Market and economic commentary

July 2023

Global equity markets rallied through the month of July but bond prices dropped a bit as interest rates continue to rise.

Global equity markets rallied through the month of July but bond prices dropped a bit as interest rates continue to rise. The Bank of Canada (BoC) hiked rates to 5% from 4.75% on July 12, and the US Federal Reserve (the Fed) hiked to 5.5% on July 26. Driving core inflation lower remains the target for central banks. For Canada, headline inflation, as reported by the Consumer Price Index (CPI), is back to within the central bank’s 1-3% target range at 2.8% but the BoC’s trim and median core measures still show nearly 4%. All of the Compass Funds and ATBIS pools (the Funds) saw positive performance for the month. Up-to-date performance can be found at atbim.atb.com/funds.

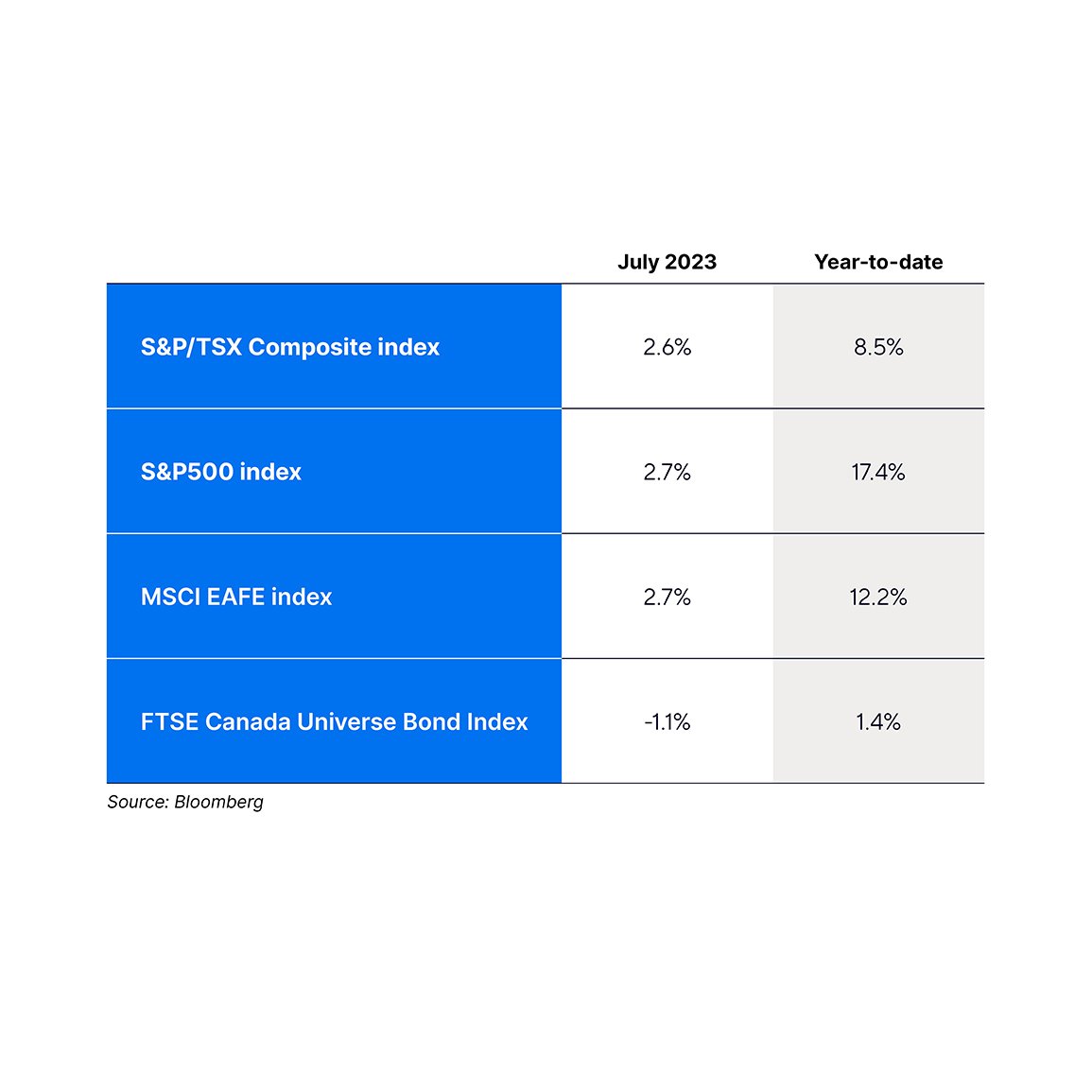

Below are index total returns in Canadian dollar terms for July, and year-to-date respectively:

During their July rate announcements, both the BoC and the Fed raised their overnight rate by 0.25% as expected, on the back of a resilient economy and elevated core inflation. With energy prices falling significantly in Canada and the US compared to last year (both down at least 14% year over year), attention remains on core measures of inflation. Core inflation excluding volatile items like food and energy continues to fall along with headline inflation (inclusive of all basket items), albeit at a slower rate than central banks are willing to stomach. Drilling down into the various measures, shelter in particular–a significant component of the core CPI basket–stands out on both sides of the border. Shelter costs year-over-year have risen 7.8% in the US, and 4.8% in Canada, driving up the general core measure in July. Even though rate hikes are intended to suppress inflation, increased servicing costs for mortgages could continue to drive the shelter component, despite other measures falling. A Canadian measure of inflation that excludes mortgage interest payments, had inflation at a mere 2% for June outlining a possible feedback loop which the BoC may have to contend with when considering further rate hikes.

Contributing to elevated core inflation, economic growth in both the US and Canada remain stronger than expected. US Q2 GDP surprised to the upside with quarterly increase of 2.4%, on an annualized basis, and Canadian GDP in May–the latest figure available–rose 1.9% on an annual basis. The job market also continues to remain robust, as initial jobless claims in the US remain more or less below expectations, with both the US and Canada adding more than double the expected number of jobs, according to the ADP National Employment Report in the US and Labour Force Survey in Canada. An economy that remains stronger than anticipated muddies the waters for central banks as they try to tame inflation while not over tightening and sending the economy into an extended downturn.

Along with the rate hikes from central banks in July, the average bond in Canada saw yields rise about 0.2%. Shorter duration maturity bonds, held within the Funds again, proved beneficial. The average bond dropped 1.1% in price, while the Funds’ fixed income holdings overall stayed positive. The average additional yield paid on lower credit quality (high yield) bonds is still below historical averages despite the tightening financial conditions from increasing interest rates. Consequently, improving credit quality across the fixed income holdings within the Funds has continued to be a focus through 2023.

Equity returns across the Funds were up on average with all three regions–Canada, US, and international–seeing positive returns for the month. As valuations have climbed higher through the first half of the year, in the second quarter commentary for the Funds we made mention that we had begun trimming equities and adding weight to fixed income positions. This extended through July bringing the Funds fully back to a neutral positioning (fixed income was brought up to each fund's benchmark weight). Through July we also began trimming US equity positions and adding to international equity positions. We tend not to favor one region’s equities over another too often, but over the past few decades relative valuation differences between the US and international stocks have rarely been as wide as today. As US valuations have run up through 2023, international stocks appear to trade at a significant discount.

1 FTSE Canada Universe Bond Index Yield

2 FTSE Canada Universe Bond Index Total Return (CAD)

3 ATBIS Fixed Income Pool Series F1 Total Return of 0.17% for June 30, 2023 to July 31, 2023.

4 Compass Maximum Growth Portfolio Series A Total Return of 1.89% for June 30, 2023 to July 31, 2023 and targets a 100% equity weight invested in across all three regions mentioned.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. The mutual fund performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc., ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

The information contained herein has been compiled or arrived at from sources believed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness, and ATB Wealth (this includes all the above legal entities) does not accept any liability or responsibility whatsoever for any loss arising from any use of this document or its contents. ATB Wealth does not undertake to provide updated information should a change occur. This document may not be reproduced in whole or in part, or referred to in any manner whatsoever, nor may the information, opinions and conclusions contained in it be referred to without the prior consent of the appropriate legal entity using ATB Wealth. This document is being provided for information purposes only and is not intended to replace or serve as a substitute for professional advice, nor as an offer to sell or a solicitation of an offer to buy any investment.