Portfolio managers' commentary

A review of Q2 2024

Q2 kicks off policy easing

Summary

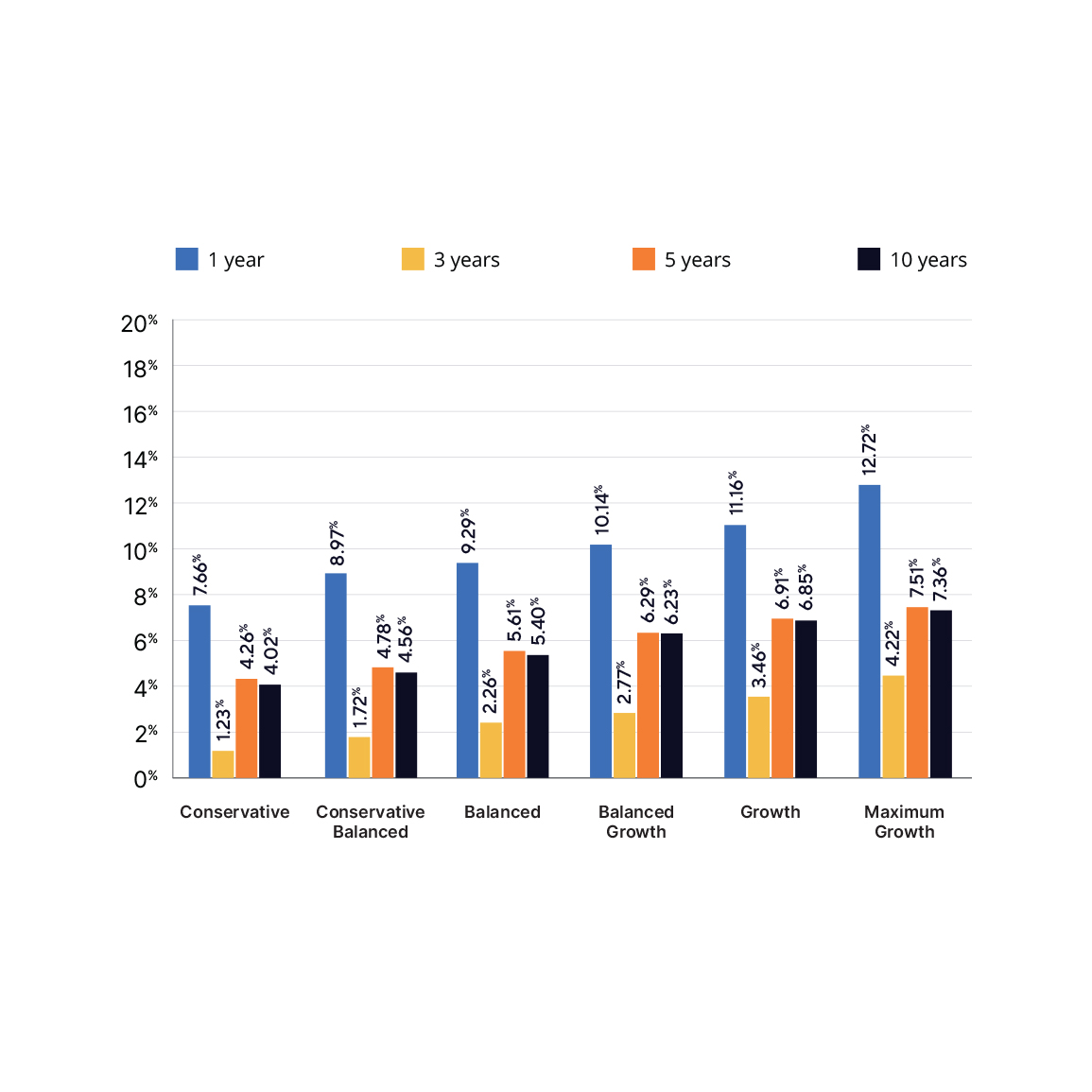

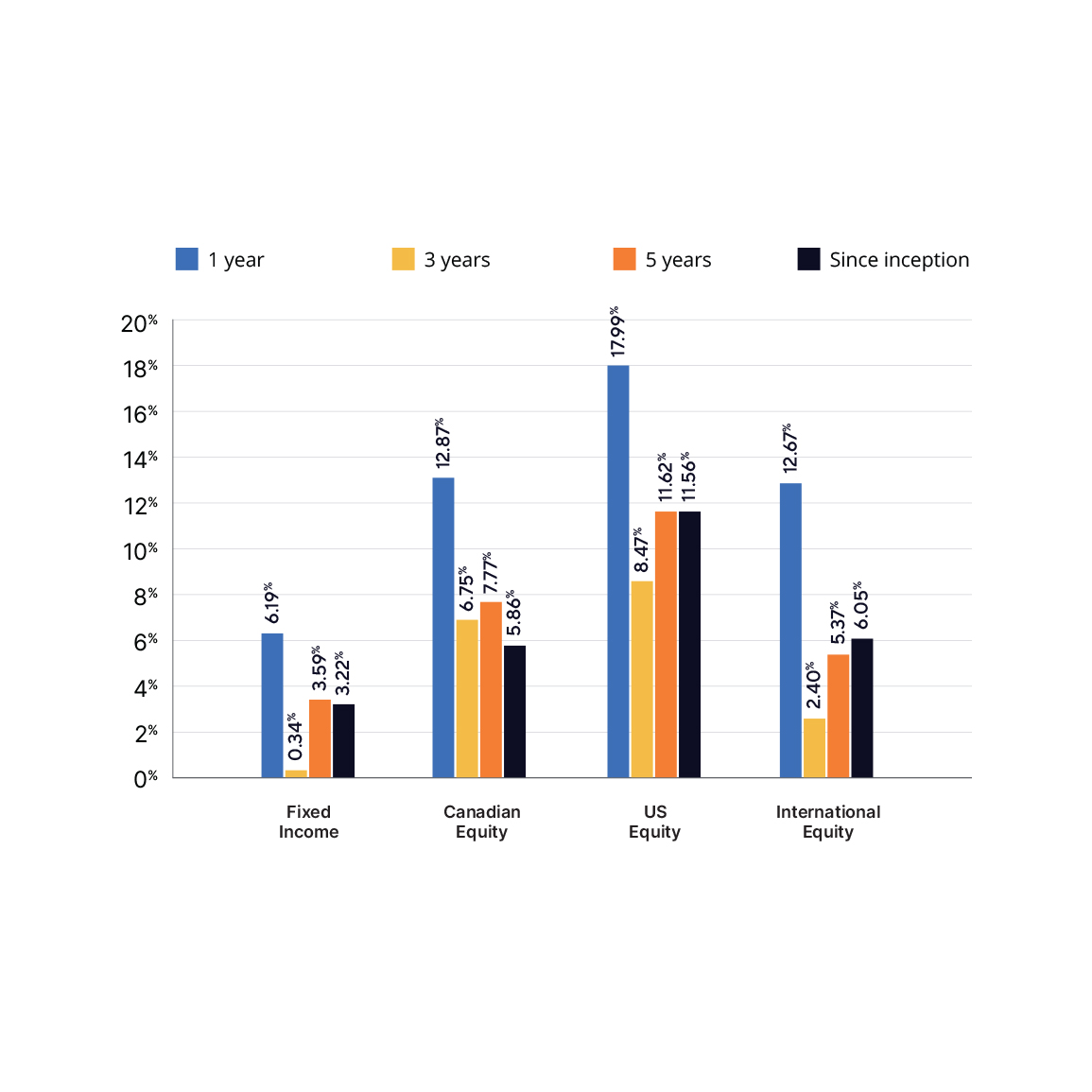

- The ATB Investment Management funds (the Funds) saw mixed performance for the quarter. Total returns for the six Compass Portfolios ranged from 0.7% to -0.5%, and the four ATBIS Pools ranged from 1.1% to -0.7%.

- The Bank of Canada (BoC) was the first central bank of major developed nations to start easing interest rates, reducing the overnight rate by 0.25% to 4.75%

- US Information Technology was once again the star of equities, as the hype surrounding artificial intelligence briefly drove Nvidia to the highest weight on the S&P 500 in June.

Economics

Within the Canadian economic landscape, the BoC’s overnight rate cut of 0.25% to 4.75% was the most significant development over the second quarter. This makes the BoC the first central bank among major developed nations to shift towards a policy of easing rates. No assurance was given for a further cut in July as further easing will be “data dependent,” but there are several factors working against it, including: a slight uptick in headline CPI for May (2.9%); a slight rise in month-over-month retail sales, excluding gas and vehicles (1.8% in April vs -0.8% in March); and, a GDP print for April that showed little weakness across the board, rising 0.3%. Within the core measures, shelter—especially rented accommodation—remains elevated and at its highest year-over-year level (8.6%) since headline inflation peaked in June 2022. There’s likely little relief for renters any time soon, as population growth has continued to surpass the growth in total private dwellings across the country, which has grown by 1.2% on a year-over-year basis to the end of 2024 Q1. Considering that the population has grown over 3.2% during the same period, more housing or a slowdown in population growth is needed to alleviate rent pressures.

As the BoC is ahead of the US Federal Reserve (the Fed) in its easing cycle, how far the two countries’ monetary policies can diverge is in question. The BoC has stated there is still room for the two countries to diverge, but eventually the rate differential will cause the CAD to deteriorate versus the USD. Initially, this will be felt by Canadians traveling to the U.S, but if left unchecked, will import inflation via higher costs domestic consumers pay for imported goods, whether those goods are directly sold to the Canadian market, or further processed by Canadian industry.

In the world of good news is bad news, the labour market in the US, which has remained resilient despite the unemployment rate ticking up 0.3% to 4% over the quarter, keeps throwing wrenches into the Fed’s fight against inflation. Initial and continuing jobless claims have been stable, which could sustain personal income and wages, leading to heightened demand and wage inflation. That being said, personal spending and consumption has dropped throughout the quarter, and the number of job openings has dropped by around 8%, indicating that there is some stress being felt by consumers. While the Fed’s dual mandate is to keep maximum employment and a target rate of inflation, the growth in the economy and “modest further progress” towards the 2% target had the Fed keeping the overnight lending rate at 5.25% for the June meeting. Markets are expecting two cuts by year end, or early January, but the data-driven Fed is quick to rain on any market parade if necessary.

The European Central Bank (ECB) faces a similar problem to its Canadian counterparts in that inflation has come down significantly and the growth outlook is milder than the US, but core inflation measures and wage growth remain higher than desired. That being said, citing significant progress on taming inflation, and the growth outlook for the EU, the ECB also cut key interest rates on June 6 to kick off the easing cycle. However, the central bank noted that inflation is “likely to stay above target well into next year” and that the ECB is willing to keep conditions restrictive as long as needed to get to its 2% goal.

Markets

Canadian bond yields were relatively unchanged over the quarter, until the end of May when one of the core CPI measures and GDP came in lower than expectations, leading to market participants pricing in a rate cut for June. The BoC delivered, but likely due to a higher-for-longer mindset setting in, coupled with continued US economic strength. Shorter bond yields decreased while longer bond yields increased, leading to a twist in the yield curve. The difference led to short bonds outperforming their longer counterparts, returning 1.24%, and 0.22%, respectively. This resulted in the bond universe rising 0.86% overall, but on the back of yield rising a mere 0.03%. The ATBIS Fixed Income Pool Series F1—which has a shorter overall term to maturity and duration compared to the index—benefited from the shorter end outperforming, and rose 1.27% over the quarter.

Changes within the fixed-income holdings over the quarter included adding a couple of Coastal Gas Link LP bonds maturing in 2039 and 2049. These were issued in June and together with a few other maturities amounted to $7.15B, the largest corporate issuance in Canadian history. Another change within the bond holdings includes the securitization of the sixth iteration of the Canadian Commercial Mortgage Origination Trust (CCMOT6). This decreases the funds’ exposure to commercial mortgages, as a portion is sold off, but continues in the same format as previous iterations. We look to continue the program and fund new mortgages, as the program remains a key component of our fixed-income holdings.

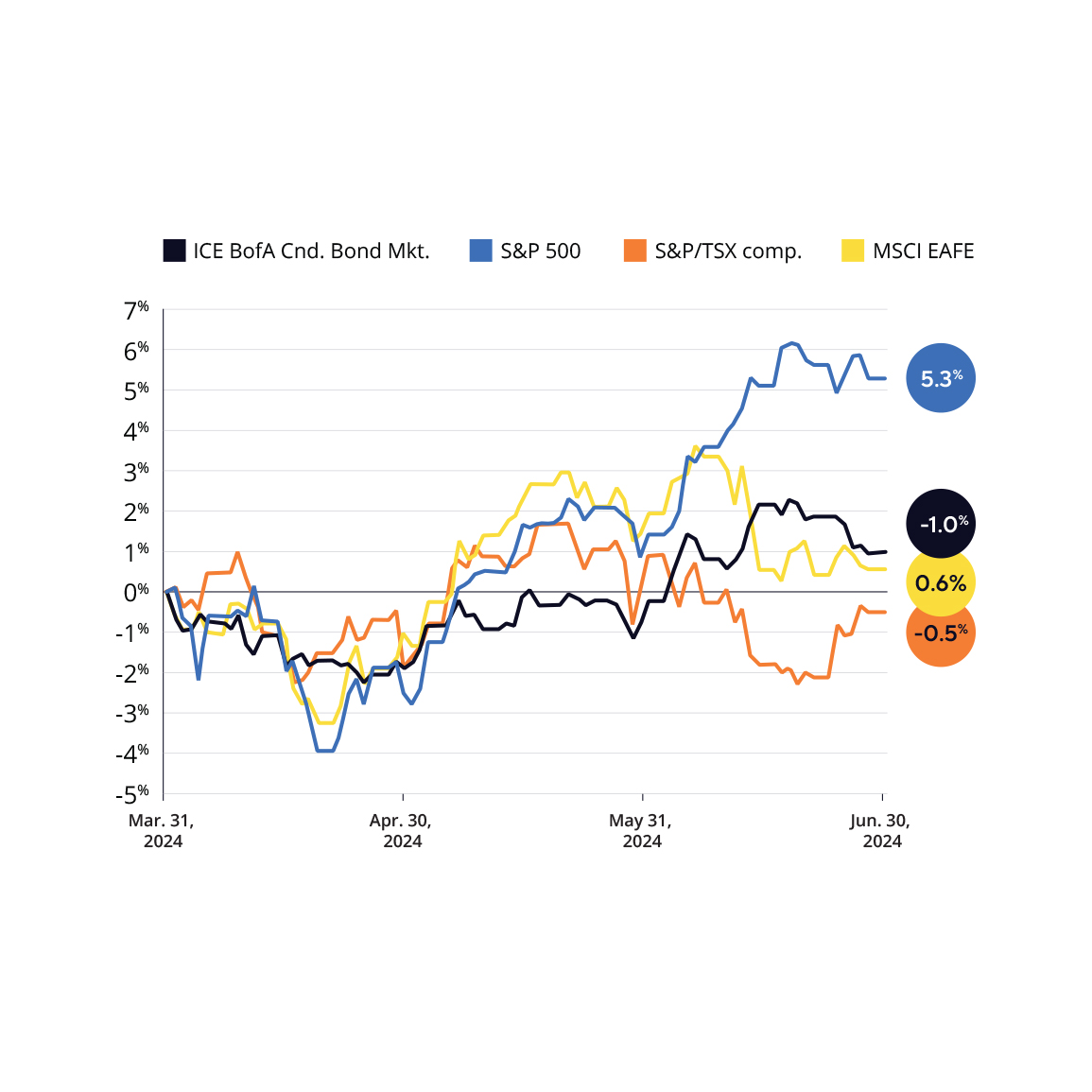

US markets were the winner over the last quarter, rising over 5%, whereas EAFE gained just under 1% and Canadian markets lost just over half a per cent, all in Canadian dollar terms, as shown in the chart. Markets moved in unison and fluctuated throughout the quarter, dipping into negative territory mid-April as rate cut expectations were pushed back amid comments from Fed Chair Jerome Powell. Markets recovered towards the end of May, but the S&P 500 took off, outperforming its international peers by over 5% in CAD terms during June alone.

Performance within the US large cap space was not widespread, and was essentially driven by the information technology sector. The sector alone rose just under 15% during the quarter, compared to the S&P 500, excluding technology, which gained a mere 1.3%. Half of the sector’s performance can be attributed to Nvidia alone, which gained a further 36% over the quarter, bringing year-to-date return to just under 150% in USD terms. The mania around Nvidia drove it to the highest weight in the S&P 500, briefly nudging Microsoft out of its top position on June 18 for two days. The stock has certainly performed well financially, growing revenues a jaw-dropping 262% on a year-over-year basis to the end of April. It begs the question as to whether it can keep up with expectations, as it is currently training at 74 times its earnings, making the info tech sector’s already historically high 38x P/E multiple look small by comparison, and emphasizing the need for caution when looking into stocks that have extremely high expectations.

Canadian markets were essentially flat, buoyed by metals miners as gold prices maintained the approximate 25% appreciation seen toward the end of Q1 and beginning of Q2. Canadian tech stocks markets didn’t enjoy any spillover effects from US tech’s rise, as the info tech sector dropped overall market favorite Shopify dropped around13% over the quarter pulling the index down amid weak earnings guidance. While the funds are underweight materials, and the holdings that are in the sector tend to be not related to precious metals, the funds were essentially flat with the index.

Source: ATBIM

Source: ATBIM

* ATBIS Pools inception date September 30, 2016.

Closing remarks

The second quarter of 2024 finally saw the first major developed countries cutting their official interest rates, a move that was long awaited. Canada was the first G7 country to cut, and was followed by the European Central Bank. Even though expectations are for further rate cuts before the end of the year, the timing will continue to depend on the data and if it supports further easing.

The markets will continue to focus on the US Federal Reserve, and when it will start broadly easing monetary policy. Initial signs of a slowdown in the US are creeping in, but headline inflation remains above 3% and core inflation remains sticky. We remain vigilant during this “higher-for-longer” period, and continue to closely watch for more certainty on the short to medium term direction of the central banks' fight against inflation.

1 Compass Portfolio Total Returns for series A, and ATBIS FI Pool Total Returns for series F1. Fund returns for all series can be found on atbim.atb.com/funds

2 Using quarterly population estimates from Statistics Canada

3 Quarterly Estimate by Statistics Canada

4 Using the daily median P/E ratio since 1990 (22.5x)

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The ATB Funds, Compass Portfolios, and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedarplus.ca.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.