Understanding where income comes from:

A practical guide for Canadian investors

Investment income comes in many forms—with each income type bringing its own mix of rewards, risks and opportunities.

Whether you're planning for retirement, looking to supplement your earnings or simply want your money to work harder, knowing the different ways income is generated can help you make more informed investment decisions and achieve your immediate and long-term financial goals.

Basic traditional building blocks of investment income

Let’s start with the fundamental components of a diversified income stream. Two important building blocks of income include:

- Fixed income (bonds)

- Dividend-paying stocks

Within each asset class, investors have a wide range of options to achieve a steady cash flow.

1. Fixed income essentials: Bonds 101

Bonds (also known as “fixed income”) are a cornerstone of most income portfolios. When you buy a bond, you’re essentially lending money to a government or corporation in exchange for regular interest payments (called coupons) and the return of your principal (the original amount you invested) at maturity.

Bonds quick reference guide—key questions and concepts

Who are the bond issuers? They include federal, provincial or municipal governments, as well as corporations—essentially the ones that need to borrow money.

Why are bonds issued? Companies or governments issue bonds to borrow money from investors to pay for things now—like building roads or expanding a business—and promise to pay it back later with interest.

What is a coupon? The interest payment a bondholder or investor receives on a regular basis—typically every six months or once a year—for lending money to a bond issuer. Think of it like the rent borrowers pay investors for using their money.

What is bond maturity? The specific date the bond issuer must repay the full amount of the original investment (principal or face value) to the investor—assuming the issuer doesn't default (fails to pay interest or repay the principal). Maturity dates can range from a few months to 30 years or more, depending on the bond.

What is credit quality? Measures how trustworthy a bond issuer is when it comes to repaying the principal on time. Agencies like Moody’s, S&P and Fitch do the work of evaluating bonds and assigning grades based on financial health and stability. Investment managers may also make their proprietary assessments of a bond’s rating. There are two main categories of credit quality.

- Investment-grade bonds are “the reliable overachievers”—lower risk, steady income. These include AAA, AA, A, BBB ratings (S&P/Fitch) or Aaa, Aa, A, Baa (Moody’s). The higher the grade, the stronger the issuer. Think governments and big, stable companies.

- High-yield or “junk” bonds are “the risk-takers” offering higher returns with more risk. These include BB, B, CCC, CC, C, D ratings (S&P/Fitch) or Ba, B, Caa, Ca, C (Moody’s). These bonds might come from newer companies or those facing financial headwinds, but they can deliver attractive interest if you're comfortable with the risk.

What are the risk/reward profiles of common bond types?

- Safe and steady—government bonds: Most secure and stable with lower risk but lower returns

- Balanced middle ground—provincial bonds: Mix of stability and better returns but considered fairly safe

- Corporate bonds—more risk-reward: Higher interest payments but more risk as businesses are considered more volatile than governments

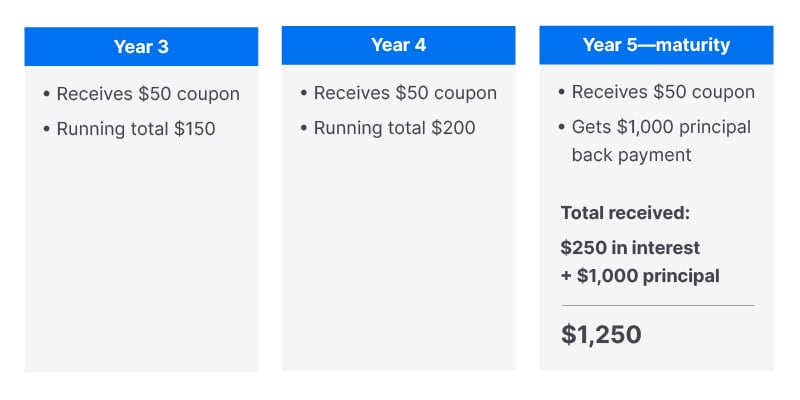

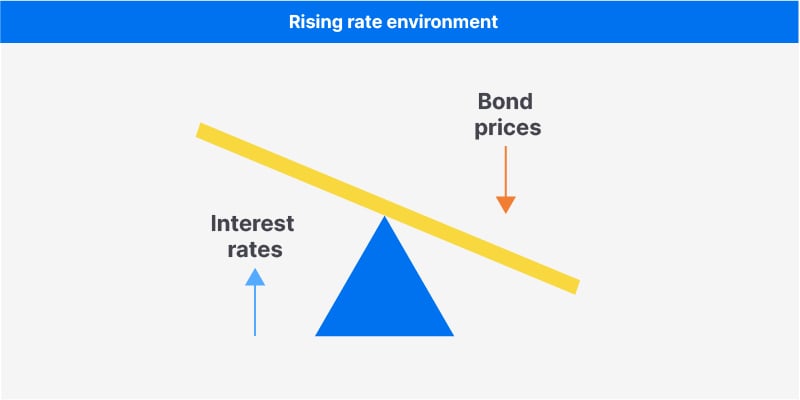

What is duration and interest rate risk? Duration measures a bond’s price sensitivity to interest rate changes.

- Longer-duration bonds (with longer maturities) are more sensitive and can shift more dramatically to rate changes

- Short-duration bonds (with shorter maturities) tend to remain more price-steady as rates go up or down

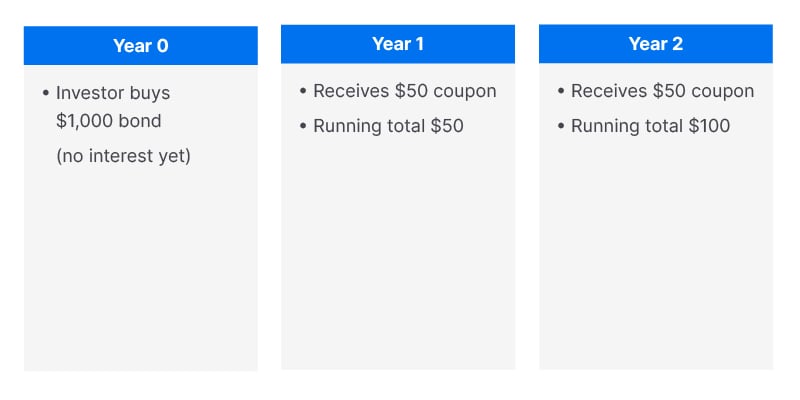

Understanding a bond’s lifecycle: An example from purchase to maturity

Example bond details

- Purchase amount (face value): $1,000

- Coupon rate: 5% annually

- Coupon payment: $50 per year (5% of $1,000)

- Maturity: 5 years

Balancing the bond elements: Why professional management matters

While bonds may seem straightforward, building a reliable income stream takes more than picking a few and letting them ride. Factors like credit quality, interest rate movements and bond duration affect how much—and how consistently—you earn. That’s where professional management comes in. They can continually evaluate the creditworthiness of bond issuers to reduce any risks of default, steer clear of lower-rated bonds or diversify holdings to minimize the impact of the poor performance of one or a few bonds on the overall portfolio.

Another critical point about bonds is that when interest rates rise, existing bonds with lower coupons become less attractive, so their prices tend to fall. When rates fall, those same bonds seem more appealing (they pay more than new ones), so their prices tend to rise. This inverse relationship can play out across the bond universe in many ways. However, it’s important to remember that when investing in the context of a mutual fund, investors are never locked into a single bond until maturity. Professional managers can adapt portfolios in real time to manage interest rate risk while pursuing steady income and potential growth.

The inverse relationship between bond prices and interest rates:

How bond managers keep portfolios balanced as rates move

Professional bond managers may:

- Shorten duration: Use bonds that mature sooner to reduce price drops.

- Add floating-rate bonds: These adjust with interest rates, helping protect income.

- Reinvest at higher yields: As older bonds mature, buy new ones paying more interest.

Professional bond managers may:

- Extend duration: Hold longer-term bonds that gain value when rates fall.

- Lock in higher yields: Secure better-paying bonds before rates drop further.

- Look for price gains: Take advantage of rising bond prices for potential capital growth.

2. Defining dividends: Your share of company profits, explained

You can think of dividends as “a thank-you cheque” from a company for owning its stock. When a company earns profits, it may share some of those earnings with investors through regular cash payments, called dividends.

Dividends are an important source of steady income while also providing the bonus of holding onto shares that may grow in value over time. It’s one of the reasons dividend-paying stocks are popular in retirement and income-focused portfolios.

Dividends quick reference guide—key questions and concepts

What type of companies give out dividends? Many established, financially healthy companies (like big banks or utilities) pay dividends consistently over time.

Why don’t all companies pay dividends? Many companies are unable or choose not to pay dividends. For example, many large, fast-growing companies (especially in technology and other growth-oriented sectors) prefer to reinvest profits into their business rather than pay shareholders.

How often are dividends paid? Most companies pay dividends every three months (or quarterly). That means if you own shares in a dividend-paying company, you’ll typically receive a cash payment four times a year. Some companies may pay dividends monthly or once or twice a year.

Do I pay tax on dividends? Yes—dividends are taxable income in most countries. However, in Canada, eligible dividends benefit from preferential tax treatment compared to regular income. The dividend tax credit is designed to reduce the impact of double taxation on corporate profits distributed to shareholders.

Can dividends grow over time? Yes. Some companies have a history of increasing their dividend payments each year—a sign of financial strength and investor commitment.

Are dividends guaranteed? No—dividends are not guaranteed. A company’s board may change the amount or cancel it entirely if needed. For instance, if a company’s profits fall, it may reduce or pause dividends to save money.

| Investment feature | Canadian dividends | Foreign/non-Canadian dividends |

| Tax credit | Yes, benefits from the dividend tax credit | No, taxed as regular income |

| Withholding tax | No | Yes (usually 15%-30%) |

| Best in | Non-registered or TFSA | RRSP (to avoid tax) |

| Typical yield | Moderate | Varies widely |

| Common sectors | Banks, utilities, telecoms, energy | Tech, healthcare, consumer staples |

| Income stability | Often stable | Varies by company/country |

| Currency risk* | None (CAD) | Yes (e.g. USD) |

*(e.g., risk of fluctuations in exchange rate when converted to CAD)

Dividend due diligence—the value of professional oversight

While dividends can be a steady source of income, some factors can determine how often and how steadily you get paid. To enjoy consistent, reliable payouts, it’s essential to invest in financially strong, well-managed companies with a reliable track record. That’s where professional management adds real value: Experienced investors know how to spot sustainable dividend payers and steer clear of risky “yield traps” that may look appealing but can disappoint.

Beyond the basics: Other complementary income tools

While building blocks like bonds and dividend-paying stocks are central to any income portfolio, there’s a wide universe of income-generating assets that can both improve diversification and return potential. Here are some other types of income investments that can complement core income investments:

Preferred shares are hybrid investments offering the best of both steady bond income and the growth potential of stocks. They typically pay higher dividends than common shares on a regular, predictable schedule. Think of them as a reliable middle ground for those who want income stability with a little upside. In the event of a company’s liquidation, preferred shareholders are also paid out before common shareholders, adding a valuable layer of security.

REITs (Real Estate Investment Trusts) let you tap into the income potential of real estate without having to own or invest in the buildings directly. REITs pool money to own and manage income-generating commercial or residential properties. In return, they pay investors a steady stream of rent-based income, often monthly.

Floating rate bonds have a built-in advantage of adjusting automatically with current market rates. When interest rates rise, so does your income—helping you stay in step with the economy. They’re especially valuable in uncertain or rising-rate environments, offering a flexible and responsive source of income.

Capital gains and Return of Capital: Other ways investors get paid

Along with income in the traditional sense, a typical income-focused portfolio can also include other types of distributions that still put money in your pocket, just in different ways.

Capital gains: When an investment is sold for more than the original purchase price, it earns a profit called a capital gain. While never guaranteed or regularly occurring, these gains are typically distributed annually to investors at the end of the year and can boost overall return.

Tax implication: Only 50% of a capital gain is taxable in Canada, making it more tax-efficient than interest income, which is fully taxed.

Return of Capital (ROC): When you receive an ROC, you’re not earning income, you’re getting a portion of your original investment back from companies. Companies do this to maintain payouts, manage taxes or return excess capital, among other reasons. As a result, your cost base (essentially what you paid for an investment) gets reduced by the amount of ROC you receive.

Tax implication: ROC can be tax-efficient today because it’s not taxed as income. However, because it lowers your investment’s cost base, it means you may owe more tax later if you sell at a profit.

Diversification and aligning with your goals

Every income investor is unique. A retiree seeking steady payouts will need a different approach than someone focused on long-term growth with some income on the side. That’s why it’s essential to build a portfolio that balances risk, time horizon and income needs.

Professional managers can help diversify your investments—across dividends, bonds, real estate and more—while making sure everything aligns with your personal goals. It’s about earning income in a way that feels stable, sustainable and right for your needs and outcomes.

Diversifying not just assets—but managers

True diversification goes beyond what you invest in—it’s also about who’s managing your money. Each investment manager brings their own perspective, strategy and strengths to the table. By combining multiple managers and approaches in one portfolio, you tap into a broader range of insights, reduce reliance on any single investment style and create more opportunities to enhance income and manage risk more effectively.

Getting the right outcome from your income

Understanding where your investment income comes from is the first step toward building a more confident financial future. Whether it’s interest income from bonds, dividend income from stocks or other income sources, each component plays a role in delivering steady, reliable income.

Want to learn more about how to generate regular income potential in your portfolio? Explore the new ATB Monthly Income Portfolio—designed to provide consistent cash flow through a diversified, professionally managed approach.

Insights

Dive into our diverse global investment expertise and perspectives

ATBIM introduces new funds

Introducing our two new products: ATB Monthly Income Portfolio and ATB Global Equity Pool.

Learn more

Thinking global in your investments

How global diversification can open up a world of opportunity

Learn more

May 2025 market commentary

ATBIM's portfolio managers provide commentary on the economy, market and our funds.

Read the articlePast performance is not indicative of future results. ATB Investment Management Inc. is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATB Investment Management Inc. is also registered as an Investment Fund Manager who manages Compass Portfolios, ATBIS Pools and ATB Funds. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATB Securities Inc., ATB Investment Management Inc., ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read fund disclosure documents before investing. The Compass Portfolios includes investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedarplus.ca.

Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents. The material in this document is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.