The US presidential election - what is its potential impact?

Does the outcome of the US election actually matter and will it have any sizeable impact on the markets?

November 5 is an important day this calendar year. It is the date when US citizens vote to elect their next president. As such, there will be intense scrutiny not only from United States residents but also other parts of the world, including, of course, Canada.

Why is the US presidential election so important? As the world’s largest economy and our neighbour, the US is Canada’s largest trading partner. The increase in global integration over the past thirty years means that policies enacted by the US can have an impact, even if indirectly, on the economies of other countries. And the health of a country’s economy can influence the health of that country’s financial markets.

In this piece, we discuss whether the outcome of the election actually matters or has any sizeable impact. We also look at how equity markets have performed in the past and whether any policies may affect Canada.

There is uncertainty, but will it matter?

The timing of the US presidential election is mandated to be the Tuesday after the first Monday in November, every four years, so there’s certainty in when an election will take place. But the uncertainty is in the outcome. Firstly, and most obviously, who will become the next US president—Republican Donald Trump or Democrat Kamala Harris? The current polling suggests a very close race. And secondly, who will be elected down ballot for seats in the US Congress (the House of Representatives and the Senate)?

Traditionally, the more conservative party—the Republican Party—is seen as being more friendly to businesses, given their platform leans towards lower taxes and fewer regulations. The more progressive Democratic Party, on the other hand, is viewed as more aggressive on spending policies and potentially raising taxes.

No matter who assumes office, however, the state of US politics has become increasingly more divided over the past decade, so it may be difficult to pass meaningful legislation for the policies proposed by each candidate. Unless, of course, the candidate’s party also wins the House and Senate, which together form the legislative branch of the US government.

As expected, the market discourse on the election has risen recently due to the uncertainty about the outcome, as mentioned above. But markets also tend to take the result in their stride and continue on their merry way once the victor is known.

So, while there is uncertainty as we approach November 5, there does not appear to be any elevated level of volatility as observed from the markets this past quarter, aside from the selloff in equities in early August. And the reason for that was less to election uncertainty and more due to other forces impacting the markets (e.g., the unwinding of the yen carry trade).

Current and former presidents and stock markets

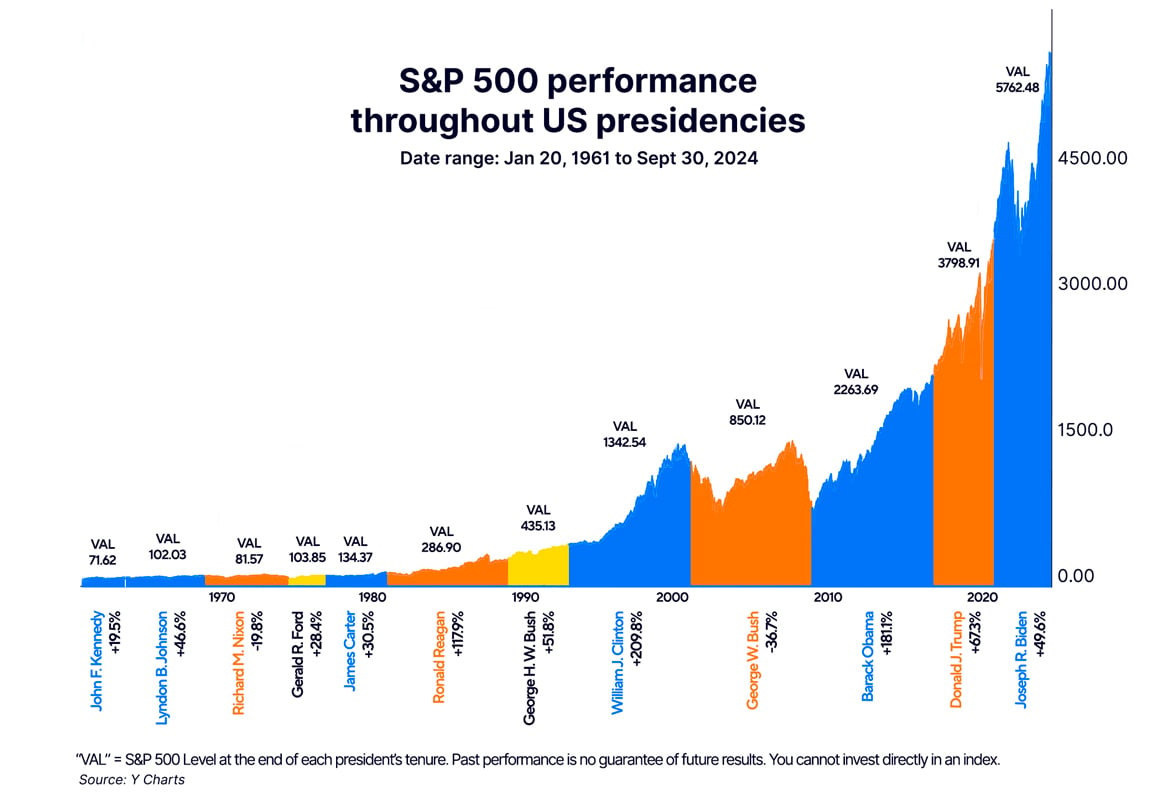

In a previous article for the 2020 US presidential election, we included a chart showing stock market performance during various presidential terms, using the S&P 500 (in USD). Here we show an updated chart that includes current President Joe Biden’s tenure in office:

For most of the presidents’ terms, the stock market generated a positive performance, with the exception of the Nixon presidency and, more recently, the George W. Bush presidency. This reflects the tendency of equity markets to go up over longer periods of time. George W. Bush’s presidency was not helped by the Global Financial Crisis (GFC) in 2008, which occurred during his time in office. Still, given its timing towards the end of Bush’s two presidential terms, it shows how difficult it is to predict how markets will behave even when he was first elected, back in 2000.

The upshot of this chart is that equities tend to rise no matter who’s in office. What does that mean for an investor? The implication is that one should remain invested and not try to time the market due to the possibility of a particular candidate getting into office. There will certainly be occasions when equity markets experience a downturn and an increase in volatility, but they have also shown resilience when they rebound and then go on to achieve higher highs. As long as one is invested for the long term, the results of US presidential elections should have little long-term impact on your investment portfolios.

Potential US policy implications for Canada

One policy that may have a direct impact on Canada is related to trade. During his presidency, Donald Trump instituted a tariff on Chinese products, a policy which the Biden administration has continued and expanded. If he is elected again, Trump has proposed a tariff across all imports, which would include Canadian products. Would Canada then retaliate with a tariff on US products? There was a brief trade war between the US and Canada in 2018-2019 before the USMCA ("Agreement between the United States of America, Mexico, and Canada") free trade arrangement came into force, replacing NAFTA ("North American Free Trade Agreement"). Whether a new tariff comes to pass remains to be seen, but it’s worth highlighting as Canada assesses the election result.

Positioning for ATBIM portfolios

Until the election results are known, for both the presidency and Congress, we maintain our current positions within Compass and the Pools. If and when new policies are passed into law, we will re-assess the potential opportunities and risks their enactment may offer and position accordingly.

Summary

In conclusion, US presidential elections are a quadrennial event that generates plenty of chatter and argument. However, as shown throughout history, whoever becomes president tends to have little impact on the markets.

As for one’s investments, it’s worth reiterating—investing for the longer term remains key, as it means that any short-term increase in volatility tends to become a blip in the rear view mirror. Staying invested is just as important, especially as markets rally. You don’t want to be caught on the sidelines.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

The material in this document is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.