Portfolio managers' commentary

A review of Q1 2024

Equity markets climbed further upward, markets await guidance on interest rate cuts, and other than 2020, global GDP sees lowest annual growth since 2009.

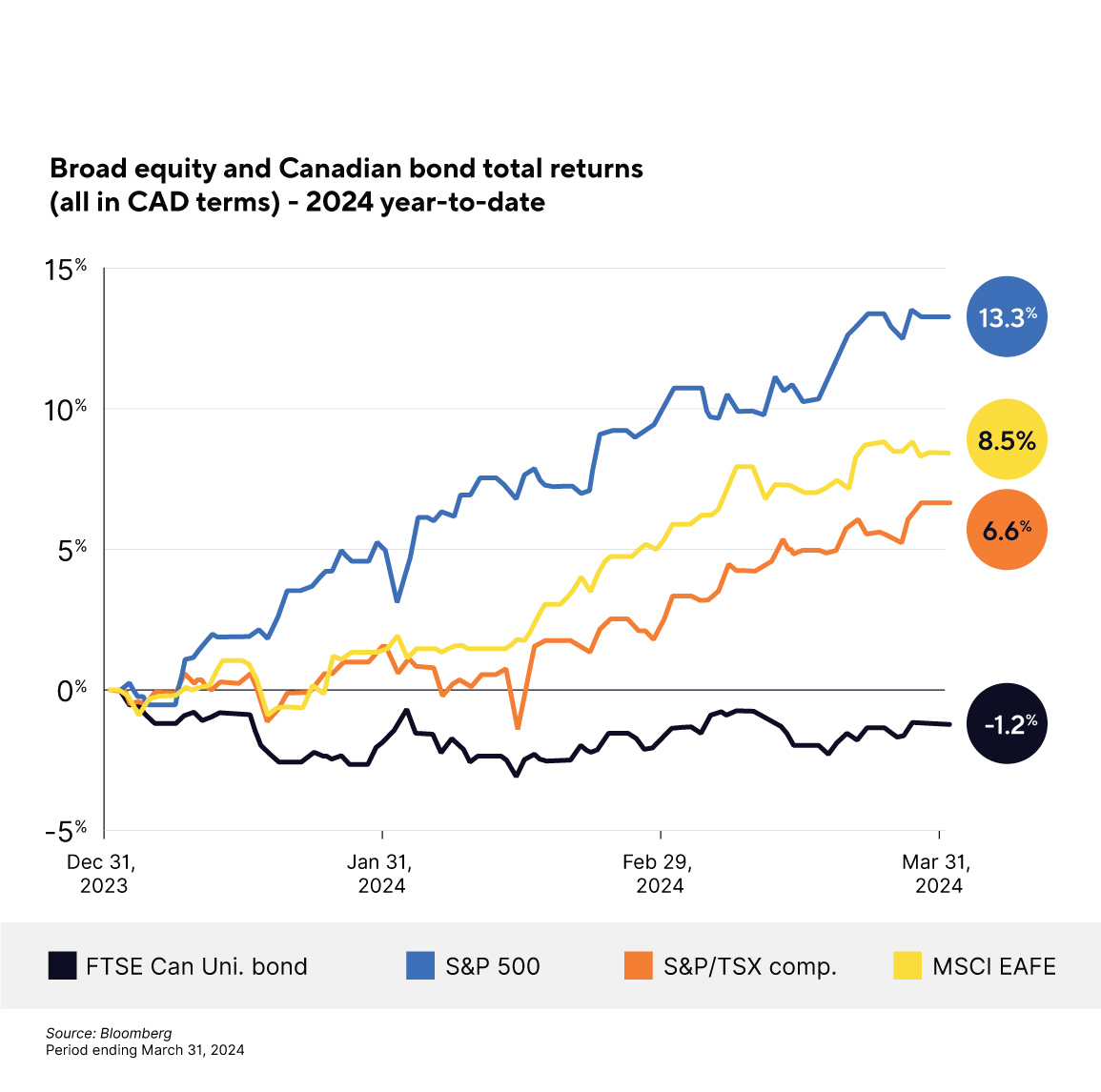

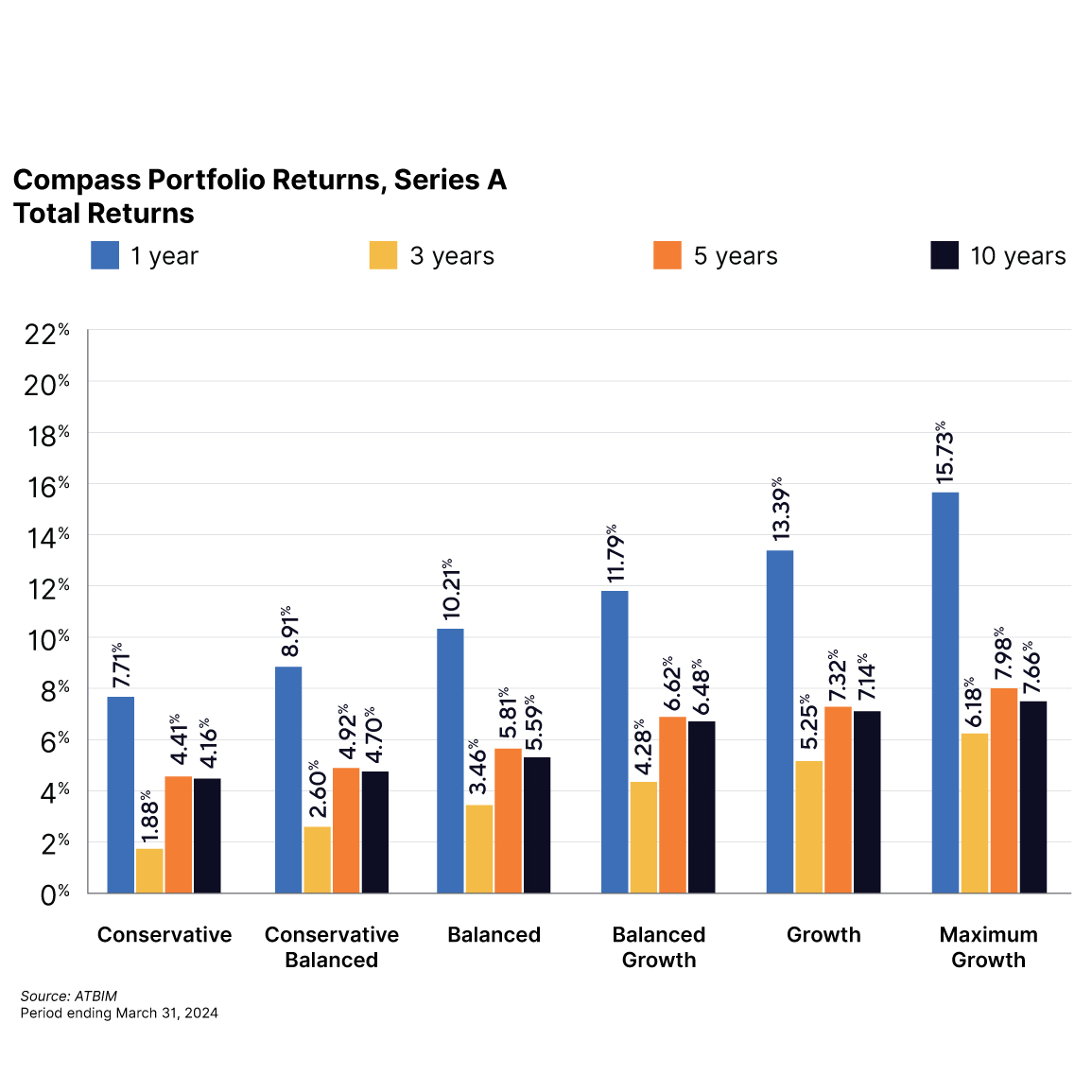

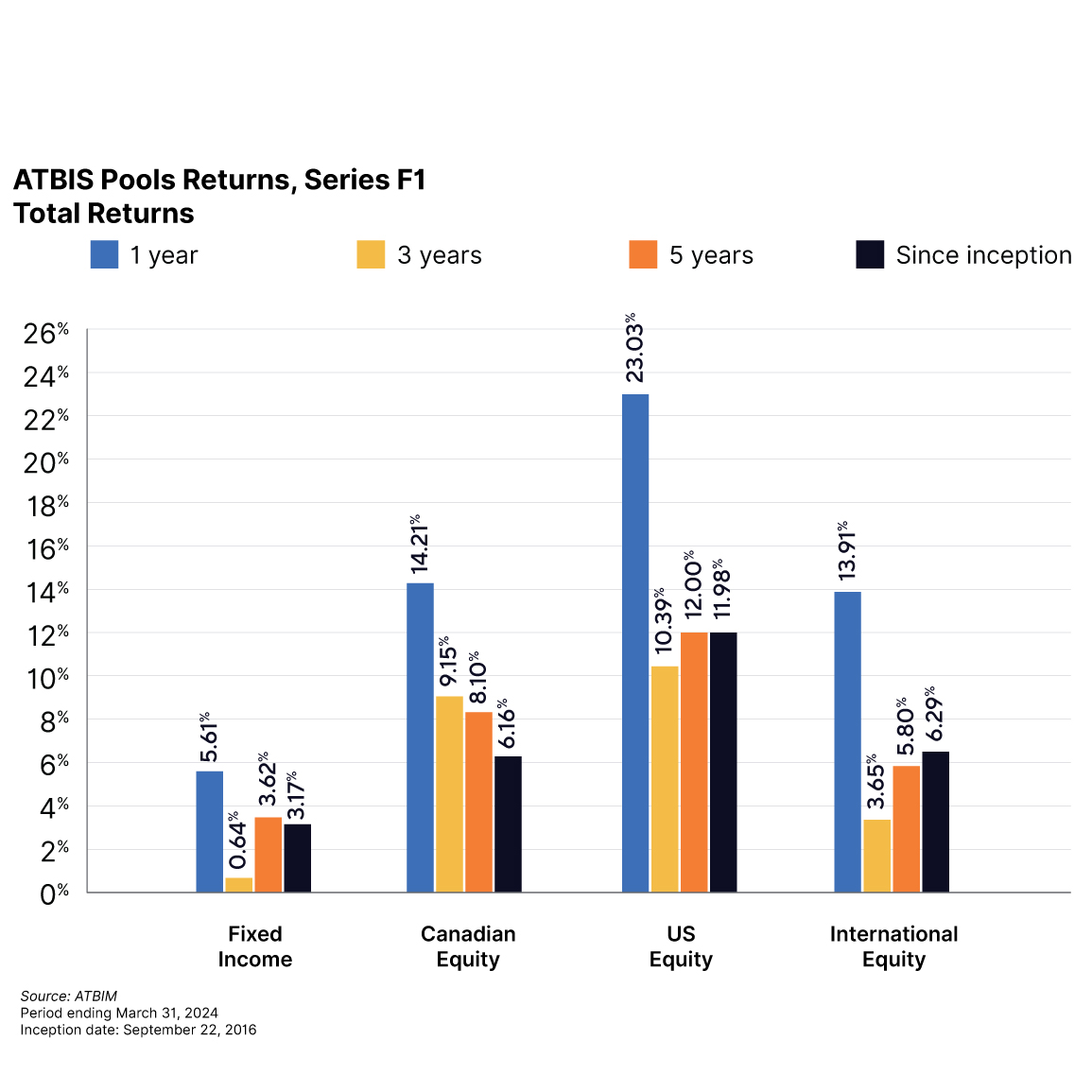

- The first quarter of 2024 had equity markets climbing further upward even with interest rates rebounding higher through the period. All Compass Portfolios and ATBIS Pools (the Funds) saw positive performance for the quarter.

- Markets are awaiting firm guidance from central banks on the direction of interest rates. Within Canada markets are anticipating a cut in July for the first 0.25%.

- Global company earnings last quarter remained resilient and equity valuations especially ex-US are quite attractive, but global GDP growth is estimated to be 2.5%1 for 2024—other than 2020, that would be the lowest annual growth since 2009.

Economics

Canada’s economy avoided a technical recession, with GDP rebounding by an annualized rate of just under 1% for the fourth quarter in 2023 following a contraction in the previous quarter. Headline inflation was also a good news story, with pricing rising 2.8% for February—below expectations and continuing from January—within the Bank of Canada’s (BoC) target 1-3% range. Canada’s population grew a further 3.2% during Q4 2023 on a year-over-year basis, maintaining the fastest growth in decades. Despite adding approximately 508k jobs since the end of 2022, the unemployment rate has risen from 5% to 5.8% as of February, in part due to the working-age population growing by about 1.15 million. As per capita GDP is falling because of a rising population and job growth that isn’t keeping pace, the BoC faces a tricky balancing act of promoting growth while limiting inflation. Now that prices are rising near acceptable levels overall, the BoC also needs to manage market expectations for the start of rate cuts, which the market has pushed back to the summer.

The US Federal Reserve (Fed) faces a different issue in that GDP growth continues to be persistently strong—Q4 2023 GDP grew by 3.4% on an annualized basis amid headline inflation that seems to be stabilizing at just over 3%. Combined with the core personal consumption expenditures (PCE-the Fed’s preferred measure) measuring at less than 3% since December, market expectations for rate cuts have been pushed back further to the latter half of the year, and talks of a soft landing have become more frequent.

The US is unique with its 'problem' of growth amid stabilizing inflation, as that isn’t necessarily the case elsewhere around the world. Inflation remains above the 2% target set by the European Central Bank (ECB), and GDP growth has been stagnant since late 2022. The ECB is signaling the likelihood of cuts sooner rather than later but won’t commit to a date to avoid damaging credibility if inflation rears up again. The Bank of Japan raised rates for the first time in 17 years, with rising wages and inflation above its 2% target.

Fixed income

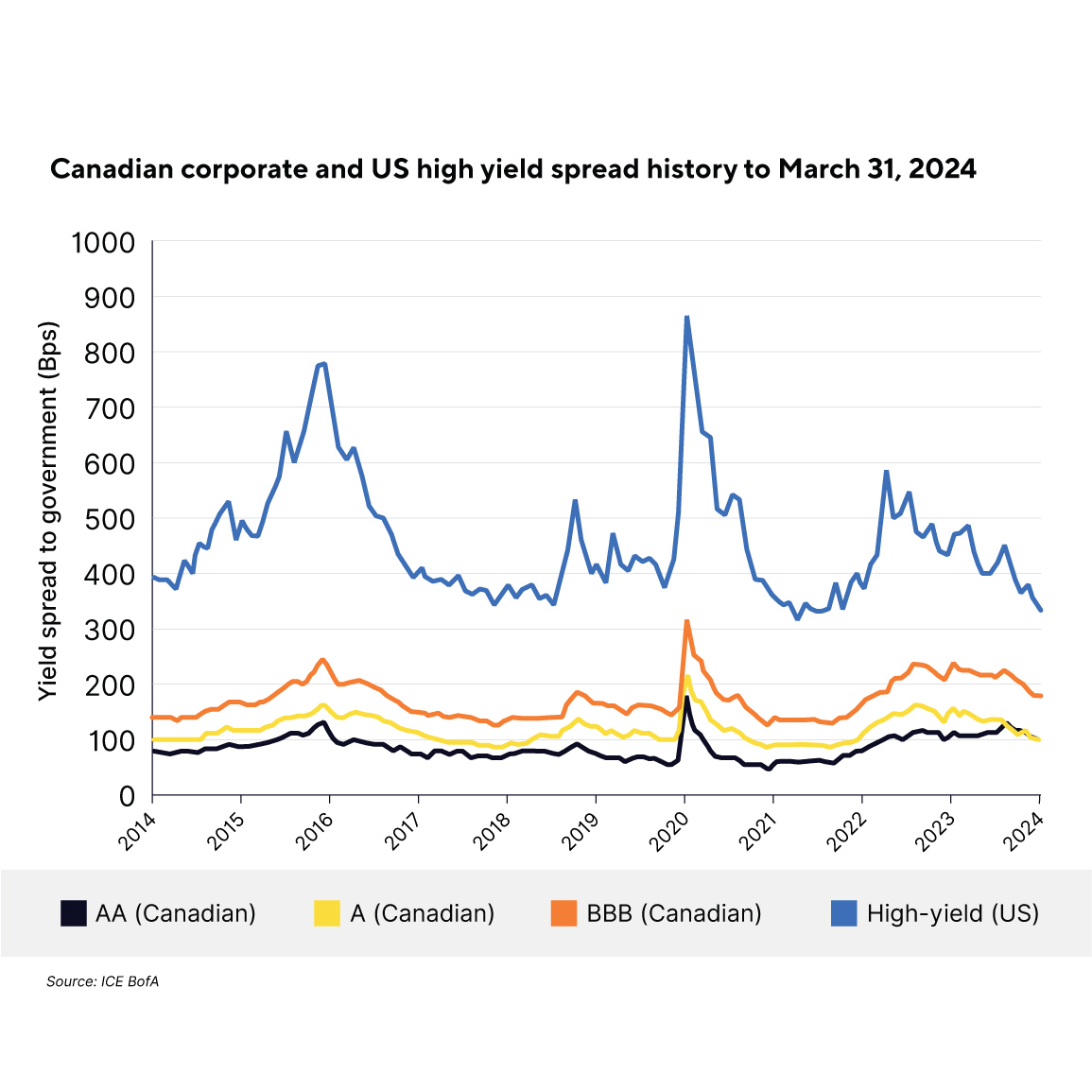

Yields rose overall for the quarter, causing bond prices to decline modestly in the broad bond market in Canada. The fixed income held in the Funds benefitted from a shorter duration, allowing the fixed income positions to hold on to a slight gain over the quarter. The Funds further benefitted from credit spreads as both investment-grade and high-yield spreads contracted through the quarter. Lower credit spreads translate into higher corporate bond prices. High yield spreads in March were as low as 325 basis points and near the lowest seen for the last decade (316 basis points set in mid-2021). Investment grade spreads, on the other hand, are right around the average witnessed in Canada for the last decade. The US economy has been performing well, but narrow spreads indicate riskier bonds are expensive. We believe less risk in the asset class at this moment in time is prudent. The Funds continue to tilt towards higher-rated issues, valuing safety and downside protection for now.

Equities

The artificial intelligence theme played a positive role through the first quarter with Nvidia benefitting the most, up 85% in USD terms during the period—Nvidia is now the 3rd largest company in the world behind only Apple and Microsoft. Beyond technology and AI, energy saw a rebound from 2023 as crude oil prices advanced on tighter supply, global growth, and continued geopolitical tensions. Energy was the second best-performing sector in the quarter, up 13% within the S&P 500 Index. The Funds’ US equity holdings saw strong absolute performance but lagged the overall S&P 500 mainly due to an underweight in Nvidia and Meta. The Funds that have exposure to US small- and mid-cap stocks3 saw positive returns but lagged large-cap performance—we maintain a view that this area of the market remains significantly undervalued.

The energy sector is a fairly insignificant weight for the US market, but that’s not the case for the Canadian equity market, where it is the second largest sector. The advance in energy contributed a significant 2.22% of the 6.62% the S&P TSX Composite Index (TSX) gained for the quarter. The Funds’ Canadian equity holdings didn’t see as much appreciation from its energy holdings, yet Canadian equities still added value for the quarter over the TSX on a gross-return basis for all individual sub-advised mandates. Overall, stock selection in technology made up the biggest positive difference stemming from holdings like Celestica, Constellation Software, and Topicus.

International stocks finished the quarter between US and Canadian stocks. Like North America, technology was a primary driver, and surprisingly, energy was one of the worst sectors. Two European defence companies—Rheinmetall and BAE Systems—as well as Taiwan Semiconductor, were among the top positive contributors in the period, helping offset some negative contributions from financials like HDFC Bank based in India4. Global small-cap stocks did not see the same performance as large-cap stocks, finishing up about 4%, resulting in a relatively lower international return for some of the Funds5.

Throughout the quarter we maintained our neutral stance toward overall equities. Regionally, we maintained a weighting tilt, favouring international equities instead of US equities for both valuation and diversification reasons. International markets persist in appearing relatively inexpensive with less concentration than the US market.

Changes to the currency hedge

One significant change over the quarter was to the US dollar equity hedge6. The US dollar exposure through US equity holdings in the Compass Portfolios has been hedged to some degree since 2007—currencies were erratic during the financial crisis and we aimed to dampen some of that volatility through currency hedging. Reassessing the risk-adjusted returns over time has shown that remaining unhedged for a Canadian investor holding US equities, has proven to be optimal. Currently, we view the US dollar as overvalued from a purchasing power parity (PPP) perspective, but PPP can take significant time to correct. Over the next couple of years, we believe there is a greater potential for both heightened equity market volatility and the Canadian central bank cutting interest rates to a greater degree than the US. If either or both prove true, the US dollar could see further gains against the Canadian dollar, leading to hedge losses.

The price of oil is a wildcard that may strengthen the Canadian dollar should oil continue to rise. However, oil is trading near its long-run inflation-adjusted average price at roughly $80 US per barrel for West Texas Intermediate. Should the global economy slow due to pressure from prolonged higher interest rates, oil could just as easily decline. That scenario would likely favour a stronger US dollar strength compared to the Canadian "petro" dollar. Moving forward for the Compass Portfolios, we will aim to be selective in initiating any foreign currency hedges on equity positions—limited to periods when we believe both short- and long-term drivers point to an overvaluation of the foreign currency in question.

Closing

With inflation nearing targets and growth in developed markets more or less stabilizing, the elusive economic soft landing—avoiding recession while seeing inflation back to target—remains within reach. This could ease investor concerns, leading to further gains this year from an already stellar start. We are confident that, even if this isn’t the case, fundamentals drive longer-term returns. On that front, interest rates and equity valuations in many areas of the global market are still attractive.

1 International Monetary Fund

2 ICE BofA US High Yield Index

3 The ATBIS US Equity Pool, and all Compass Portfolios with the exception of Compass Conservative

4 The four mentioned companies are held in all Compass Portfolios and the ATBIS International Pool

5 Compass Balanced Growth, Compass Growth, Compass Maximum Growth, and the ATBIS International Pool have global small-cap holdings.

6 Any non-Canadian denominated fixed income exposure within the Funds continues to be fully currency hedged

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report may contain forward-looking statements about a fund, currency, oil, or general economic factors which are not guarantees of future performance. Forward-looking statements involve assumptions, risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. We caution you not to place undue reliance on these statements as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.