A new dawn for bonds?

A review and outlook for the asset class in eight charts from our portfolio management team.

The bond market has been tumultuous over the past two years, but elevated bond yields and the possibility of falling rates could mean a turning point for the asset class. We review the recent history of fixed income including an outlook for the short-term, and how the funds at ATB Investment Management (ATBIM) are positioned to take advantage.

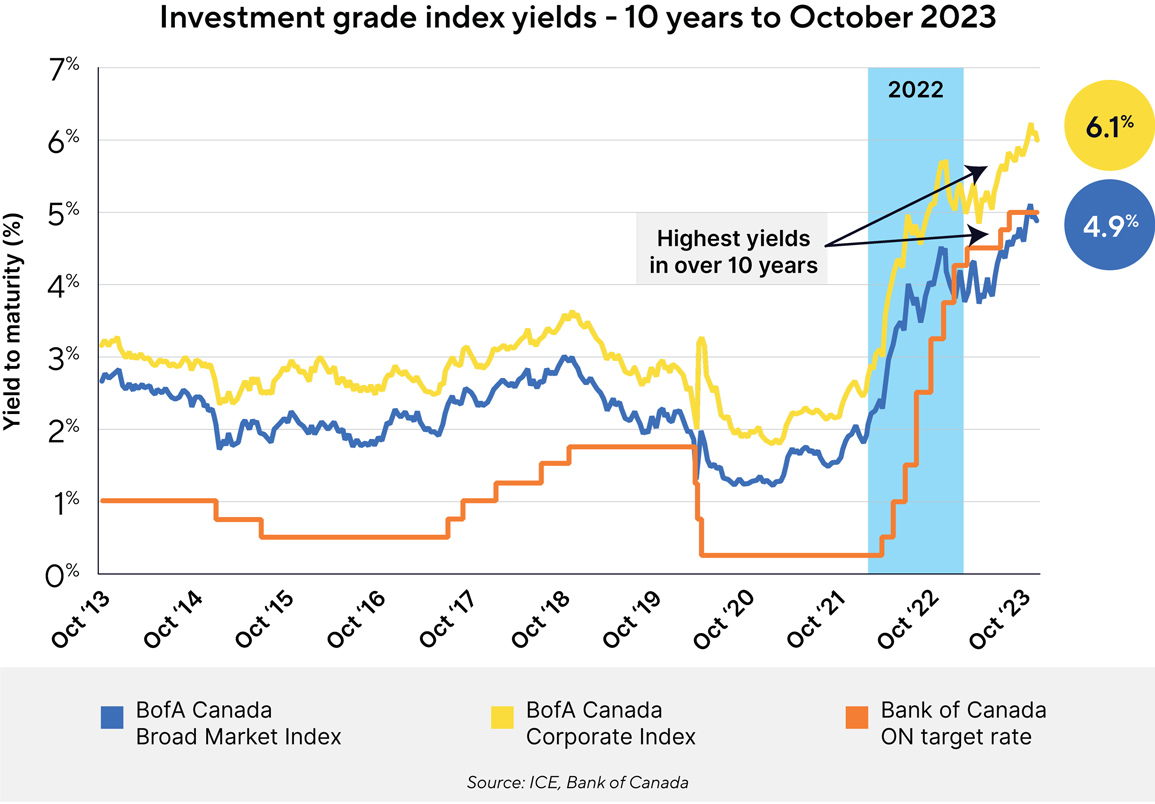

1. Rate increases since 2021 and what got us here

Interest rates have been rising over the past couple of years. During the brief COVID recession, short-term target rates from developed central banks, including the Bank of Canada (BoC), dropped to near 0%. The economy recovered faster than anticipated, resulting in higher-than-expected inflation due to heightened demand and slow-to-recover supply chains.

To return inflation to the 2% target, central banks began increasing their short-term target interest rates. Increased rates dampen consumer spending, reduce business investment activity, and slow the economy, which can reduce inflationary pressures.

Since the end of 2021, the BoC has raised its short-term target rate from 0.25% to 5%. The average bond in Canada has gone from roughly 2% to 5%. Looking at our ATBIS Fixed Income Pool, the yield on the bond portfolio has increased from 3% to nearly 7%.

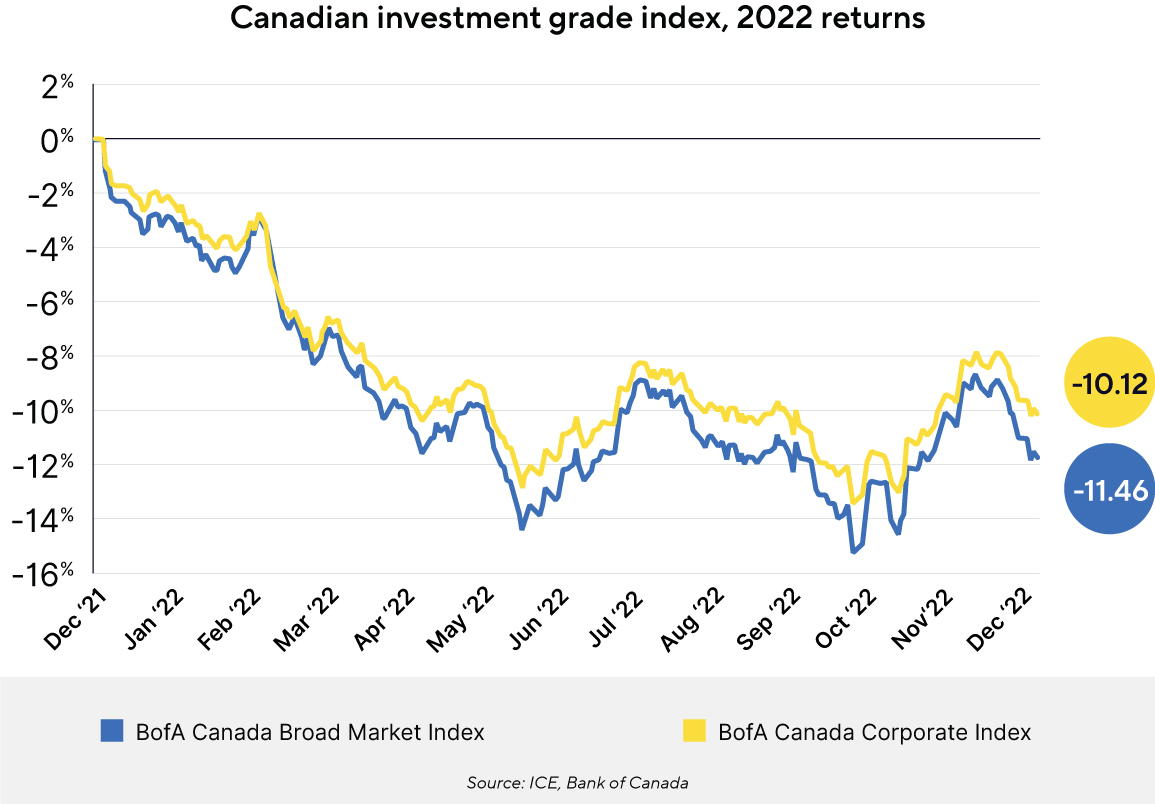

2. Surprise pace of rate hikes coupled with a low starting yield left 2022 with poor performance

The sharp increase in rates since 2021, coupled with low starting yields, led to one of the worst years the bond market has seen in terms of return. The reason was not due to the default of any bonds. It was simply because as rates go up, the price of existing bonds with fixed coupon rates fall in order to maintain their attractiveness to new buyers.

As an example, a bond that may have been priced at $100, paying a 2% coupon and yielding 2% at the start of the year, maturing in five years, wouldn’t be fair value compared to a newly-issued bond with a 4% coupon rate also priced at $100. But suppose the older 2% coupon bond falls to $90. In that case, the expected yield to maturity rises to roughly 4%—the bond will still mature at $100, giving about $2 in expected capital gains per year in addition to the interest—and keeping it attractive compared to the newly issued 4% bond.

Had we ended 2021 with something like a 10% yield, the interest income would have buffered the price decline, but starting with a 2% yield gave little protection, resulting in poor performance for 2022. With higher yields at the end of 2022, prospects for 2023 were already looking brighter.

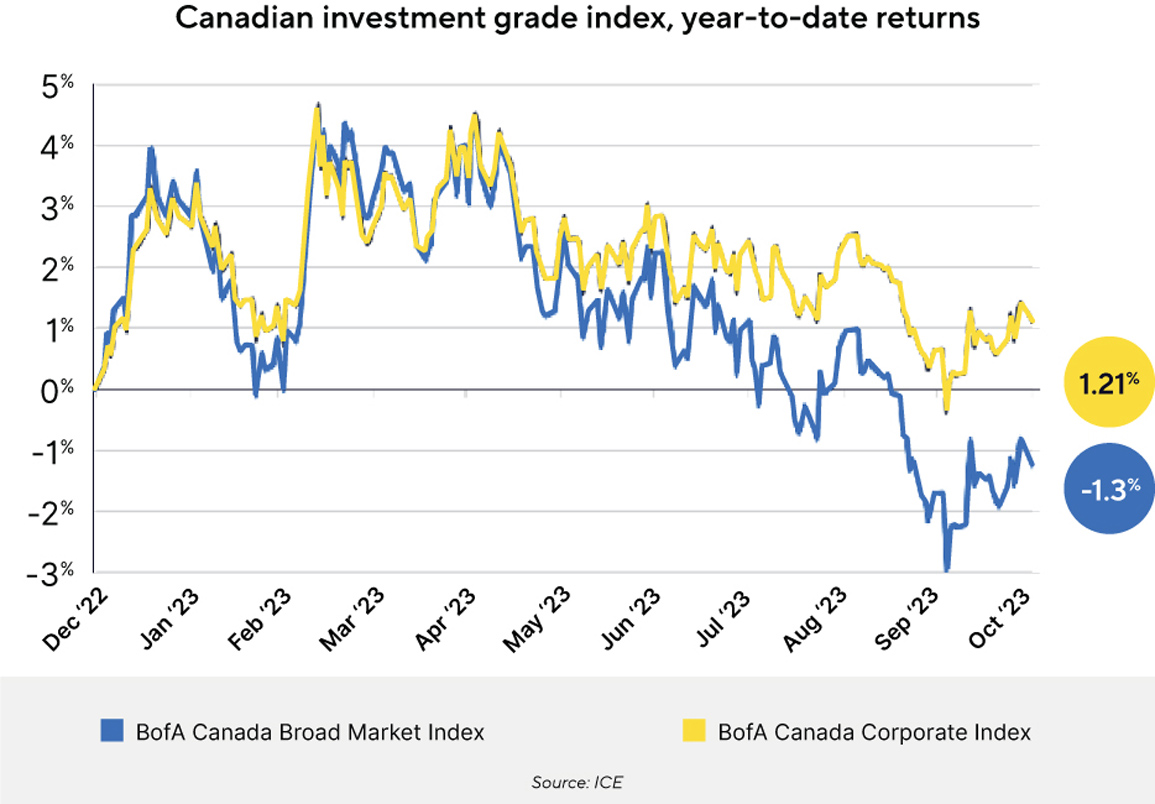

3. 2023 has been a different year; inflation has declined, and rate increases have slowed

Inflation has fallen from a high of 8.1% in the summer of 2022 to 3.1% in October 2023. With this decline, the BoC has slowed its rate hikes, increasing just 0.75% to date in 2023, compared to 4.25% in 2022. As a result, bond yields have also slowed, moving up only 0.3%.

The ATBIS Fixed Income Pool ended 2022 with about a 6% yield and a four-year duration across all the holdings on average. Through the first 10.5 months of 2023, if we have a 6% yield, we would expect to see about a 5.25% return from the yield in the portfolio, minus roughly 1.2% from the increase in rates—0.3% multiplied by four years of duration—to give a net expected return of about 4%. On individual holdings, this back-of-the-napkin math tends to be quite accurate. The ATBIS Fixed Income Pool has hundreds of holdings, but the math still holds up reasonably well. Year-to-date, the fund has returned 4.39%1, gross of fees. We focus primarily on yield because it can support us in evaluating future return potential.

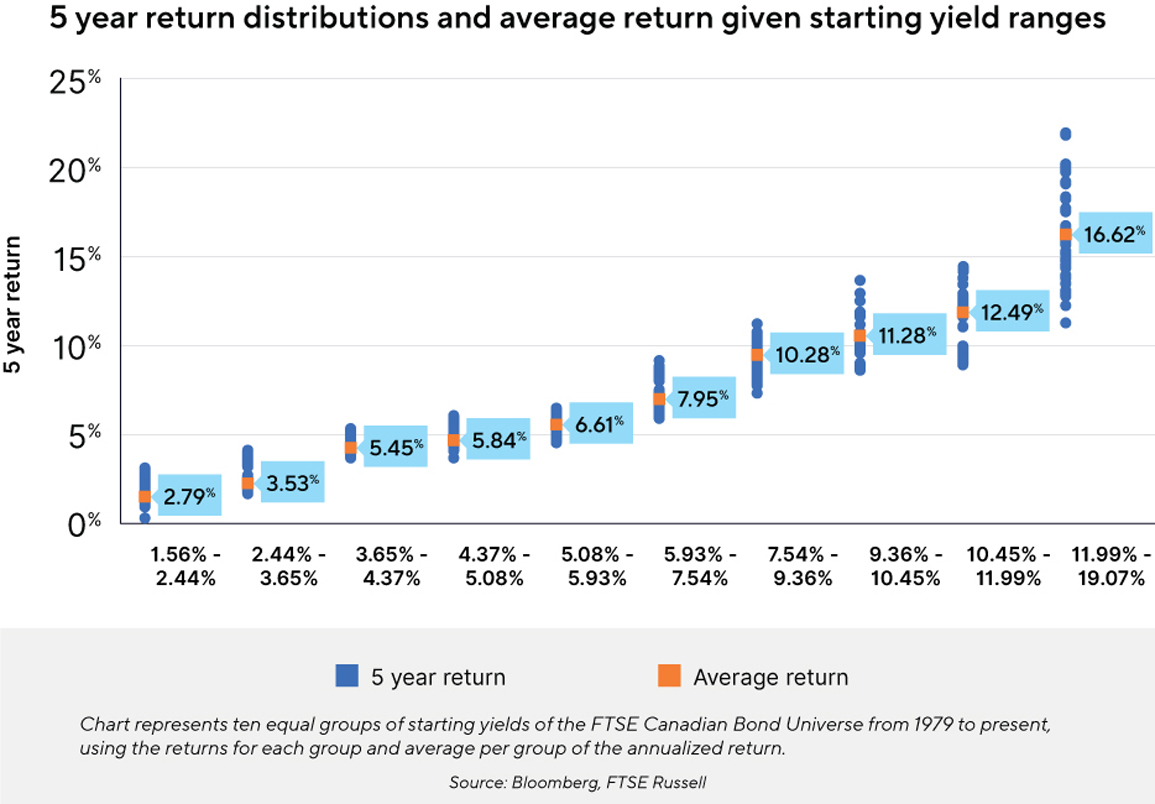

4. Starting yield explains much of a bond fund’s return over a few years or more

This chart shows how the FTSE Canada Universe Bond Index’s annualized returns have stacked up against its starting yield. Interest rates cycle up and down over the medium term, so price declines, such as in 2022, often even out when rates decline again through the business cycle. When we look at average returns over several years, the bulk of a bond fund’s or index’s return stems simply from the yield of the bonds held.

For investors holding bonds today, expected returns based on prevailing yields have not been this high since the mid-00s, with the average bond in Canada being priced at about 4.5% today. Within the ATBIS Fixed Income Pool, the yield is closer to 6.5% since we target a higher proportion of corporate bonds.

At the end of 2021, the average bond yielded about 1.8%. Even with the roughly -9.5% return across 2022, and year-to-date through 2023 for the index2 (1.8%), bond investors may still get what they expected over the five-year period ending 2026. Assuming no interest rate movements over the next three years, bond investors could earn roughly the yield or 4.5% per year. Over the full five-year period ending in 2026, the average return could be 1.01% per year. It’s not quite the 1.8% expected, but it’s still close, considering 2022 was indisputably the worst year for bonds in decades.

It’s still possible for bonds to return 1.8% for the five year period ending 2026. There are still three more years of market movement, interest rate changes and capital appreciation to happen before the full five year period ends in 2026 giving average returns time to fluctuate.

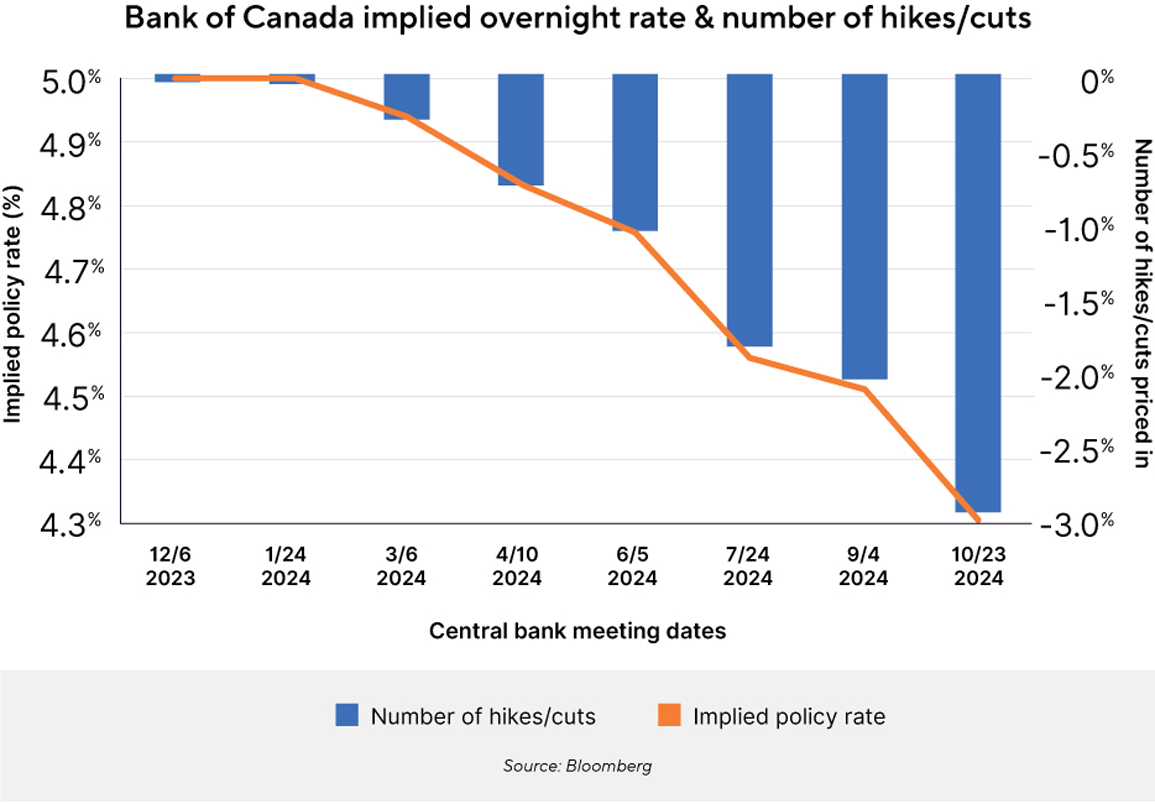

5. Have interest rates finally peaked?

On November 1, 2023, the US Federal Reserve kept rates steady again and has done so since July. While it has yet to call a peak on rates for this cycle, the US Federal Reserve reiterated that the decision would be data-dependent with careful consideration of inflation. The consumer price index with October’s data was released on November 14 and showed better-than-expected numbers, declining for the seventh month in a row. This news was enough to shift the market’s opinion on only pricing in cuts over the following year for the first time since the end of 2020. Being closely aligned economically, Canada also saw this shift in expectations.

For bondholders, lower interest rates aren’t necessarily good over the long term, but prices do rise on falling rates. The market is pricing 0.75% of cuts in Canada over the next year. If that comes true, it would lift bond prices nicely. Along with the already higher yield, the stage is set for bond returns to be quite attractive over the coming years if the market expectation is right and rates normalize lower again.

The gut instinct might be to buy longer maturity bonds to take advantage of this anticipated fall in interest rates. After all, longer-dated bond prices are more sensitive to interest rate movements, and they stand to benefit the most if we see all interest rates across the maturity spectrum fall in tandem.

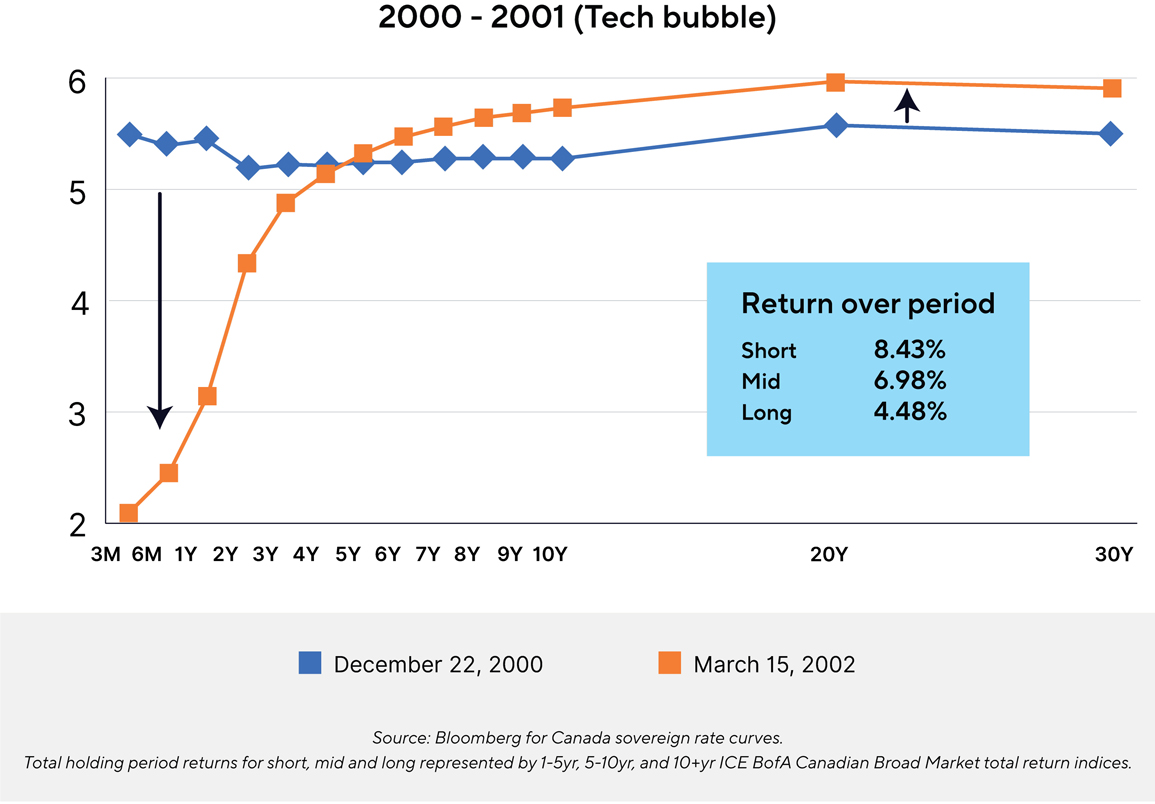

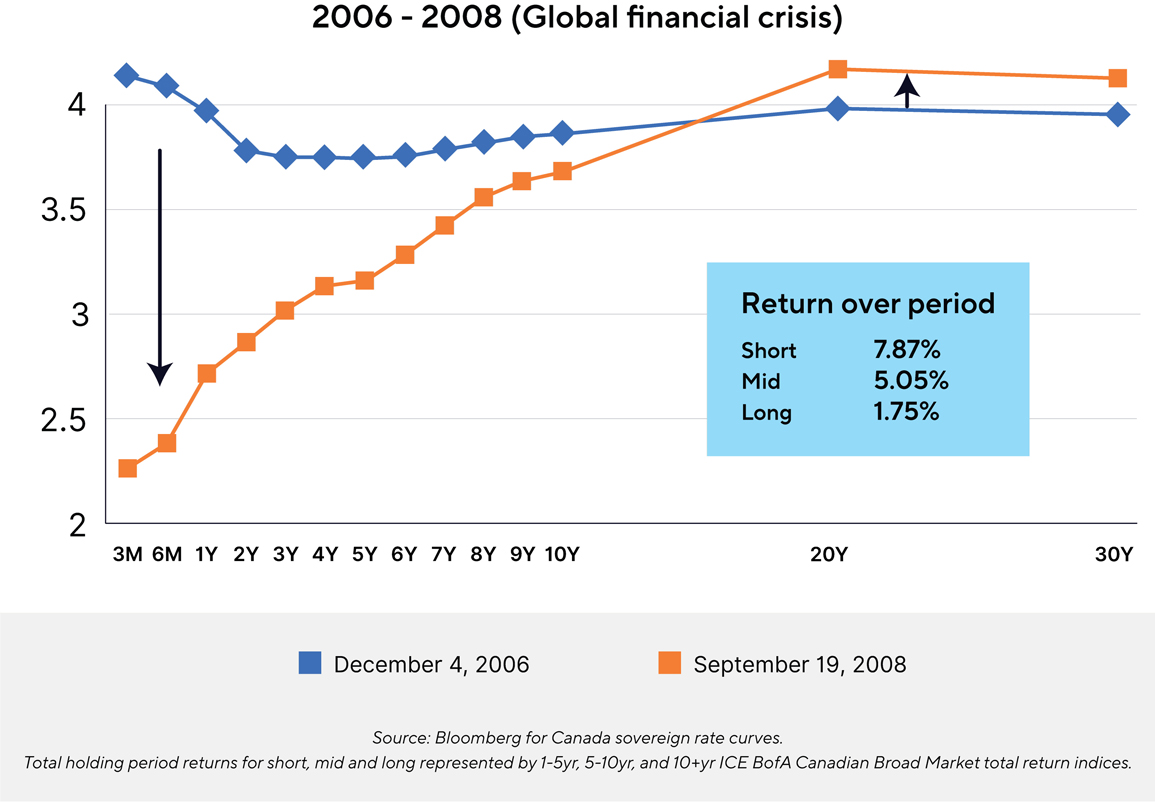

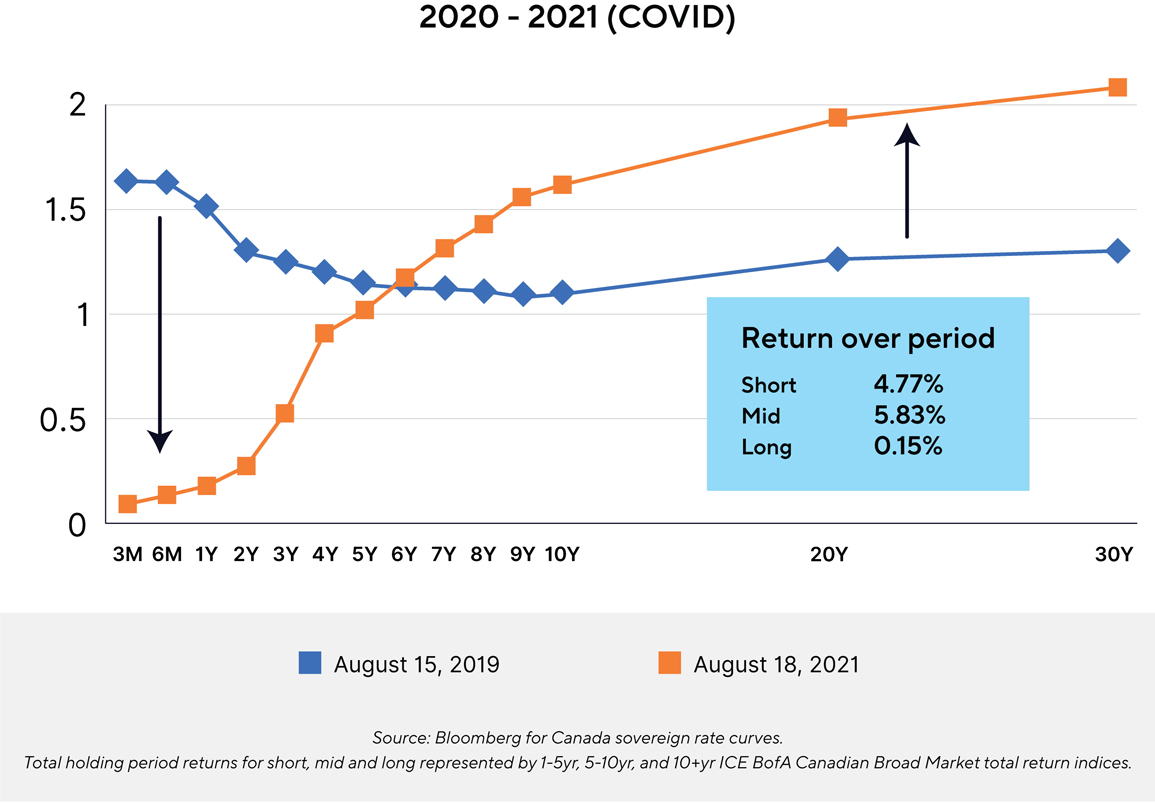

6. Central banks cutting short-term rates does not guarantee that long-term rates will also fall

We have maintained a relatively short duration on the funds at ATBIM, for several years and have been asked whether we should extend the duration during this time. The easiest way to do that would be to buy longer-maturity bonds. However, long-term bond yields often march to a different beat, with interest rates across 10+ year maturities moving more on longer-term inflation and growth expectations than central bank short-term interest rate targets.

Look at the last three recessionary periods from the BoC. Each period starts roughly when a rate peak was reached in the cycle and continues through to when rates were substantially cut:

The BoC had significantly cut their overnight target rates in each scenario. Yet, long bonds did not provide additional returns over shorter and mid-term bonds as longer yields remained elevated. One reason this may have a chance for repeating over the next couple of years is that the central banks can cut interest rates to provide relief to a slowing economy, but longer-term inflation expectations may remain anchored higher.

We believe the sweet spot in the maturity curve that will provide investors with the most consistent stream of returns over time will be to stick with a moderate duration. The current fixed income holdings in the ATB Funds managed by ATBIM sit at four years on average as of the end of September 30, 2023. Should it extend over the next while, it will likely result from selling a portion of the floating rate holdings still held in favour of fixed coupon issues.

Closing thoughts

Bonds have had a challenging time, but 2023 has already shown improvement. Should markets see rate cuts in 2024, bonds could be poised to see meaningful returns over the next few years. With the opportunity, however, economic uncertainty still weighs on markets. As the market evolves, ATBIM continues to favour active management to execute on opportunities quickly as they arise while ensuring the portfolio remains resilient through proper diversification.

1 ATBIS Fixed Income Pool O Series Total Return from December 30, 2022 to November 22, 2023, returns are gross of management fees and include distributions. Annualized performance for the ATBIS Fixed Income Pool can be found at https://atbim.atb.com/funds/.

2 Total return of the BofA Canada Broad Market Index to November 22, 2023.

A rise in interest rates typically causes bond prices to fall. The longer the average maturity of the bonds held by a fund, the more sensitive a fund is likely to be to interest-rate changes. The yield earned by a fund will vary with changes in interest rates. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a fund’s investments.

This article may contain forward-looking statements about a fund, bond yields, or general economic factors which are not guarantees of future performance. Forward-looking statements involve assumptions, risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. We caution you not to place undue reliance on these statements as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility.

ATB Investment Management Inc. ("ATBIM") manages the Compass Portfolios and ATBIS Pools. ATBIM and ATB Securities Inc are wholly owned subsidiaries of ATB Financial and operated under the trade name ATB Wealth. ATB Securities Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization.

Past performance is no guarantee of future results. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATBSI, ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

The information contained herein has been compiled or arrived at from sources believed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness, and ATB Wealth (this includes all the above legal entities) does not accept any liability or responsibility whatsoever for any loss arising from any use of this document or its contents. This information is subject to change and ATB Wealth does not undertake to provide updated information should a change occur. This document may not be reproduced in whole or in part, or referred to in any manner whatsoever, nor may the information, opinions and conclusions contained in it be referred to without the prior consent of the appropriate legal entity using ATB Wealth. This document is being provided for information purposes only and is not intended to replace or serve as a substitute for professional advice, nor as an offer to sell or a solicitation of an offer to buy any investment. Professional legal and tax advice should always be obtained when dealing with legal and taxation issues as each individual’s situation is different.