Market and economic commentary

August 2023

Global equity markets saw declines through mid-month before mostly recovering through the end of the month.

Global equity markets saw declines of about 3% through mid-month before mostly recovering through the end of the month. Markets continue to look for direction as central banks remain keen on keeping rates elevated with stronger than expected economic data—US gross domestic product (GDP) may be accelerating through the third-quarter and both Canadian and US core Consumer Price Index1 (CPI) did not see declines last month. The performance of the Compass Funds and ATBIS pools (the Funds) was mixed—positive returns for fixed income and US equities, slightly negative for Canadian and international— but all saw on par or positive relative performance. Up-to-date performance can be found here.

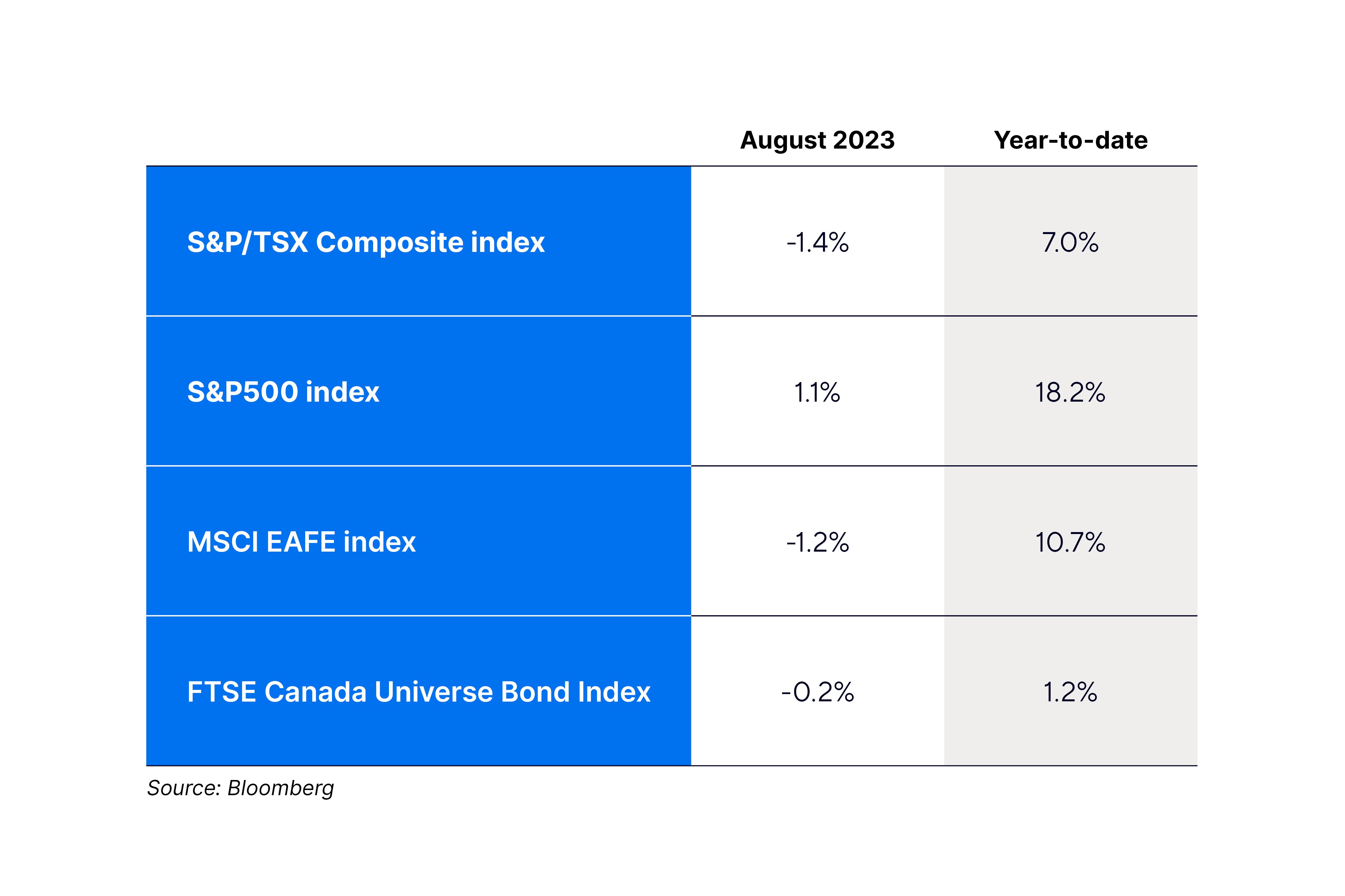

Below are index total returns in Canadian dollar (CAD) terms for August, and year-to-date respectively:

August saw labour markets showing signs of normalizing in the US as the unemployment rate ticked up to 3.8%—although still near historically low levels—and the number of job openings for July unexpectedly declining back to early 2021 levels. Coupled with the quit rate dropping back to pre-pandemic levels and three million fewer job openings compared to the peak in March, we may start seeing enough labour market normalization to satisfy the US Federal Reserve (Fed). The Canadian employment landscape saw a contraction in July with the net change in employment dropping slightly, although the unemployment rate remained unchanged. Wages in Canada continue to climb above inflation, rising 5% on a year-over-year basis with increases for both part-time and full-time workers.

Inflation for July in the US at 3.2% was more or less in line with expectations, but the Canadian figures were a bit stronger than expected across the board, rising 3.3% up from 2.8% in June. Core measures were little changed, but shelter rose, driven by mortgage interest costs which are now up 30.6% on a year-over-year basis. As energy prices may continue to have less of a dampening effect on headline inflation—since they peaked in June 2022—and higher mortgage rates continue to work their way through to consumers, the Bank of Canada (BoC) may have to contend with some elevated core inflation. A slightly weaning job market, coupled with Canadian GDP contracting 0.2% for Q2, and indicators such as the manufacturing Purchasing Managers Index (PMI) suggesting slowing activity, may give the BoC some leeway to keep rates where they are for the time being. Expectations for the BoC’s meeting on September 6 are for no change.

Fixed income markets saw a surprise right at the start of the month with headlines highlighting the downgrading of US sovereign debt to AA+ from AAA by ratings agency Fitch. Their rationale for the move was over expectations of fiscal deterioration and amid “erosion of governance2” relative to AAA peers. Fitch’s downgrade follows closely on the heels of the debt-limit negotiations back in May which were pushed to the eleventh hour between Congress and the Biden administration. Over the month, yields, while volatile, ended approximately where they started and credit spreads also saw little change. The fund’s fixed income holdings were roughly flat for the month but positive on a relative basis compared to the broader Canadian bond market3. Depending on the fund, the blended fixed income component carried a 6.2%-6.4% yield-to-maturity as at the end of August.

Equities were a mixed bag on an absolute basis with the US being the only region that saw positive returns (in CAD terms; in local currency, the US market also fell). However, each of the fund’s regional equity components—Canadian, US, and international —outperformed their respective indices4 or were in line in the case of Canada. Overseas equity performance was helped by a falling CAD where it lost approximately 2.6% against the US dollar and approximately 2% against the Euro for the month. Novo Nordisk, a Denmark-based pharmaceutical company, was the largest positive return contributor of equities for August in the funds that have an international equity component. As the manufacturer of diabetes and weight-loss drug Ozempic, the company has seen significant growth in earnings over the past few years which has translated to strong returns for the stock.

The second-quarter earnings season is nearly finished reporting. Growth has not been as great as previous quarters in the US, and especially in Canada, although nearly two-thirds of companies were still surprising to the upside for net earnings. Despite the welcome surprises, roughly half of these companies saw a contraction in earnings growth. Of particular importance to Canada, earnings growth in materials and energy sectors declined the most as commodity prices on average have been declining over the past six months—it’s worth noting that crude oil prices have recently rebounded over the summer stemming from OPEC production cuts. Overall valuations in US and international equity markets were little changed over August. Our view remains that the US is still relatively expensive compared to other globally developed markets (including Canada).

1 Core inflation is the Consumer Price Index (CPI) excluding food and energy.

2 Source: Fitch Downgrades the United States’ Long-Term Ratings to ‘AA+’ from ‘AAA’; Outlook Stable. Published August 1, 2023.

3 FTSE Canada Bond Index

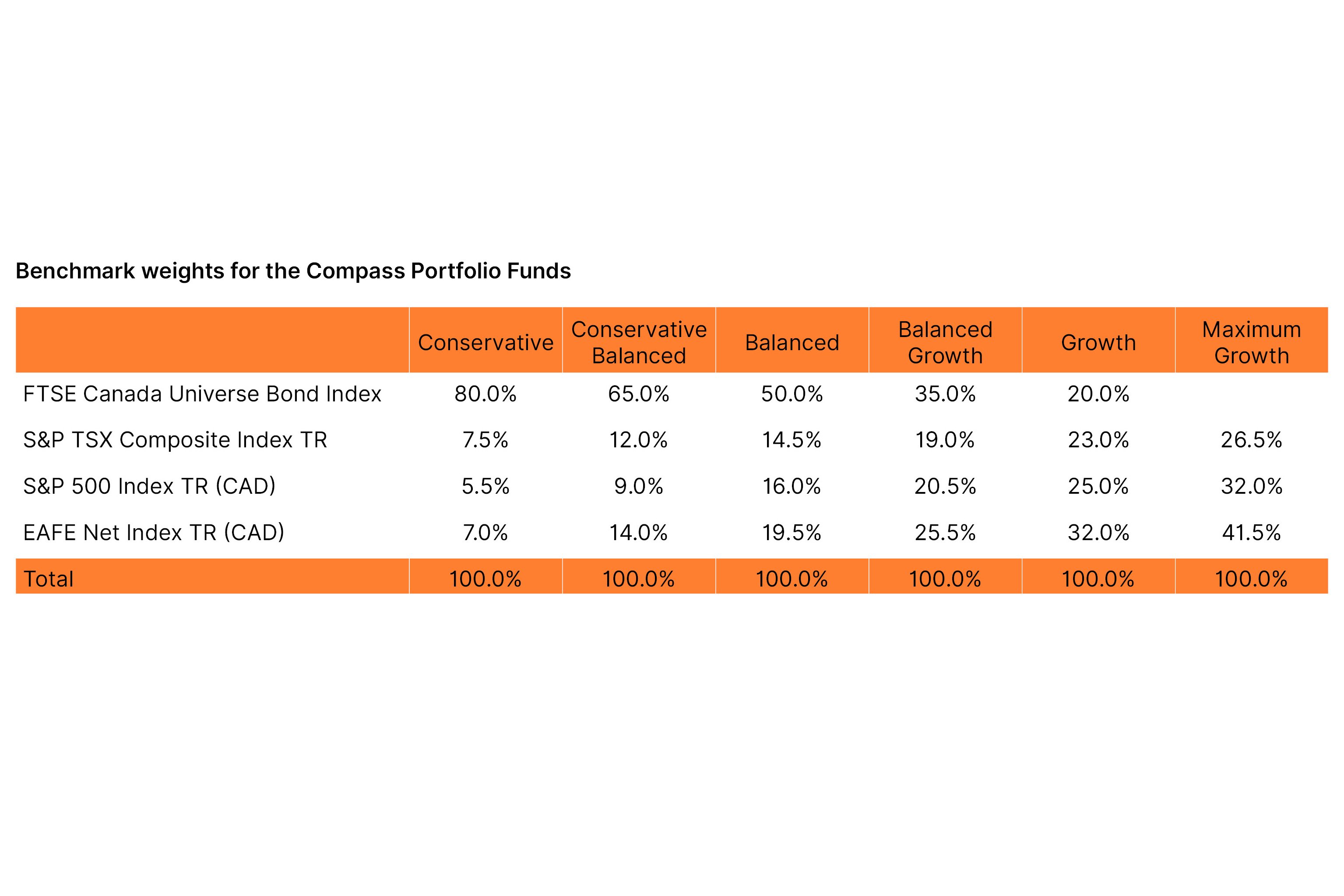

4 The ATBIS Canadian Equity Pool is benchmarked against the S&P TSX Composite Total Return Index, the ATBIS US Equity Pool is benchmarked against the S&P 500 Total Return Index (CAD), and the ATBIS International Pool is benchmarked against the MSCI EAFE Net Total Return Index (CAD).

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. The mutual fund performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc., ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

The information contained herein has been compiled or arrived at from sources believed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness, and ATB Wealth (this includes all the above legal entities) does not accept any liability or responsibility whatsoever for any loss arising from any use of this document or its contents. ATB Wealth does not undertake to provide updated information should a change occur. This document may not be reproduced in whole or in part, or referred to in any manner whatsoever, nor may the information, opinions and conclusions contained in it be referred to without the prior consent of the appropriate legal entity using ATB Wealth. This document is being provided for information purposes only and is not intended to replace or serve as a substitute for professional advice, nor as an offer to sell or a solicitation of an offer to buy any investment.