Stock market selloff August 5, 2024

Equity markets have experienced a rocky start to August, resulting in the global selloff we saw on Monday.

What happened on Monday, August 5, 2024?

- Japanese equities fell by almost 11% in CAD terms.

- US markets followed, with the S&P 500 down 3.1% (CAD).

- The TSX didn’t trade due to the public holiday in Canada, but international equities, as measured by the MSCI EAFE, fell 3.8% (CAD).

Primary reasons behind the selloff

- There were increased concerns about a recession in the US. Why?

- Last Friday’s jobs report showed a slowdown in job growth in July, with only 114,000 jobs added compared to the expected 175,000. This was also significantly lower than the monthly average of 215,000 jobs added over the last 12 months. As a result, the unemployment rate rose to 4.3%, compared to 4.1% in June. While still relatively low, the uptick represents an acceleration in the softening of the labour market.

- After leaving interest rates unchanged last week, there is now a perception that the US Federal Reserve (the Fed) is moving too slow on cutting interest rates. The prevailing data supported the Fed’s caution, but the weak jobs report has put a spotlight on the bank’s rate policy, especially given past criticism of how slow they were to raise rates back in 2022 (remember the use of the term “transitory inflation”?).

- Weak earnings reports from tech giants such as Amazon and Alphabet have put a dampener on the Magnificent 7 story and have given rise to questions as to if and when the spending in AI-related investments (which has fuelled the Mag 7’s rise over the past 18 months) will translate to growth (and profits).

- Reversal of Japan carry trade.

- The Bank of Japan raised its interest rate last week for only the second time in 17 years—the first was four months ago.

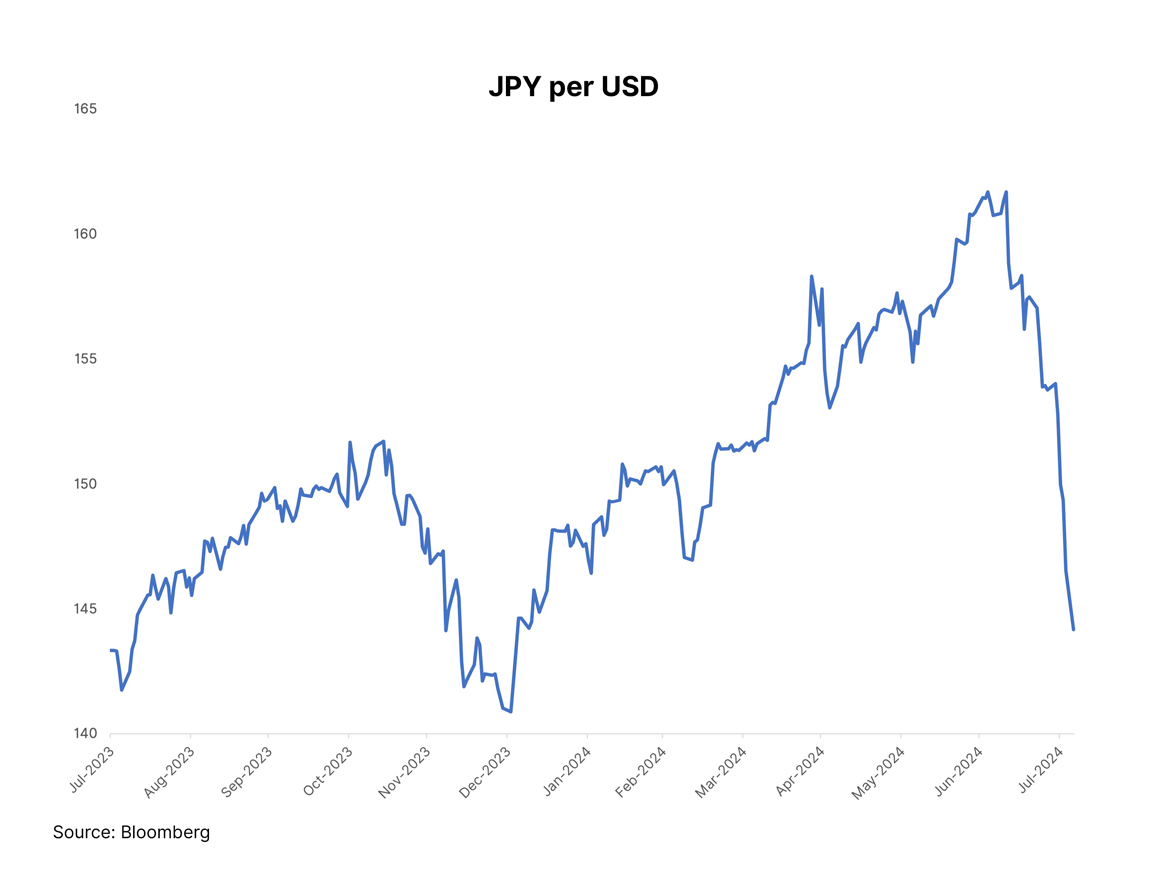

- This led to the yen (JPY) extending a rally against the USD, as, on a relative basis, Japanese rates are now more attractive than before the rate hike.

-

- Given this trajectory for Japan rates, many investors are unwinding the so-called “carry” trade (essentially where one borrows at a lower rate to invest at a higher rate). This contributed to the selloff in Japanese equities on Monday.

Our thoughts and the impact on ATBIM funds

It’s important to reiterate that equity market downturns, like Monday’s event, happen occasionally. For example, the S&P 500 fell by 4% on May 18, 2022. Markets also often overreact over the short term. While the data indicates the US economy is softening, given the latest job report numbers, an unemployment rate of 4.3% is still low by historical standards. The Fed has emphasized its data-driven approach to policy, but the market action on Monday may have given more impetus to the expected rate cut in September.

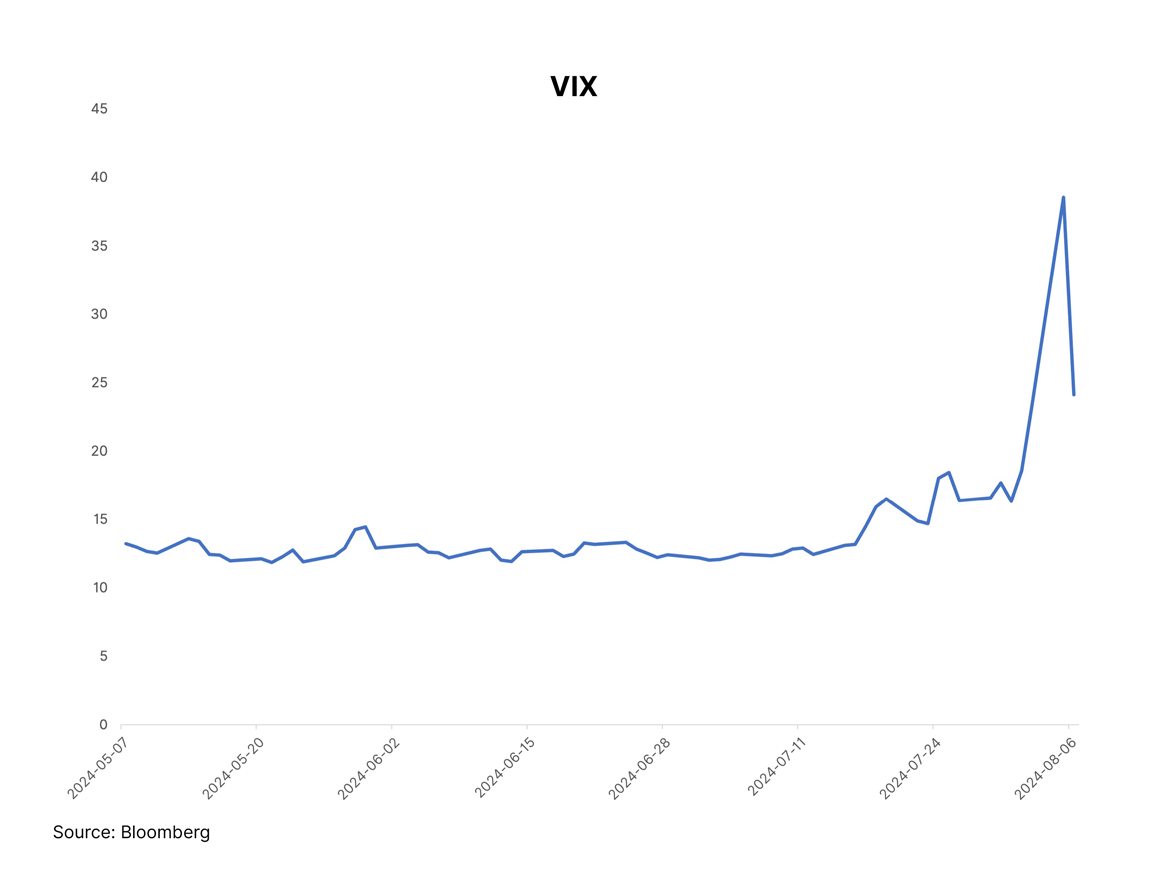

Thankfully, stability has returned to the markets today, with the Japanese equity market rebounding by 9.4% (CAD) and the US (and other equity markets in general) displaying a semblance of normality. For example, the VIX, an indicator of the market’s expectations regarding volatility, spiked up to almost 40 on Monday but has come back down today (with markets still open as of this writing).

Given that Monday was a holiday in Canada, we have yet to determine the full impact on the Compass Portfolios and ATBIS Pools. Concerning Japan exposure, our funds are underweight, so a downturn in Japan would actually benefit the funds relative to the benchmark.

It’s worth remembering how our investment philosophy has worked well during these volatile times, as reflected in the strong performance of our growth-oriented portfolios over the last month. In particular, our focus on (a) the longer term, (b) not chasing the latest fad or trend, (c) downside risk management, and (d) staying true to our core investment beliefs has contributed to the resilience and steady performance in the portfolios.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

The material in this document is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.