A growing opportunity - private assets

Today’s investor is faced with an ever-increasing menu of investment options. The practice of including private market investments or private assets into portfolios has grown in popularity in recent years, creating opportunities for investors equipped to take advantage.

Many investors have traditionally relied on public markets to build long-term portfolios. This diversified mix of publicly traded stocks, bonds and other financial instruments, has served investors well for many years, especially in the years following the great financial crisis of 2008 when most risk assets had persistent strong returns for over a decade with very little volatility in public markets.

Large institutional investors have historically incorporated private assets alongside public securities in order to benefit from a number of advantages that can improve a portfolio’s risk and return characteristics. So, what are private assets and why should qualifying investors consider adding them to an investment portfolio?

Private assets (also referred to as private market investments or private market assets) are investments that are not publicly traded and are not available to the general public. These assets can include investments in private equity, real estate, infrastructure, venture capital, hedge funds and more.

What is a private asset?

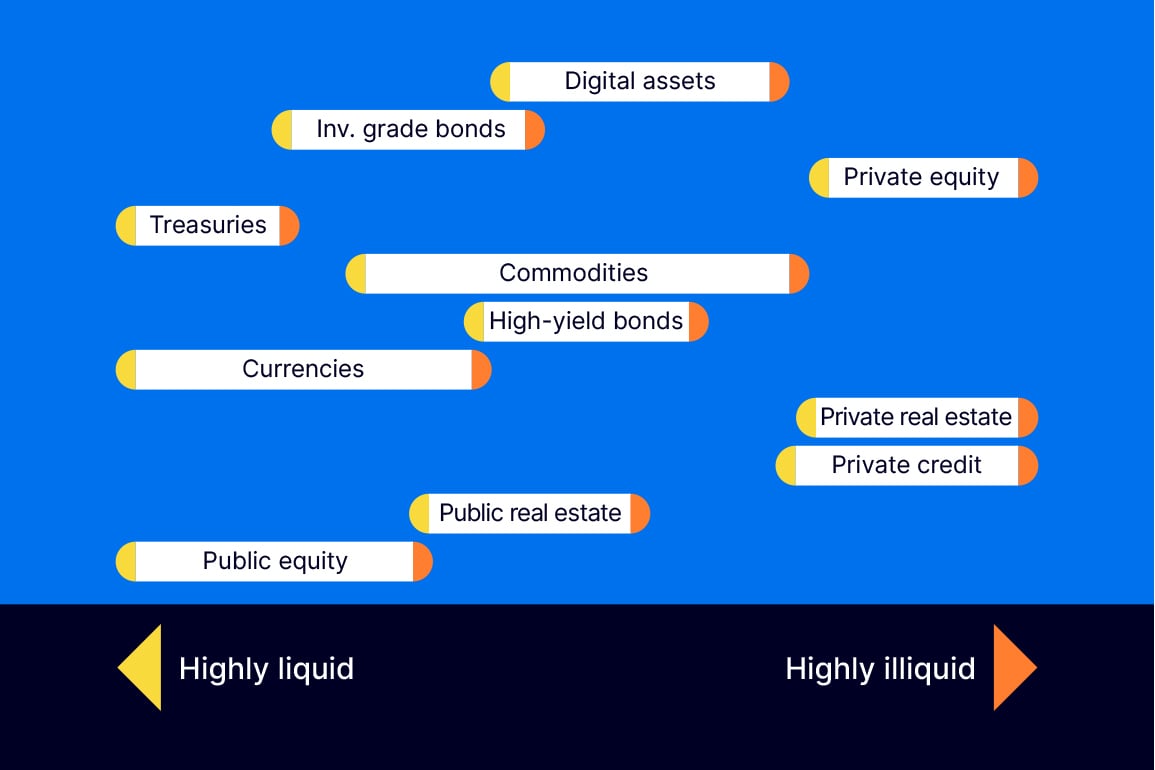

Investments in private assets are characterized by their limited availability and their illiquidity.

By definition, direct investments in private assets require access to opportunities that are limited to investors such as large institutions, high-net-worth individuals, and family offices. They are not publicly traded on exchanges or easily available to general investors.

Investors often must commit their capital for long periods of time, and may have limited options for exiting once they commit to a fund program or strategy. Private assets are also sometimes referred to as real assets as they are frequently direct investments in buildings, bridges and other types of infrastructure projects. Private equity is ownership of a business that is not available to buy fractional ownership through shares. Co-investment with other large institutional investors is also common.

Public market investments are divided into asset classes such as equities, bonds, and cash. Private assets are also grouped into what are referred to as alternative asset classes like: private equity, real estate, infrastructure, venture capital, hedge funds and others. As in public market asset classes, each alternative asset class plays a different role in portfolios and has a different risk and return profile.

Why invest in private assets?

Investing in private assets can significantly improve your investment portfolio in many ways. A few key benefits include:

Diversification

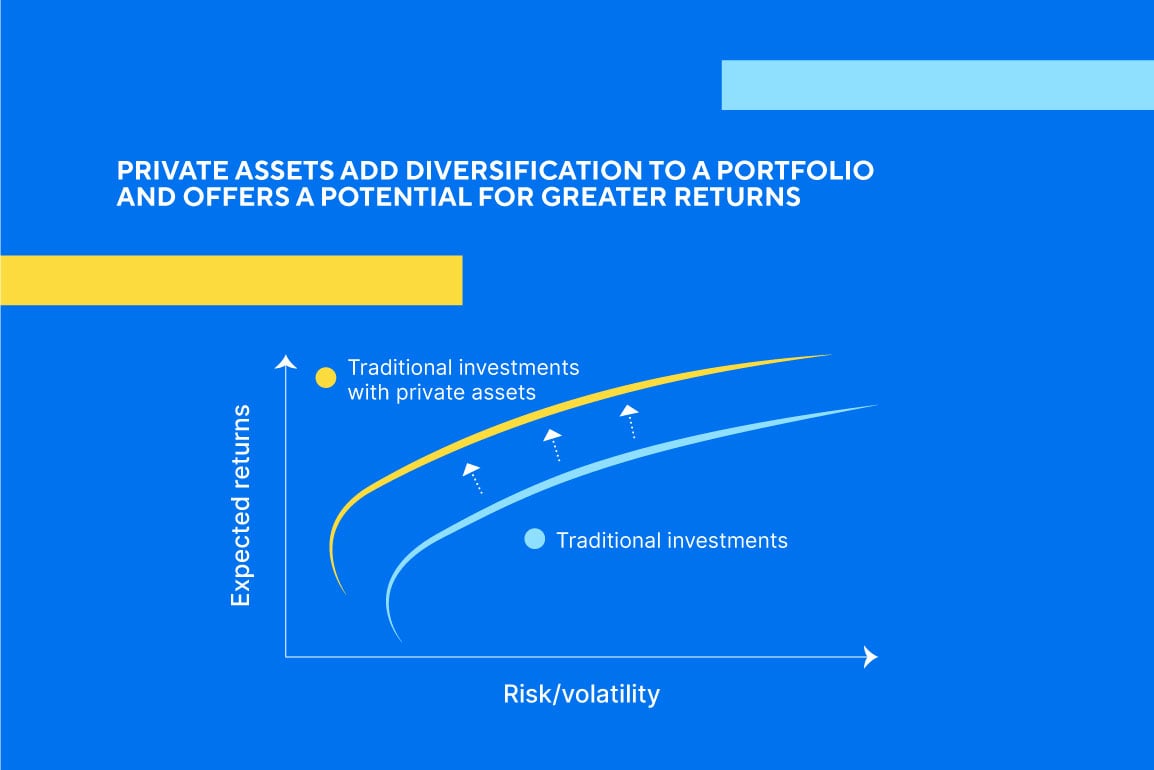

Private assets can provide diversification benefits by offering exposure to different asset classes and sectors that are not available through public markets. These assets have historically shown a different return pattern than equity markets1. This can help to reduce overall portfolio risk and increase the potential for long-term returns. In times of stress, public-asset correlations increase and having an allocation to private assets can reduce a portfolio’s volatility.

Potential for higher income and overall returns

The illiquid nature of private assets allows investors to demand a higher rate of compensation, known as the illiquidity premium, as compared to similar liquid assets in public markets. According to renowned investor David Swensen of the Yale Endowment program, “Market participants willing to accept illiquidity achieve a significant edge in seeking high risk-adjusted returns. Because market players routinely overpay for liquidity, serious investors benefit by avoiding overpriced liquid securities and by embracing less liquid alternatives.”2

The impact to portfolios is a higher expected return for the same level of risk compared to a traditional portfolio of only publicly traded investments.

Inflation protection

Private assets have characteristics that create a differing risk and return profile than public market investments. Each alternative asset class provides an opportunity set that will react in different ways to the major macroeconomic drivers of performance, like inflation rates.

Investments in real estate are considered to provide inflation protection because property values and rents generated tend to increase with inflation. Infrastructure investments such as toll roads, airports, and utilities can also provide inflation protection. They typically have long-term contracts or regulatory agreements that provide steady cash flows that increase with inflation.

As a long-term investor, differing economic environments are a certainty over time. Incorporating private assets can improve your portfolio's ability to be resilient in a broader range of economic conditions.

What are the risks involved?

There are a number of risks associated with investing in private assets that are important to understand.

Lack of transparency

As these strategies are not publicly traded, they do not have the same reporting regulations as a public company. This is why extra research and due diligence is required to ensure there is an understanding of the strategy and risks involved.

Liquidity

An organization needs to ensure they have the appropriate time horizon to capture the full return benefits unique to private assets. Large-scale infrastructure projects, as an example, can have ultra long time horizons and would have longer-term cash-flow projections as part of the due diligence process.

Complexity

The level of complexity involved in investing in private assets is significantly elevated compared to investing in public markets due to the illiquidity, limited availability, and specialized expertise required.

Higher costs

Overall, greater costs are incurred to execute private asset investment strategies. The importance of understanding the net-of-fees impact of each opportunity is heightened as a result.

Crowding

The rise in popularity of private assets has resulted in increased competition for premium private asset opportunities. Good investments are still available to qualifying investors but the need for expertise and due diligence to avoid overpriced assets has increased over the last decade.

Opportunity

The trade-off between the drawbacks and the benefits of private market investments has been shifting over time in favor of the benefits.

The success of large investment programs, such as Yale’s Endowment fund or Canada’s CPP Investment Board, which allocate the majority of their portfolios to private assets, has increased the demand for investment options and increased awareness of this opportunity set.

In reaction to the increased demand, there are now more ways to access private asset opportunities, and at increasingly lower costs.

Lack of transparency, increased complexity, and illiquidity remain significant hurdles to investing in this space, however. Investors who are equipped to navigate the increased due diligence and research requirements have shown the ability to capture value in private assets with greater ease.

In conclusion

It is important to understand that there is not a one-size-fits all approach when it comes to investing in private assets. While there can be significant advantages to adding them to a long-term portfolio, the allocation needs to align with the organization's risk and return profile, and the objectives of its portfolios.

Our Institutional Portfolio Management team has the expertise and resources to help clients unlock the benefits of private assets by diligently incorporating select alternative asset classes and strategies into long-term portfolios.

Connect with our specialized team

Your organization's investment program might benefit from investing in private assets.

1 Source: Asset Allocation to Alternative Investments by Adam Kobor, PhD, CFA, and Mark D. Guinney, CFA

2 Source: David F. Swensen, Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment, Fully Revised and Updated

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

The material in this document is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.