The momentum of "The Magnificent 7" and AI

A spotlight on "The Magnificent 7" stocks and Artificial Intelligence momentum into 2024.

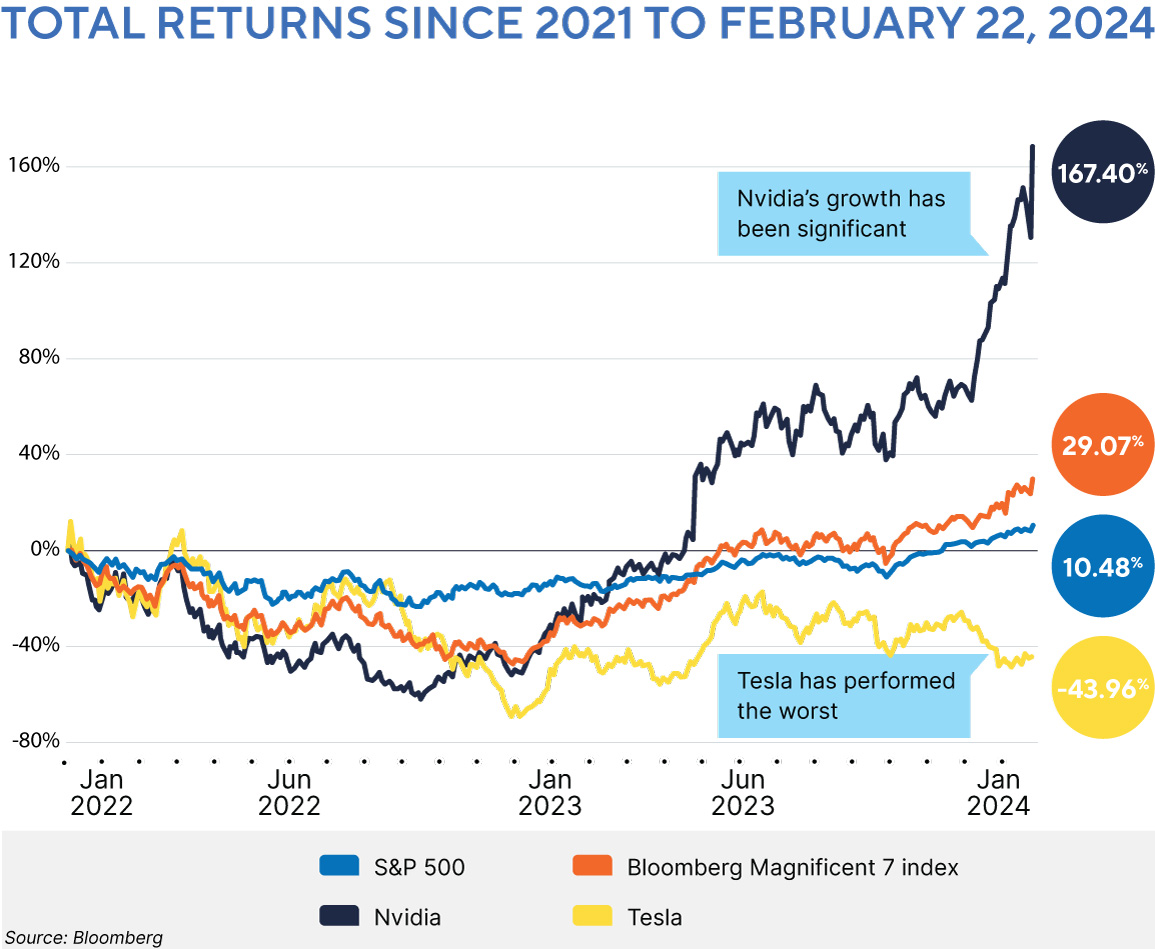

Artificial intelligence (AI) was a significant contributor to pushing global stocks higher during 2023. Seven stocks, in particular, dominated performance-wise, and the trend has continued into 2024. Stocks of "The Magnificent 7"—Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla—rose about 75% on a market-cap-weighted basis, contributing about 45% of total developed market returns last year. In other words, your portfolio likely didn’t keep up if you didn’t hold these stocks.

These companies are so large now that you’ll often see attention-grabbing statistics shared, such as Microsoft or Apple being bigger than the entire combined Canadian stock market—which is true! Their returns show significant revenue and earnings growth, although there has been some turbulence, and despite the exceptional investor returns in 2023, the year prior, they were collectively down 45%1.

A closer look at the star performer: Nvidia

Much hype and anticipation surrounded Nvidia’s most recent earnings, released on February 21, 2024. Out of the seven, Nvidia is the stock that has performed the best recently. We examine this company in more detail.

On the hardware side of the AI theme, Nvidia has the largest global market share in selling the hardware necessary to run AI technology efficiently. Initially focusing on video hardware for computers, Nvidia has grown their data centre segment, providing computing power primarily for AI-driven solutions. Data centres now account for 78% of Nvidia’s overall revenue. They have had the benefit of being a first mover within the space, along with enjoying a durable competitive advantage with proprietary technology that is likely difficult to replicate quickly. As a result, Nvidia has returned roughly 1800% over the last five years, growing revenues by 2.8 times and profits by nearly as much, with a considerable growth rate expected for many years. Nvidia is now the world’s third largest publicly traded company, behind only Apple and Microsoft. Industry experts have readily applied the old adage of getting rich selling shovels in a gold rush when looking at Nvidia.

Is Nvidia doomed to repeat Cisco’s path?

An often-used historical comparison for Nvidia is Cisco at the end of the 2000’s tech boom. At the time, Cisco was front and centre in providing the necessary hardware to build out the internet’s infrastructure. In the last five years ending 1999, it returned roughly 2600% for shareholders, with revenue increasing ten-fold2 and profits by nearly as much. Cisco was the largest publicly traded company in the world at its peak. Despite maintaining profitability and even growth over the years following the 2000's market peak, Cisco shares ultimately fell roughly 80% as the high degree of expected growth failed to materialize.

It’s important to note that, today, net income for Cisco has grown roughly six times since 2000, and it continues to be consistently profitable despite remaining 11%3 lower than its highs in 2000. Valuations today are certainly not to the extremes witnessed in the 2000’s tech boom, but at the end of the day, Nvidia is primarily a highly profitable hardware provider. It remains to be seen whether Nvidia will be able to keep its market share, whether AI will grow as quickly as expected, or if the path will also moderate, akin to the internet era.

AI’s potential impact on other sectors at this early stage could be undervalued

The Magnificent 7 won’t be the only benefactors of AI since every type of business today utilizes data in some fashion and stands to gain efficiencies from the technology. The early companies directly involved with the internet were rewarded even if they only had a ".com" associated with them. Similar to the dotcom era, those providing and enabling AI-related technology have done well to date, but there could be an underappreciation for how much non-tech-related businesses will benefit. Currently, US stocks, in general, and those at the centre of the AI theme, have led to notable market concentration.

While the Magnificent 7 stocks have certainly impressed with their performance over 2023 and into 2024, it is worth noting that these are individual stocks that, by definition, are much less diversified than a broad market index like the S&P 500. The outsized market caps of these stocks are driving a significant portion of the performance of the S&P 500 as well, but it is prudent not to discard the idea of diversification simply because a few stocks have done better than the rest of the market.

Companies like Amazon and Microsoft have done well by diversifying their businesses by adding, for example, cloud computing to their original business lines (online sales for Amazon, software for Microsoft). Others, like Nvidia (graphics cards, data centres) and Tesla (electric vehicles), are more singularly focused and more sensitive to changes in consumer demand.

Nvidia may go on to exceed expectations, but forecasting the future is incredibly difficult. Within the portfolios and funds managed by ATBIM that hold US stocks, we prioritize holdings believed to offer strong competitive positioning, stable growth through compounding cash flows, low leverage, and reasonable valuations. In our view, within the Magnificent 7, Microsoft, Alphabet, and Amazon best fit our criteria and have the most significant position sizing within the portfolios. We aim to avoid excess concentration to minimize downside impacts like that of 2022 but will continue to hold those of the Magnificent 7 that can hopefully offer stable long-term growth and returns for our investors.

1 Source: Bloomberg Magnificent 7 Index Total Return (USD)

2 Source: Bloomberg

3 Source: Bloomberg - Cisco total returns from March 27, 2000 to February 22, 2024 in USD.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.