Market and economic commentary

May 2023

While economic growth continues to be better than expected, May turned out to be a volatile month due to concerns surrounding the US debt ceiling.

Overall, financial markets for developed economies were down for the month, but remain positive year-to-date. The Compass Portfolios and ATBIS Pools (the funds) saw better relative performance in fixed income, Canadian, and international stocks, but performance lagged in US stocks.

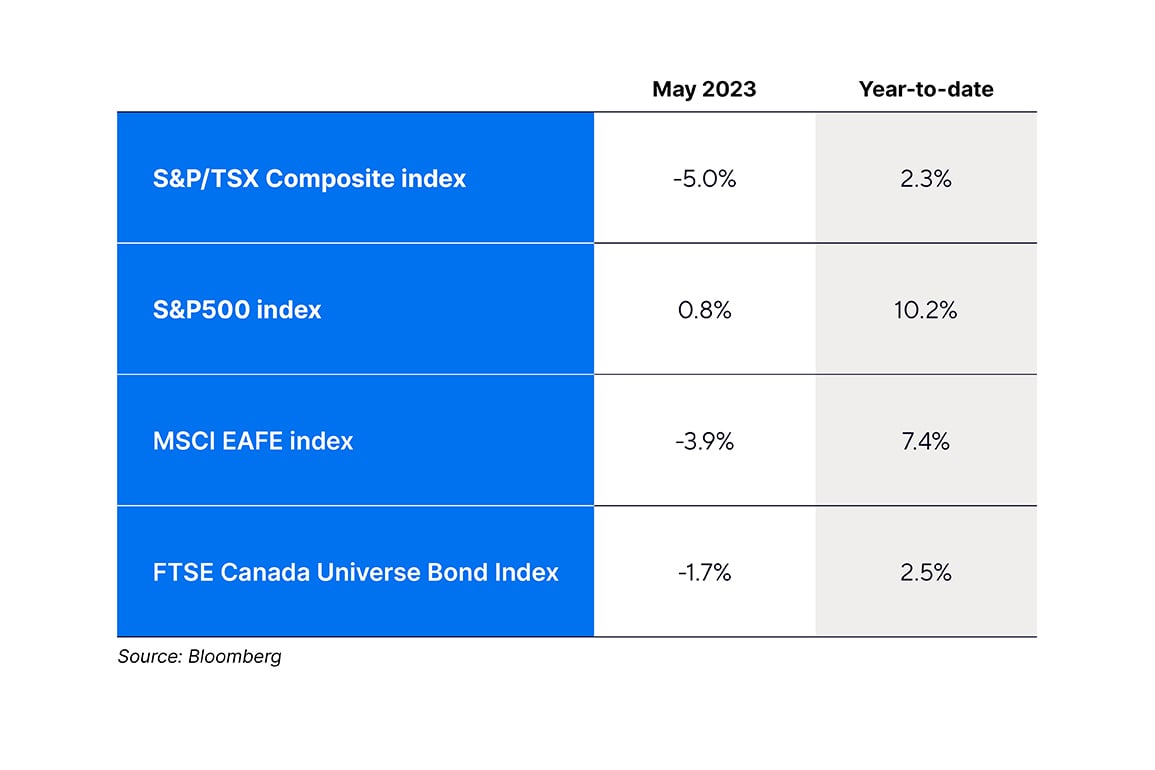

Below are index total returns in Canadian dollar terms for May, and year-to-date respectively:

The debt ceiling issue took centre stage in May when US Treasury secretary, Janet Yellen, signaled that the US could default in early June. Negotiations between President Biden and House Speaker, Kevin McCarthy, finally yielded a deal to suspend the US debt ceiling for two years. While concessions were made on both sides, Congress passed the bill with bipartisan support from both Democrats and Republicans. For further information on the debt ceiling, see our article on the subject.

Also in May, the much anticipated Canadian Gross Domestic Product (GDP) figures were released, and came in higher than expected. Canadian GDP grew an annualized 3.1%. This was fueled by trade rising 10.1%, and household spending which rose 5.7%, showcasing a resilient consumer despite the rise in rates. On the flip side, household savings fell to pre-pandemic levels, which is indicative of savings being drawn down to support consumption. Headline Consumer Price Index (CPI) for Canada came in slightly elevated compared to April and finally, employment figures were also stronger than expected, with the unemployment rate falling 0.1% to 5%. The new data underscores the challenge the Bank of Canada is experiencing with balancing their efforts to tame inflation without excessively slowing economic activity.

Similarly, in the US, GDP grew more than expected, although CPI was muted, and even Personal Consumption Expenditures (PCE) was slightly elevated compared to April. Inflation in the US continues to be above target, labour markets remain tight, and the banking sector stress from March seems to have abated, leaving an outside chance for another rate hike in June from the US Federal Reserve.

Turning to financial markets, in the US, large-cap stocks represented by the S&P 500, managed to hold on to a small positive return in May of 0.8% due to rallying technology companies. Nearly all companies on the S&P 500 have reported their earnings for the first quarter of 2023, and over three quarters have announced an upside on earnings. Overseas, international stocks represented by the MSCI EAFE Index fell 3.9%, compared to the fund's international stocks which were down 3.7%. Holdings in Taiwan Semiconductor and Samsung, both of which saw returns of around 10% for the month, led to the funds slight outperformance.

The Canadian equity market was overshadowed by the large commodity sectors’ decline, leaving the TSX Composite worse off relative to other regions, and down 5% for May. Most commodity prices fell through the month, including oil which fell below $70 for the first time since March on concerns that global growth is likely to slow. As a result, materials and energy were two of the worst performing sectors, down 11% and 8% respectively. The funds are underweight materials compared to the S&P TSX Composite, leaving the Canadian equity holdings relatively better, down 3.7% for the month.

Yields on the average Canadian bond rose 0.35%1 to 4.2%—back to where Canadian bonds started the year at—on a combination of higher than expected inflation figures coupled with US debt ceiling concerns. Despite the volatility caused by the pending debt ceiling deal, investment grade and high-yield spreads were more or less unchanged over the month. Within the funds, the shorter duration and higher-carried yield resulted in better relative performance, down 0.5% compared to 1.7% for the FTSE Canada Universe bond index. Despite the negative month and yields moving back to levels at the beginning of the year, fixed income returns overall are still positive year-to-date.

1 ICE BofA Canada Broad Market Index Yield

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. The mutual fund performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc., ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

The information contained herein has been compiled or arrived at from sources believed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness, and ATB Wealth (this includes all the above legal entities) does not accept any liability or responsibility whatsoever for any loss arising from any use of this document or its contents. ATB Wealth does not undertake to provide updated information should a change occur. This document may not be reproduced in whole or in part, or referred to in any manner whatsoever, nor may the information, opinions and conclusions contained in it be referred to without the prior consent of the appropriate legal entity using ATB Wealth. This document is being provided for information purposes only and is not intended to replace or serve as a substitute for professional advice, nor as an offer to sell or a solicitation of an offer to buy any investment.