Market and economic commentary

May 2024

May saw rebounding markets, but weaker economic news. Investor sentiment remains skittish.

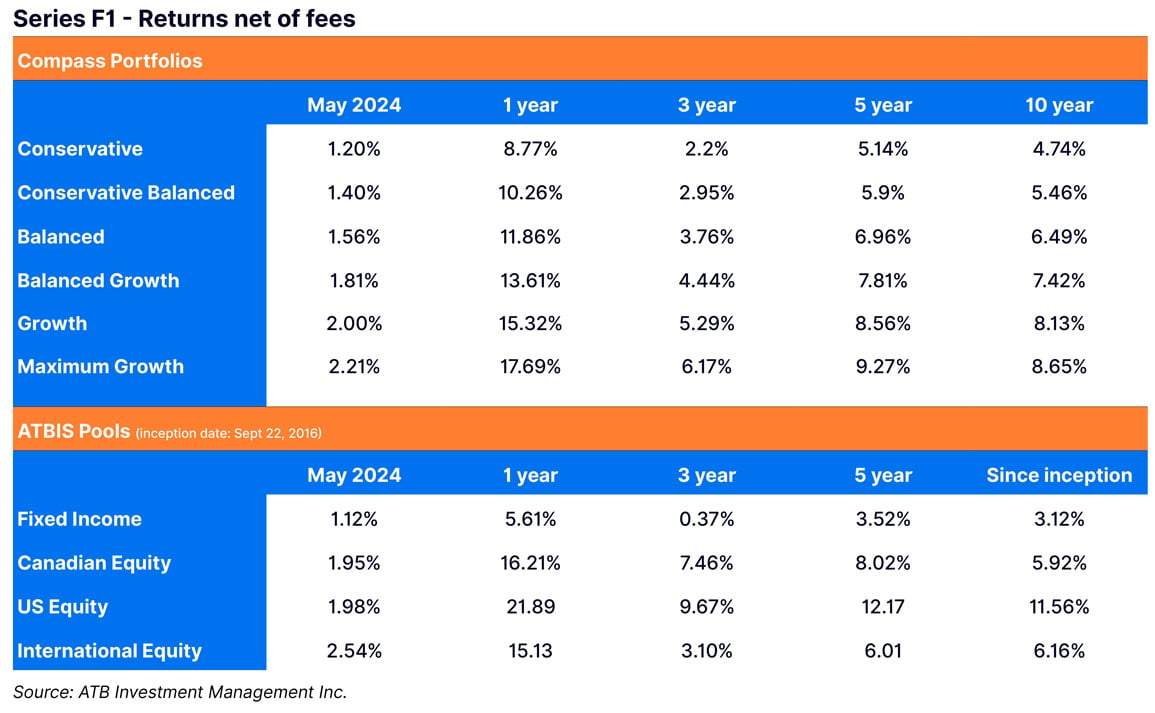

May saw rebounding markets paring declines from April, with both broad equity and bond markets advancing. In a reversal from April, weaker economic news throughout May renewed hopes for a US Federal Reserve cut this year. Investor sentiment overall remains skittish, looking for direction in this market. All Compass Portfolios and ATBIS Pools (the Funds) saw positive returns for the month. Find up-to-date performance data on the ATB Investment Management website here.

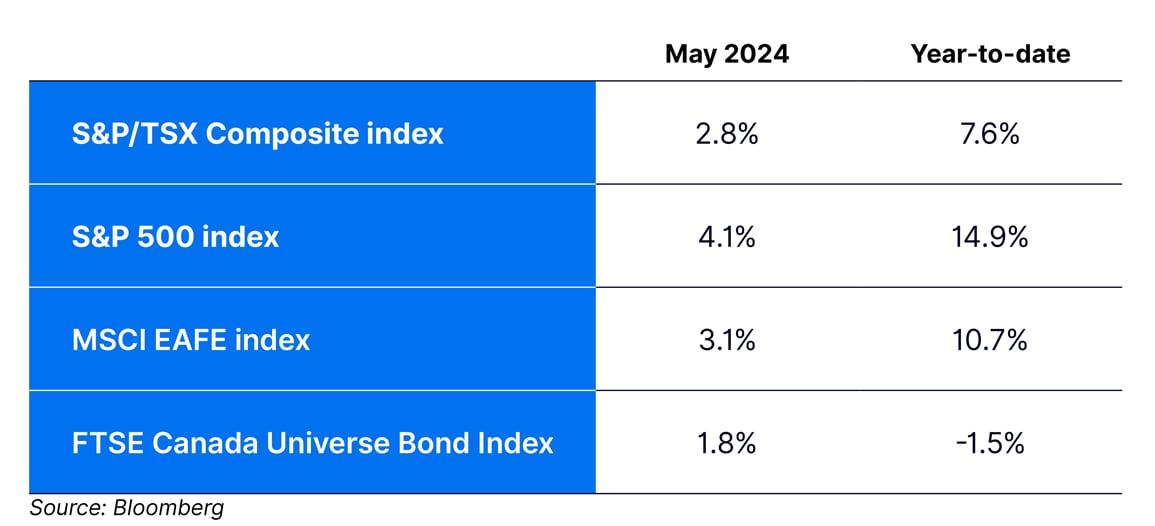

Below are index total returns in Canadian dollar (CAD) terms for May and year-to-date, respectively:

The Canadian economy showed some mixed signals during the month of May, although most signs are pointing to a general slowdown in activity.

Gross domestic product (GDP) and labour market releases were positive, although less so under the surface. For the first quarter, GDP demonstrated growth of 1.6% on an annualized basis as investment in inventories fell and household consumption slowed. The previous quarter was also revised, down to roughly flat, from just under 1% on an annualized basis. The labour market rebounded, adding 90 thousand jobs in April, driven by the private sector, although 55% of that 90 thousand were for part-time workers. In addition, the participation rate—simply the total employed as a proportion of total working age-population—rose to 65.3%, rising for the first time since June 2023.

Housing starts slightly slipped in Canada, remaining just below average for the last three years despite political appetite to close the housing gap and stabilize home prices, as higher rates are likely weighing on homebuilders. As more individuals renew mortgages at higher rates and have less to spend, the average consumer also continues to pull on retail sales, which fell in March for the third consecutive month. Ending on a positive note for Canada, headline inflation ticked down to 2.7% on a year-over-year basis thanks to falling food prices and a slight slowdown in shelter price increases.

The better-than-expected inflation data wasn’t just in Canada. The US saw similar data, which pushed rates lower over the month. Besides inflation, US GDP, personal consumption, pending home sales, and producer consumption expenditure indices all showed softer data—pointing to an earlier cut.

Renewed optimism over cuts was good news for stocks, further bolstered by positive earnings surprises. Stock prices rallied higher through the month. Nvidia, as a standout with their May 22 earnings release, continued the bullish investor sentiment for artificial intelligence, exceeding lofty expectations. For the US as a whole, aggregate revenues and earnings maintained growth in the quarter.

Canadian and international markets did not show the same data, with slight declines in revenues and earnings over the same period. However, stocks in these markets still rallied through the month. After all, lowered rates could be here much sooner in these markets, with the European Central Bank and the Bank of Canada looking at a likely cut in early June. The Funds overall saw positive returns from equities for the month, but did lag broader markets holding less weight in names like Nvidia, Apple, and Meta.

Within bonds, yields fell about 20 basis-points across the curve, leading to rising bond prices for the month. Both investment grade and high-yield credit spreads were relatively unchanged during May, remaining at or near lows this year—high-yield spreads in particular, are still near all-time lows. Tight spreads necessitate careful allocation to credit with a focus on potential downside remaining a top priority for the Fund’s fixed income holdings. The Funds fixed income holdings saw positive returns on the declining yields and continue to be positive overall for this year.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedarplus.ca.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.