Portfolio managers' commentary

A review of Q4 and 2023

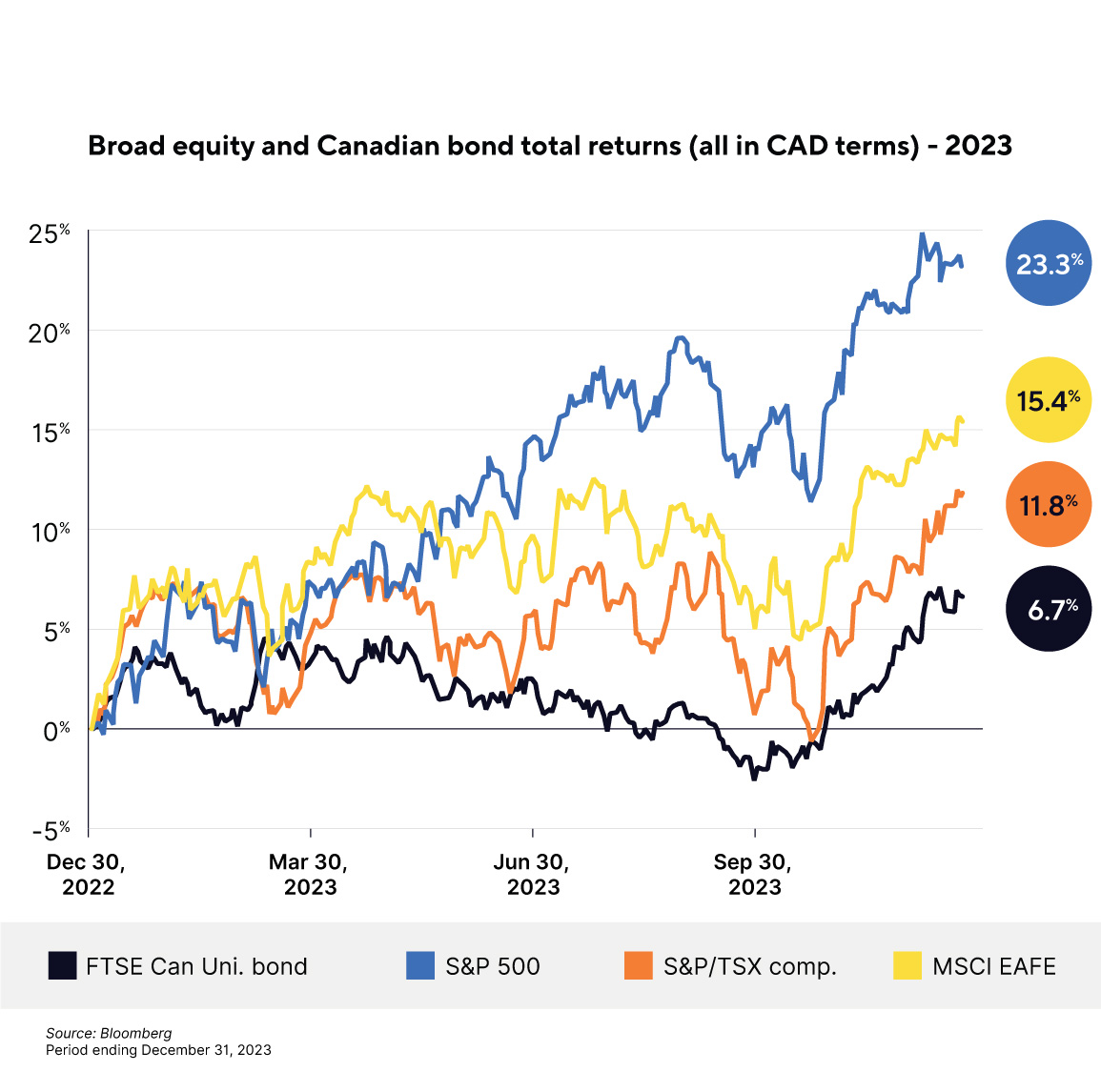

After a particularly difficult 2022, in which both fixed-income and equity markets saw double-digit losses, 2023 was a welcome reprieve for investors.

Summary

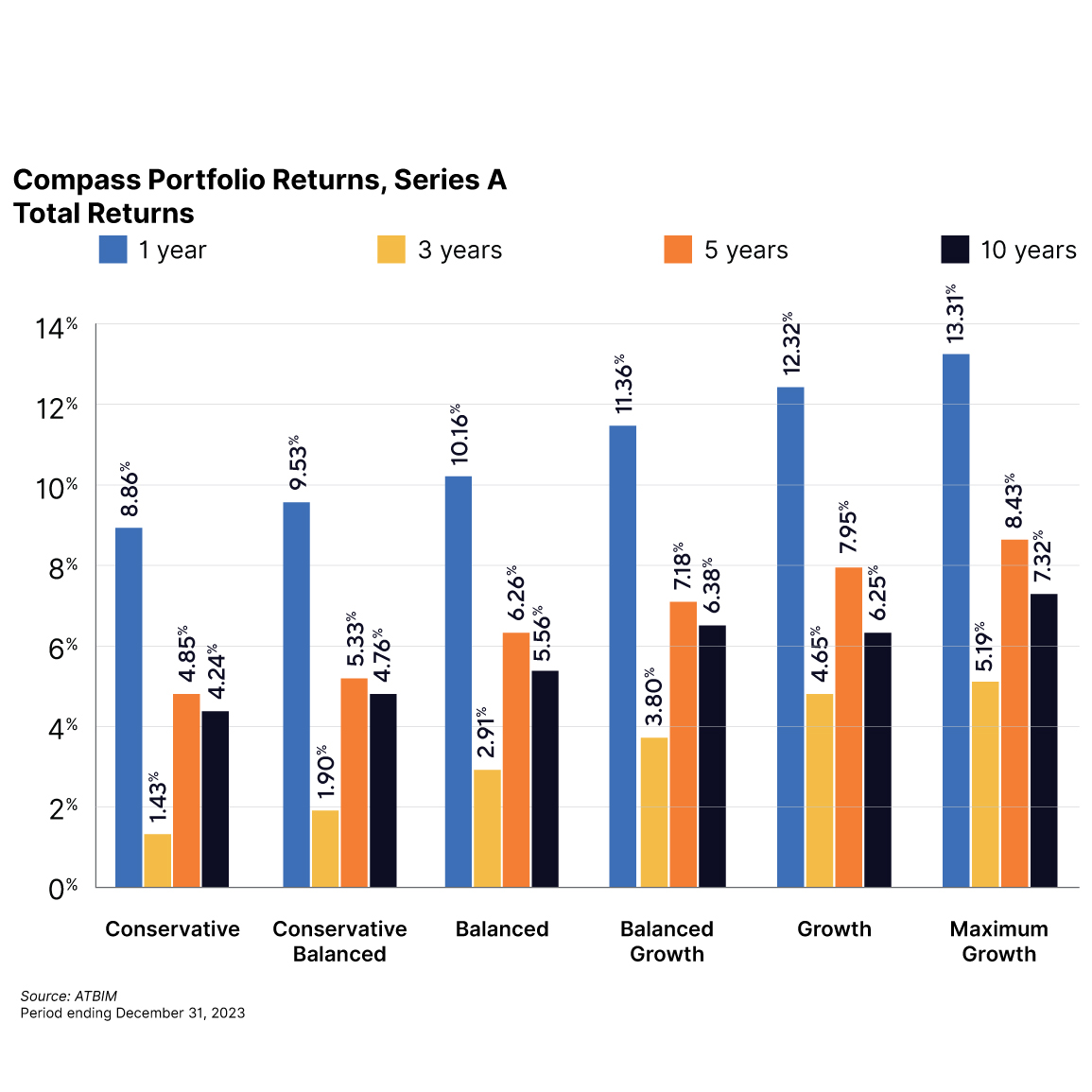

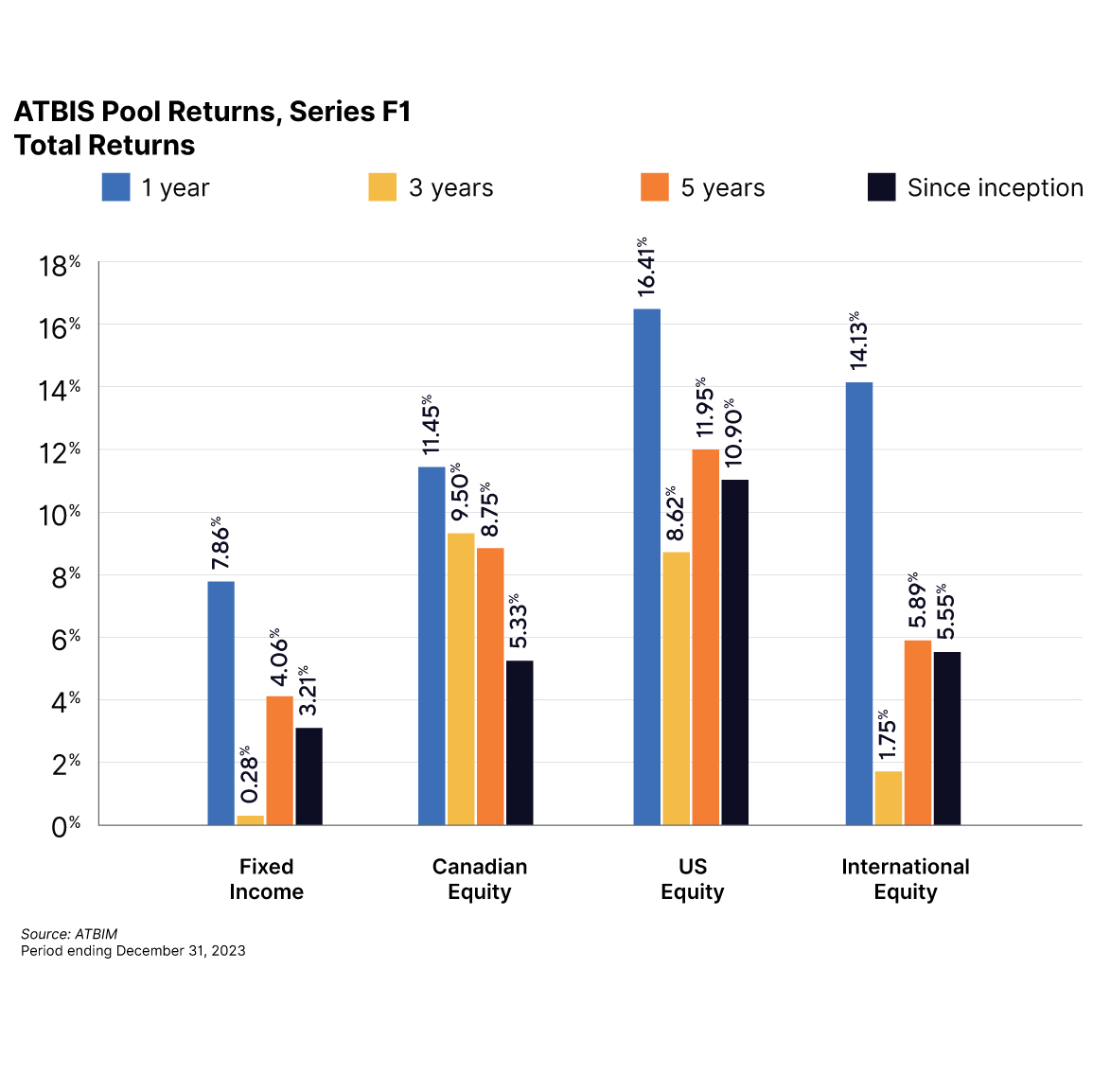

- All ATB Investment Management funds (the Funds) saw positive overall performance for 2023, including Q4 returns. For the full year, total returns for the six Compass Portfolios ranged from 8.9% to 13.3%, and the four ATBIS Pools ranged from 7.9% to 16.4%1.

- After a particularly difficult 2022, in which both fixed-income and equity markets saw double-digit losses, 2023 was a welcome reprieve for investors. Both stocks and bonds recovered some lost ground, and the S&P 500 came within 0.1% of a new high.

- Recession risks still linger for 2024, but equities by and large can still be found at attractive valuations, and yields remain elevated, providing good reason to stay invested.

Economics

The past couple of years involved central banks actively addressing inflation concerns, with the US Federal Reserve (Fed) taking centre stage. The Fed remained persistently hawkish into 2023 despite inflation declining markedly from the highs in the summer of 2022. Early in the year worries about the fast pace of rising interest rates potentially breaking something in the economy or market did occur in the form of an emerging banking crisis, testing the Fed’s resolve.

Silicon Valley Bank featured prominently in the headlines as that ‘something’ breaking. The bank became insolvent on paper in February after witnessing losses on long-dated treasury holdings as rates rose. A concentrated depositor base then caused a run on the bank to withdraw deposits, turning that paper insolvency into an actual insolvency. Swiftly responding, the Fed and other central banks eased concerns and risk of contagion by offering support backstopping deposits and creating programs such as the Bank Term Funding Program (BTFP). With concerns barely allayed, the Fed issued a rate hike on March 22, 2023. This solidified the market’s view that the Fed was indeed hawkish, committed to driving inflation back down to their target rate. Interest rates rose significantly over the following six months.

In the fourth quarter, central banks dialed back the hawkish rhetoric as headline and core inflation continued to decrease, and signs of slowing economic growth emerged. Discussions of a possible ‘soft landing’ have even re-emerged. While markets are predicting rate cuts for 2024, central banks have repeatedly stated that rate hikes are not off the table if the inflation data necessitates it.

Fixed income

Yields over the year were volatile as central banks kept the tone of higher rates and further tightening until the last quarter of the year. As the tone changed, yields fell over one percent from early October to year-end in Canada2. This drop drove bond prices higher—the ATBIS Fixed Income Pool returned 7.86%3 for the calendar year.

Credit spreads fell early in the year as inflation continued to fall after peaking in mid-2022, and there was some hope that the tightening cycle was coming to an end. The Silicon Valley Bank failure saw spreads spiking in late March, especially in financials, as contagion spread through the banking system. Canadian banks have historically been lower than their corporate counterparts, but the differential between these groups has significantly narrowed since at least 2014.

By the end of 2023, the prospect of an ending tightening cycle saw spreads contract back to and beyond March 2023 levels, with Canadian banks tightening more than their corporate counterparts. Spreads fell approximately 0.3% since the end of 2022 despite spiking around 0.3% in March. As a result of a higher starting yield and spread compression throughout the year—especially in the last couple of months—corporate bonds outperformed the index despite their lower duration.

When looking at performance for the year, a higher starting yield is having a positive impact on bond performance. Yields had increased approximately 0.7% to the end of September, and a rough calculation based on index duration would have seen bonds drop by roughly 4.8% overall but were only down about 1.5% on a total return basis.

The narrative of rate cuts coupled with still-attractive bond yields should provide a tailwind for positive bond returns again in 2024. We recently wrote about our outlook, specifically on fixed income in December, in an article titled “A new dawn for bonds?”

Equities

Besides the expectation for potential cuts next year—which drove the equity market higher in the last quarter—if there was one theme that underscored 2023, it was artificial intelligence (AI). The spotlight on programs such as ChatGPT drove future earnings growth expectations for any company that might be able to take advantage of the technology. It stands to reason that the information technology sector will likely benefit the most—the sector advanced 50% globally for the year4.

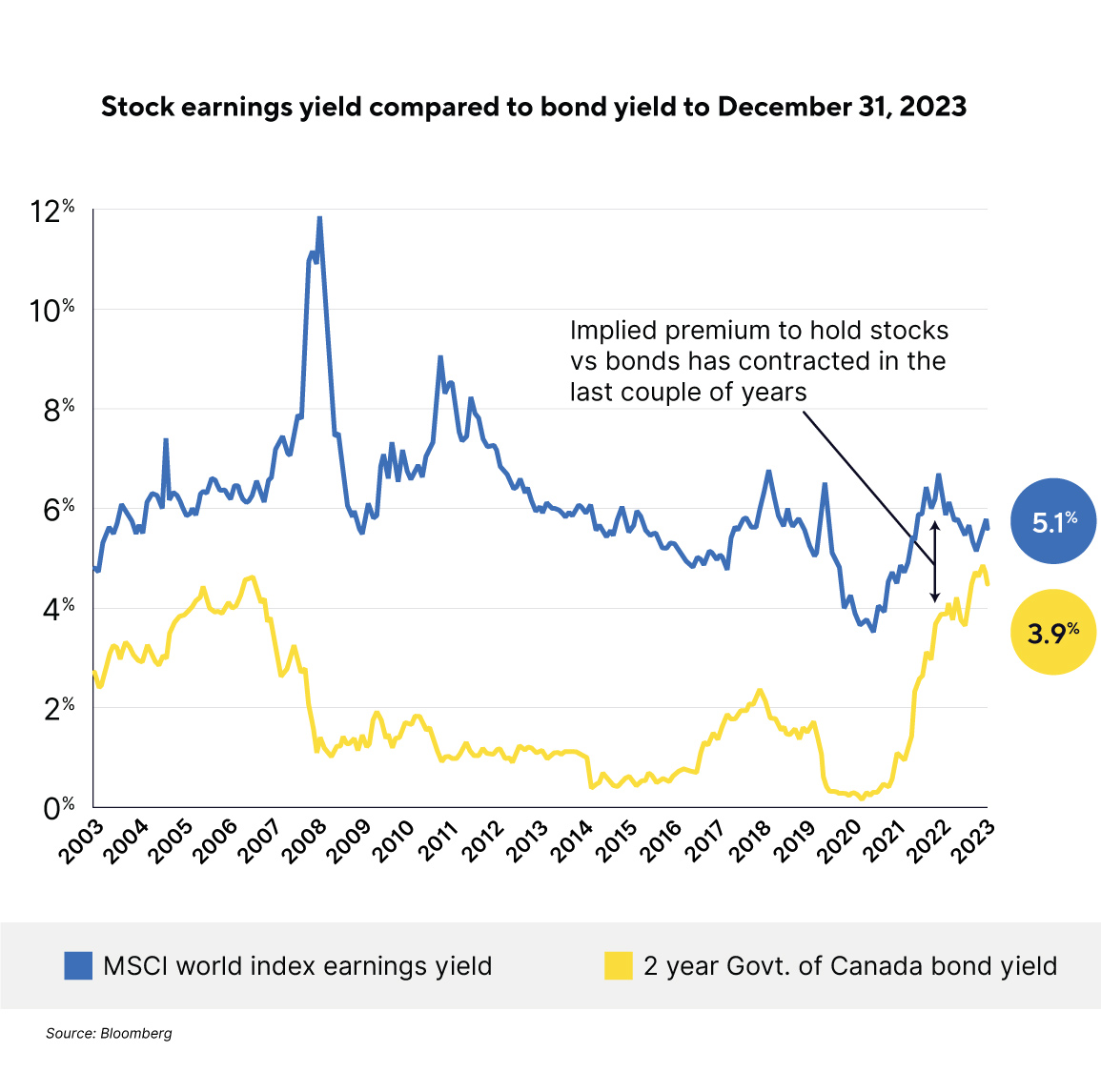

By year-end, the US equity market—propelled by its large tech sector—advanced the most out of major developed markets. Earnings, while expected to grow at a faster pace from AI efficiencies in the future, have yet to materialize. For the US market in particular, the rise in equity prices without the earnings growth has pushed up equity valuations compared to other global markets.

We took this opportunity to sell some of the Funds' US equities, especially from the relatively more expensive US large-cap stocks. Using these proceeds, we bought fixed income to take advantage of higher prevailing interest rates and purchase relatively less expensive international stocks.

Targeting a higher fixed income weight within the Compass Portfolios5 returns the overall asset allocation to a more neutral position. These Portfolios have been targeting an overweight in equities since the COVID market decline in March 2020.

Given the geopolitical concerns in Europe, international stocks continue to trade at a significant discount, no doubt reflecting the expectation of lower growth in such areas. In our opinion, stocks are valued low enough at this point that real growth is not a requirement. Earnings simply keeping up with inflation could still offer good returns over the next decade. The US, by contrast, needs to see some growth to justify the higher valuations, especially with risk-free government rates at roughly 4-5% today rather than the near-zero rates we saw on average through the last decade which had justified higher US stock valuations.

Canadian stocks did well on an absolute basis through the year. Still, they did see some drag in the materials and energy sectors, with commodities declining for the year including energy, metals, and agriculture6. These two sectors makeup nearly 30% of the Canadian market as defined by the S&P TSX Composite index but contributed just 1.9% of the total 14.9% return for the index last year. Technology, of which Canada has a relatively small sector, performed the best.

In closing

Paraphrasing our 2022 year-end commentary, we concluded that uncertainty remained high even as inflation moderated but that it remained important to stay invested.

Last year allowed investors to sigh with relief and pare losses, with both equity and bond markets posting strong returns. Overall, inflation seems to be declining, and markets expect a slowdown for next year, leading to central bank rate cuts sooner rather than later. Whether we see an eventual recession or a soft landing remains to be seen, but we remain cautiously optimistic, reflecting our neutral risk position.

1 Compass Portfolio Total Returns for series A, and ATBIS FI Pool Total Returns for series F1.

2 ICE BofA Canada Broad yield-to-maturity fell from 5.14% on October 3, 2023 to 3.94% at year-end.

3 ATBIS Fixed Income Pool series F1 total returns for 2023 at 7.86%.

4 MSCI World Information Technology Sector Total Return (CAD) returned 49.99% for 2023.

5 Compass Portfolios excluding the Compass Maximum Growth Portfolio which always has a 100% equity target.

6 Bloomberg Commodities Index fell overall for 2023 including declines in major sub-indicies (Energy, Industrial Metals, Precious Metals, and Agriculture).

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The ATB Funds, Compass Portfolios, and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedarplus.ca.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.