Market and economic commentary

April 2023

International markets led the way for positive returns for equities in April, and with fixed-income markets also in a positive state, this benefitted all Compass Portfolios and ATBIS Pools.

Equity and fixed-income markets both achieved positive returns in April. International markets were the leading region for equities, followed by Canada and the US. As a result, all Compass and ATBIS pool funds saw positive performance for the month. In its April rate decision, the Bank of Canada continued to hold the overnight rate at 4.5% with the expectation that economic growth will remain weak for the rest of the year, and inflation will

continue to ease to around 3% by the summer.

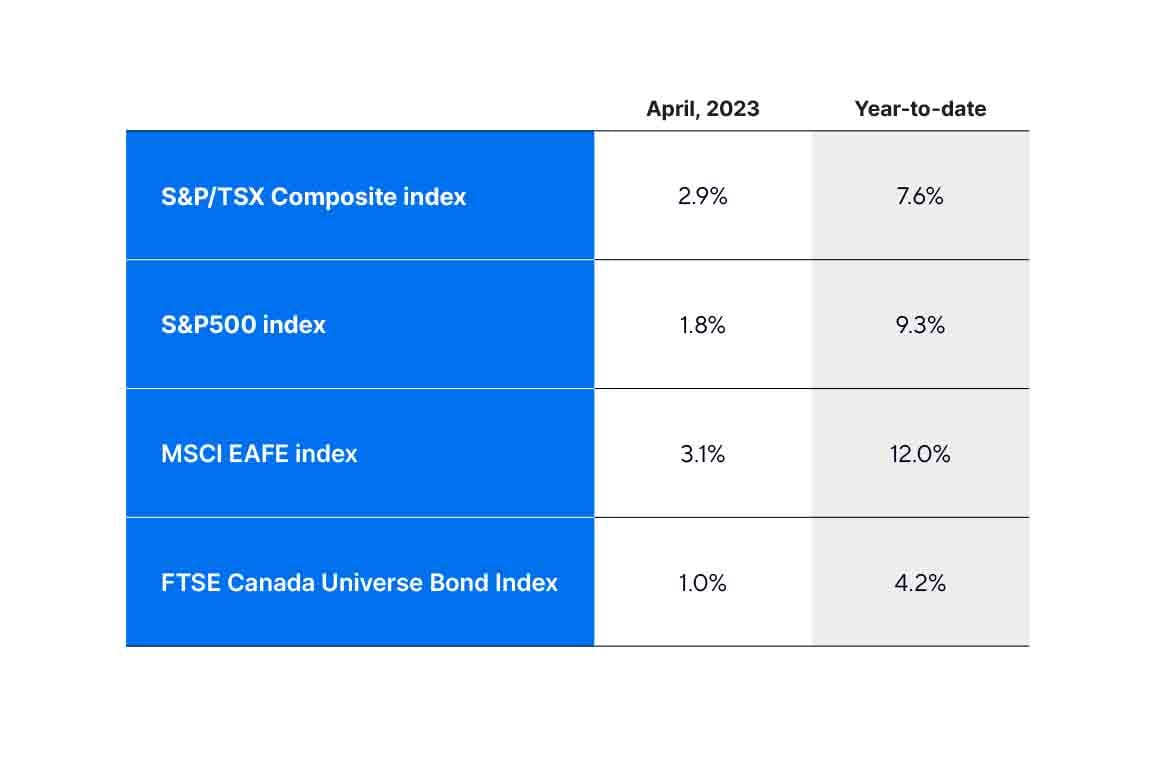

Below are index total returns in Canadian dollar terms for April, and year to date respectively:

Source: Bloomberg

The month started off with a jolt thanks to OPEC announcing a surprise oil production cut of around 1.2 million barrels a day in an effort to stabilize oil prices, having hit a 15-month low of just over $66 mid-March. The surprise cut sent oil prices up, rising to just over $83 by mid-April. The surprise cut drew criticism from the US, with US Treasury Secretary Janet Yellen calling it an “unconstructive act.” While energy prices came off their mid-April highs, the cut adds additional uncertainty to the inflation outlook, as oil is a key input in economic growth and subsequent inflation. Energy stocks in Canada and the US responded favourably to the news, initially outperforming other sectors within their respective indices, but paring back their gains as oil prices fell back to late-March levels by the end of April.

As the US Federal Reserve (Fed) did not meet in April, the focus was on the Bank of Canada (BoC), which decided to hold the overnight rate at 4.5% as expected by markets. While headline inflation is still well above the BoC’s (midpoint) target of 2%, the latest data showed inflation fell to an annual rate of 4.3% for March (versus 5.2% for February). The BoC expects inflation to continue to decline to 2% by the end of 2024 amid a weaker growth outlook for the rest of 2023 and into 2024. South of the border, March Consumer Price Index (CPI) figures were in line with expectations, however, core Personal Consumption Expenditures (PCE)—the Fed’s preferred measure of inflation—came in a little higher than anticipated. These numbers pave the way for an additional 0.25% hike in May. While Fed board members have expressed their discomfort with the current level of inflation, higher core PCE numbers may have cemented the prospect.

Although bond yields were only slightly lower on a month-over-month basis, fixed-income markets were relatively volatile, seeing yields swing more than 30 basis points (as measured by the Canada 10 year bond) during the month. As a result, returns on the bond index varied by around 2% swinging from positive to negative, but gaining ground by month end. Narrowing credit spreads pushed corporate bonds to outperform the index, however, high-yield bonds underperformed likely due to their shorter overall duration, despite slightly narrower spreads. The credit-heavy fixed-income holdings within the funds benefitted from the narrowing spreads, but the fund’s short duration likely limited those benefits, as the holdings performed in line with the overall index.

Equities across all major markets were positive on an absolute basis for both the Compass and ATBIS pools, as well as the major indices. The international holdings within the funds ended the month in line with the benchmark, with the small-cap mandate offsetting some picks within the funds’ industrial names. US equities within the funds saw outperformance from the large-cap holdings thanks to an overweight in financials and avoiding poorly performing consumer discretionary names such as Tesla, which fell more than 20% over the month. This was offset by the small- and mid-cap allocations both underperforming their large-cap counterparts, resulting in the US holdings slightly lagging the benchmark overall. Canadian equities were the biggest detractor from performance, underperforming the benchmark by approximately 1.4%. A combination of small-cap names underperforming their large-cap counterparts, compounded by an underweight in both materials and communication services (the best-performing sectors for the month) primarily contributed to the funds’ holdings coming in behind the benchmark for April.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. The mutual fund performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc., ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

The information contained herein has been compiled or arrived at from sources believed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness, and ATB Wealth (this includes all the above legal entities) does not accept any liability or responsibility whatsoever for any loss arising from any use of this document or its contents. ATB Wealth does not undertake to provide updated information should a change occur. This document may not be reproduced in whole or in part, or referred to in any manner whatsoever, nor may the information, opinions and conclusions contained in it be referred to without the prior consent of the appropriate legal entity using ATB Wealth. This document is being provided for information purposes only and is not intended to replace or serve as a substitute for professional advice, nor as an offer to sell or a solicitation of an offer to buy any investment.