Market and economic commentary

January 2024

While interest rates continue to be the hot topic, January saw equity markets performing well and bond markets declining slightly. The common message from central banks continues along the lines of potential interest rate cuts, but timelines are still in the air until inflation concerns lessen.

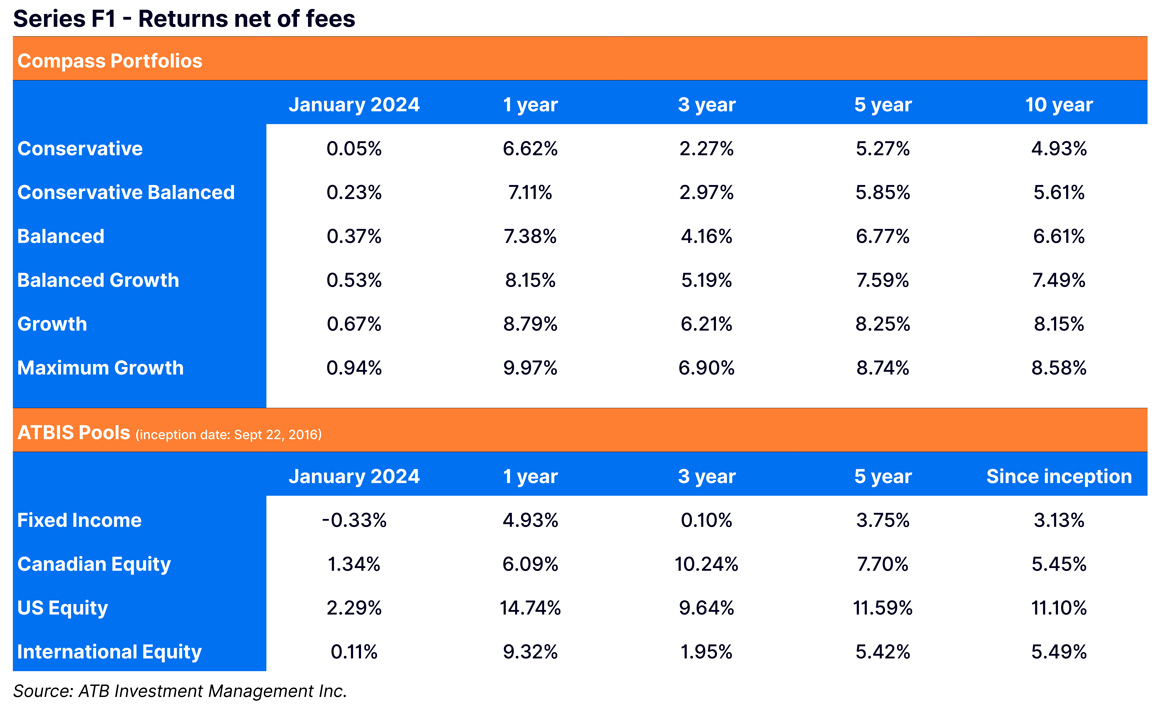

Equity markets continued their rally for January, while bond markets saw slight declines in rebounding interest rates. Interest rates and their anticipated direction continue to be the hot topic for markets. Canadian, US and European central banks held policy rates steady at their respective January meetings. The common messaging is that the door is open for potential cuts at some point, but only when inflation concerns have lessened. Most Compass Portfolios and ATBIS Pools (the Funds) saw positive performance for the month except for the ATBIS Fixed Income Pool and some series of Compass Conservative. Find up-to-date performance data on the ATB Investment Management website here.

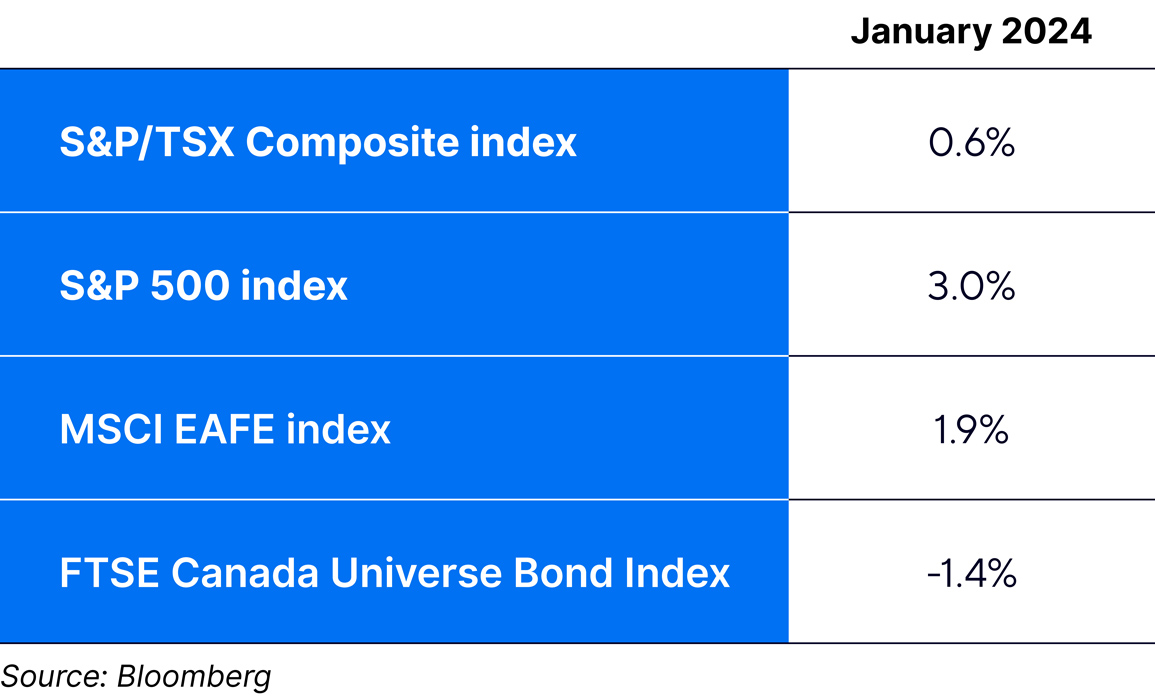

Below are index total returns in Canadian dollar (CAD) terms for January:

Economics

The central bank continues to watch the elements of economic activity driving market direction, such as labour and inflation. The US core consumer price index (CPI), which measures inflation and is likely the most closely watched economic report for global markets, rose 0.1% to 3.9% annualized for December (report released mid-January), initially driving overall interest rates higher mid-month. However, towards the end of the month and offsetting this report, US core personal consumption expenditure (PCE)—another measure of inflation—ticked down 0.1% to 2.9%. Inflation in Canada remains just over 3%, with the Bank of Canada expecting it to stay around this level for the first half of 2024, then gradually ease to 2% through 2025. Both the Bank of Canada and the US Federal Reserve (Fed) left their policy interest rate targets unchanged at their January meetings. Fed Chair Jerome Powell stated that the last six months of inflation data have been good enough to cut rates, but that March is too soon for the first of those cuts.

The European Central Bank (ECB) gave a similar story. European gross domestic product (GDP) was flat for the last quarter of 2023—an improvement coming off modest declines—and the ECB is also signalling the likelihood of a cut this year but won’t commit to a date. Overall, developed economies continue to do quite well, and policymakers are eyeing a soft landing. Still none want to be in a position where they cut preemptively only to have to reverse course, impacting credibility, should inflation re-emerge.

Despite being prevalent in headlines, geopolitical conflict has taken a backseat to economic releases for market impact. However, the current situation in the Red Sea may impact inflation this year if it continues. The US military strikes on Houthi targets combined with the US transportation department warning US merchant ships to avoid the Red Sea until further notice pushed oil prices higher through the last half of the month. If the situation persists, this will certainly impact shipping costs and could increase goods inflation.

Turning to emerging economies, China’s GDP missed the mark for the last quarter of 2023, coinciding with a weaker job market. As anticipated, the Peoples Bank of China (PBOC) responded with policy changes to try and spur growth, which they did by cutting the bank capital required reserve ratio by 0.5%. The PBOC is anticipated to follow some time soon with a rate cut.

Financial markets

Yields climbed modestly—about 0.15%—through January in Canada due to slightly higher inflation data coupled with central banks holding target rates and declining to advise when cuts may occur. This led to small price declines for bonds, although the Fund’s fixed income holdings continue to have a relatively short duration at 3.9-4.4 years, helping dampen the downside during periods of increasing rates. The ATBIS Fixed Income Pool Series F1 saw relatively flat returns overall, declining 0.3%.

Global equity markets rallied to start the year, with the US market in particular continuing to do extremely well, advancing 3.0% in Canadian dollar terms. Tech-related stocks such as the "Magnificent 7"1 continue to be a driving force, but even without them, the S&P still returned 2.8% in Canadian dollar terms, so the rally was fairly broad-based. That rally, unfortunately, did not include small- and mid-cap stocks, which dropped a couple of percent. One of the catalysts dragging down smaller stocks at month-end was an announcement from a smaller regional bank, New York Community Bancorp, stating missed earnings and a cut in their dividend. The Funds’ US equity holdings saw positive returns overall as Mawer US, the largest mandate within each Fund’s US equity portion, matched the S&P500’s return at 3.0% for the month.

International stayed slightly positive, with positive contributors held in the funds like Novo Nordisk—maker of weight-loss drug Ozempic—and luxury goods maker LVMH, doing well. Overall, though, international small-cap stocks saw some declines.

The Canadian equity market was mixed. Technology did well as with the US, along with energy in line with the Red Sea conflict driving energy prices upward. Offsetting this, however, materials were down about 6% for the month, with gold stocks in particular selling off as the metal declined in price along with production misses from companies like Barrick Gold. The Funds have less overall exposure to gold and mining, though—the ATBIS Canadian Equity Pool F1 Series returned 1.3% net of fees during the month compared to 0.6% for the S&P TSX Composite.

1 Apple, Alphabet, Nvidia, Tesla, Meta, Amazon, and Microsoft

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.