Navigating markets for the ATBIM funds amidst the conflict in the Middle East

Our Portfolio Managers discuss the exposure to the ATBIM Funds from the current conflict between Israel and Hamas.

Regional conflicts are difficult for individuals and investment managers to navigate, especially when considering the humanitarian aspect aside from market impacts. We express our sympathy and condolences for all those affected by the current conflict between Israel and Hamas.

Tensions have existed in the Middle East for decades, and similar to the Russian invasion of Ukraine, we can only react to what has happened rather than speculate on what may come to fruition. The scale of the most recent conflict could not have been anticipated. From an investment perspective, it is prudent to limit our exposure where appropriate while still maintaining our investment thesis. This article will outline where we believe the ATB Investment Management (ATBIM) portfolios have exposure.

The direct exposure to the conflict for the Compass Portfolios and ATBIS Pools (the Funds) is limited to those Funds that hold the BMO MSCI EAFE ETF (ZEA). EAFE stands for Europe, Australia, and the Far East. This holding gives the funds broad market-capitalization weighted exposure to the top 85% of the largest companies across the 21 developed countries included in the index. Israel is a member of this group as the only developed Middle Eastern country. It was added to the MSCI EAFE index in 2010 when it was classified as a developed market rather than an emerging market.

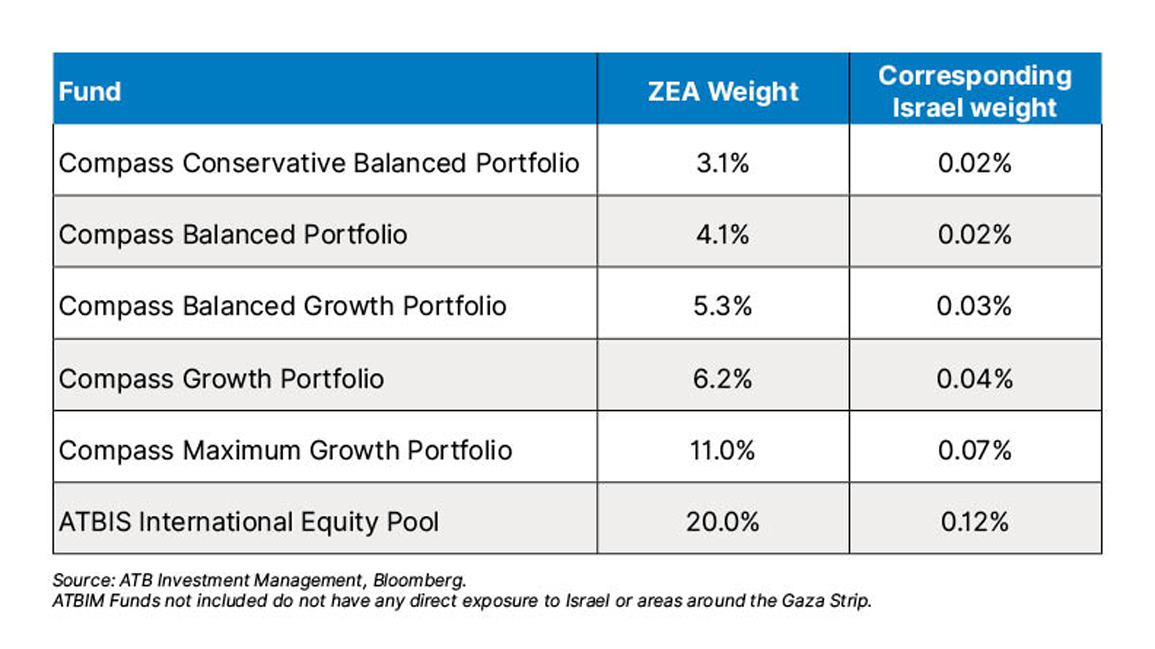

ZEA holds roughly 800 companies within the 21-country grouping, and 14 of them are situated in Israel as of September 30, 2023 (quarter end). Those companies combined represent about a 0.6% weight within ZEA. ZEA is not held in all Funds at ATBIM. The weighting is approximately 20% within our international equity sleeve for each of the Funds listed below. Total exposure directly to Israel as of quarter-end is as follows:

Given the minimal exposure across the Funds, we do not foresee any direct material impacts from the ongoing conflict.

Beyond direct exposure, the broader implications of geo-political conflict can be complex. Energy markets will likely see added volatility due to significant oil production in the region. Still the dynamic in the Middle East is different enough from previous conflicts that the impact on oil production is likely to be minimized. There is no one-size-fits-all answer as to how wars may impact markets. We maintain diversification across many different assets and regions because this is key for long-term investors to minimize exposure to unforeseen events.

This report has been prepared by ATB Investment Management Inc. (“ATBIM”) which manages the Compass Portfolios and ATBIS Pool funds. ATBIM and ATB Securities Inc. (“ATBSI”) are wholly owned subsidiaries of ATB Financial and operate under the trade name ATB Wealth.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATBSI, ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.