Think global in your investments: How global diversification can open up a world of opportunity

When was the last time you thought about global exposure in your portfolio?

Global diversification is one of the most effective ways to position your portfolio to power possibilities for a stronger future, depending on your goals and time horizon. In fact, your Canadian investments can exist alongside or as part of a global allocation to further boost growth potential and manage risk.

While Canada offers a strong financial system and world-class companies, expanding beyond our domestic borders in your investments can allow you to maximize opportunities, manage risk and enhance long-term returns.

Unlocking a world of opportunity

Investing globally alongside your domestic investments can bring fresh opportunities for diversification and growth potential—helping to strengthen and complement your investments here at home in Canada.

Global diversification helps reduce sector-specific risk and gives investors access to a broader range of industries that are shaping the future economy. Investing globally allows you to tap into economic cycles, innovations and growth trajectories that may be out of sync with the local economy, offering the potential for greater returns.

A well-designed global portfolio taps into game-changing industries, leading companies and emerging markets that may not be present in the Canadian market today:

Dominant global companies: US-based tech giants continue to lead with innovation and strong brand loyalty.

Established multinational firms: High-quality businesses in Europe and the US offer strong dividends and consistent revenue growth.

Next-gen technologies: AI and machine learning in the US and Asia-Pacific are reshaping finance, transportation and healthcare.

Medical breakthroughs: Biotechnology companies in Europe and Asia-Pacific are pioneering gene therapy and vaccine development.

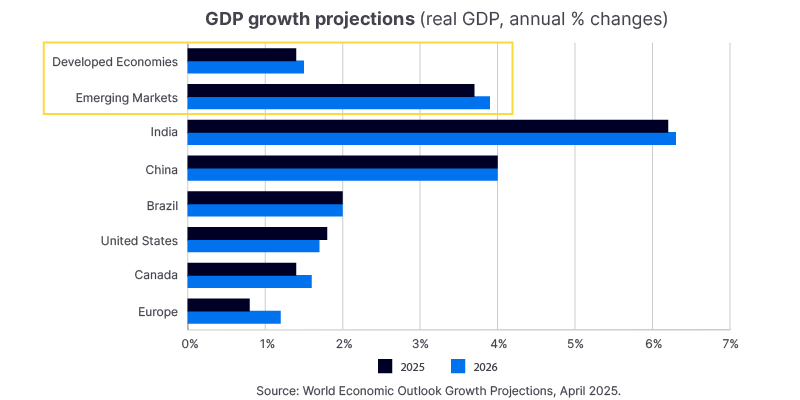

Rapidly expanding emerging markets:

- India’s booming economy benefits from a rising middle class and strong tech expansion

- China’s growing expertise spans manufacturing, consumer goods and technology

- Brazil’s leadership in natural resources and agricultural exports continues to rise

Emerging markets are on the rise

Broaden your return potential

International markets—including the US, Europe, Asia and other developed and emerging economies—provide exposure to high-growth industries that are underrepresented in Canada, including:

Canada has a leading economy—but it’s concentrated and relatively small on the global stage

Canada has a well-earned reputation for stability and sound governance. Our economy is anchored by reliable sectors like banking, natural resources and utilities, and our public companies are often praised for their transparency and dividend discipline. For many investors, this creates a strong and well-founded sense of familiarity and trust in Canadian assets.

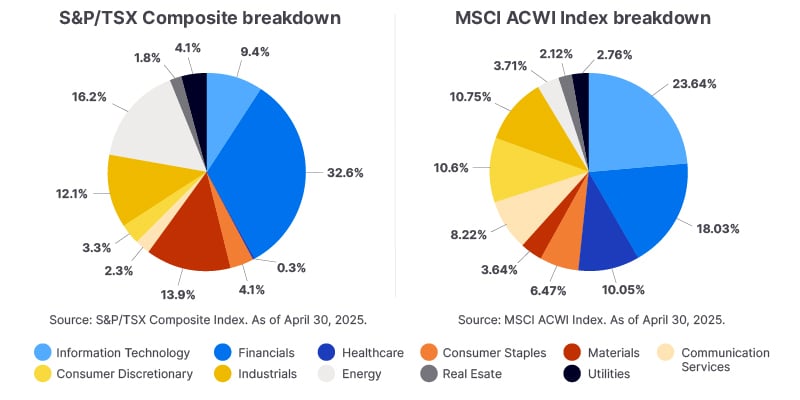

However, it’s important to remember that Canada makes up only about 3% of the global equity market.1 That means by focusing exclusively on Canadian investments, you're missing exposure to the other 97% of the world’s capital markets1—including thousands of leading companies across innovative and rapidly expanding sectors.

In addition, the Canadian stock market is notably concentrated in a few dominant sectors. The Financials, Energy and Materials sectors collectively represent more than 60% of the S&P/TSX Composite Index. While these sectors can offer attractive income through dividends, they can be heavily influenced by commodity prices and interest rate movements.

Even though Canada represents 2.8% of the global equity market, Canadian investors allocate approximately 50% of their equity portfolios to domestic stocks—representing an allocation that is over 18 times Canada's weight in the global market. This suggests Canadian investors have a strong home country bias and may benefit from more diversification.2

Global exposure: Smart defence against volatility

Markets don’t always move in lockstep. While a downturn in one region may affect local investments, another region could be experiencing growth. Diversifying across geographies means you are less reliant on the economic fortunes of any single country, including your own.

For example, Canada may be subject to a range of risks specific to its economy, including global trade conflicts, weak GDP growth or commodity downturns. As a resource dependent economy, heavily weighted in oil and gas, our underlying economy tends to be more cyclical in nature, meaning it can grow when the economy is up and slow when the economy is down. This can make Canada more susceptible to volatility versus more diversified global economies.

You can help reduce this volatility in your investments by supplementing Canadian exposure with global exposure, reducing reliance on the performance of one or a few sectors. This can provide stability and exposure to growth potential from other regions, especially when paired with a disciplined investment strategy.

It’s important to note, however, that investing globally can present challenges. Currency fluctuations, geopolitical instability and unfamiliar regulatory environments can all introduce additional layers of risk. That said, the potential benefits of global diversification may outweigh these risks when approached thoughtfully.

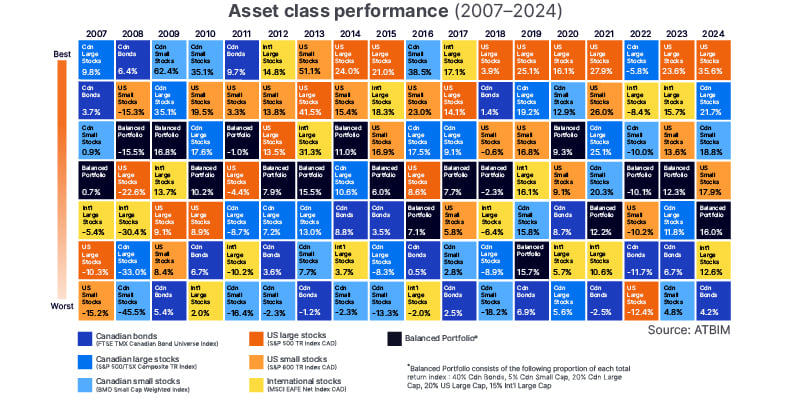

Diversification matters: Leaders rotate, so it’s important to be diversified

Investing in global markets also means investing in foreign currencies. While this can introduce some short-term volatility, it also offers strategic advantages. When the Canadian dollar weakens—often during global uncertainty or commodity slumps—foreign investments denominated in other currencies like the US dollar, euro or yen often gain value when converted back into Canadian dollars. This acts as a cushion and can help preserve your purchasing power over time.

Striking the right balance: The power of diversified investment perspectives

A globally diversified, growth-oriented portfolio doesn’t mean giving up on Canadian investments. On the contrary, Canadian equities, bonds and real assets provide valuable benefits—quality, stability and favourable tax treatment, among many others. However, pairing them with global opportunities can strengthen diversification.

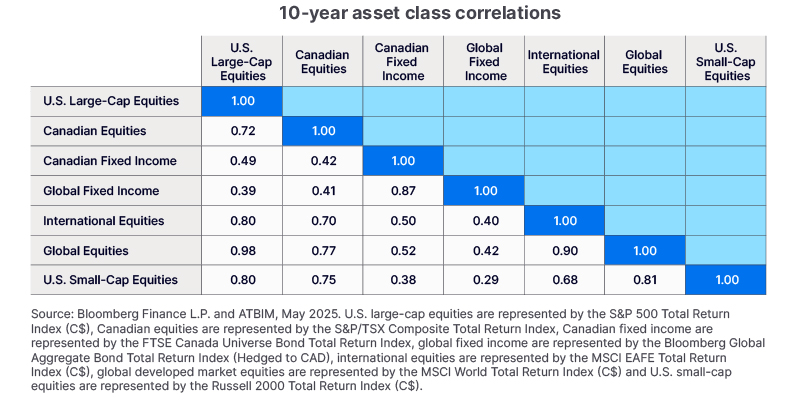

Importance of diversification exemplified: Global markets share high/low correlations

You can get the best of all worlds by striking a balance: Keep the anchor of Canadian stability through a core allocation to Canadian investments, while expanding the opportunity set and building a more resilient portfolio through global exposure.

“A well-diversified portfolio includes both Canadian and global investments, each offering unique advantages,” says Steve Xu, Senior Portfolio Manager. “Together, they can form a ‘core’ and ‘satellite’ that work together to help an investor balance risk, broaden return potential and build wealth more sustainably over time.”

It takes expertise to navigate the world

Navigating global markets and capitalizing on global opportunity requires expertise and local domain knowledge. When constructing a globally diversified portfolio, this often means tapping into the expertise of independent investment managers and ensuring representation across a range of styles, geographies, market caps, asset classes and investment perspectives.

By leveraging different managers—each with deep, on-the-ground insights into specific markets and unique perspectives—investors can better uncover opportunities and unlock the growth potential that exists across the world.

How to “go global”

As discussed earlier, a globally diversified portfolio doesn't mean abandoning Canadian investments. Instead, it creates a blend of domestic stability with international growth opportunities.

- Core: Hold Canadian equities for strength and quality

- Explore: Gain exposure to innovative global sectors with strong return potential—this will depend on your personal risk tolerance, goals and time horizon

- With the strength of independent perspectives: Leverage multi-strategy portfolios that tap into diverse investment managers and perspectives

In closing: Investing beyond borders with confidence

Canada is a strong and dependable market, but it only represents a fraction of the global investment universe. By combining the strengths of both Canadian and global markets, you can position your portfolio to be more resilient, diversified and better aligned with the world’s evolving opportunities.

Would you like to find out more about the benefits of a globally diversified, growth-oriented portfolio? Learn how the ATB Global Equity Pool can help power your financial possibilities.

Insights

Dive into our diverse global investment expertise and perspectives

ATBIM introduces new funds

Introducing our two new products: ATB Monthly Income Portfolio and ATB Global Equity Pool.

Learn more

Not all income sources are created equal

The benefits of diversified income in your portfolio

Learn more

May 2025 market commentary

ATBIM's portfolio managers provide commentary on the economy, market and our funds.

Read the article1MSCI All Country World Index as of April 30, 2025. MSCI Inc.

2BNNBloomberg.ca, Canadian investors have too much of a 'home bias': Vanguard, June 25, 2024.

Past performance is not indicative of future results. ATB Investment Management Inc. is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATB Investment Management Inc. is also registered as an Investment Fund Manager who manages Compass Portfolios, ATBIS Pools and ATB Funds. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATB Securities Inc., ATB Investment Management Inc., ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read fund disclosure documents before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents. The material in this document is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.