Navigating trends in the Canadian housing market

Our Portfolio Managers take a closer look at Canada's real estate market which has seen significant growth in recent years, and is a major part of an individuals' net worth.

Canada’s rising real estate market has been hard to ignore over the past couple of decades. Beyond a place to live, real estate is often a significant portion of an individual’s net worth—whether a primary residence or any of the numerous real estate investment opportunities available. Given the value appreciation, it begs the question as to whether real estate should make up an even larger portion of one’s portfolio.

This article will focus on Canadian residential real estate, contextualizing historical price appreciation. For those investors looking for continued appreciation similar to the last decade, we offer some data points on why we believe there are headwinds to that scenario. Owning a property for income, excluding assumed capital appreciation, can still be a worthwhile investment. However, modeling leverage, taxes, and other related expenses will be out scope for this article due to the intricacies involved.

A look back at historical Canadian home prices

There are differing opinions on treating your primary residence as an investment. From an investment point of view, a few things work in favour of home ownership that, in practice, don’t translate as easily to investments such as REITs and the broader stock market. Individuals live in their primary residence for decades and tend not to flip between owning and renting. Houses are also relatively illiquid because they are time-consuming and expensive to buy and sell. Economist Paul Samuelson said, “investing should be more like watching paint dry or watching grass grow.” A primary home turns into the perfect boring long-term investment. You live in it, pay down the mortgage, and decades into the future, it will probably be worth a lot more money despite the market gyrations encountered throughout the journey. The buy-and-hold nature of residential properties has added considerable wealth to Canadian households over the past couple of decades.

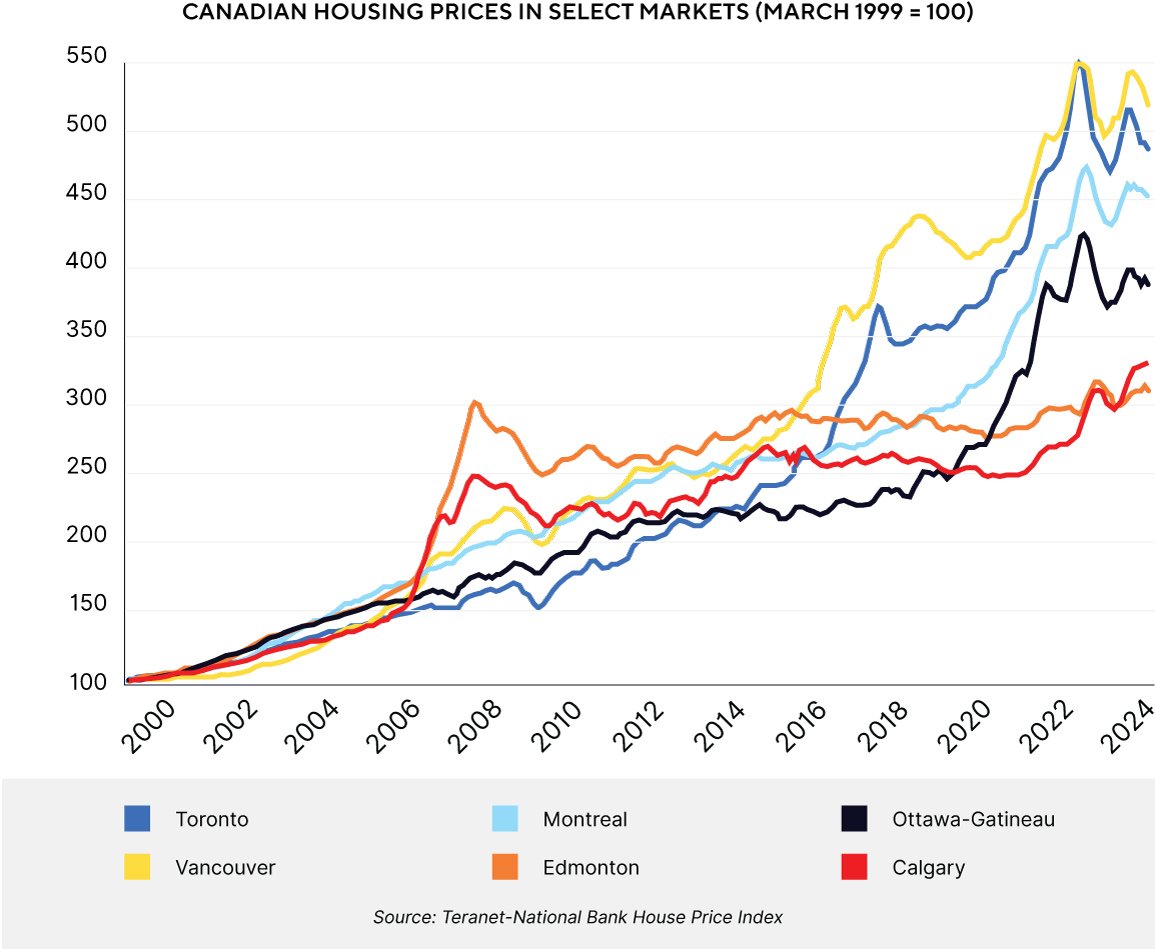

A quick review of housing markets within Canada since 1999 shows that select markets— namely Toronto and Vancouver—have been the primary drivers of housing prices since 2015.

Edmonton and, to a lesser extent, Calgary saw a boom in 2007/2008 as oil prices jumped, and Alberta saw significant investment in crude oil production. Since then, prices have stagnated, whereas Ontario and British Columbia have seen property values increase significantly due to immigration and population growth.

Examining the data, it’s clear why real estate has become such a hot topic. Stories of homes appreciating 2-3 times their value are enough to make anyone wonder how they can get in on the action. However, these price increases have not come without their challenges. Affordability, especially in recent years with the rise in interest rates, has caused strain for those carrying considerable mortgages and for those aspiring to buy a home but feeling they are priced out of the market.

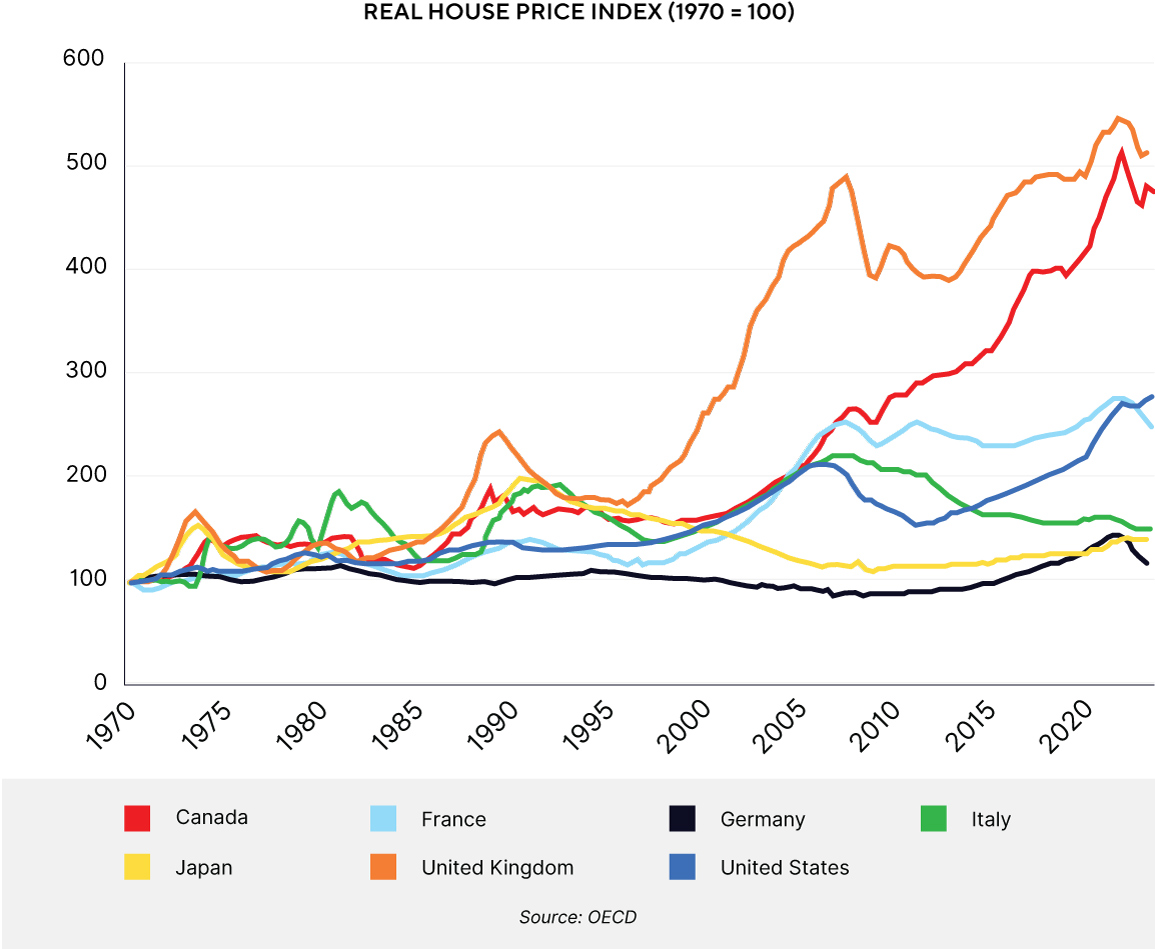

Those feelings aren’t without merit. Comparing the price increases to other countries, the Organisation for Economic Co-operation and Development (OECD) has tracked relative home prices net of inflation over time. Since the 1970s, growth in housing prices in Canada was in line with its peer G7 countries until the 2008 financial crisis, where Canadian prices continued upward while other countries stagnated. Over the full period, only the United Kingdom has experienced higher real price increases by a slight margin.

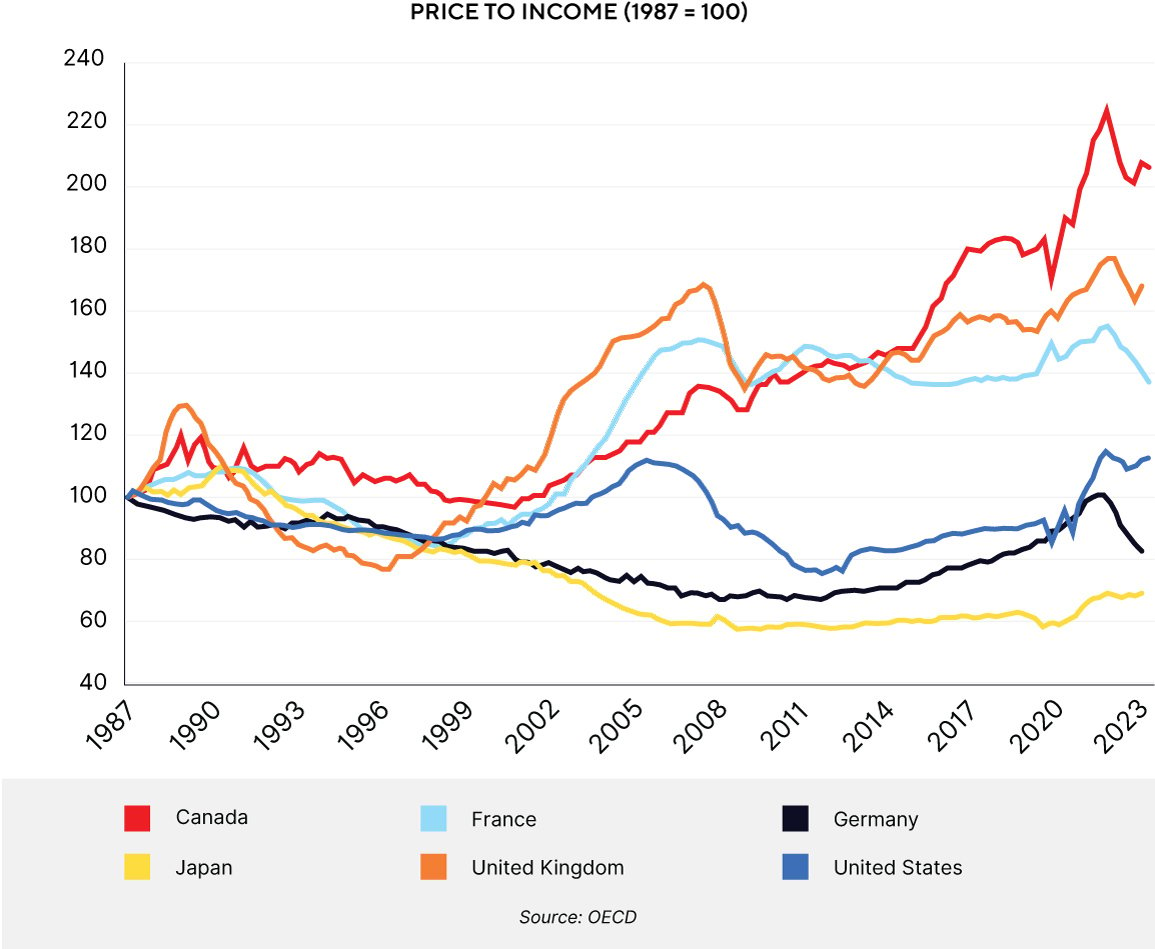

The OECD also tracks home price to income ratios. Compared to other similar nations, incomes in Canada have not grown fast enough to counter the price increases. The US, perhaps being Canada’s most similar peer, has individuals paying about 15% more for housing per dollar of inflation-adjusted income today compared to 1987, while Canadians are paying more than double.

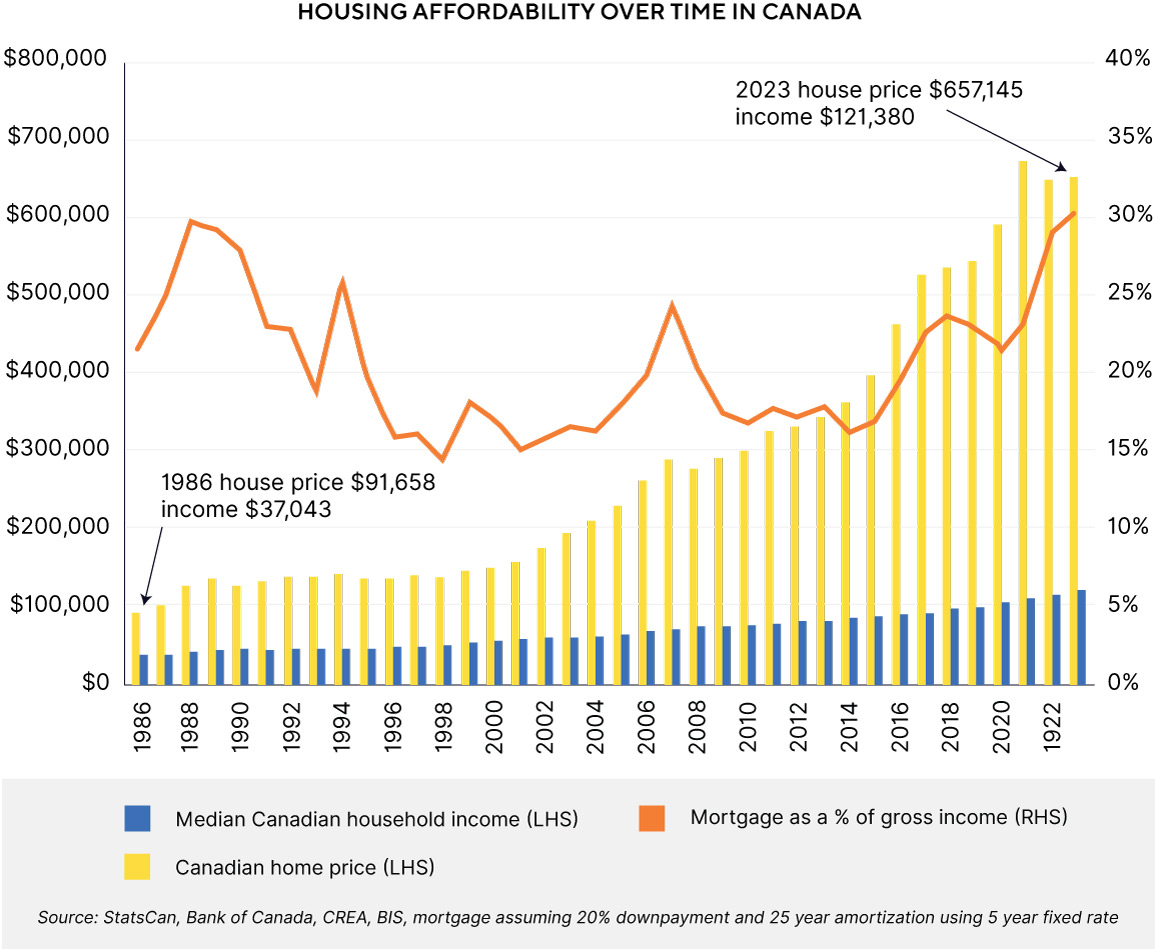

Despite the price increases, overall housing affordability, when taking interest rates into account, remains roughly the same as in the late 1980s. Mortgage payments today, for a new buyer of an average priced home, are around 30% as a percentage of median household income—roughly the same as in the late 1980s when home prices were cheaper but interest rates were higher. The late 1980s was a period that also saw significant price appreciation nationally—$91,658 in 1986 to $137,337 in 1989, up nearly 50%—while also seeing mortgage rates increasing 3-4% over the same period. With high interest rates and surging prices, new buyers found it difficult to carry a mortgage. Prices briefly dipped in the early 1990s before stagnating for roughly the next decade. Net of inflation, housing lost value during this period. By the end of the 1990s, affordability was significantly better for the average Canadian.

Narrowing the focus to Alberta, the province is in a comparatively healthier state. Assuming a 20% down payment and using the average home price in Alberta as of March 2024, mortgage payments are roughly 20%1 of median Alberta household income. The relatively low cost of living and strong wages in Alberta have recently driven demand again from interprovincial migration, further supporting housing demand. These advantages could point to a more resilient housing market for the province over the coming years compared to high-cost areas in Canada.

Investment considerations

While we have seen mortgage carrying costs this high, as they were in the 1980s, home prices also increased from just over 2.5 times median household income to over five times since the same period. This means the down payment required on these properties is significantly higher than previously required on an absolute and relative-to-income basis. The barriers to entry for direct real estate investors are as high as they have ever been.

With the significant amount of capital needed to invest directly in Canadian real estate, there are alternatives to consider. Real Estate Investment Trusts (REITs) or stocks related to the real estate sector provide the opportunity to participate in the market at a far lower initial cost of capital. REITs own and manage a portfolio of commercial real estate properties, passing along income to shareholders.

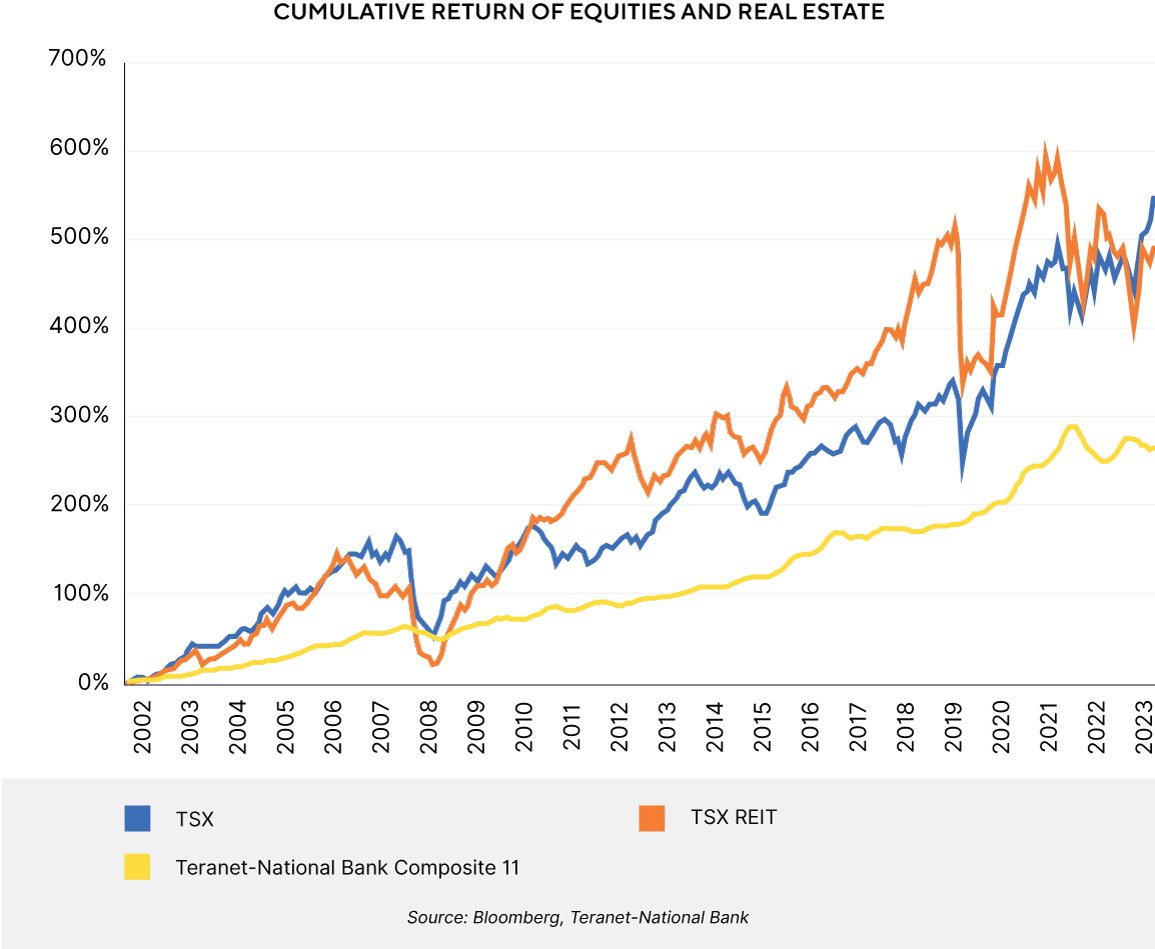

From a performance perspective, REITs have outperformed the Teranet-National Bank Home Price Composite 11 Index, which tracks the price appreciation for Canada’s 11 largest metropolitan areas over time. Like owning an income property, REITs are often levered to some degree, offering an income component and passing along tenant income to investors.

REITs have managed to keep up with the S&P/TSX Composite Index more or less since the inception of the REIT index in 2002. Given our outlook for muted real estate prices in the coming years due to elevated affordability pressures, REITs will likely have similar headwinds. Both residential real estate prices and the REIT index peaked within 2022 as interest rates began increasing sharply.

Summary

For those considering investment or looking to enter the market, we expect residential real estate prices to moderate in Canada in the coming years. The Canadian market continues to look expensive compared to other developed countries. In addition, easy affordability in the 1990s and a decades-long period of falling interest rates created conditions ripe for price appreciation. An environment of higher interest rates and now high costs to carry a mortgage no longer offers support for higher prices. Similar conditions in the late 1980s led to years of flat prices–whether that repeats remains to be seen. If housing continues to move higher from here, it will likely be attributable to demand imbalances but may not be sustainable given that affordability is already nearing all-time lows. The silver lining for Alberta is that affordability is significantly better than the rest of the country, and subsequent demand may give a higher chance of maintaining price stability.

1 Average home price as of March 2024 from AREA

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report may contain forward-looking statements about a fund, currency, real estate or general economic factors which are not guarantees of future performance. Forward-looking statements involve assumptions, risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. We caution you not to place undue reliance on these statements as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.