Portfolio managers' commentary

A review of Q3 2024

Equity and fixed income markets advanced. US Federal Reserve and Bank of Canada cut target rates following encouraging inflation and labour market data.

- Equity and fixed income markets advanced, although the AI-themed mega-caps took a backseat to the rest of the S&P 500 index, small, and mid-cap stocks.

- The US Federal Reserve cut its overnight target rate by 0.5% to 5% largely as expected after encouraging inflation and labour market data at its September meeting. The Bank of Canada also cut rates twice by 0.25% at the July and September announcements, bringing the rate down to 4.25%.

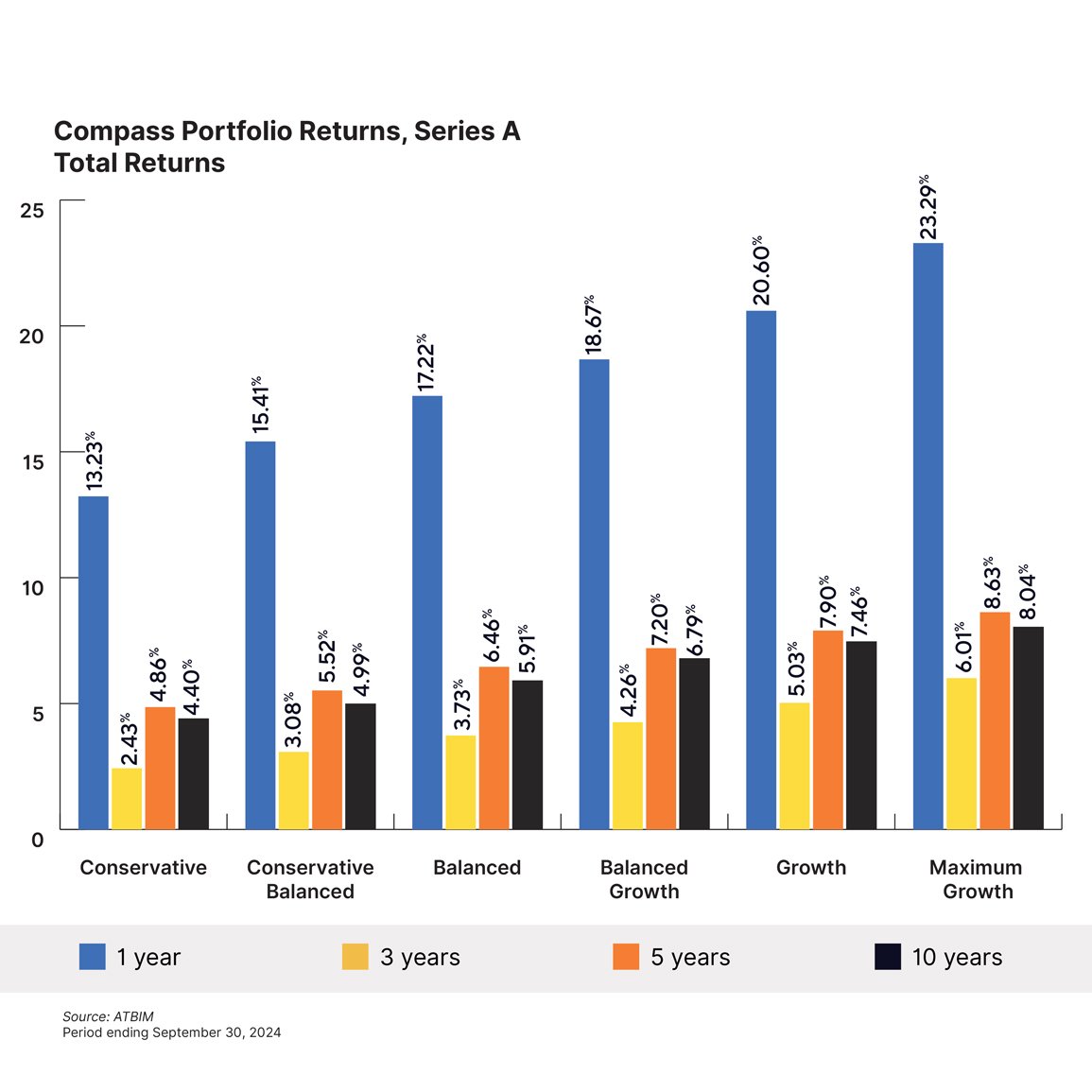

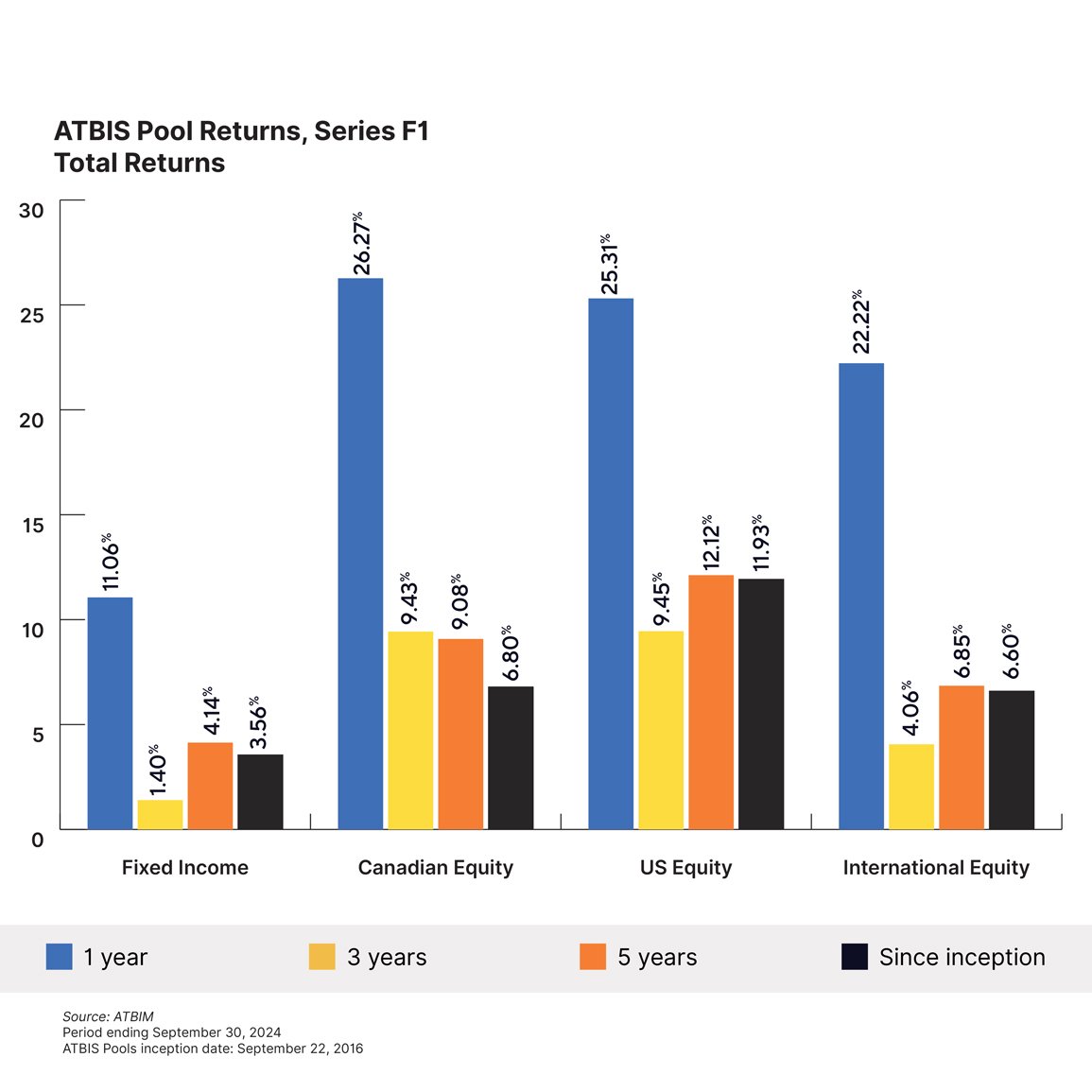

- The ATB Investment Management funds (the Funds) saw positive performance for the quarter. Total returns for the six Compass Portfolios ranged from 4.0% to 6.5%, and the four ATBIS Pools ranged from 3.5% to 8.9%1.

Economics

Interest rate cuts were the hot topic of the quarter in Canadian markets, with the Bank of Canada (BoC) cutting its overnight rate by 0.25% in July and September bringing the overnight rate to 4.25%. Both were expected as core and headline inflation had continued a steady decline, with the headline figure remaining at 2.2% for July, well within reach of the 2% target. Data for August, which came in after the rate announcement, showed that headline inflation declined further to 2%. The question is now not if, but how much the Bank will cut at the next meeting. The market may interpret the BoC’s hastening cuts as a sign of playing catch-up, although the data might be indicating the need for more stimulus sooner. While the Canadian economy is still growing, GDP per capita has continued to decline as population growth outpaces economic activity, and likely contributing to increasing shelter costs. Lowering interest rates is likely to help with shelter inflation, as taking mortgage interest payments out, inflation rose 1.1%. On the other hand, falling interest rates might spark more interest in the housing market, leading to housing prices rising further, negating any effect from lower interest payments.

South of the border, markets focused on how the data would affect the September rate decision by the US Federal Reserve (Fed). Due to relatively strong economic growth and comments from the Fed, the markets did not anticipate a rate cut in July. Similarly to Canada, the unemployment rate in the US has been increasing over the past quarter, from more entrants to the workforce as opposed to job losses. Fed chair Jerome Powell noted that the labour market had “cooled considerably.” Combined with progress on inflation, this gave way for the Fed to cut the overnight rate by 0.5% to 5% at the September meeting. The forward path of the Fed will remain dynamic, although the direction is not in question, more so the magnitude of easing. The Fed, as well as the BoC, is still wrangling with shelter being the largest driver of core inflation, but the Fed also has to contend with persistent economic growth, unlike its BoC counterpart.

One topic that flew slightly under the radar was the movement in currency markets over the past three months. Even prior to the Bank of Japan (BoJ) raising interest rates and the carry trade unwind being blamed for the rapid market movement, the yen had already gained about 7% versus the USD by the end of July. Fast forward to the end of the quarter, the USD had lost more ground versus its developed peers—around 1.5% against the CAD (to 1.35 from 1.37), and up to 12% versus the yen. It was more of a situation of the non-North American currencies weakening, as the CAD also weakened versus other developed nations, but by less so than the USD.

Markets

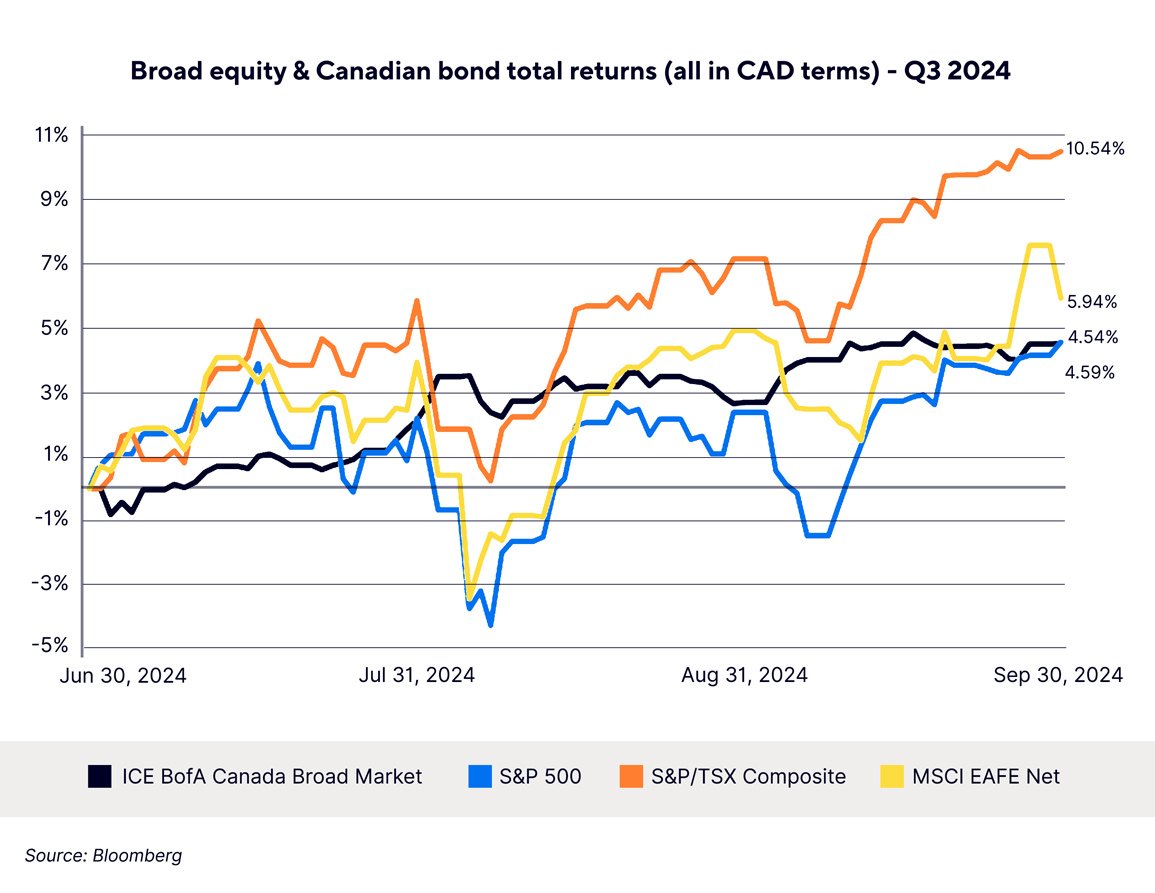

Markets started off the quarter with expectations of sooner-than-later rate cuts following a favourable inflation print for June, kicking off a rotation into small and mid-cap equities from mega caps, particularly within the US market. July saw a bit of a decline in the Magnificent Seven2 stocks on average, likely a combination of the market rotation and some disappointing aspects of Alphabet’s earnings. Equity markets then sold off at the end of July into the first week of August, largely because of the effects of the unwinding of the Japanese yen carry trade. This saw the Nikkei 225 index drop just over 12% on Labour Day, and gain over 10% the following day, causing a tension in markets worldwide. All this said, stocks recovered most of the losses by mid August and all major developed markets ended up positive for the quarter.

Technology mega-caps took a breather during the quarter, as the AI theme appears to be losing some steam, with rate cuts making interest-sensitive sectors look more attractive. The equally-weighted S&P 500 index outperformed the capitalization-weighted index by over 3% in USD terms, pointing to investor appetite for those stocks other than the top-weighted darlings. On a sector basis, utilities and real estate, two debt-heavy sectors significantly outperformed the index, rising over 17%, and 19% respectively, versus the index’s overall 5.9% return. When looking at earnings, over 69% of companies showed earnings growing over the prior earnings cycle, with earnings rising over 10% on average and over 79% of companies surprising to the upside. That being said, valuations continue to grind higher as US stocks are still enjoying investor enthusiasm as multiples continue to expand. The US holdings within the fund benefitted from the rotation away from mega-cap stocks, as mid and small-cap stocks continued to outperform to the end of the quarter.

Canadian stocks outperformed their developed market peers, with financials and materials stocks leading the way. Performance was fairly broad based, with banks and gold companies leading the way amid falling interest rates and rising gold prices. Earnings have also been positive, with the only sore spot being the consumer discretionary sector where earnings fell overall. This was not due to the retail side, as Magna, an auto parts maker and companies classified as leisure products saw outsized declines in earnings. The Portfolio’s Canadian positions came in slightly behind the benchmark, as the holdings were overall underweight financials and information technology, and small-caps underperformed the broad large-cap index.

International stocks, as measured by the MSCI EAFE Index, were ahead of their US peers, mainly driven by UK and Asia-ex Japan stocks. Japanese equities were actually negative on the quarter on a yen basis, however, due to strengthening of the yen from the carry trade unwind and the BoJ raising rates, Japanese equities were positive for foreign investors. Earnings growth surprised to the upside, although the level of earnings declined in aggregate in the EAFE region. Much of the decline can be attributed to a few large names within the financials sector. Overall, we are still favouring international stocks over US equities, as they remain cheaply valued on an absolute and historical basis.

Fixed income markets were a little more subdued, however, interest rates were on the move. Broad market yields, as measured by the FTSE Canada Universe Bond index, fell 70 basis points to 3.48%, translating to a 4.66% return for the quarter. Despite short bonds benefitting from the largest decline in overall yields, the higher duration of long bonds was more than enough to make up for yields in the longer part of the curve not falling as much and leading to long bonds outperforming their short counterparts. Spreads were little moved over the quarter, and despite having a shorter duration than the index, corporate bonds performed inline with the index. At a high level, this is likely attributable to these bonds being at the sweet spot on the curve given the drop in yields.

Closing remarks

With the US having joined many other major economies (Canada, Euro-zone, UK) in cutting its official interest rate, the focus now turns to what’s in store for the rest of the year and into 2025. Markets are expecting at least another 50 basis points worth of cuts in both Canada and the US by year-end, assuming inflation continues its current trajectory. However, if the economy shows strong growth or inflation spikes back up, then the central banks would likely pause and reassess.

With one source of uncertainty removed (i.e. when would the US cut rates?), we are now seeing other sources of uncertainty enter the picture. The US presidential election cycle is entering its last month, and the chatter surrounding the potential outcome, and the resultant impact on the economy and markets, has increased, as to be expected.

The other is geopolitical uncertainty, given the increased tensions in the Middle East region. While such conflicts are hard to predict, markets are likely to keep more of a watchful eye unless it expands into a broader regional conflict that involves more countries, including the US.

Our Portfolios are built for resilience, especially in periods of uncertainty, with an eye to reducing downside if market volatility flares. Staying invested remains key, as trying to time the market is a difficult endeavour.

1 Compass Portfolio Total Returns for series A, and ATBIS FI Pool Total Returns for series F1. Fund returns for all series can be found here.

2 Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The ATB Funds, Compass Portfolios, and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedarplus.ca.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.