Markets, investing and what matters most: Quarter in review Q4 2024

The Private Investment Counsel team reviews market performance during the fourth quarter of the year, looking at how the Compass Portfolio and ATBIS Pools have performed.

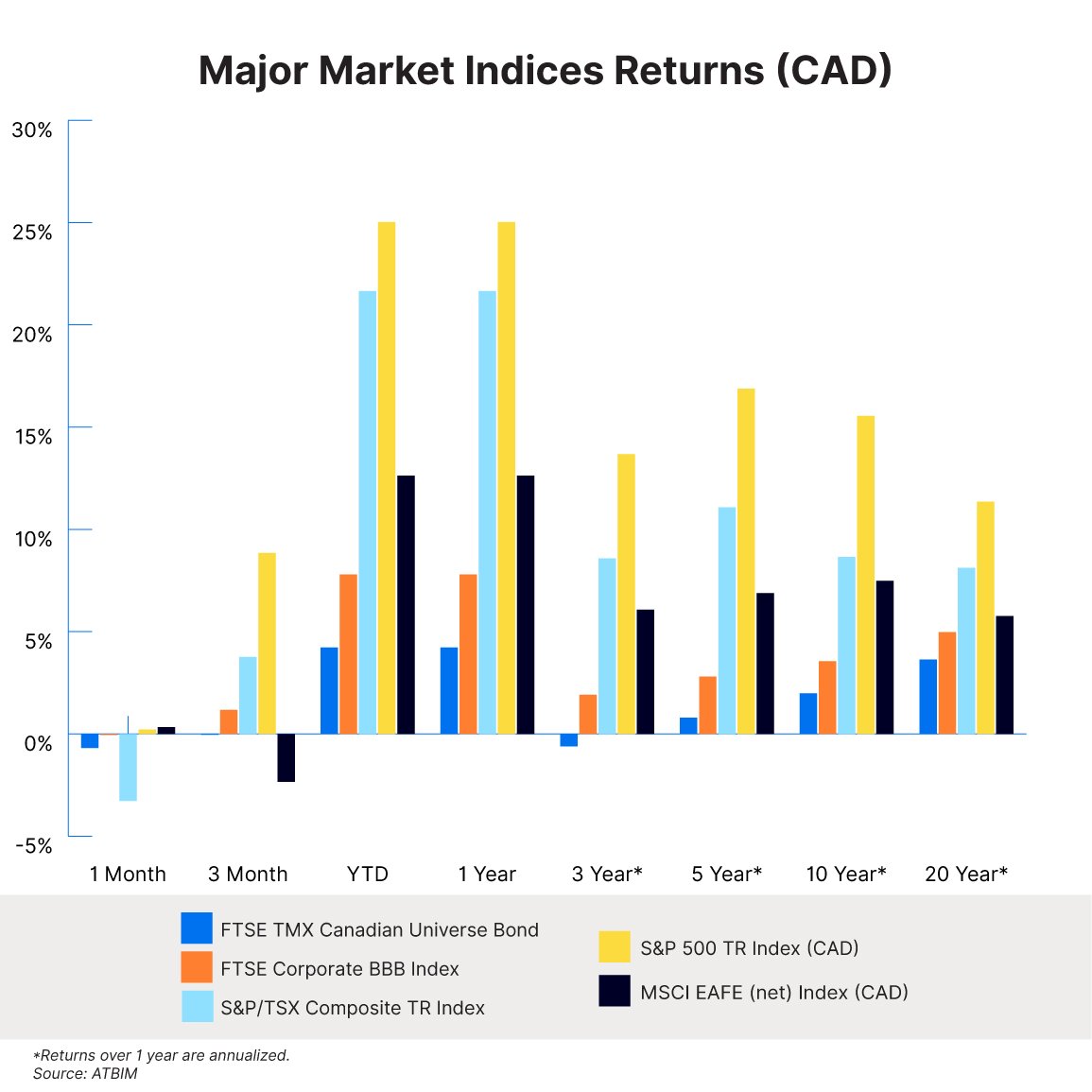

2024 was another remarkable year for US equity markets, defying expectations and delivering strong returns for investors. The S&P 500 surged by 25%, marking its second consecutive year of gains exceeding 20%. This impressive performance was fueled by a confluence of factors, including robust economic growth, the rise of artificial intelligence (AI), and accommodative monetary policy. However, beneath the surface of this seemingly unstoppable bull market lie potential risks and uncertainties that investors need to be aware of as we head into 2025.

A year of surprises and records

The US economy proved to be remarkably resilient in 2024, exceeding initial growth forecasts and confounding predictions of a recession. Consumer spending remained strong, supported by a healthy job market and wage growth that outpaced inflation. Meanwhile, massive investments in AI fuelled a technology boom, with companies like NVIDIA, Apple, and Microsoft leading the market higher. This concentration of gains in a small number of mega-cap tech stocks raised concerns about market concentration and potential vulnerability.

While posting respectable gains of 21.7%, Canadian equities lagged their US counterparts by a significant margin. This divergence highlights the influence of the AI boom and the dominance of US tech giants on global markets. While Canadian markets are generally considered to be more attractively valued, they are also more cyclical and susceptible to global economic headwinds.

Navigating the AI revolution

The increasing influence of AI has been a defining feature of the 2024 market, capturing the imagination of investors and driving significant capital investment. AI’s potential to transform industries and generate economic growth is undeniable. However, the current frenzy also raises concerns about potential over-investment and the risk of inflated expectations. As companies pour billions into AI research and development, it remains to be seen whether these investments will translate into sustainable profits and justify current valuations.

The valuation puzzle

Despite strong earnings growth and continued economic expansion, valuations in US equity markets remain elevated. Does this mean the market is becoming overly optimistic, and potentially detached from underlying fundamentals? While high valuations can be justified by expectations of continued strong growth, they also increase the risk of lower future returns.

Looking ahead to 2025

As we enter 2025, investors face a complex and evolving landscape. The US economy is expected to continue its growth trajectory, but at a more moderate pace. Inflation remains a concern, with the potential for renewed price pressures if supply chain disruptions persist or geopolitical tensions escalate. The Federal Reserve is likely to maintain its accommodative monetary policy for the time being, but this may change.

In this environment, investors must be selective and discerning. While the long-term prospects for equities remain positive, a cautious approach is warranted in the near-term. Maintaining a diversified portfolio, focusing on quality companies and undervalued sectors, is prudent.

Key considerations for Canadian investors

Navigating global headwinds: Canada's open economy is sensitive to shifts in the global landscape. Investors should be mindful of potential slowdowns in major economies, as these can impact demand for Canadian exports and influence domestic economic activity. Staying informed about global trends is crucial for making informed investment decisions.

Beyond the mega-caps: While US mega-cap companies have played a dominant role in markets, investors should be aware of the risks associated with over-concentration in this area. Exploring opportunities in diverse sectors and geographies can help build a more resilient portfolio for the long term.

The value of value: In today's market, it's essential to avoid overpaying for growth prospects. Disciplined valuation analysis can help identify companies with solid fundamentals trading at attractive prices. Don't overlook the potential of undervalued sectors, which may offer compelling investment opportunities.

Strength in diversification: A well-diversified portfolio is essential for navigating market uncertainty. By spreading investments across different sectors, asset classes, and geographies, investors can reduce risk and potentially enhance returns over time.

For insights from our Portfolio Management Team, follow these links:

How our Fund strategies performed

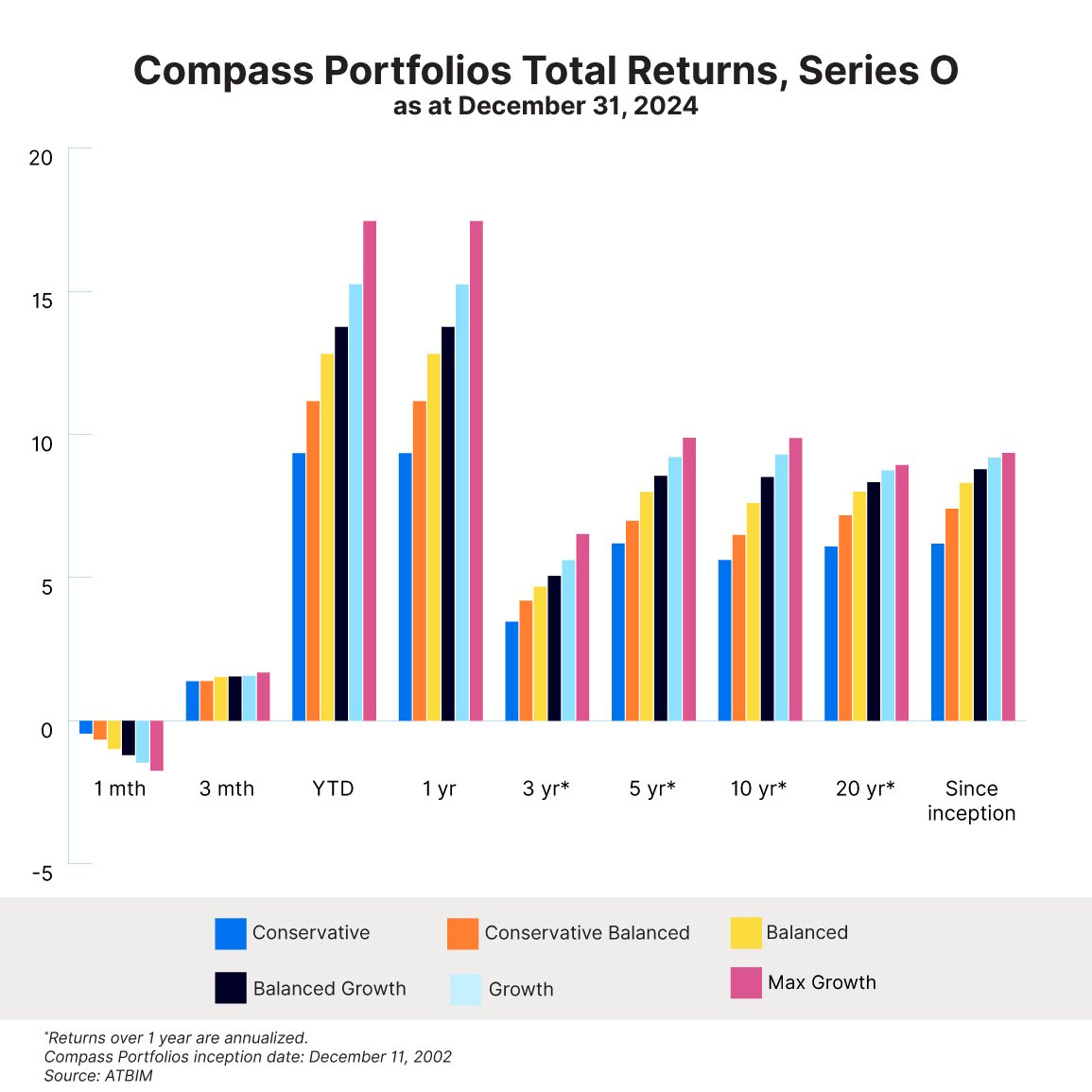

A big quarter for US equities more than offset the negative performance of our international equity holdings to give all of the Compass Portfolios a positive quarter to end another strong year.

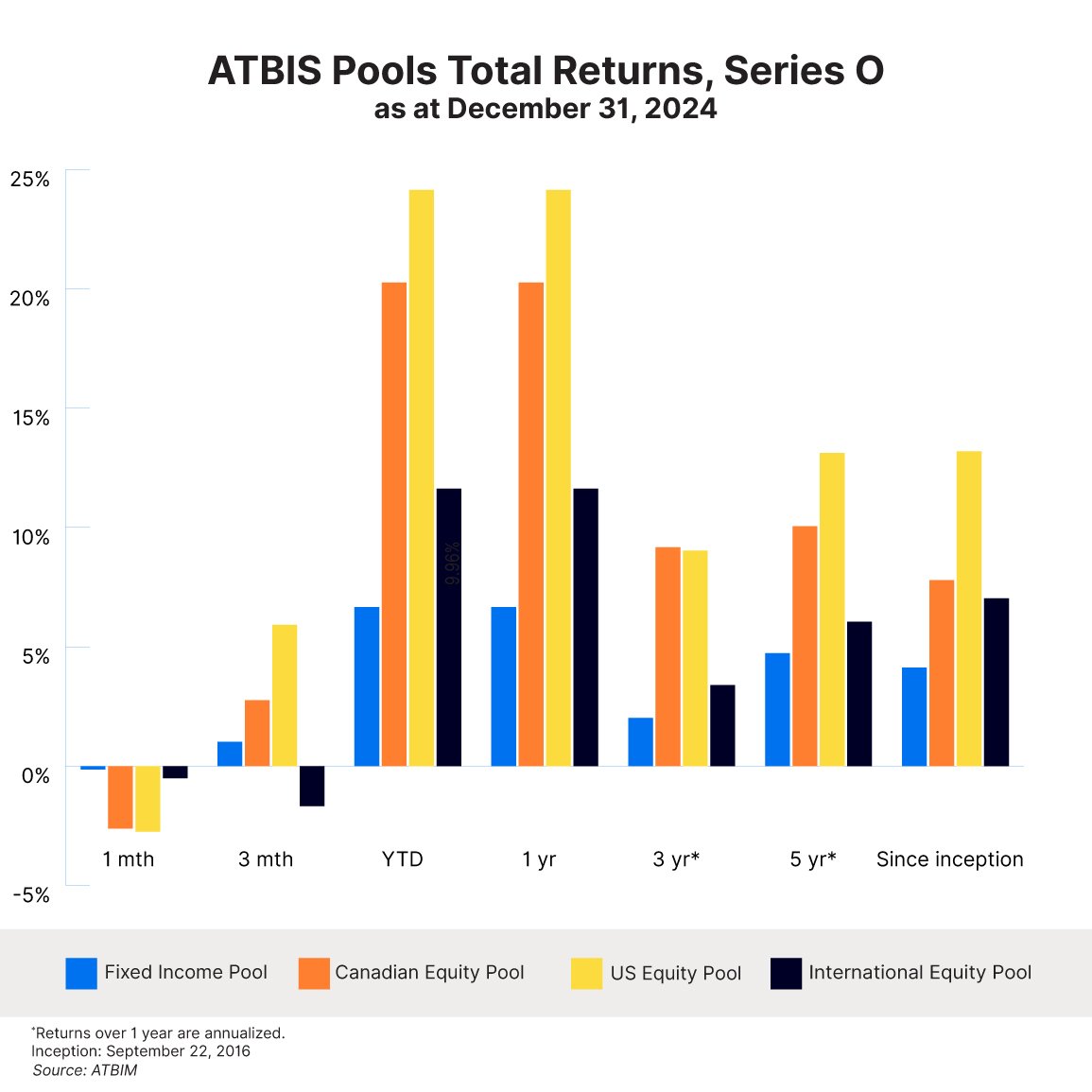

The ATBIS Pools saw mixed results. The Fixed Income, Canadian Equity, and US Equity Pools all had positive quarters, while the International Equity Pool had a slightly negative quarter. All of the Pools finished the year with positive results; from 6.66% for the Fixed Income Pool to 24.14% for the US Equity Pool.

Please see the charts below for a full breakdown of ATB Compass Portfolios and ATBIS Pools performance.

Navigating uncertainty in a shifting economic landscape

2025 brings political developments in the United States front and centre for investors. With Donald Trump returning to power and signalling potential policy shifts, including the imposition of tariffs on Canada, there is understandable concern about the possible economic and market impacts. While headlines and speculation can stir uncertainty, we remain focused on maintaining a disciplined and resilient investment approach to safeguard our clients’ portfolios.

Historically, political developments such as trade tensions or changes in fiscal policy have introduced short-term volatility in financial markets. However, markets tend to recalibrate as the long-term implications become clearer. Our investment philosophy remains rooted in the belief that reacting impulsively to short-term events can often do more harm than good. Instead, we are prepared to respond thoughtfully and decisively as the situation evolves.

At present, we are maintaining a cautious portfolio stance. This includes holding a well-diversified mix of equities and bonds, spread across geographies and sectors, to mitigate risks tied to any one region or policy. We continue to focus on identifying attractively valued opportunities rather than chasing high-growth, high-risk areas of the market. This positions our portfolios to weather a range of potential scenarios while preserving flexibility that capitalizes on opportunities that may emerge in the months ahead.

We also emphasize the importance of maintaining liquidity within portfolios. Should market volatility increase, our allocation to high-quality fixed income assets provides a buffer and the potential to rebalance into equities at more attractive valuations. This disciplined approach ensures that your portfolio remains aligned with your long-term goals, regardless of short-term disruptions.

As always, we are closely monitoring the situation, including potential trade policy changes and their broader economic implications. While it is too early to assess the full impact, we are confident that a well-diversified and cautiously positioned portfolio is the most prudent strategy in uncertain times.

We encourage you to contact your investment counselor with any questions or concerns. In times like these, maintaining open communication and a clear focus on your long-term objectives is more important than ever.

What we’re watching/reading/listening to

“The Big 2025 Economy Forecast: AI and Big Tech, Nuclear’s Renaissance, Trump vs China, and What’s Eating Europe” Plain English with Derek Thompson.

In this podcast, Derek interviews Michael Cembalest, Chairman of the Market and Investment Strategy for JP Morgan Asset Management to discuss the year ahead.

***

“Charted - The Pyramid of S&P 500 Returns (1874-2024) - The Visual Capitalist website.

For a graphic to show how 2024 returns in the S&P 500 compared to past calendar year returns, check this out.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.