Gold as an investment

The topic of gold as an investment is often in and out of the news as the commodity itself moves in and out of favour with investors. Gold is many things to many people, but is it a sound investment?

The topic of gold as an investment is often in and out of the news as the commodity itself moves in and out of favour with investors. When economic times are weak, gold is promoted as a diversifying investment or store of value. When economic times are good, and equity markets are on an upward trajectory, gold is touted as a hedge against inflation.

Gold is many things to many people, but is it a sound investment? Should it have a place in your portfolio? As with all investments, it is essential to understand the potential risks and rewards associated with investing in gold.

How to invest in gold

There are two main ways to invest in gold:

- physical delivery, and

- an investment in the stock market.

Physical delivery

With physical delivery, you own the actual gold bars (or jewellery, coins, or other medium). You must have a safe place to store the gold, typically in a bank vault, which will incur storage costs. Then, you wait to see whether or not your gold holdings will increase in value.

Investing in physical gold and paying storage costs make it harder for your investment to provide the same level of compound growth that you might enjoy with a stock market investment.

Lastly, buying or selling physical gold can incur considerable transaction costs as gold dealers tend to sell gold for a far higher price than they are willing to buy it, further reducing the net return for an investor.

Stock market investment

The second way to invest in gold is indirectly through an ETF, mutual fund, or futures contract. An ETF can provide exposure to gold bullion and/or gold companies. Meanwhile, mutual funds are usually invested in gold companies, although some will maintain holdings in physical gold and/or futures. Both have historically been highly volatile and prone to extreme highs and lows.

A futures exchange is a central financial exchange, similar to the TSX (the main Canadian stock exchange), where investors buy and sell standardized futures contracts. An investor wishing to speculate on the future price of gold would buy or sell a futures contract and then wait to see if the bullion price moves in the right direction and by the right amount before the contract expires.

Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

What are the benefits or risks associated with gold?

The most popular rationales for owning gold or gold stocks are:

- as a hedge against inflation, and

- as a means of further diversifying a portfolio.

Realistically, there are other means to achieve both objectives without investing in gold or gold companies.

The main risk of investing in gold relates to the inherent difficulty in valuing the commodity. Unlike companies, physical gold does not generate cash flow, and the storage costs mean there is a negative cost of carrying. Also, you will never receive dividends on bullion holdings.

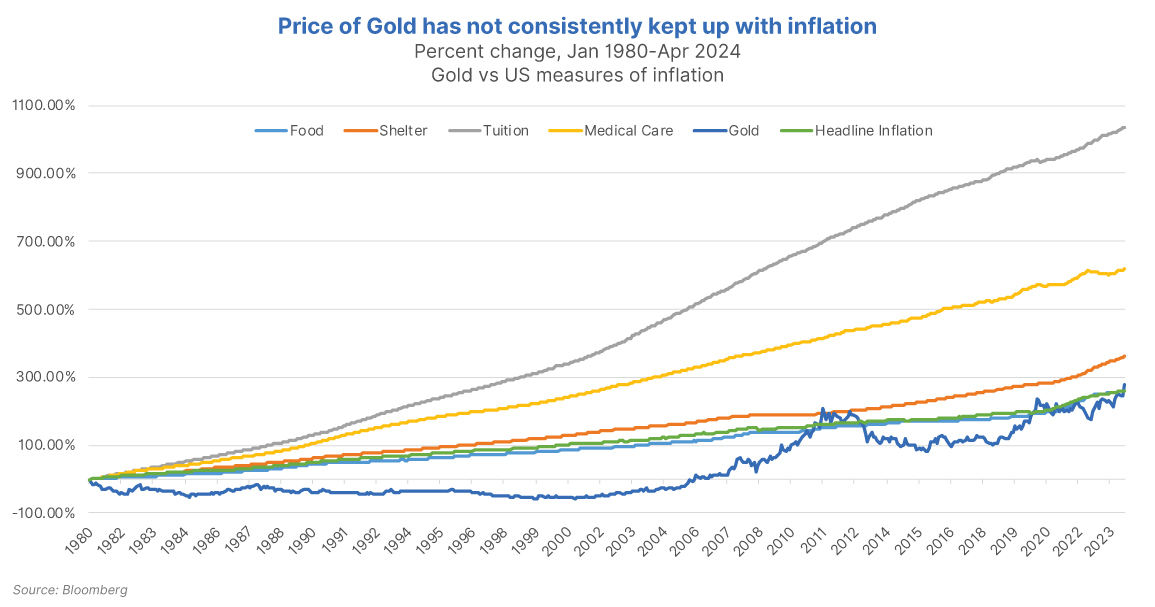

This graph shows that gold hardly changed from the 1980s to the early 2000s, dropping from a high of $660 USD to around $275 USD in 2000.

An investor would have lost money holding physical gold for those 20 years. Recently, gold has done well and has kept up with inflation, but that performance has not been consistent. How many investors timed it perfectly to sell gold in the early 1980s and stay out until the early 2000s, selling in 2011 and then buying back again in 2016 to hold until today?

What is our philosophy around gold?

Our investment philosophy is centred on sound portfolio construction. We do not maintain holdings in investments that we cannot value.

Compass Portfolios are globally diversified solutions that employ multiple sub-advisors who follow a disciplined, bottom-up approach to evaluating existing and potential investments. Bottom-up analysis focuses on finding companies that will perform well regardless of the macroeconomic environment. An analyst begins with a company’s financial statements (balance sheet, income statement) and considers various valuation measures.

While our equity sub-advisors do not invest in gold, they may invest in a gold miner, or a company focused on the utility of gold like a jeweller. This type of company uses gold to create products they can sell for a profit.

Conclusion

Gold can be a viable investment, but as with all investments, it has to fit with your strategic plan and ultimately aid in achieving your long-term goals.

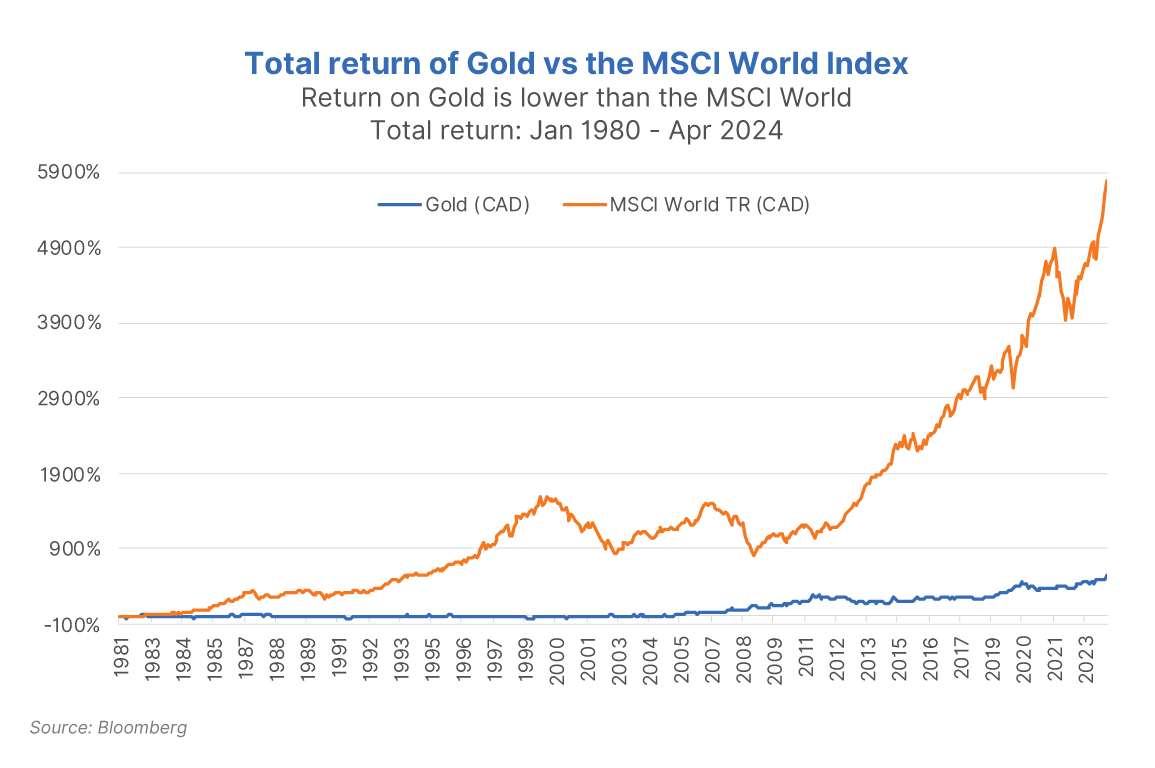

It may be a reasonably good diversifier, but traditional asset classes like stocks and bonds have been far more consistent for those looking for reliable long-term returns.

You want to be able to continue holding your portfolio throughout periods of market disruption and market gains. We know that building a diversified portfolio of solid investments and leaving them to compound over time is the best approach to achieving financial success.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

The material in this document is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.