Market and economic commentary

April 2024

April had broad equity and bond markets selling off due to sticky inflation reports. As a result, anticipated rate cuts from central banks were pushed out later into 2024, which the market took as a negative.

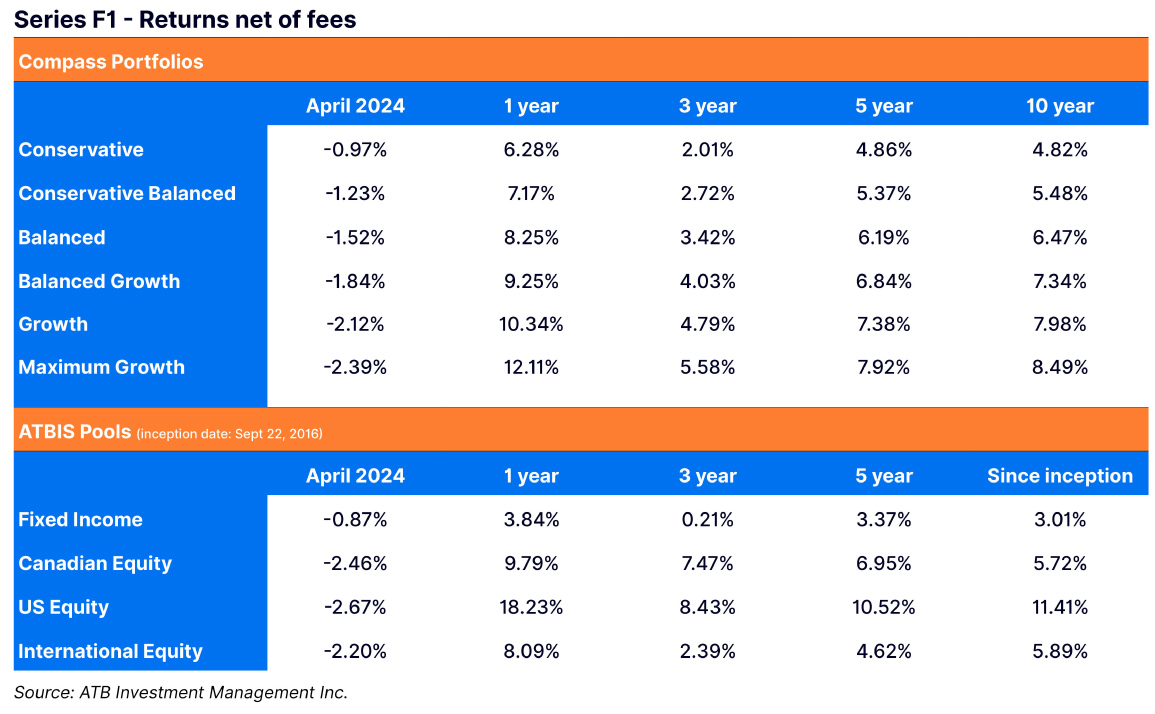

April had broad equity and bond markets selling off due to sticky inflation reports. As a result, anticipated rate cuts from central banks were pushed out later into 2024, which the market took as a negative. All Compass Portfolios and ATBIS Pools (the Funds) saw declines for the month. Find up-to-date performance data on the ATB Investment Management website here.

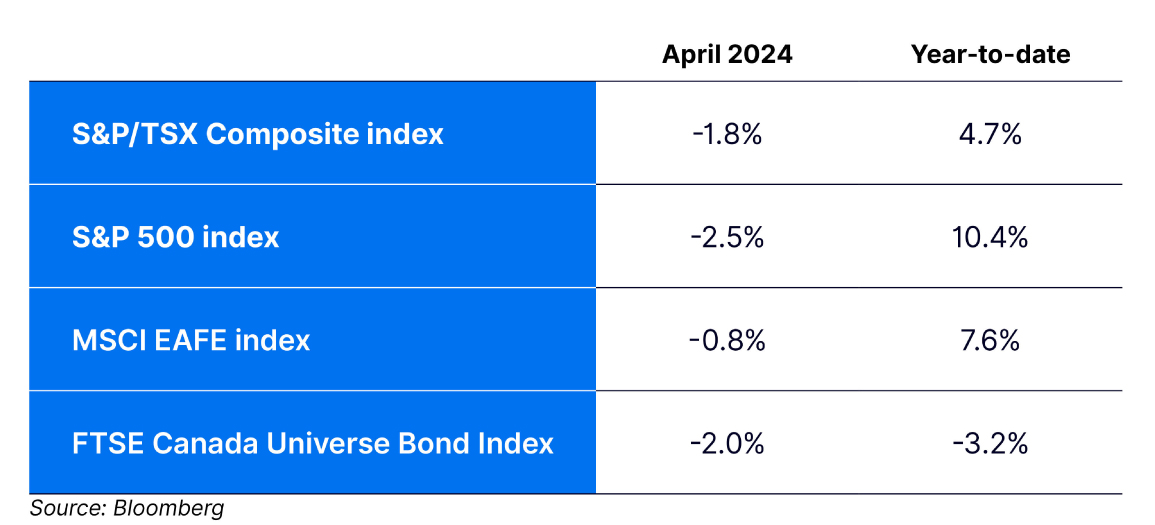

Below are index total returns in Canadian dollar (CAD) terms for April and year-to-date, respectively:

Economics

Economic activity across Canada, Europe and the United States appears to be deviating in direction, with the US pulling ahead of its peers and leaving its closely linked neighbour to the north to contemplate a divergence in monetary policy.

Advanced estimates put the US GDP growing at a 1.6% annualized pace in the first quarter of 2024 vs 3.4% in the previous quarter. Most of the decline came from higher imports, fewer exports, and reduced government spending. These were large enough to offset some positives in the form of modest increases in consumer spending and domestic residential investment. Consumer spending remains robust, as evidenced by retail sales continuing to top expectations. With all the spending, the savings rate remains well below long-term average. The confidence in spending might stem from the labour market, which is continuing to fire on all cylinders. The latest jobs report surprised to the upside, adding 315 thousand jobs—90 thousand more than expected. Combined with continuing and initial jobless claims that have barely moved, the unemployment rate dropped to 3.8%. All of this further complicates the US Federal Reserve’s (Fed) fight against inflation, and a higher-than-expected 3.5% headline inflation rate for March is pushing rate cuts towards the end of the year.

Here at home, the Bank of Canada (BoC) is further along in its timeline for rate cuts, as the central bank is “seeing what we need to see” to lowering the overnight rate. Market observers are conflicted as to whether this means we will see a rate cut as soon as June or if it gets pushed to July. Certainly, the data will tell the tale, but the overall Canadian economic picture supports some easing. Despite skirting a recession over the last couple of quarters, GDP per capita will likely continue to fall, as GDP growth has not kept pace with population growth. Part of this could be blamed on the job market. Although Canada lost a modest 2,200 jobs in March, job growth is not keeping pace with the quickly expanding workforce from a larger population— the unemployment rate rose by 0.3% for the month to 6.1%.

As the BoC appears ready to lower rates sooner than the Fed, market observers are wondering just how much the two central banks can differ in policy. A more accommodative regime in Canada is likely to devalue the Canadian Dollar versus the US Dollar. This, in turn, would elevate import costs, which could put upward pressure on prices, reigniting inflationary pressures. The two central banks have diverged in policy in the past, so it’s not unprecedented. There is a careful balance the BoC needs to maintain between slowing economic activity, keeping inflation in check, and not distressing currency markets.

Financial markets

Fixed income in the Funds declined slightly in April, although the shorter average duration of the fixed income holdings protected some of the downside as bond yields rose through the month. The overall yield curve in Canada flattened for the month. The first rate cut is still expected to occur in June or July, but beyond that, the total cuts by year-end are two compared to the three priced in at the end of March. Yields, as a result, rose by about 30 basis points in the mid- to long-maturities, leading to small price declines for fixed income holders. Credit spreads were flat for the month, with little movement in either investment grade or high yield.

The US led the way for declines this month in equities, faring a little worse than Canadian and international stocks. Early declines in the month rebounded after a stellar US payrolls report, but the bounce was short-lived, with the US CPI report released a few days later showing a third month straight of inflation advancing. That set the tone for the remainder of the month globally as yields rose from there and equities declined, expecting higher rates for longer. The Fund’s equity holdings were down around 2-3% as noted by the April performance below in Compass Maximum Growth Portfolio and each of the ATBIS regional equity pools. Energy and materials (miners specifically) were two of the best equity sectors for the month. The Funds tend to be underweight or holding fewer commodity price-sensitive companies, choosing integrated and pipeline energy companies instead, for example within energy or non-miners for materials. Beyond sector allocations, small-cap holdings in the US and international regions lagged behind large-cap stocks for the month1.

1 US small-cap allocations are held in Compass Balanced Portfolio, Compass Balanced Growth Portfolio, Compass Growth Portfolio, and Compass Maximum Growth Portfolios, as well as the ATBIS US Equity Pool. International small cap allocations are held in Compass Balanced Growth Portfolio, Compass Growth Portfolio, and Compass Maximum Growth Portfolio, as well as the ATBIS International Equity Pool.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.