Market and economic commentary

February 2024

A similar story to January, February saw equity markets performing well and bond markets declining slightly. Speculation on interest rate cuts was put on hold and the focus turned to US earnings where almost 75% of those released to-date have beat expectations. Canada avoided a technical recession, but the UK and Japan didn’t.

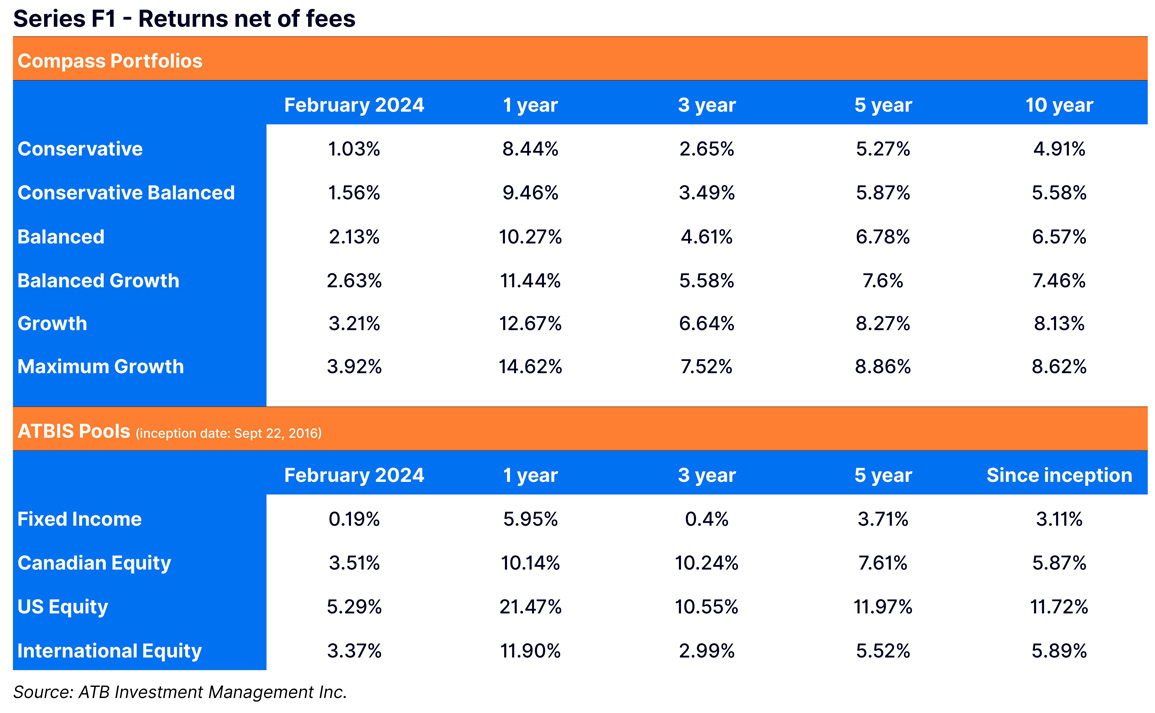

Equity markets advanced in February, while interest rates increased just enough to give bond markets slight declines for a second month in a row. As central bank meetings will pick up again in March, the speculation on interest rate direction was relatively muted for the month. Instead, the focus centred around earnings, and by month’s end, global stocks hit new highs1. All Compass Portfolios and ATBIS Pools (the Funds) saw positive performance for the month. Find up-to-date performance data on the ATB Investment Management website here.

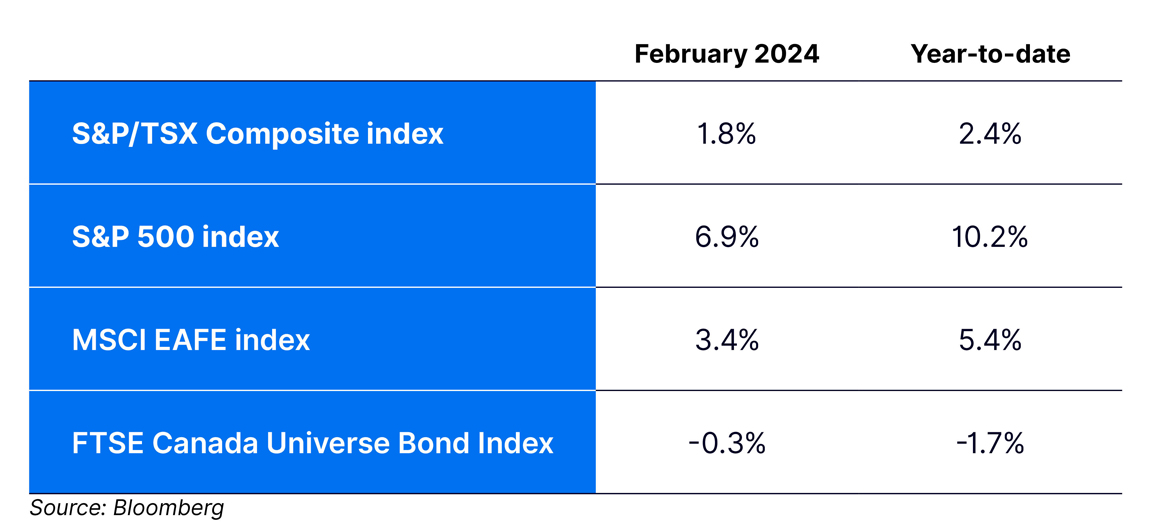

Below are index total returns in Canadian dollar (CAD) terms for February and year-to-date, respectively:

Economics

Canada’s gross domestic product (GDP) pointed to an annualized 1.0% gain in the fourth quarter, avoiding a "technical recession" defined as two consecutive quarters of negative GDP growth. While strong exports were more than enough to offset a decline in business activity, the economy did not keep pace with population growth, as per capita GDP continued to fall. Headline inflation slowed, with prices rising 2.9% for January versus 3.4% in December, with shelter accounted for around half of that, as taking it out left prices rising 1.5%.

Shelter’s significant contribution to inflation may prove to be problematic for the Bank of Canada (BoC) as it likely has limited ability to influence shelter costs. Removing mortgage interest costs brings inflation down to 2%, and while the BoC can lower its rate outlook to influence borrowing costs, it risks inflation and housing prices rebounding. Even if mortgage costs were to disappear overnight, people would still find ways to spend that extra money, and the induced demand would likely also push prices higher. Canada isn’t alone in this problem as annual headline inflation in the United States rose 3.9% in January, and taking the shelter component out left it at 1.6%. While mortgage interest payments are not specifically broken out, the Federal Reserve will face similar risks as the BoC when considering its rate path.

The UK and Japan both fell into a technical recession as Q4 GDP dropped for the second consecutive quarter. This puts the Bank of England (BoE) in a difficult situation from an inflation perspective—headline inflation is still 4% year-over-year for January, still higher than its 2% target. The BoE will have to balance their inflation strategy with pressure from lawmakers to cut rates to spur economic growth and improve public opinion, especially during an election year.

Financial markets

Bond markets saw slight declines throughout the month as interest rates increased by 0.09% for the average bond in Canada2. Overall, news from central banks was light, with only the BoE having a decision date early on February 1 and keeping rates steady. The Funds’ fixed income holdings saw slightly positive returns for the month. Narrowing investment-grade and high-yield spreads contributed positively to the Fund’s corporate bond holdings. In addition, the focus on an overall shorter duration compared to the average bond in Canada maintains less negative interest rate price sensitivity when yields rise.

The US equity market pushed to new highs, helped by better-than-expected earnings releases. Nvidia’s release was the most watched of those earnings—the company is best known for supplying graphics processors that are particularly well-suited for running artificial intelligence (AI) software. The company announced better-than-expected earnings on February 21, causing its stock, and the broader market, to rally through month’s end as confirmation that earnings growth from AI was alive and well.

Nearly all companies in the S&P 500 Index have reported financials for the last quarter of 2023. About 75% of companies have surprised to the upside, even though revenue and earnings growth remain relatively flat at 2.5% and 0.3% year-over-year, respectively. The Funds that hold US equity participated in much of the gains but lagged to some degree due to small- and mid-cap stocks returning less than large-cap stocks and the Funds having a smaller than market-cap weight in Nvidia.

Canadian equity also saw positive performance, just to a lesser degree than the US. Fourth quarter earnings releases for the S&P TSX Composite index have just over half of companies surprising to the upside. Revenues and growth have modestly declined over the year for Canadian companies, with the materials sector seeing the largest declines. For the Funds’ Canadian equity holdings, differing stock selection within the materials sector contributed positively for the month. Metals and mining that largely make up the sector on average were down for the month, but some long-held materials sector holdings unrelated to metals saw positive returns—namely packaging maker CCL Industries, and fertilizer producer, Nutrien. The ATBIS Canadian Equity Pool F1 targets holding entirely Canadian equity and returned 3.51% for the month, adding value over the S&P TSX Composite index up 1.82%.

Lastly, overseas equity markets advanced a few percent for the month. Like Canada, earnings season is about 75% reported, and just over half are surprising to the upside. Revenue growth is up about 3% year-over-year, edging out the US market. However net earnings have declined a couple of percent, with materials and energy companies seeing the largest declines as commodity prices moderated through 2023. German defence systems manufacturer, Rheinmetall, was a standout performer within the Fund’s international equity holdings. The stock advanced 32% on plans to open a factory in Ukraine and news of a few other defence contracts secured in Western Europe.

1 MSCI All Country World Index (ACWI)

2 FTSE Canada Universe Bond Index

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.