Market and economic commentary

November 2023

Signs that inflation may be meaningfully decreasing drove equity and bond markets globally into positive territory for November.

Signs that inflation may be meaningfully decreasing drove equity and bond markets globally into positive territory for November. Specifically, in the first half of November, the US headline Consumer Price Index (CPI) showed decreases in both the core and headline figures, along with some language from the US Federal Reserve (the Fed) suggesting that further hikes may not be necessary. The Compass Portfolios and ATBIS Pools (the Funds) saw positive performance for the month. Find up-to-date performance data here.

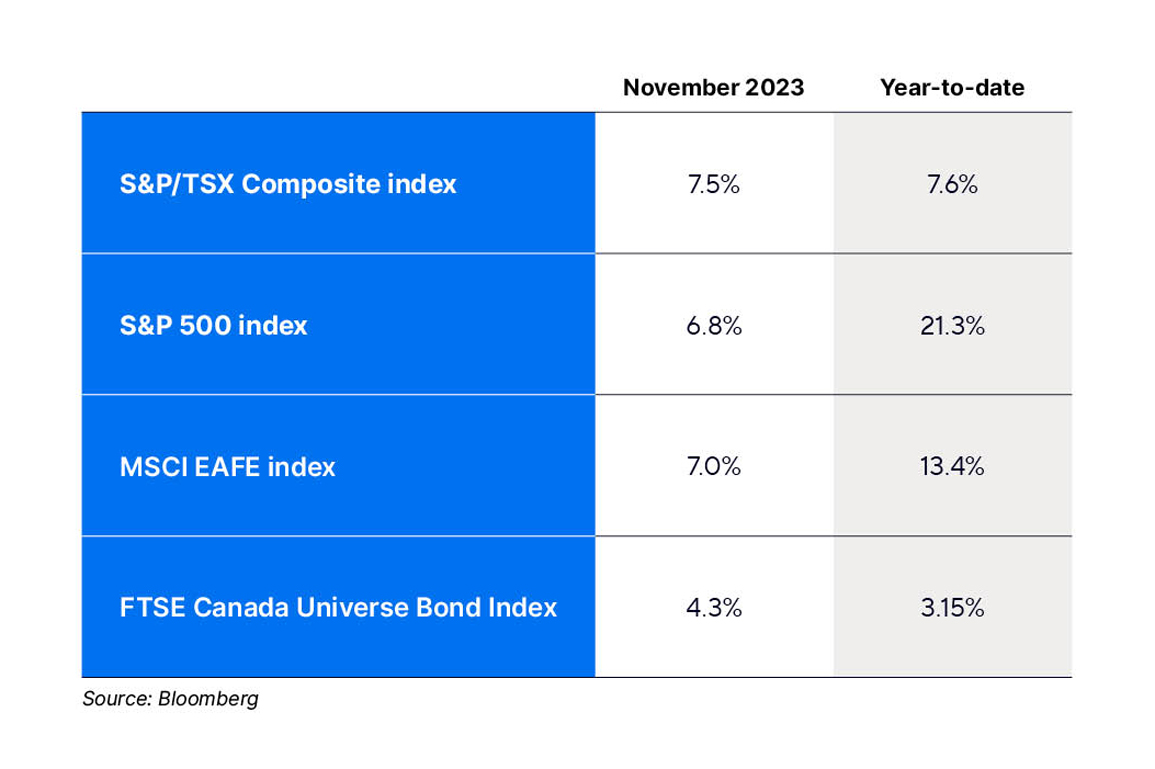

Below are index total returns in Canadian dollar (CAD) terms for November and year-to-date, respectively:

Economics

Inflation was the focus of markets again in November, as US headline CPI came in lower than expected at 3.2%, with core inflation continuing to decline, rising 4% on an annual basis. Both figures were weaker than expected as energy prices continued to decline year-over-year, and food prices increased (3.3% year-over-year) at the slowest rate since June 2021. The shelter component of core CPI—the most significant contributor—finally fell below 7% to 6.7% for the first time since October 2022. With the 30-year average mortgage rate hitting around 8% at the end of October and the Zillow Rent index taking roughly 12 months to peak, the indications suggest that the shelter component will continue to fall. At home, Canadian inflation figures were also positive, with headline inflation dropping to 3.1% as fuel prices continued to fall. The Bank of Canada’s (BoC) preferred core measures also fell, averaging 3.6%. BoC governor Tiff Maklem commented that the “excess demand” that “made it too easy to raise prices” is no longer present. While these comments were encouraging, the CPI report also noted that rent rose 8.1%, the highest on a monthly basis in over 40 years.

The other side of the inflation picture—growth—was a mixed bag for Canada and the US. In the US, annualized quarterly Gross Domestic Product (GDP) for Q3 was a whopping 5.2% amid strong residential investment and demand for goods. Conversely, Canada’s annualized quarterly GDP dropped by 1.1%. Although one might think that triggers a technical recession, as the previous quarter also contracted 0.2% when the figures were published last quarter, Q2 was revised up to 1.4%. Digging into the details shows that the primary driver of the decline in GDP was exports, although domestic demand showed weakness, especially when removing the addition from government spending. Employment on both sides of the border was also mixed, as the unemployment rate for Canada and the US rose 0.1% to 5.7% and 3.9%, respectively, even as both countries added jobs in November.

Equities

Equity markets were generally positive as investors cheered on falling inflation and the prospect of rates peaking, with rate cuts on the horizon sooner than later. All of the Funds’ equity components shared in the excitement, and all rose on an absolute basis. Strength in the Canadian dollar versus the US dollar took away around 2% from overseas returns over the month, but all major regions remained positive.

In Canada, stocks were largely driven by financials, but performance was divided between banks and their non-bank counterparts, with non-bank financials contributing more overall to the index. Shopify rebounded from last month, rising just over 50% in November, and was another key driver of index performance, adding around 1.4% to the TSX alone. Valuations overall in Canada remain relatively attractive, and financials—banks in particular—are still trading at historically low levels. Overall, earnings in Canada were varied. With around 96% of companies reporting, about half were in line or missed expectations. Results were consistent across sectors, so it isn't necessarily one particular area of the market starting to show weakness, and earnings growth overall seems to be falling.

Elsewhere, US and international equities performed well over the month. Information technology led the US again—namely Microsoft, Apple, and Nvidia who posted double-digit gains—as investors cheered on falling inflation and yields. International stock gains were a little more diversified as the top four sectors (industrials, financials, IT and consumer discretionary) all added between 1% and 2% of the index’s performance, as opposed to the US, where IT alone was responsible for over 3.6% of the index performance. Even with the strong performance over the month, valuations remain at levels that make international stocks more attractive than their US counterparts.

Fixed Income

Although bonds didn’t gain as much as equities, the drop in yields from favourable inflation news and dovish statements from central banks made bond investors happy during November. Canadian bond yields on average fell 0.56% as measured by the FTSE Canada Bond Universe through the month. Yields dropped across the curve other than in the very short (<1yr) end, as the inflation and growth data—both important factors for the market pricing long-term yields—suggested slower growth and some positive progress towards slowing price levels. Portfolios with longer durations were the primary benefactor of a movement in the yield curve like this. As a result, the funds underperformed due to their shorter-than-index duration. It was almost entirely a story of falling yields, as corporate and high-yield bond spreads were little changed and saw less benefit.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.