Balanced is beautiful

The enduring value of the balanced portfolio—where risk management meets growth

In today’s shifting global landscape, investors are facing an environment shaped by interest rate uncertainty, inflationary pressures and evolving market cycles. While change is constant, so is the opportunity to make smart, confident decisions. It’s natural to feel uncertain, but with the right strategy, you can stay grounded and focused on your long-term goals.

One approach that continues to prove its worth is the balanced portfolio. Far from being outdated, this time-tested strategy remains a powerful way to manage risk, generate income and build lasting wealth—especially in times of transition.

What is a balanced portfolio?

A balanced strategy blends growth and stability by combining equities (stocks) and fixed income (bonds) in a single, diversified portfolio. A balanced portfolio reflects the idea that equities drive long-term growth, while fixed income—helps protect against downturns and provides steady income. The balanced portfolio model has caught on with investors because it delivers a simple, effective way to pursue returns without taking on unchecked risk, providing a smoother ride through market cycles. This mix has become a standard for retirement accounts and long-term investment strategies because it offers:

- Diversification: spreads risk so one weaker asset class doesn’t drag down the rest of the portfolio

- Risk mitigation: uses bonds to help steady the ups and downs of stock-market volatility

- Income generation: generates regular interest—ideal for those in need of steady cashflow

The typical asset classes in a balanced portfolio include Canadian and global equities, and government and corporate bonds. In today’s fast-changing market environment modern balanced portfolios can go beyond these traditional building blocks—incorporating alternative investments, real assets and private markets to access new sources of growth and income.

This broader approach has become increasingly important as macroeconomic market conditions and the dynamics between asset classes continue to evolve. In response, many investors are exploring alternative sources of income and stability to build more resilient balanced portfolios that are suited to today’s environment.

History lesson: origins of the balanced model

The balanced portfolio has its roots in Modern Portfolio Theory (MPT), pioneered by Harry Markowitz in the 1950s. His work showed that investors could improve outcomes by diversifying intelligently—seeking the best possible return for a given level of risk.1 His theories would soon move into practice by investors. One of the first real-world examples was the Wellington Fund, launched in the late 1920s by Walter L. Morgan, which blended stocks and bonds in a “balanced” approach that became a model for future funds.2

From there, the balanced concept spread to pension funds, endowments, foundations and large institutional investors, which embraced it as a pragmatic way to balance growth with stability. And today, the balanced portfolio framework is accessible to virtually all types of investors, from individual savers to global asset managers.

How a typical balanced portfolio has fared over the years

The true test of any investment strategy isn’t just about its design—it’s about how it performs through time’s inevitable ups and downs. History shows us that when markets tremble, a balanced approach stands relatively more firm. Recently, Morningstar performed a 150-year stress test on the 60/40 portfolio. It found that a 60/40 portfolio experienced 45% less pain than an all-equity portfolio during major crashes.3

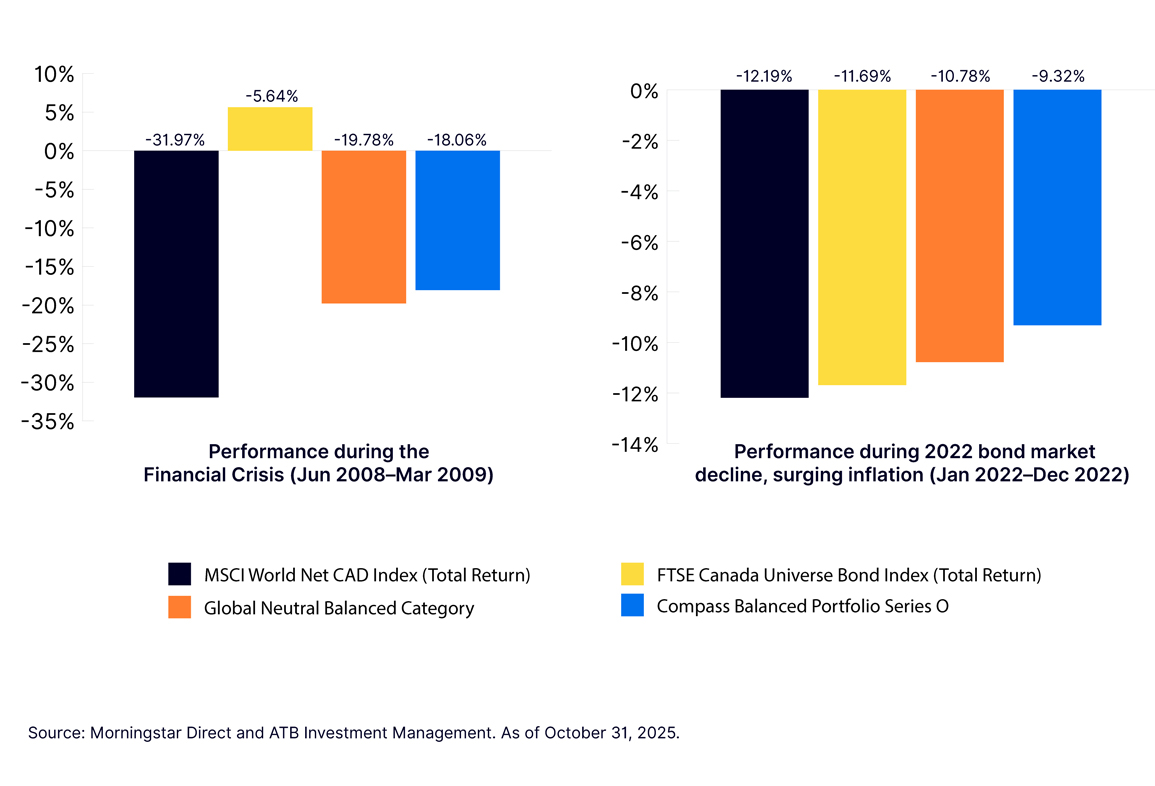

Figure 1: How balanced portfolios provided downside protection during market meltdowns

So, what’s the lesson? While no portfolio is immune to downturns, a balanced approach dramatically reduces the depth of losses and supports faster recoveries.

Modern challenges and the 2022–2025 exception

Even the most time-tested strategy faces challenges. The surging inflation and bond market decline of 2022–2023 was historic—marking the only time in 150 years that a balanced 60/40 portfolio underperformed equities. Rising interest rates, global inflation, supply chain breakdowns and geopolitical conflict (notably the Russia–Ukraine war) all contributed.

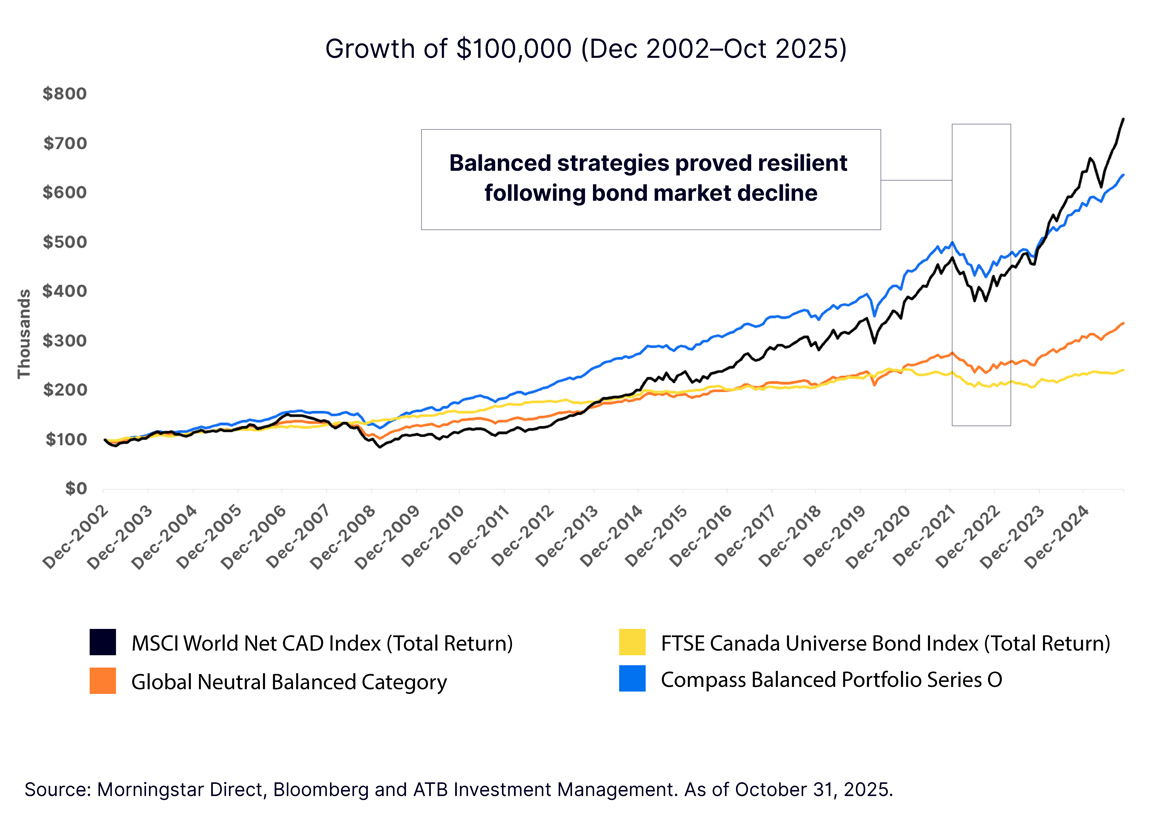

But resilience prevailed. By mid-2025, the balanced portfolio (as represented by the Compass balanced portfolio) had fully recovered, even while bonds remained underwater. This exception reinforced an important truth: Balanced bends but rarely breaks.

Figure 2: Resilience in action—how balanced strategies bounced back and provided long-term growth

Why balanced still works

In a world of market noise and shifting narratives, the fundamentals of a balanced portfolio have often proved reliable, especially during unsteady markets—namely, by providing:

- Diversified investments across asset classes, geography, market capitalizations and manager styles, which smooth out volatility across cycles and reduce the impact of any single market downturn so investors can stay the course

- Downside protection from fixed income that acts as a stabilizer during turbulent equity markets, softening the blow to overall portfolio value

- Upside potential from equities that remains the engine for compounding growth, offering the potential for capital appreciation and fueling wealth-building over time

- Income generation from bonds and dividends from stocks providing regular cash flow, especially valuable for retirees or income-focused investors seeking reliability

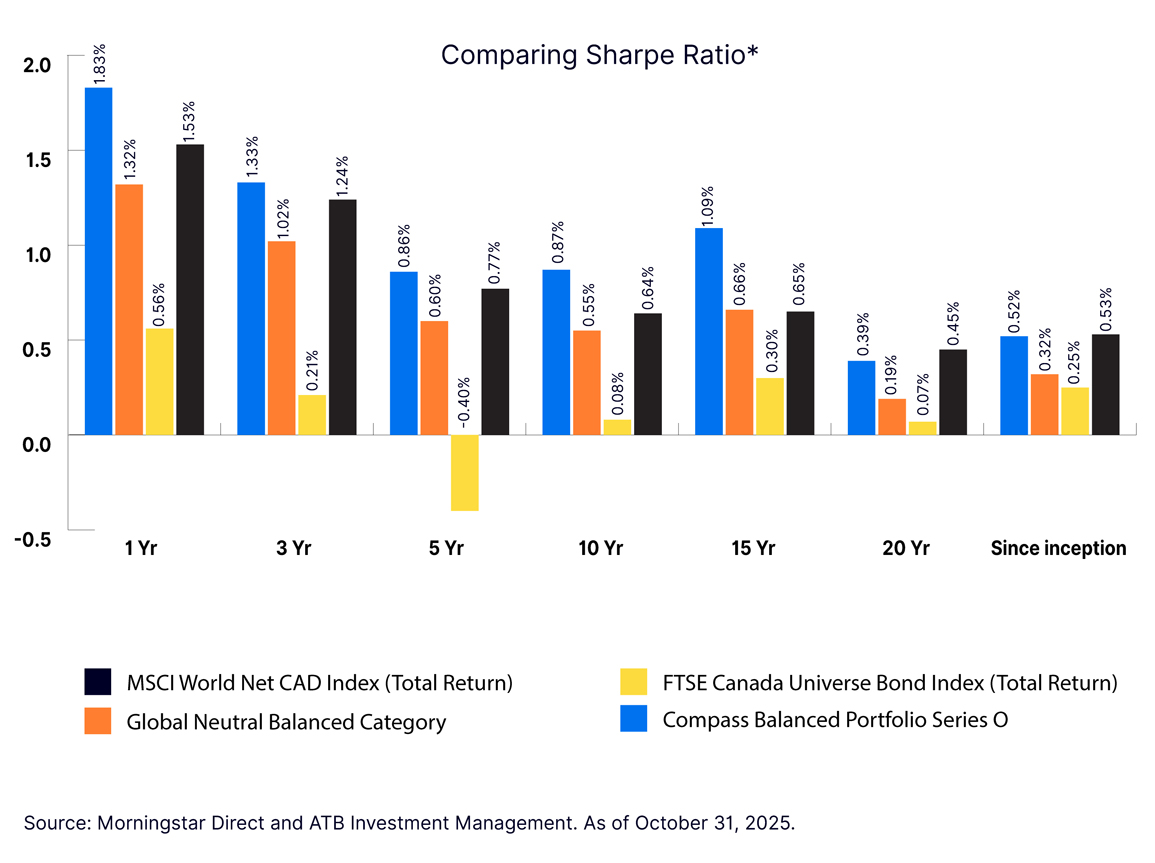

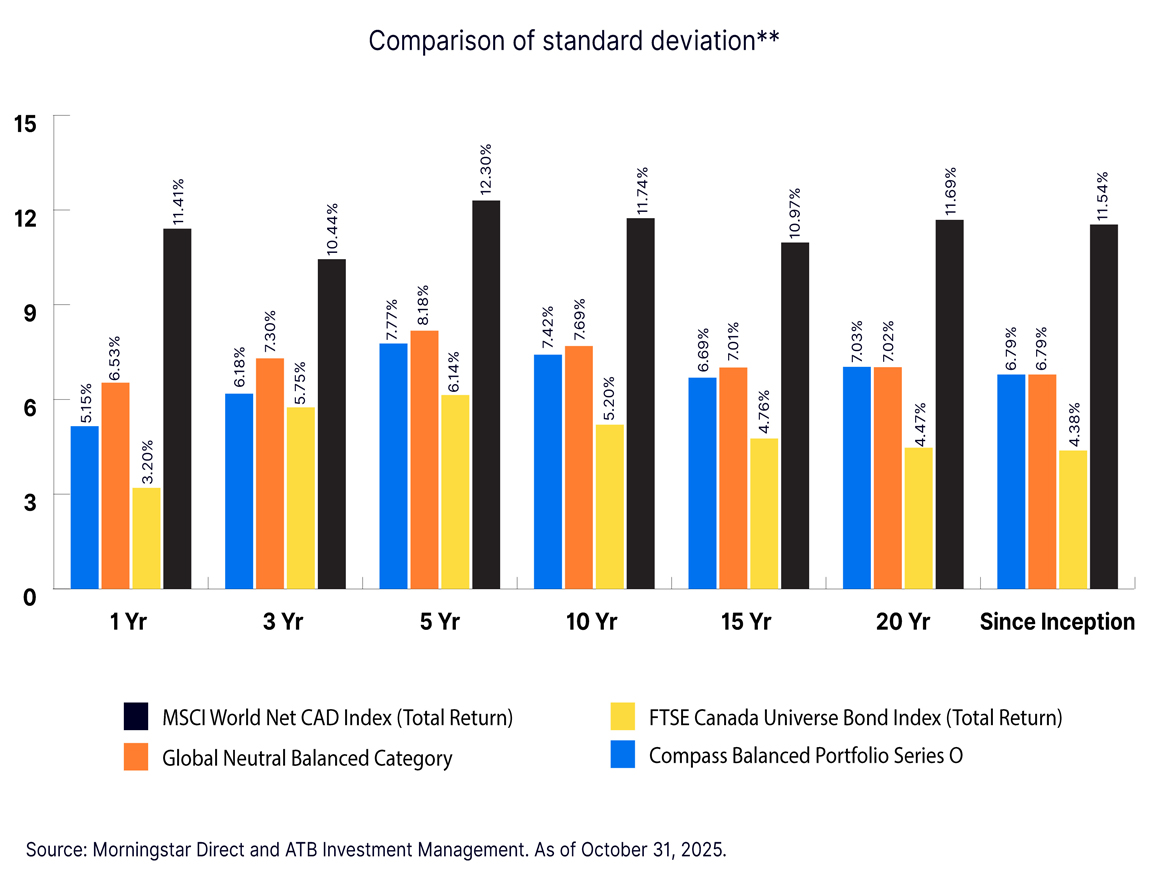

Over a 15+ year horizon, balanced portfolios have consistently outperformed single-asset-class strategies on a risk-adjusted basis—providing steadier returns and less emotional stress for investors. The higher Sharpe ratios in Figure 3 show that balanced portfolios delivered better returns for each unit of risk taken, while the lower standard deviations in Figure 4 highlight smoother performance relative to the benchmarks with fewer ups and downs along the way. Together, Figures 3 and 4 illustrate why diversification across multiple asset classes remains one of the most effective ways to achieve growth with greater stability over time.

Figure 3: Demonstrating strong risk-adjusted returns over time

Figure 4: Delivering competitive returns with lower volatility

Balanced portfolios remain one of the most effective ways to manage risk while pursuing long-term growth. By combining equities and fixed income, we’re able to smooth out market volatility and provide investors with a more consistent experience—especially important for those relying on their investments for income.

Balanced in action: demonstrating the benefits of ATBIM’s balanced offerings

ATB Investment Management’s robust balanced fund platform includes Compass Balanced Portfolio, as well as Compass Conservative Balanced and Compass Balanced Growth portfolios. In addition, the newly launched ATB Monthly Income Portfolio provides a single-ticket solution designed to support investors’ income needs.

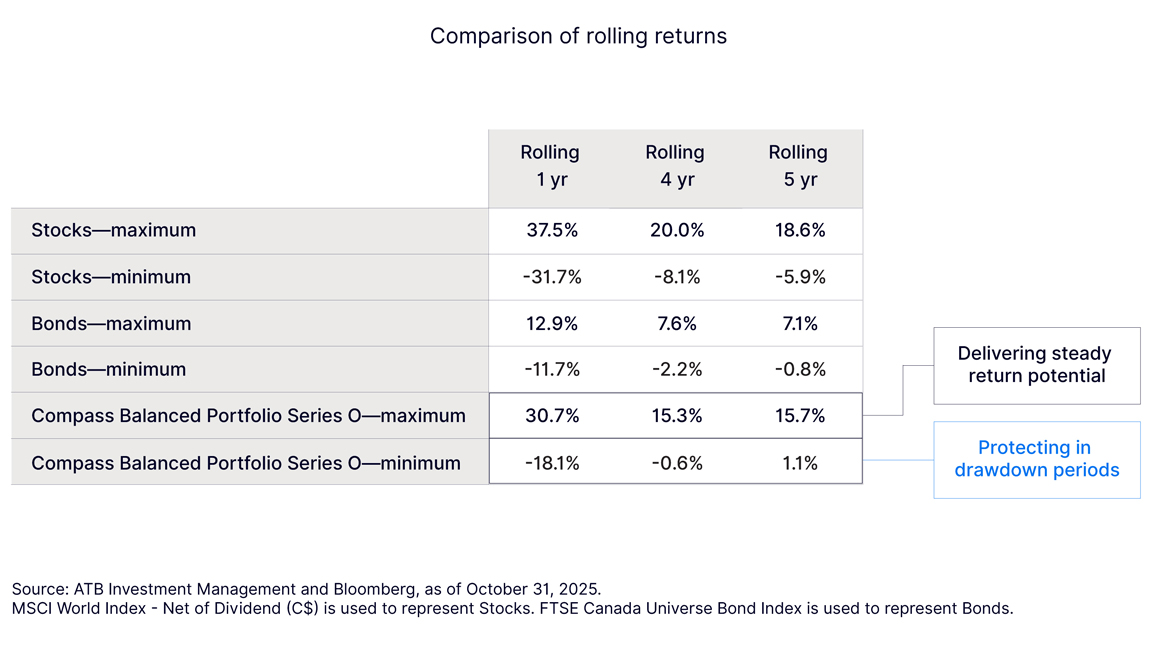

Compass Balanced Portfolio proves you don’t have to take on full equity risk to achieve attractive risk-adjusted returns. Another way to see the Portfolio’s strength is by looking at its rolling returns—a method that allows you to track performance over many overlapping time periods.

For instance, instead of just checking how the portfolio did from 2005 to 2010, a 5-year rolling return looks at every possible 5-year stretch since the fund began. This gives you a clearer picture of how consistently it has performed over time, not just in one specific window of time.

Based on the 5-year rolling returns for Compass Balanced Portfolio, no matter when you looked over any five-year stretch, it beat its benchmark 99% of the time. That shows how reliable and steady its performance has been, thanks to disciplined investing, a diversified asset mix and sound risk controls.

Figure 5: A smoother experience: Balanced strategies deliver attractive return potential and protect during drawdowns

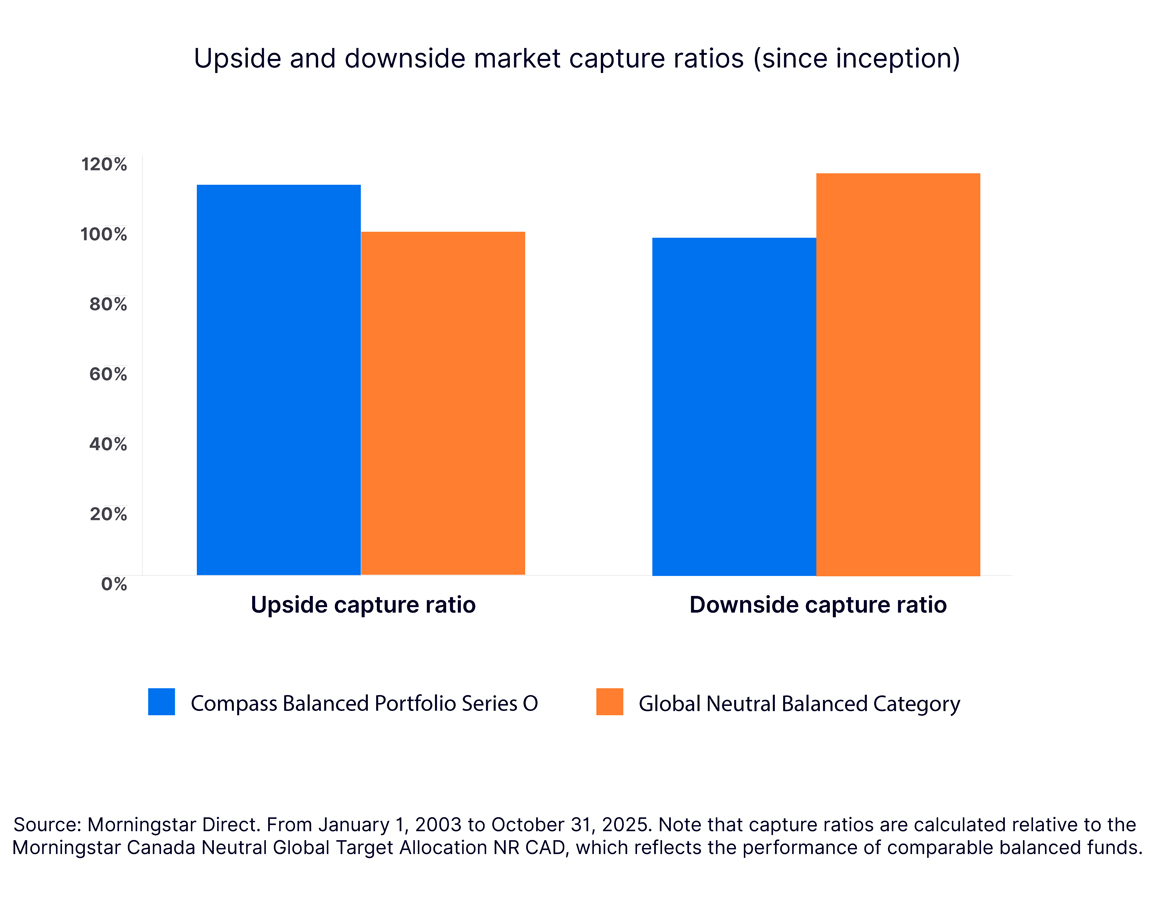

For more context, let’s take a look at Compass Balanced Portfolio’s upside market capture (the gains captured when the market is rising) and the downside market capture (the losses when the market is falling), since fund inception. As seen in Figure 6, Compass Balanced Portfolio’s higher upside capture ratio indicates that it performed better than the benchmark when the benchmark was rising. Lower downside capture ratio indicates that it protected on the downside by losing less in periods that the benchmark was declining.

Figure 6: Protecting on the downside while capturing the upside

The power of diversified investment perspectives

Another important differentiator of ATBIM’s disciplined balanced foundation is its multi-manager, multi-strategy approach. The Multi-Asset Strategies Team at ATBIM actively oversees the portfolios while collaborating with external investment managers—each a trusted leader in their respective asset class. These diverse partnerships bring a range of perspectives and investment styles, helping to reduce reliance on any single strategy or market outlook. This layered approach adds resilience and enhances the ability to adapt across different market conditions.

We believe in the power of diversified investment thinking. By drawing on a range of specialized partners, we gain access to distinct viewpoints and investment styles. That breadth helps us build portfolios that are not only well-rounded, but also better prepared for whatever the market throws our way.

Balanced for the long run

While there has been some recent debate about the relevance of the balanced portfolio, it’s evident that it’s both resilient and thriving. It has weathered wars, recessions, pandemics and inflation spikes. And it continues to offer a smart, accessible path to long-term financial success for Canadian investors.

Whether you're an advisor guiding clients or an investor planning for retirement, balanced portfolios deserve a place in your strategy.

Explore ATBIM’s balanced investing approach

Discover how our Compass Portfolios and ATB Monthly Income Portfolio can help you build a resilient, globally diversified investment plan.

1 Investopedia, Modern Portfolio Theory: What MPT Is and How Investors Use It.

2 https://www.nytimes.com/1998/09/04/business/w-l-morgan-finance-pioneer-dies-at-100.html

3 Morningstar, The 60/40 Portfolio: A 150-Year Markets Stress Test, September 15, 2025. Values measured in USD, using the US Large-Cap Stock Inflation Adjusted Total Return Extended Index, S&P 500 (2025).

ATB Investment Management Inc. (ATBIM) is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATB Investment Management Inc. is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future performance. The mutual fund performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATB Securities Inc. (ATBSI), ATB Investment Management Inc., ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read fund disclosure documents before investing. The ATB Funds and Compass Portfolios include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedarplus.com.

Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents. The material in this document is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.

© 2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.