Not all income sources are created equal:

The benefits of diversified income in your portfolio

Whether it’s funding retirement, creating a lasting legacy or building financial independence, everyone has different reasons for wanting consistent cash flow, otherwise known as investment income.

In an era of dynamic market forces and shifting economic conditions, generating income is no small feat. A thoughtfully constructed income-oriented portfolio can help not only build resilience against market volatility but also has the potential to generate strong risk-adjusted returns over time.

A critical component to achieving consistent income is diversification. Rather than viewing income sources in isolation, sophisticated investors recognize the importance of blending differentiated yield streams—including interest, dividends and others. Doing so creates a diversified portfolio that can grow and adapt to different market conditions, achieve income goals and power greater investment possibility.

Under the hood: How diversified income sources work together

Diversification is critical to a resilient strategy. A well-designed income portfolio seeks to achieve several key objectives: Stability, investments with potential for tax efficiency and long-term capital preservation.

The optimal income “engine” integrates complementary sources of return, with stable cash flow. That way, you gain exposure to different income-paying assets that collectively work to create a strong, consistent income stream able to support you through your financial journey.

Anatomy of a consistent income stream

Here are some common income sources that work together to deliver a potentially resilient and consistent income stream:

Fixed income

Fixed income instruments such as bonds offer regular, predictable interest payments, known as coupons, and return principal at maturity (the amount of money you originally lent to the bond issuer). Interest income is taxed at the investor’s marginal rate, which can reduce the amount of income that you keep.

Not all fixed income assets have equal risk. Diversifying between different bond holdings enhances credit quality (higher credit quality means a company is less likely to default on the credit it issues) while managing interest rate exposure:

- Government bonds are typically the safest, backed by the stability of a government, but tend to have lower yields

- Provincial bonds tend to offer stable returns and relatively low risk, backed by the credit of the provincial government

- Corporate bonds can offer higher yields, but introduce credit risk

Dividend-paying equities

These are shares in companies that reward investors by distributing a portion of their profits back in the form of cash dividends. Dividends can offer the best of both worlds: regular cash flow alongside capital-appreciation potential.

Canadian dividends, in particular, benefit from preferential tax treatment via the dividend tax credit, making them an efficient income source for taxable accounts. The companies paying these dividends tend to be businesses with a track record of steady payouts and underlying earnings growth.

Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without owning the properties—while benefiting from a steady stream of income. These publicly traded trusts generate cash flow by collecting rent from properties like apartment buildings, office towers and shopping centres, and then distribute that income directly to you as a unitholder.

Along with rental income, REIT distributions can include return of capital (ROC) and capital gains. This mix can be more tax-efficient than traditional interest income, especially for Canadian investors holding REITs in taxable accounts. ROC, for instance, is not taxed immediately but instead lowers an investor’s cost base, allowing them to defer tax until the investment is sold.

Money market instruments

These ultra-low-risk investments include short-term, high-quality debt like Treasury bills, commercial paper and bankers’ acceptances—designed to protect your capital while earning modest interest.

Guaranteed investment certificates (GICs)

Guaranteed investment certificates (GICs) add another layer of low-risk income—without the market’s ups and downs. Offered by trusted Canadian financial institutions, they guarantee your principal and lock in a fixed rate of return over a set term.

Integrating these elements in a well-structured portfolio allows investors to navigate different market conditions and interest rate environments while maintaining a strong payout potential. To do this, it’s important to have a strategic mix of different income sources. “Canadian-eligible dividends can be a tax-smart building block in an income portfolio,” says Steve Xu, Senior Portfolio Manager of the ATBIM Multi-Asset Strategies Team. “They provide a solid stream of cash flow while also offering the potential for capital appreciation.”

Why diversification matters: The many risks to your income portfolio

Today’s increasingly complex financial landscape can present a range of risks to your income stream, including market volatility, inflationary pressures, geopolitical instability and shifting monetary policy. These factors influence income consistency, making diversification not just a “nice to have” but essential for generating income you can depend on.

For many Canadians, especially those planning for or living in retirement, diversification is crucial as they must rely on supplemental income to meet their daily needs and to preserve their purchasing power. That’s why it’s important to complement more conservative options, like GICs or high-interest savings accounts (HISAs), with other income sources. While they offer capital preservation, they may not be enough to hedge against the eroding effects of inflation—potentially diminishing your purchasing power over time.

A thoughtfully diversified strategy can incorporate high-quality corporate bonds or dividend equities, to offset inflation risk while maintaining liquidity and cashflow efficiency.

Diversifying across asset classes is only part of the equation. Another key is diversifying across investment expertise. Having a mix of investment managers and strategies in a portfolio can reduce your dependence on any one investment style or viewpoint, allowing you to better capture opportunities and manage risk.

“In an environment where no single asset class offers a complete solution, diversification isn’t just a good idea—it’s essential,” emphasizes Robert Armstrong, Head of Multi-Asset Strategies. “It’s the key to enhancing income quality and stability. And it works on multiple levels—not only across asset classes, regions and industries, but also across different investment perspectives.”

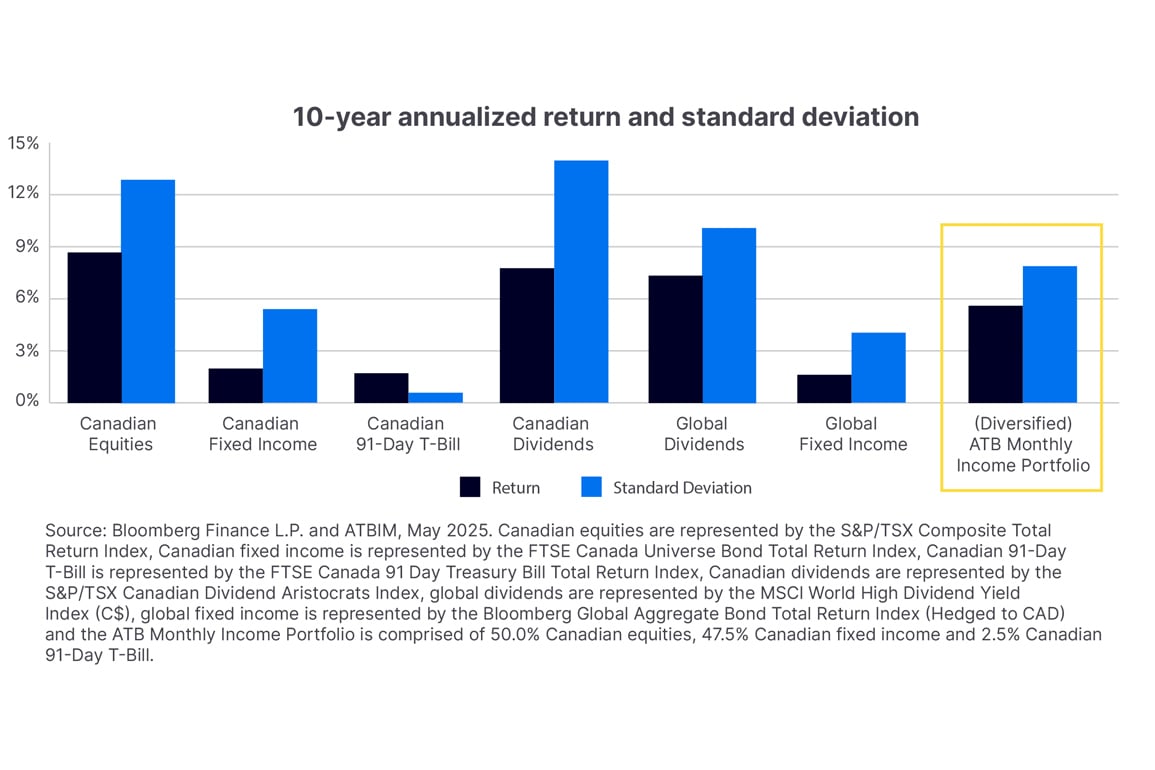

Diversification provides balanced results vs. single-asset class strategies

A diversified income portfolio provides steady relative income and lower relative volatility over time, helping to deliver the consistent income investors need with less risk than holding most asset classes by themselves.

The role of active management

Active investment managers can use the following tools and strategies to help you create a stable, income-generating portfolio.

Balancing durations

Interest rate dynamics can fluctuate, requiring a blend of short- and long-duration instruments. Shorter-duration investments are a good defensive tool that can help reduce sensitivity to interest rate changes, providing stability in volatile markets. These typically include instruments like short-term corporate bonds or floating-rate notes. On the other hand, longer-duration investments—such as 10- or 30-year government bonds—may offer higher yields but come with more interest rate sensitivity. A thoughtful blend of both helps to manage risk while capturing income, especially in uncertain rate environments.

Avoiding yield traps

Not all high-yield assets are created equal. Some may offer strong payouts on the surface but mask underlying weaknesses that can erode value over time. Active managers play a big role in separating out the quality players from the “yield traps”—where a company may seem like it has a high yield, but itis ultimately unsustainable. Here are some of the characteristics active managers canlook for to ensure quality yield:

- Companies with consistent earnings growth, supporting stable dividend payments

- Healthy payout ratios, ensuring a company isn’t distributing more income than it can afford

- Strong cash flow, which supports ongoing dividend payments even during periods of economic stress

- Robust balance sheets with manageable debt levels help to reduce debt risk and allow for flexibility in managing growth and investments

Tax optimization

In Canada, not all income is taxed equally. Canadian dividends often come with tax credits, which can significantly reduce the effective tax rate compared to interest income or foreign dividends. An actively managed portfolio seeks to optimize income sources to reduce tax drag and the portion of returns lost to taxes, and aims to maximize after-tax income.

Balancing income with capital appreciation

Your income needs to grow alongside inflation. That’s why it’s important to have exposure to holdings that offer the potential for capital appreciation. For instance, Canadian dividend stocks may offer both yield and earnings growth, while global investments can enhance diversification potential through exposure to different economies and sectors.

Managing currency risk

Diversifying income sources across currencies can protect against Canadian dollar fluctuations and also serves as a hedge against inflation, further safeguarding purchasing power. For example, holding assets denominated in US dollars or other major currencies can offset a decline in the Canadian dollar, effectively preserving the value of your income and portfolio in domestic terms.

Final check: Is your income stream truly diversified?

Consider this framework when assessing your current allocation:

- Are your income sources diversified across asset classes, such as fixed income, dividend-paying equities and money market instruments?

- Are you optimizing exposure across Canadian and international markets?

- Are your holdings strategically positioned across sectors with consistent cash flow generation?

- Are you leveraging diverse investment perspectives across portfolio management styles and investment managers?

Addressing these elements ensures an adaptable, resilient income portfolio capable of navigating both stable and uncertain financial environments.

If you answered “no” to any of the above, it might be time to revisit your income strategy.

Ready to build a better income stream?

A diversified income strategy enhances cash flow predictability, risk-adjusted returns and tax efficiency, empowering you to navigate your investment journey with confidence.

If you’re interested in powering more possibility through a diversified income solution, click here to learn about our newly launched ATB Monthly Income Portfolio.

Learn more about the ATB Funds.

Insights

Dive into our diverse global investment expertise and perspectives

ATBIM introduces new funds

Introducing our two new products: ATB Monthly Income Portfolio and ATB Global Equity Pool.

Learn more

Thinking global in your investments

How global diversification can open up a world of opportunity

Learn more

May 2025 market commentary

ATBIM's portfolio managers provide commentary on the economy, market and our funds.

Read the articlePast performance is not indicative of future results. ATB Investment Management Inc. is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATB Investment Management Inc. is also registered as an Investment Fund Manager who manages Compass Portfolios, ATBIS Pools and ATB Funds. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATB Securities Inc., ATB Investment Management Inc., ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read fund disclosure documents before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedarplus.ca.

Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents. The material in this document is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.