Six options for successful investing

For many new investors, the world of stocks, bonds, and equities can seem complicated and intimidating, especially during turbulent economic times. So, how do you position your investments for growth and safeguard them at the same time?

Navigating the investment landscape doesn’t have to be daunting. Increasing your savings and wealth while ensuring that your money is managed responsibly can be challenging when doing it alone, especially when you consider risk. ATB Investment Management’s approach to investing can help by making successful investing simple. How?

The Compass Portfolios

ATB Investment Management (ATBIM)’s family of investment funds—the Compass Portfolios—are industry-recognized and designed for different types of investors.

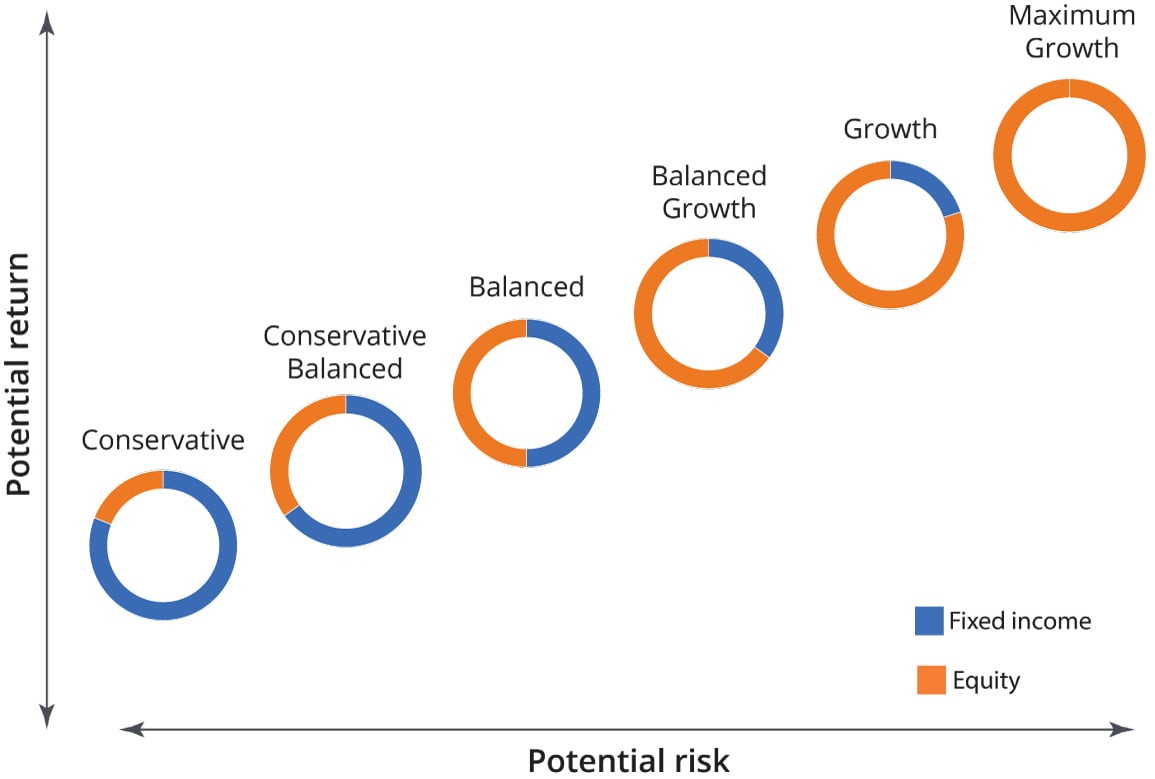

Depending on your goals, we have six different portfolios for you to choose from, each providing a spectrum of investment options, ranging from funds with low-risk, stable returns to funds with higher-risk, maximum growth potential:

The Compass Conservative Portfolio is predominantly made up of bonds that can handle the adverse effects of rising interest rates and is well-suited for the cautious investor. At the aggressive end of the spectrum, the Compass Maximum Growth Portfolio is invested entirely in a geographically diversified group of equities that offer substantial growth potential but are also at risk of market fluctuation.

The Compass Portfolios have delivered consistent returns for its investors for over two decades. So, what is our recipe for managing risk and volatility?

It starts with a proven investment philosophy

Markets are unpredictable, so we concentrate on aspects of the investment journey that are within our control. This means creating purposeful portfolios of assets with a history of compounding returns well-positioned to deliver long-term success for our investors.

We combine the expertise of our in-house investment management team with external sub-advisors—who are the best at what they do—to create the optimal mix for our various portfolios. It’s an independent business model that is rare in our industry and ensures that investment management decisions are made for the betterment of the portfolio and, ultimately, our investors.

We balance growth with risk mitigation

A key aspect of our investment philosophy is to invest only in solid, well-managed companies. “We take a longer-term, or more strategic, view when building and managing our portfolios,” says Joe Wong, Managing Director, Portfolio Management at ATBIM. “We assess each asset class on its own merits, as well as what it can add to the portfolio—not only in terms of the potential return but, just as importantly, the potential risks.”

Ensuring you don’t have all your investment eggs in one basket is also key. “We know that building a diversified portfolio of solid investments and allowing them to compound over time is the best approach to achieving financial success,” says Joe. “For this reason, our portfolios hold a wide selection of stocks across different asset classes, sectors, and geographical areas, helping mitigate risk in times of market volatility.”

Regular rebalancing is essential to maintaining the risk-return profile of our portfolios. We monitor and realign each portfolio to prevent overexposure to any one asset class and its associated risks. It’s a continuous fine-tuning process that provides you with maintenance-free investing.

Why choose the Compass Portfolios?

Through our strong investment discipline and preference for simplicity and clarity, our investors understand how and why their portfolios are structured for resilience, even when markets inevitably experience turmoil. This allows us to stay the course and be opportunistic in all types of market environments rather than reactionary when the latest investing fad doesn’t work out.

We have the purchasing power to help keep product fees low and ensure the stability and quality of our portfolios. It’s a simple way to grow your savings and achieve long-term success.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

The material in this document is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.