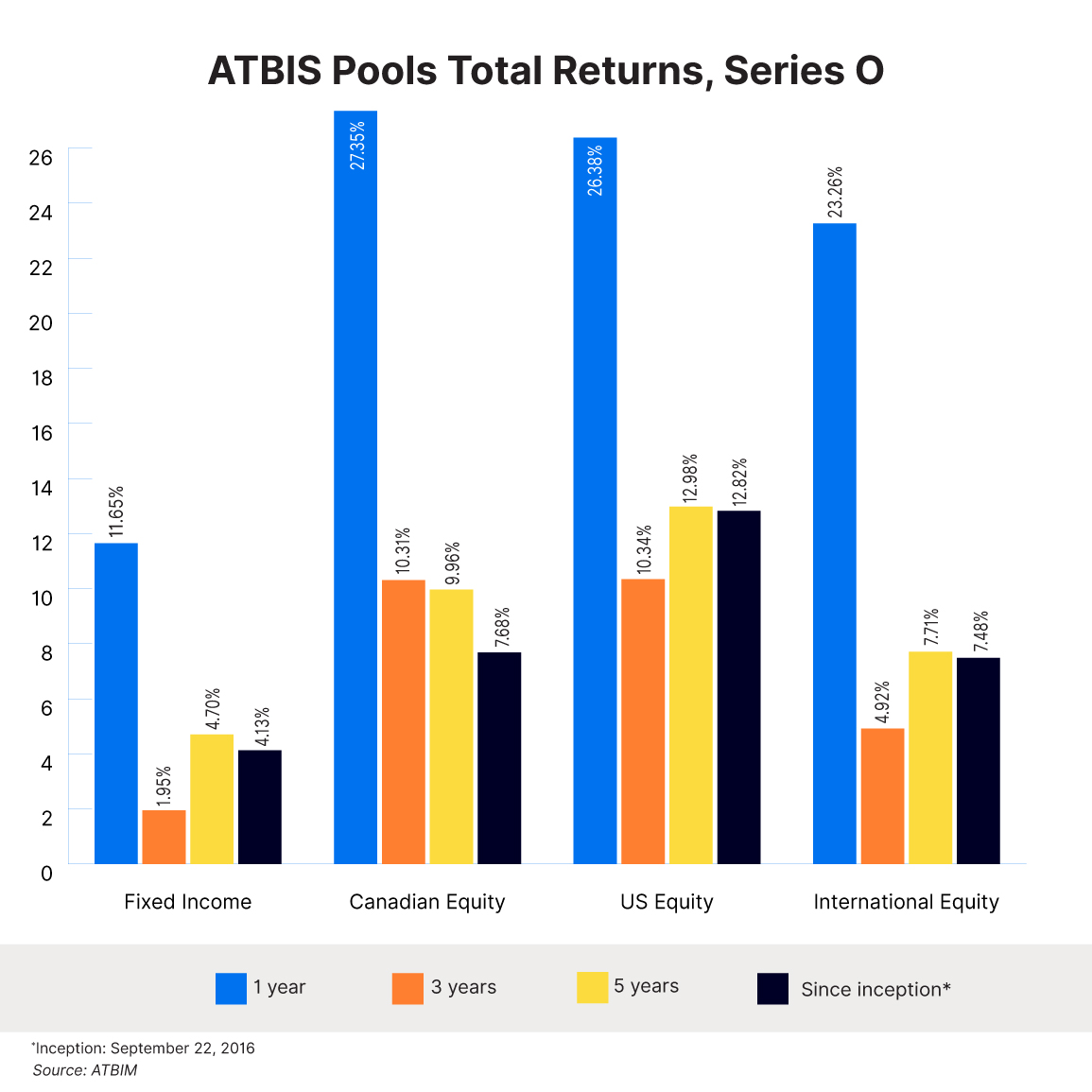

How our fund strategies performed:

Both Compass and ATBIS Pools have done well during this quarter, in part because of the 9.21% increase from the Canadian Equity Pool. All of our Canadian large-cap equity sub-advisors had a strong third quarter. Cardinal Capital Management led the way posting a 13.88% return, with Mawer and Cidel posting 9.06% and 7.31% returns respectively. Mawer Investment Management also manages parts of the Compass and ATBIS Pools US and International Equity positions, where they saw returns of 6.02% and 7.30%. Please see the charts below for a full breakdown of ATB Compass and ATBIS Pools performance.

Election outcomes and market returns:

The case for a long-term investment approach

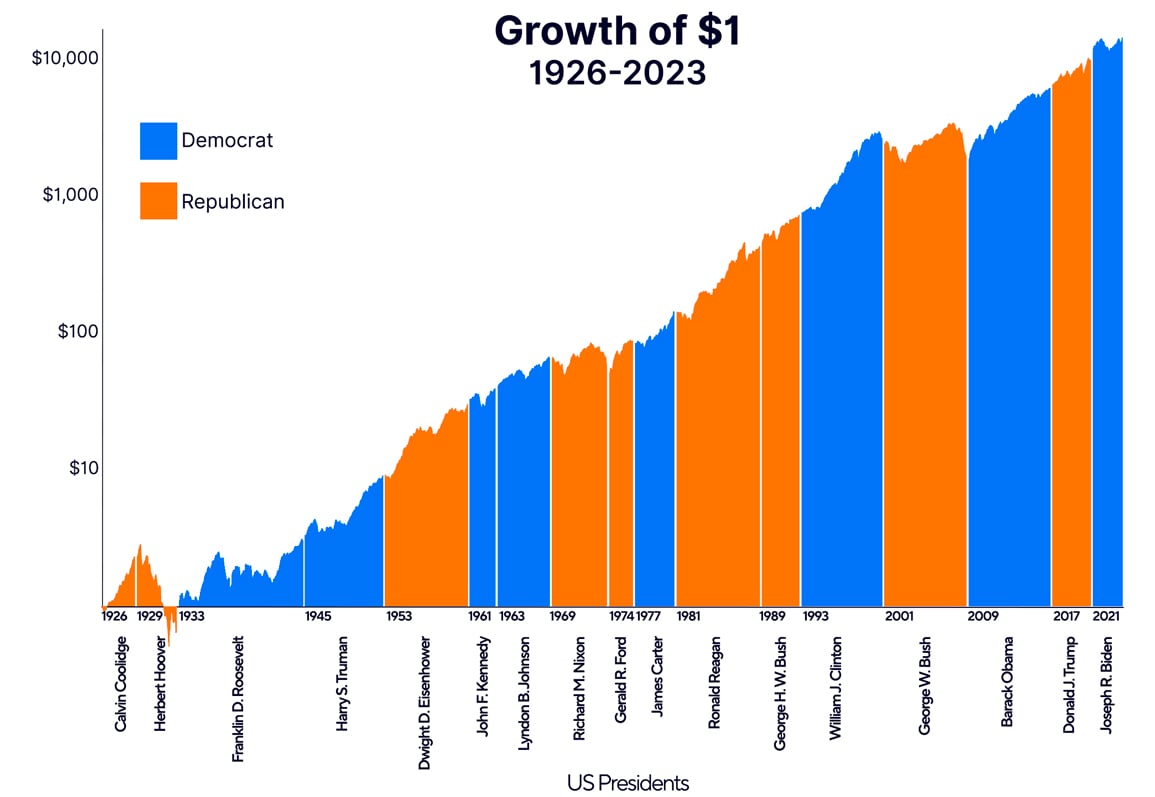

As election cycles approach, investors often find themselves caught up in speculation about how financial markets will respond. Many wonder whether changes in government will spark a market rally or downturn. However, historical data tells a different story—one that suggests the market’s performance is driven by far more than the results of any election. In fact, over nearly 100 years of US presidential terms, the trend for US equities has been a consistent upward march, regardless of which party is in power.

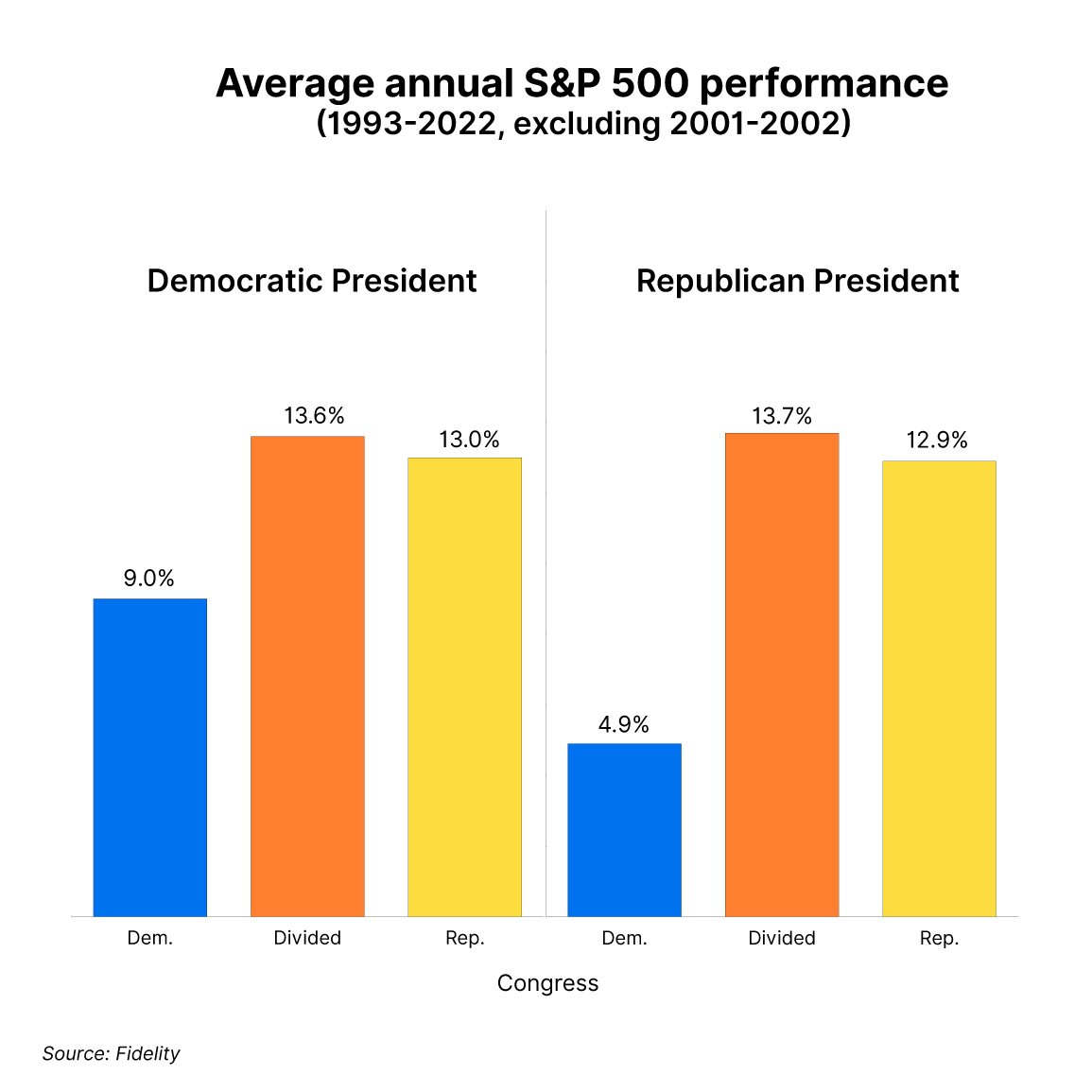

Markets are nonpartisan

One of the most pervasive myths in investing is that one political party is better for market returns than the other. The S&P 500, a broad indicator of US equity market performance, has averaged positive returns under nearly every political party combination. This underscores a key point: the market is resilient over the long term, regardless of which party occupies the White House.

The risks of election-driven investment strategies

Many investors try to anticipate how specific sectors or industries might benefit from the policies of an incoming administration. However, research has shown there are very few consistent patterns of relative sector returns in election years. Betting on sector performance based on partisan expectations can often lead to disappointing results, as the market is influenced by numerous factors beyond government policies. Trying to time the market based on political events can backfire, as election-driven volatility often proves to be short-lived and overshadowed by more fundamental economic drivers.

Economic fundamentals drive markets

While election outcomes may create short-term ripples in the markets, over the long run, the market’s trajectory is determined by economic fundamentals. Factors like corporate earnings, interest rates, inflation, and broader economic conditions play a much bigger role in shaping market performance.

The importance of a long-term investment plan

Given the many variables at play in both politics and markets, it’s nearly impossible to predict how any election will impact the financial landscape in the short term. Instead of trying to anticipate political or market cycles, investors should focus on a thoughtful, long-term financial plan. A plan should be based on an investor’s goals, their risk tolerance, and other considerations regarding their specific situation as an investor or as a family. Election cycles should not play a significant role in long-term investment decision-making.

A positive outlook on recent interest rate cuts:

Opportunity amid change

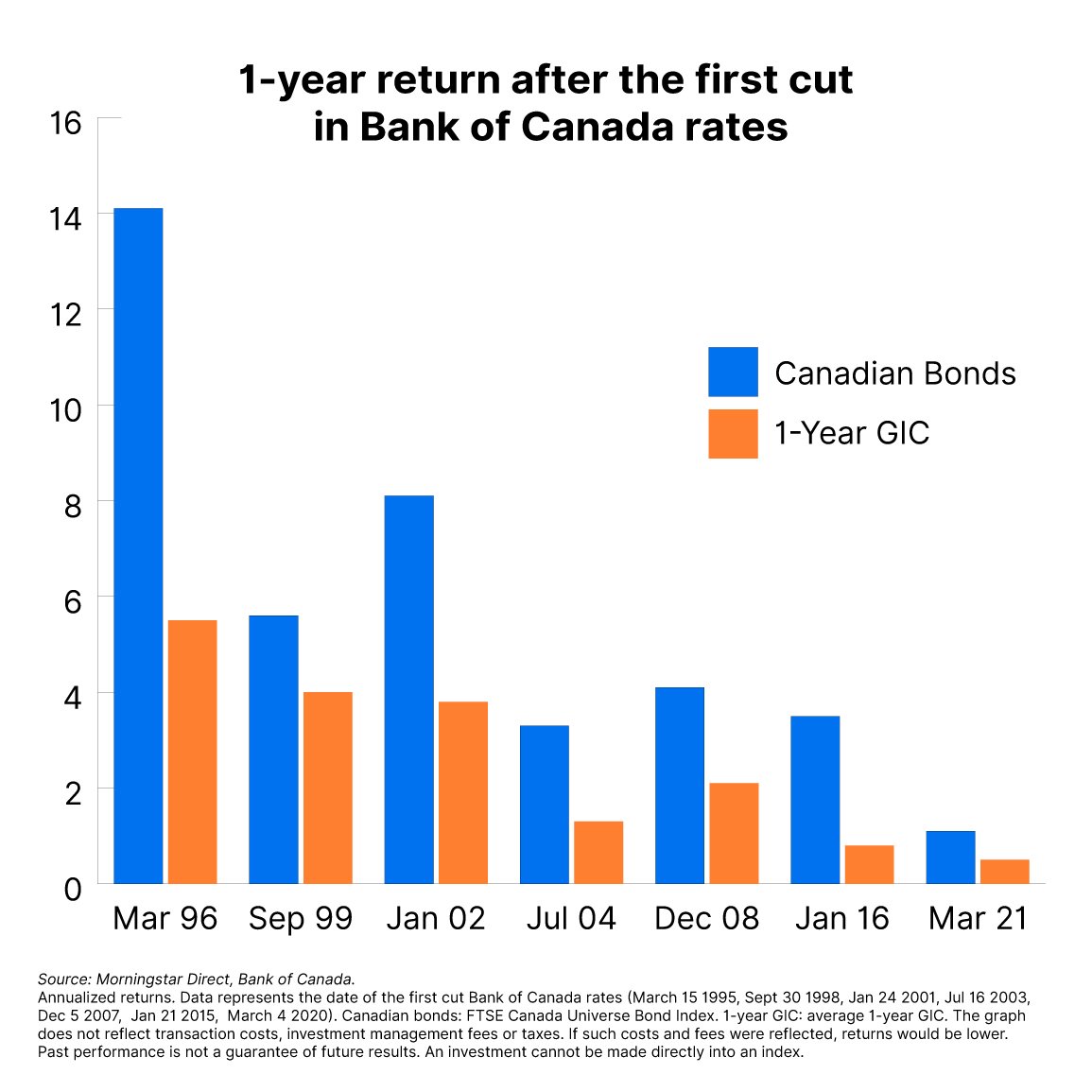

The BoC and the Fed have both taken proactive steps to reduce interest rates, signaling a shift toward more supportive economic policies. The BoC, one of the first among the G20 to act, has set the stage for potential growth, while the Fed has followed suit with a 50 basis point reduction in September. This environment offers exciting possibilities for investors willing to adapt to these changes. As central banks begin easing monetary policy after a period of tightening, history shows us that even though markets may experience short-term fluctuations, these adjustments can pave the way for long-term growth and stability. By understanding the potential market implications and making strategic moves, investors can position themselves for success in this evolving economic landscape.

The promise of a new economic cycle

There is optimism about how declining interest rates could positively impact the stock market. While past periods of rate adjustments were met with market challenges, they also set the foundation for recovery and growth. For instance, after interest rates rose and then fell during the dot-com bubble, the global financial crisis, and the COVID-19 pandemic, markets eventually rebounded, and opportunities for innovation, expansion, and wealth creation emerged.

Now, as North American central banks ease monetary policy, we can anticipate similar potential. The easing of rates creates favourable conditions for consumer and business spending, encouraging investment and economic activity. Rather than focusing on short-term volatility, investors can look to the future and see how this shift opens doors for new growth.

In a falling rate environment, headlines are often dominated by the potential for stock market gains, as lower interest rates can stimulate corporate earnings, reduce borrowing costs, and boost consumer spending—all of which can support higher stock valuations. Investors, attracted by the prospect of growth, often shift their attention to equities, overlooking the equally important opportunities in fixed-income markets.

However, we believe bonds deserve just as much focus, if not more, in such an environment.

In a rate-lowering environment, fixed-income investments, particularly bonds, tend to outperform other conservative investment options like Guaranteed Investment Certificates (GICs). This outperformance stems from the unique characteristics of bonds, including price appreciation, the potential for capital gains, and more favourable tax treatment compared to GICs, which are heavily taxed as interest income.

When the BoC cuts interest rates, bond prices typically rise due to the inverse relationship between interest rates and bond prices. Investors holding bonds with higher coupon rates issued before the rate cut see the market value of their bonds increase, as these bonds are now more attractive compared to newly-issued ones that offer lower yields. This price appreciation can significantly enhance the total return for bondholders, particularly in long-term bonds, which are more sensitive to rate changes. This ability to earn capital gains sets bonds apart from GICs, which lack such potential since GICs do not fluctuate in price—holders of GICs simply earn the fixed interest agreed upon at the time of purchase.

GICs - Principal protected, but not without risk

In a falling-rate environment, reinvestment risk becomes a crucial consideration. As GICs mature, investors are forced to reinvest at the lower prevailing rates. This can erode returns over time, especially in periods of extended rate cuts.

Another significant factor is the difference in after-tax returns. GICs are taxed as interest income, which means that the entire interest earned is subject to the investor’s marginal tax rate. For higher-income earners, this can result in a substantial portion of their GIC earnings being lost to taxes. In contrast, the returns from bonds can be more tax-efficient. While bond interest is also taxed as income, capital gains realized from selling bonds at a higher price are taxed more favourably at the capital gains rate, which is typically lower than the rate for interest income. This difference in taxation makes bonds a more attractive option, especially for investors looking to maximize after-tax returns in a declining-rate environment.

What we’re watching/reading/listening to:

Fall/Winter 2025, top travel trends

***

Chris Silvestre, an Analyst on the Mawer US Equity Team, shares insights from his recent research trip to Northern Virginia, the global hub for data centres. He explores the pressing challenges these centres face, including limited land availability, energy generation and transmission hurdles, and the skyrocketing power demands needed to support the growth of large language models.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.