Markets, investing and what matters most: Quarter in review Q2, 2023

The Private Investment Counsel team reviews market performance during the second quarter of the year.

The theme driving market performance in the second quarter of 2023 continued to be interest rates and inflation. In North America, inflation came down significantly from the highs experienced in 2022, while in other parts of the world high inflation remains stickier. Central banks continued to raise interest rates, though the pace at which the Bank of Canada and the Federal Reserve are increasing rates has slowed down. After pausing its rate hikes in January, the Bank of Canada raised the overnight rate again in June, while the Federal Reserve decided to pause at their June meeting, concluding a run of 10 consecutive hikes.

In the financial markets, equities continued to rally from their October lows, largely driven by strength in the tech sector in the US. Performance of the S&P 500 would have been negative had it not been for a handful of companies. The top 10 largest companies in the S&P 500 grew by 30.5% in the second quarter1, accounting for most of the performance of this quarter overall. Canadian and international equity markets were modestly positive, losing some of the steam they had in the first quarter.

Government bond yields continued to increase over the quarter causing a decline in price, but corporate credit spreads (the extra yield earned from corporate debt over government debt) decreased, which protected corporate bond prices from significant decline. Overall, the FTSE Canada Universe Index (which represents the broad Canadian bond market) was slightly negative for the quarter.

Headlines that mattered this quarter:

- The US government was able to raise the debt ceiling after much negotiation. A resolution was reached that will bring stability to the budgetary process until 2025. The Bank of Canada raised its policy interest rate by a quarter percentage point in June to 4.75%.2

- Canadian price growth eased in May. After rising slightly in April, the national inflation rate fell in May to its lowest level since June 2021. The year-over-year (y/y) change in the Consumer Price Index (CPI) came in at 3.4% in May compared to 4.4% in April, but was still almost a point-and-a-half above the Bank of Canada’s target of 2%. A slowdown in annual price growth was widely expected given elevated energy prices in the base period (May 2022). In Alberta, the CPI grew by 3.1% in May, down from 4.3% in April.3

- A failed coup by Yevgeny Prigozhin’s Wagner Group has created doubts about the strength of Putin’s leadership in Russia and left many questions about what this means for the ongoing war in Ukraine.

- Closer to home, the provincial election in Alberta saw the United Conservative Party win a majority government, largely driven by support from most ridings outside of Alberta’s two largest cities.

Charts of the quarter:

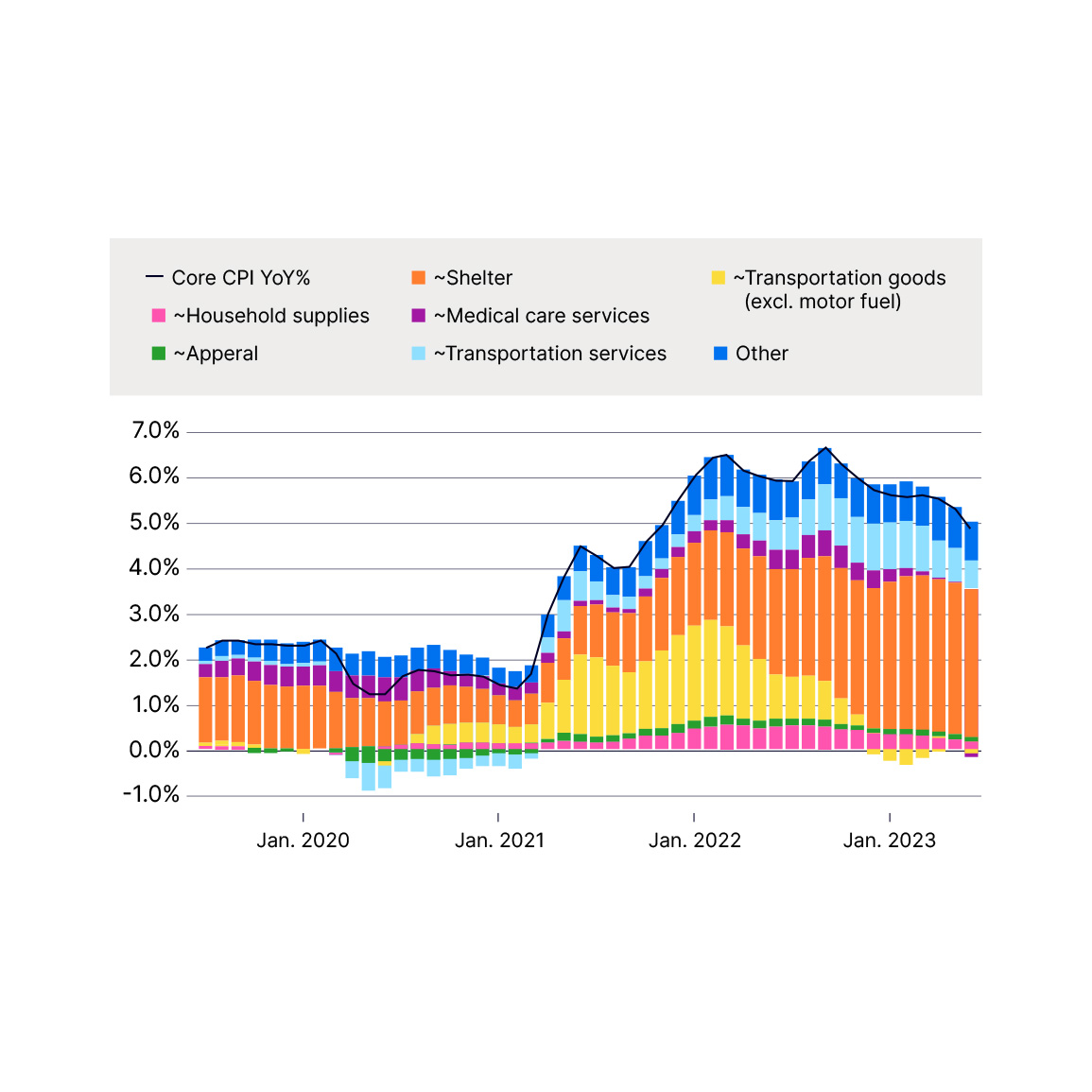

Inflation—and the actions central banks are taking to tame it—are still driving market performance. The chart below shows the underlying components that drive inflation, and how it has evolved over time. As commodity and shipping prices fall from the highs seen last year, many of the contributors to inflation are normalizing, but the cost of housing is becoming a larger contributor. The good news is there are some signs that the rise in housing costs may begin to slow.

US Core CPI YoY% including topline contributions

Source: Bureau of Labour Statistics and Bloomberg

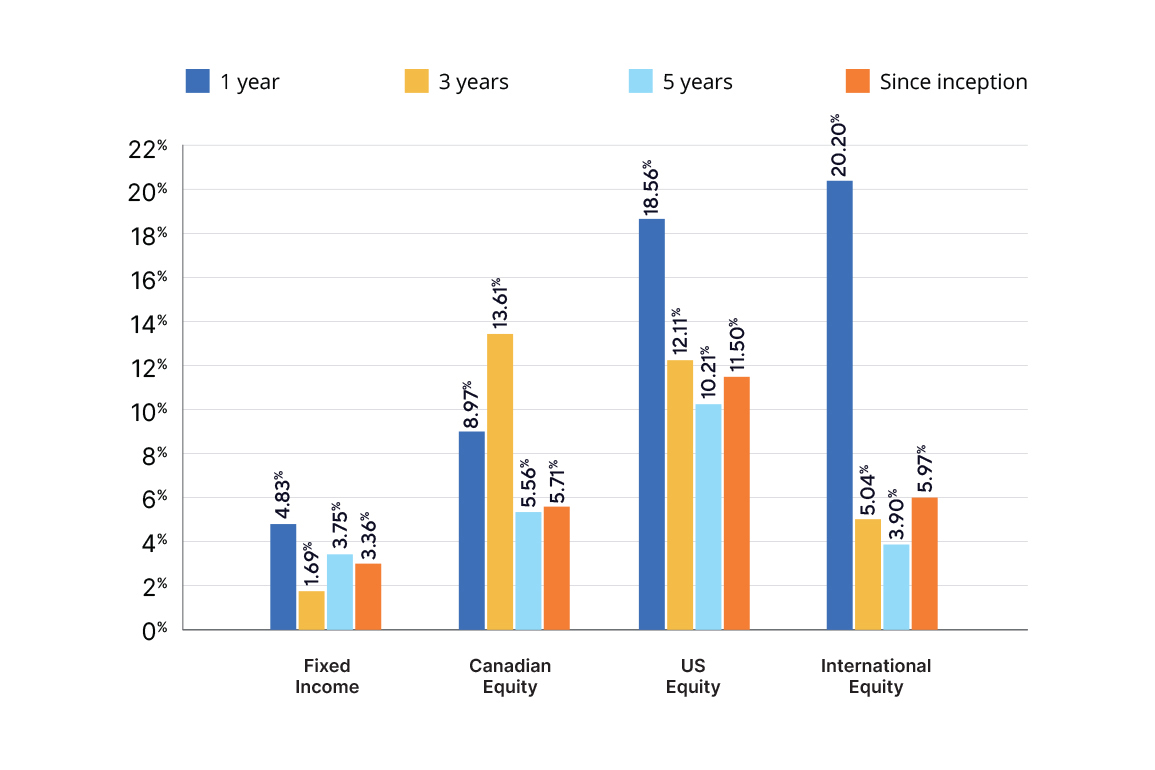

How our Fund Strategies performed:

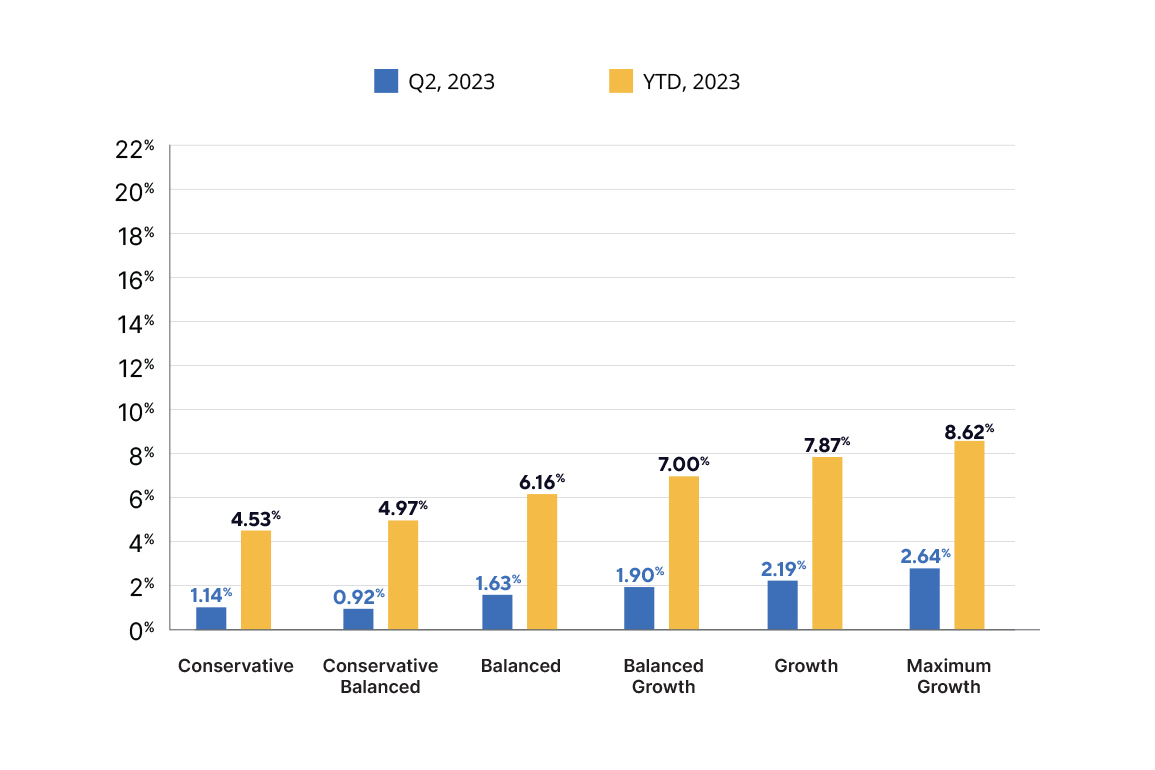

All of our model portfolios saw positive overall performance for the second quarter of 2023. Total returns for the six Compass Portfolios ranged from 0.5% to 2.1%, and the four ATBIS Pools ranged from 0.5% to 4.2%. Further details can be found in our latest ATBIM Portfolio Manager Commentary.

Compass Portfolios total returns, Series O - Quarterly and YTD 2023

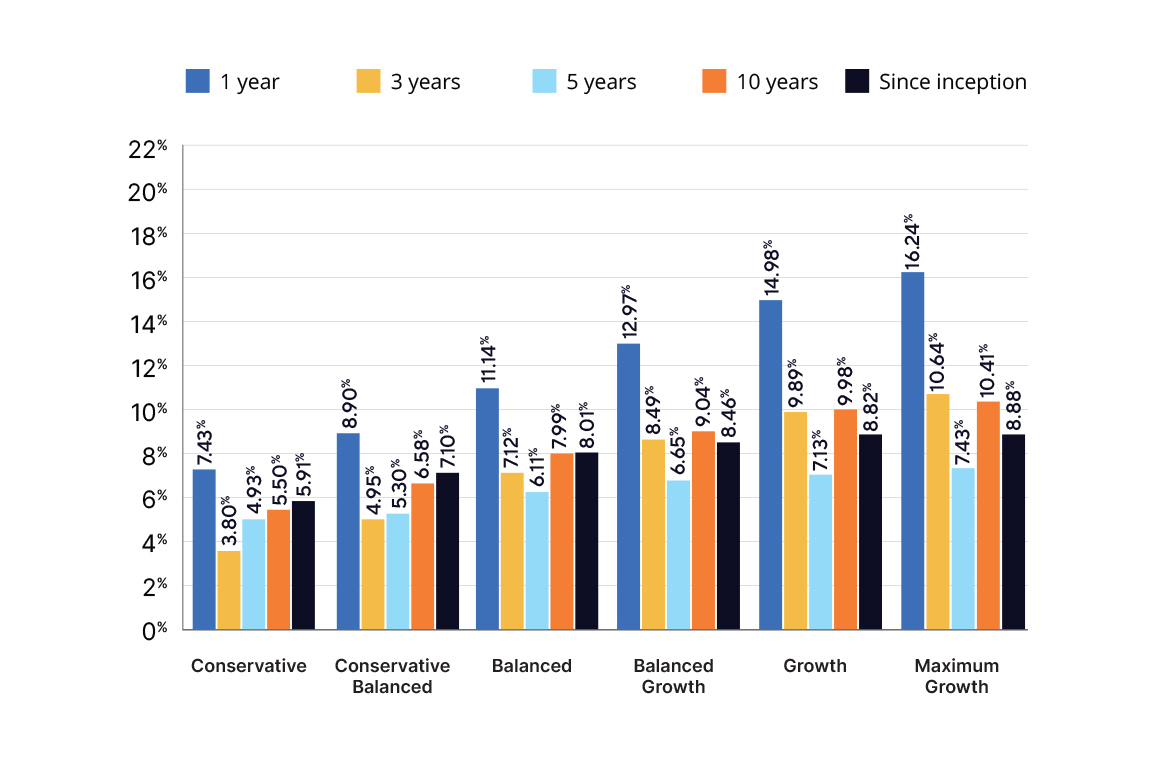

Compass Portfolios total returns, Series O

Source: ATB Investment Management Inc.

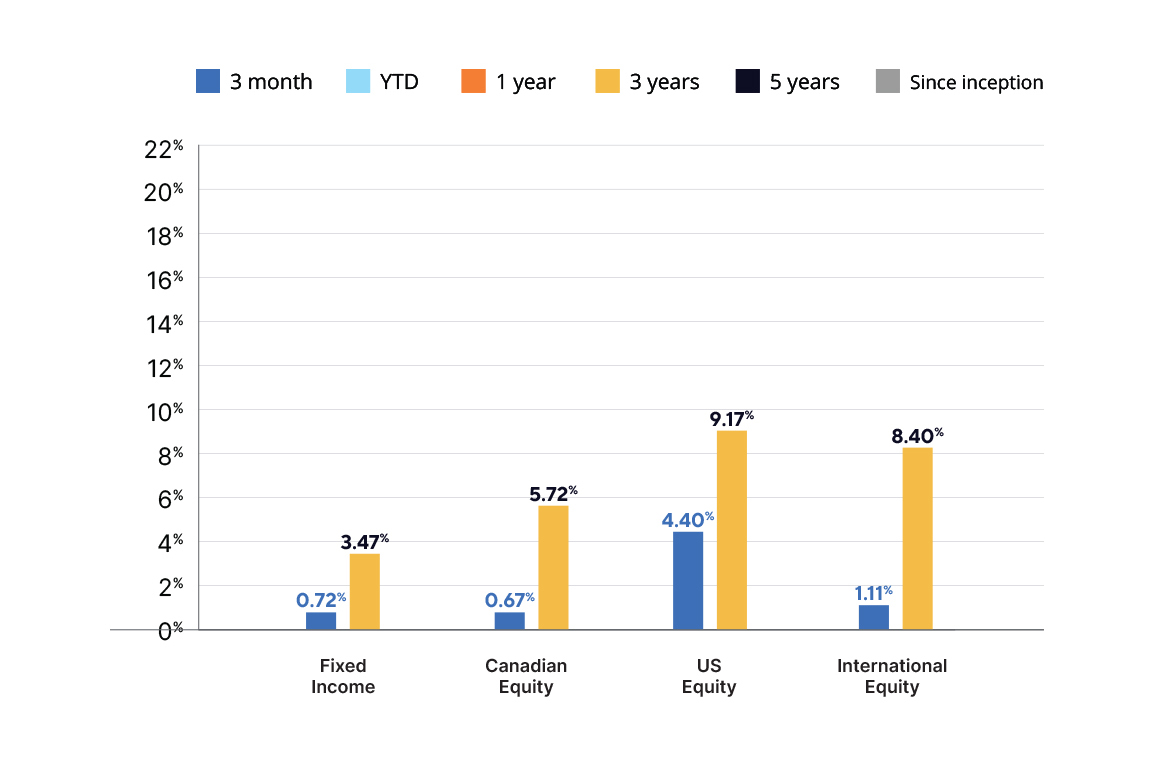

ATBIS Pools total returns, Series O - Quarterly and YTD 2023

ATBIS Pools total returns, Series O

Source: ATB Investment Management Inc.

Portfolio Positioning:

In June 2023, ATB Investment Management’s Portfolio Management team recommended shifting our portfolios from being "overweight” equities to a "neutral" position. In particular, our exposure to US equities were scaled back while exposure to fixed income was increased. The decision was made due to a sharp increase to the valuations of US equities (especially tech valuations) and to the attractiveness of bond yields.

We continually compare relative valuations across regions and asset classes. This year equity valuations became more expensive (the US in particular) yet interest rates continued to rise. We don't know where markets will be over the next couple of years, but with over a 6% yield in our bonds currently, we felt we could trim some of the equity exposure and be paid well to lower some of the risk in the portfolios at this time.

Sub-advisor spotlight:

ATB Investment Management uses a wide range of sub-advisors to build our Compass Funds. This is done to ensure we incorporate the best strategy possible for each asset class, and to ensure diversification of expertise and perspective across the Compass Portfolios. This process is not unlike the work of our Private Investment Counsel group, where we ensure our client’s portfolios are properly balanced and tailored to each individual's needs.

Picton Mahoney Asset Management was added as one of the sub-advisors in November of 2022 in order to add to our expertise in the Canadian small-cap equity positions and capture the growth potential of smaller Canadian companies, bringing their value into the Compass Portfolios.

Picton Mahoney is a Canadian-based asset management company which was founded in 2004. They currently have over $9 Billion in assets under management. Picton Mahoney aims to maximize risk-adjusted returns for their clients. They have a three-step investment process that has enabled them to grow into a well-known and trusted Canadian asset manager.

They start with their idea generation which is made up of an independent quantitative process and an independent fundamental analysis. These two teams work separate from each other to ensure both foundational elements of any investment hold up on their own. Next, their team of portfolio managers take these newly-generated ideas and filter them through a series of portfolio construction and risk-control programs to identify the best opportunities. Lastly, they continue to monitor these portfolios daily to ensure they remain within their acceptable risk/reward balance. This monitoring process is owned by both portfolio managers and their quant team, ensuring that both raw quantitative and portfolio construction perspectives are kept in consideration.

Picton Mahoney puts this entire process to work for ATBIM as they manage the small-cap Canadian equity sections of both our Compass funds and ATBIS Canadian Equity Pool.

For Your Interest

Why AI will save the World.

“The era of Artificial Intelligence is here, and boy are people freaking out. Fortunately, I am here to bring the good news: AI will not destroy the world, and in fact may save it.”

The smoke and mirrors of Covered Call products

"Many investors view this strategy as generating extra yield. While it boosts up-front cash flow, this strategy is not what investors think it is. That cash yield that seduces so many investors is not yield at all."

Beyoncé and Inflation

"Sweden reported higher-than-expected inflation for May, causing economists to wonder: What could have kept prices elevated? And then it hit them like a ray of sun: Beyoncé. The pop superstar kicked off her Renaissance tour in Stockholm last month, drawing 80,000+ fans to the city’s Friends Arena over two nights. In response to the influx of concertgoers, hotels and restaurants raised their prices to such a degree that it boosted overall inflation, Danske Bank concluded. The fact that one person, by the sheer force of her popularity, was responsible for higher inflation in an entire country is…not normal. Danske’s chief economist in Sweden, Michael Grahn, said, “It’s quite astonishing for a single event. We haven’t seen this before.”"

1 Source: S&P Dow Jones Indices commentary

2 Source: Bloomberg

3 Source: the Owl

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.