Quarterly commentary

A review of Q3 2025

Stock markets rallied to new highs during the third quarter, as concerns over tariff uncertainty were replaced by optimism from surprisingly resilient economic growth. While this strength was reasonably broad-based in the US, the Canadian market's outperformance was more concentrated, driven largely by the financials and materials sectors.

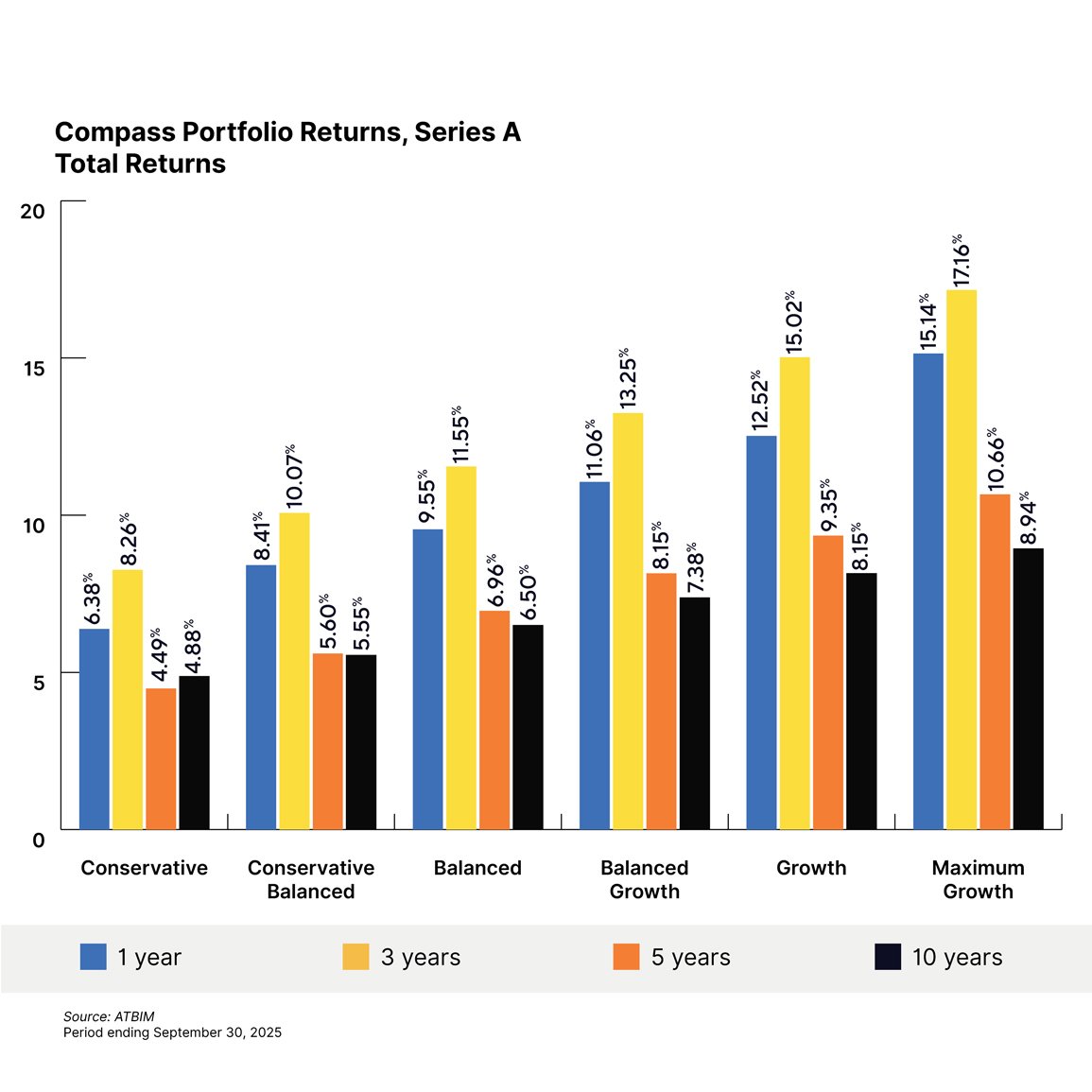

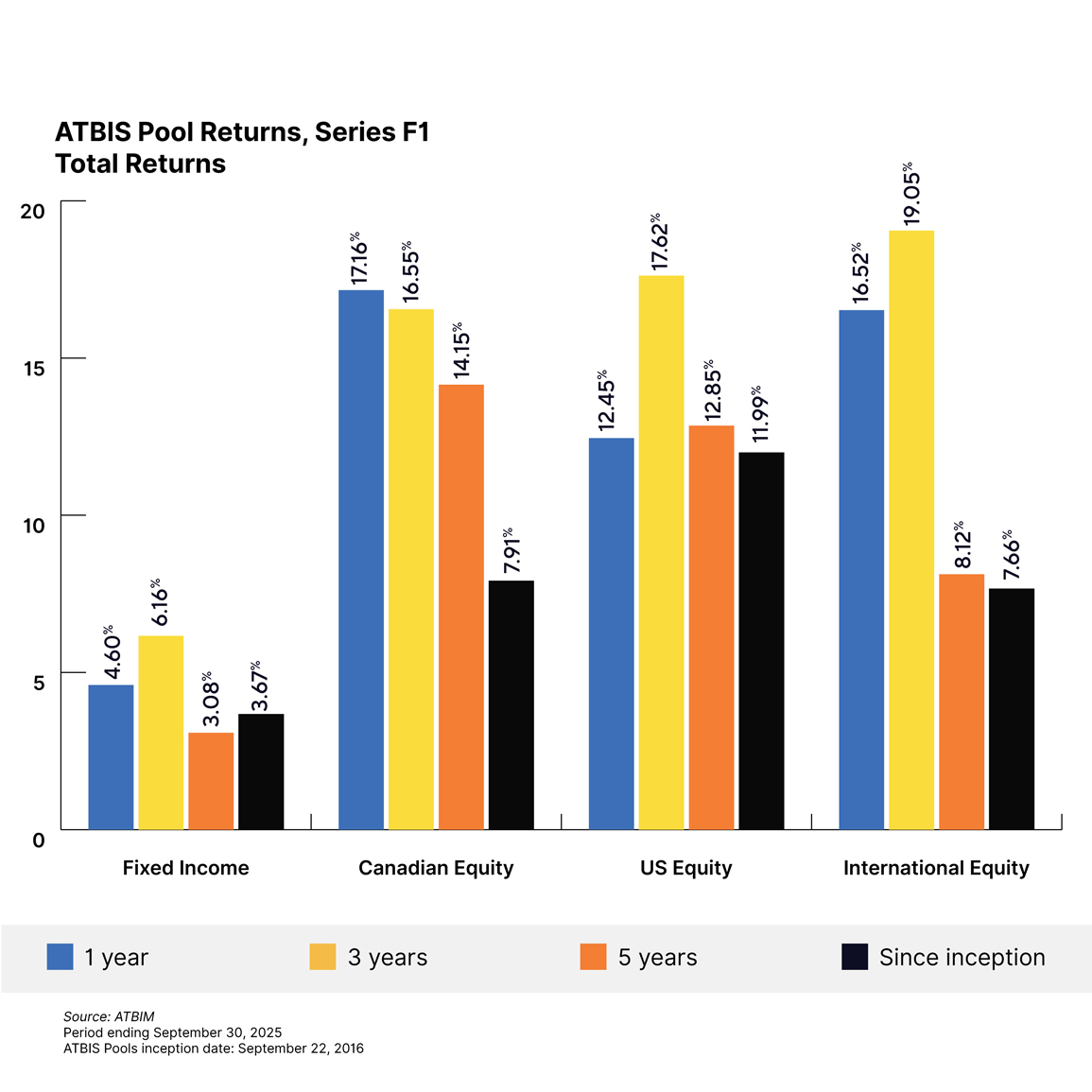

- The ATB Investment Management Funds (the Funds)1 continued to perform well over the third quarter. The Compass Portfolios delivered positive returns ranging from 2.1% to 5.3%, while the ATBIS Pools saw performance that ranged from 1.8% to 7.2%.

- As trade deals came to fruition, concern regarding tariff uncertainty subsided, propelling stock markets to new highs. This rally was driven by growth that has surprised to the upside in most economies.

- Strong equity returns were reasonably broad-based, although some concentration at the top remains in the US markets. The Canadian equity market saw the strongest performance amongst its peers. This performance was largely driven by the financials and materials sector, particularly gold stocks.

Economics

With much of the policy uncertainty from tariffs in the rearview mirror, the effects have started to appear in economic data, and market participants have a clearer picture of what the baseline case for tariffs looks like. The distortions we saw in the second quarter from import and export front-loading have more or less worked their way through the system. The result is an economic landscape that differs between and within regions worldwide. That said, growth has been resilient globally, prompting the OECD to revise its growth expectations from 2.9% to 3.2% in its September publication.

Looking within regions, the US saw one of the largest distortions with quarterly GDP dropping 0.6% in Q1 as companies front-ran tariffs, and then it rose by 3.8% in the second quarter as trade normalized. Canada was one of the major counterparties of this distortion, as Canadian GDP expanded 2% in Q1, but contracted by 1.6% in the second quarter. GDP in both nations is expected to normalize in the coming quarters as economic activity continues to withstand the turbulence from tariffs.

Although economic growth is exceeding expectations and showing resilience in the US, and inflation measures remain somewhat above target, the Federal Reserve (Fed) delivered a much-anticipated 0.25% cut to the policy rate. The Fed indicated that a job market that is showing signs of stress—as outlined by the largest downward revision since the pandemic in the July employment report—and concerns surrounding further headwinds from trade policy led to the resumption of rate cuts. The Bank of Canada (BoC) also cut the overnight rate by 0.25%, citing similar risks to the economy from tariffs and a weakening employment market. The decision by the BoC was less anticipated, given that core inflation measures remain above target at around 3%, but was prompted by the September jobs report, which showed a net loss of over 65,000 jobs.

Markets

Equity markets continued to rally worldwide over the quarter, with major indices, especially in North America, repeatedly hitting new highs. The anticipation and eventual realization of a more accommodative monetary policy fueled the rally, but the reasons for robust equity performance differ by region. All major equity markets are seeing double-digit growth on a year-to-date basis. It certainly was a “September to remember,” as essentially all asset classes gained during a month that is historically seen as cautious for investors.

US Equities: The rally broadens

Equity market performance within the US continued to broaden beyond the usual mega-cap stocks that have driven market performance for the past several years. The Russell 2000, a key index for smaller companies, hit a new all-time high for the first time in four years at the end of September. This possibly signifies investor confidence in the space now that the Fed has returned to an easing cycle and the impact on earnings from tariffs seem to be more or less contained. Overall, earnings growth in the US market continues to surprise observers, highlighting the resilience of American consumer spending and corporate earnings amid cost headwinds from tariffs.

Canadian equities: A concentrated outperformance

Canadian equity markets also continued to surprise investors throughout the quarter, with strong performance relative to global peers, especially the US. The key difference, however, is the drivers of that performance, which has almost entirely been precious metals and financials on both a year-to-date and quarterly basis. Despite making up only about 13.5% of the S&P/TSX Composite Index, the materials sector is responsible for just over 38% of the Canadian market’s performance this year. This is not surprising, as gold has risen more than 50% this year to $3,858 USD per ounce amid increased buying from central banks and more general positive sentiment towards the metal. Financials in Canada have also surprised to the upside despite soft sentiment toward the Canadian economy, as a normal yield curve and stable loan-loss provisions have been favourable to earnings growth.

International equities: Awaiting earnings growth

Markets outside of North America also continued to rise overall, although performance in developed markets, in aggregate, lagged behind their North American counterparts. European markets, in particular, which saw a lift from promises of increased fiscal spend and growth-oriented legislation, took a backseat performance-wise. Much of the rise in European stock prices has been met with limited earnings growth, and performance this quarter might indicate that investors now want to see earnings materialize before rewarding companies further.

Bond markets: Navigating rate cuts and inflation

Bond markets were fairly calm throughout the summer, although incrementally rising yields kept overall bond returns negative until employment data released around the end of August caused yields to fall. The BoC’s decision to cut rates in September despite sticky core inflation caused yields on bonds with shorter maturities to fall, while yields on bonds with longer maturities rose slightly. This continued “twist” of the yield curve reflects a disconnect between the market’s long-term expectations for inflation and the short-term direction of the economy. Essentially, the market is indicating that it believes inflation is likely to remain higher over the longer term, despite falling for the time being. This has been supportive of short- to mid-term bonds (maturities shorter than 10 years), where most corporate bonds are found. This, coupled with spreads that continue to tighten, has significantly boosted the performance of both corporate and short-term bonds on both a year-to-date and quarterly basis.

Conclusion

Markets continued to drive forward as economies around the world have shown resilience amid a reset in global trade policies. The initial shock from tariffs is now in the rearview mirror. While there are still likely some trade policy surprises to contend with, it is apparent that the market thinks anything new will be managed. It was easy to be pessimistic in early April, but as the rest of the year has shown, it is important to not lose sight of long-term goals and stay invested. The Funds remain well-positioned to capitalize on opportunities in the market.

1 Compass Portfolio Total Returns for series A, and ATBIS FI Pool Total Returns for series F1. Fund returns for all series can be found on atbim.atb.com/funds

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The ATB Funds, Compass Portfolios, and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedarplus.ca.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.