Markets, investing and what matters most: Quarter in review Q4, 2023

The Private Investment Counsel team reviews market performance during the fourth quarter of the year.

Top news:

- The theme driving positive market performance in the fourth quarter was the expectation of declining interest rates and falling inflation.

- In North America, despite October’s concerns over rising interest rates from the US Federal Reserve, stocks rebounded in November and December as consumer spending and inflation slowed.

Globally, equity markets performed well in the fourth quarter, dispelling earlier worries, and global growth remained positive, supporting hopes for a "soft landing." Bond markets also rallied, benefiting from lower inflation and steady interest rates, with North American bond markets leading the way. Investment-grade and high-yield corporate bonds outperformed, while sovereign government bonds lagged.

Headlines that mattered this quarter:

In December, oil prices averaged $72 per barrel amid growing concerns about the ability of OPEC members to effectively implement their promised supply cut of 2.2 million barrels per day. This uncertainty unfolded against the backdrop of the global economy dealing with a higher interest rate environment. On the last trading day of the year, West Texas Intermediate (WTI) crude oil closed at $71.7 per barrel.1

US core consumer price index (CPI), excluding food and energy prices, rose by 3.9% year-over-year in December, lower than 5.6% at the beginning of 2023. Federal Reserve Chair Jerome Powell’s expectation of a ‘lumpy and bumpy’ path to the 2% inflation target seems to align with the data. Although headline inflation rates have significantly dropped since early 2023, the recent reading shows a slight bump, influenced by stabilized energy prices in December after a decline in October and November. Shelter prices remain a key driver of inflation, showing a slight increase in December month-over-month but a continued deceleration in year-over-year terms. The expectation is for shelter prices to cool in 2024, providing additional relief to CPI. In Canada, the core CPI for December was 3.7%.2

Overseas, on October 7, Hamas militants launched a surprise attack against Israel from the Gaza Strip. In response, Israel declared war on Hamas, and the conflict continues today. How this may affect the Compass Portfolios is discussed in this insight article from ATBIM’s portfolio managers.

Charts of the quarter:

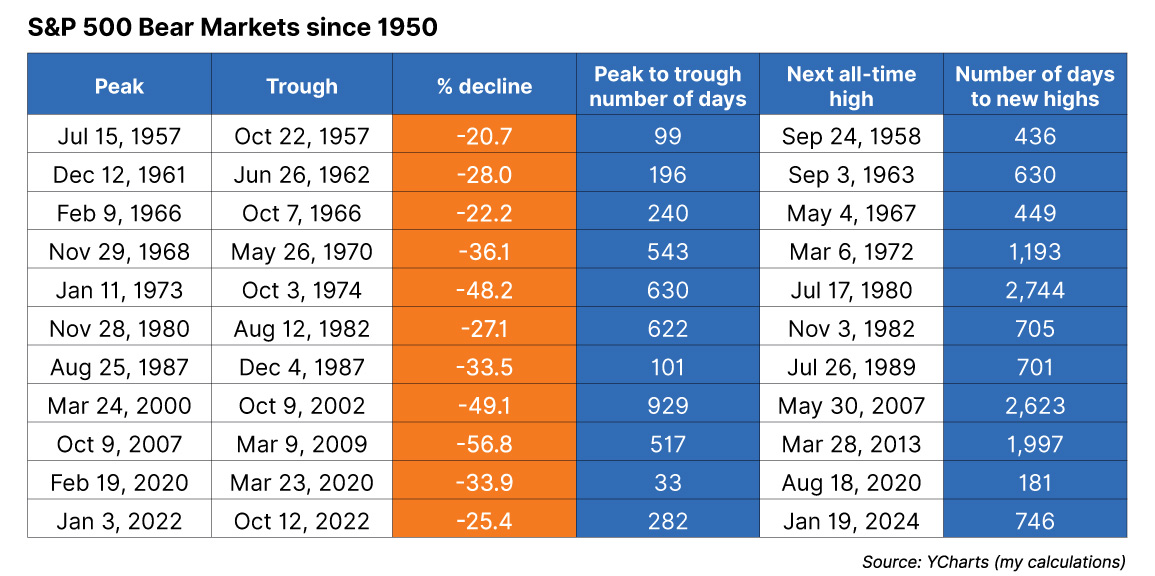

Above is a table showing the S&P 500 bear markets since 1950 and how many days it took from peak to trough and then how many days it took to reach a new high.3

The 2022 bear market had the S&P 500 down by 25% for the year as central banks tried to combat high inflation by raising interest rates at record levels. It took 282 days for the S&P 500 to reach a new low between January 1 and October 12, 2023, and 746 days to reach a new high from October 12, 2023 to January 19, 2024. Maintaining a longer-term view will help investors stay the course and participate in the recoveries.

How our funds strategies performed:

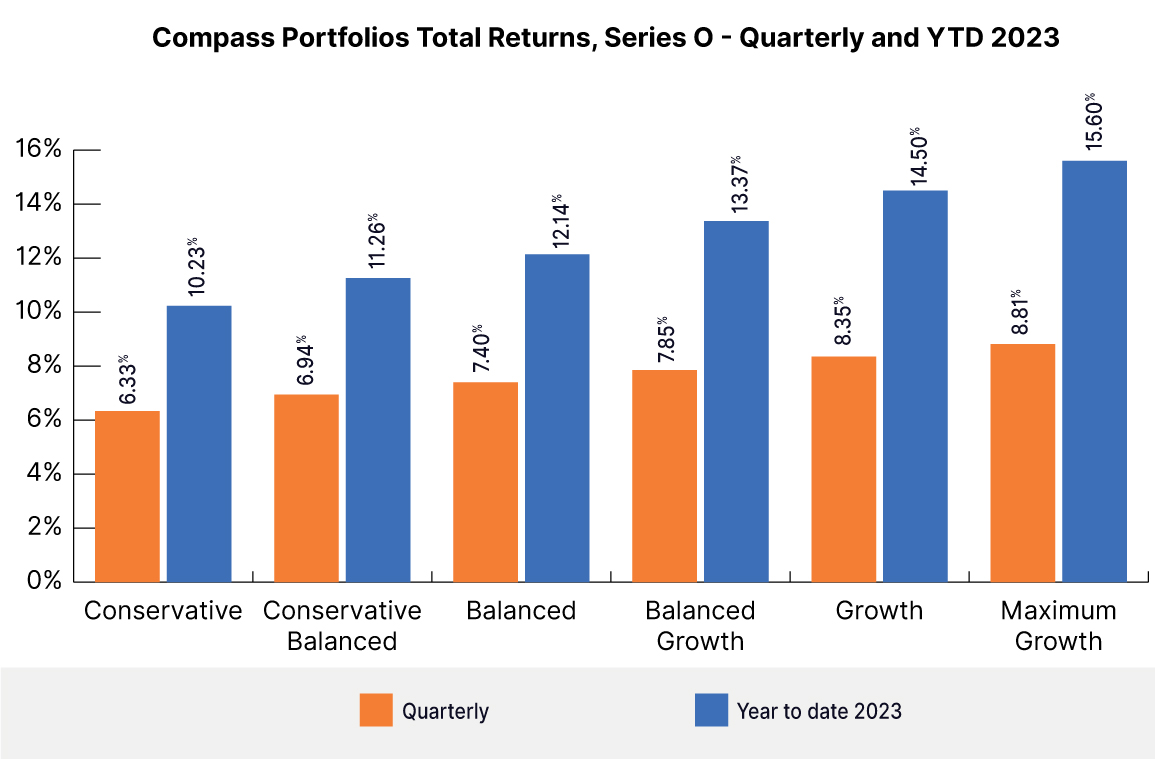

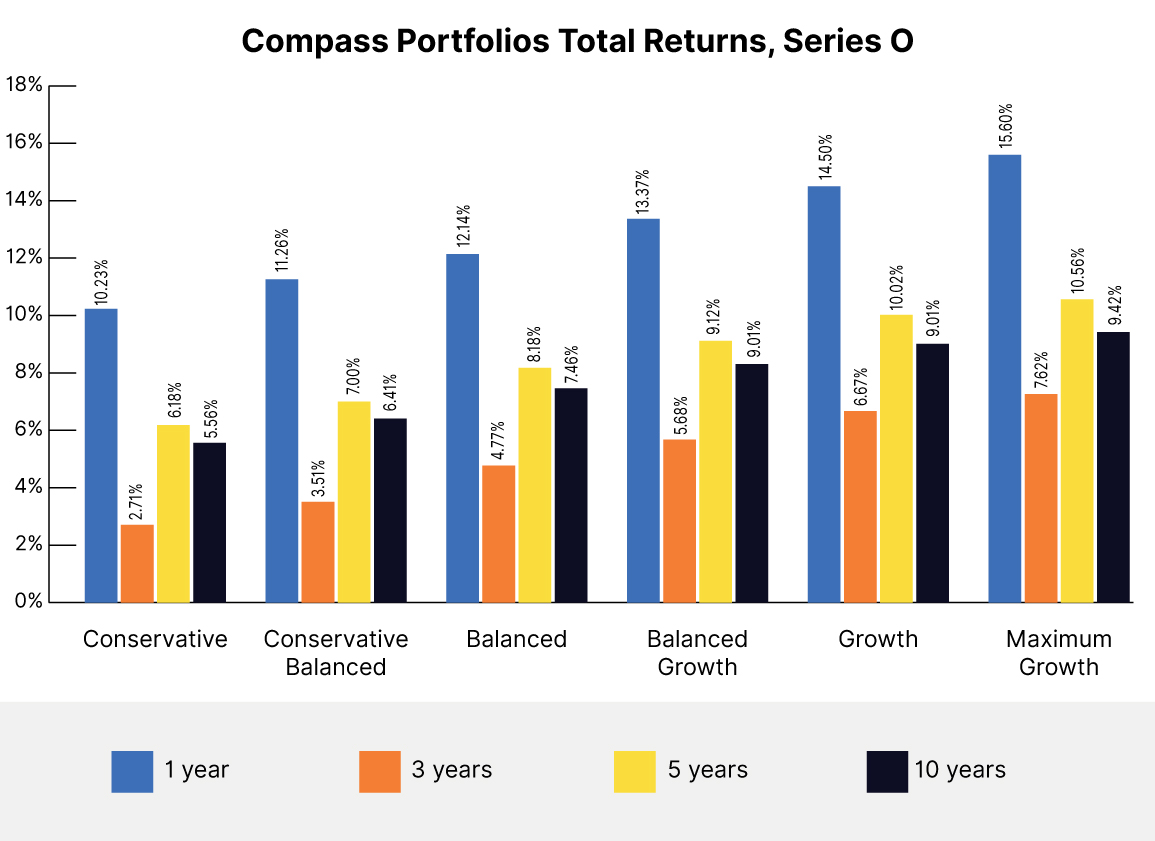

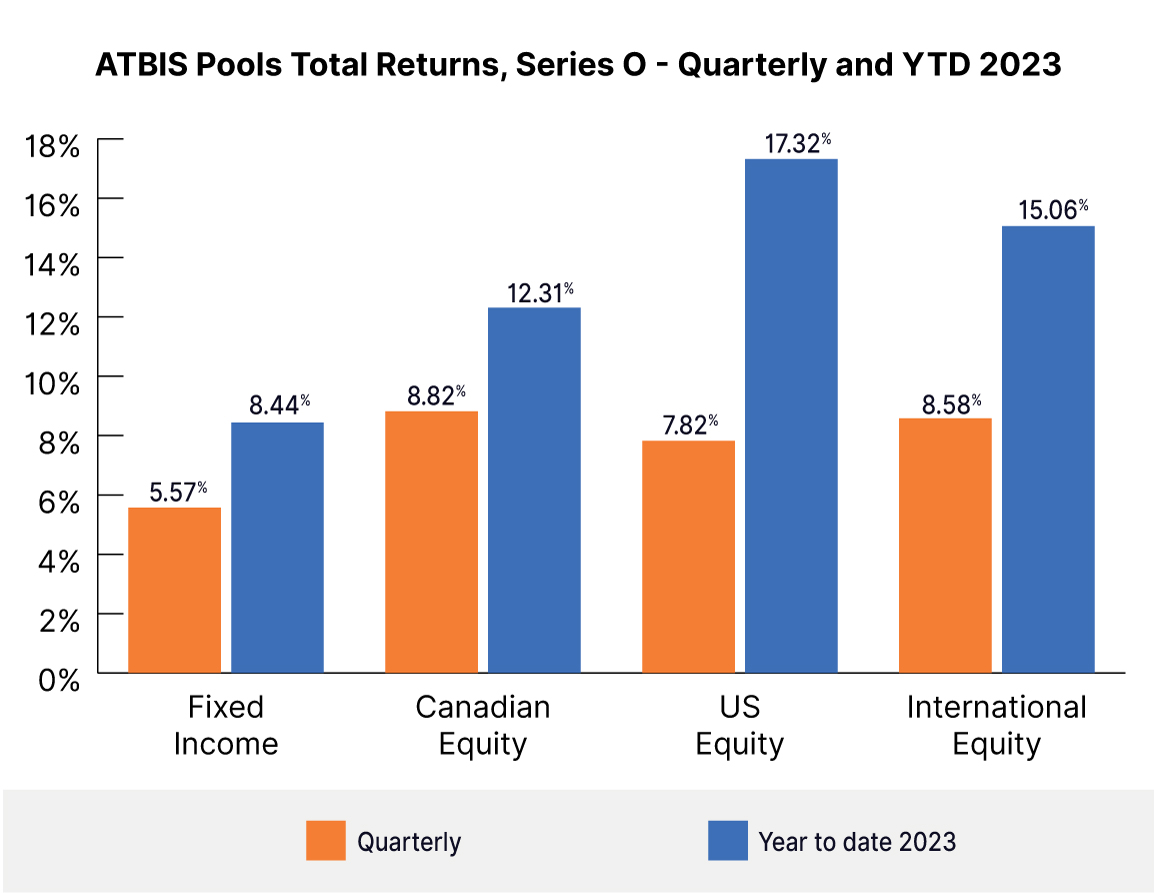

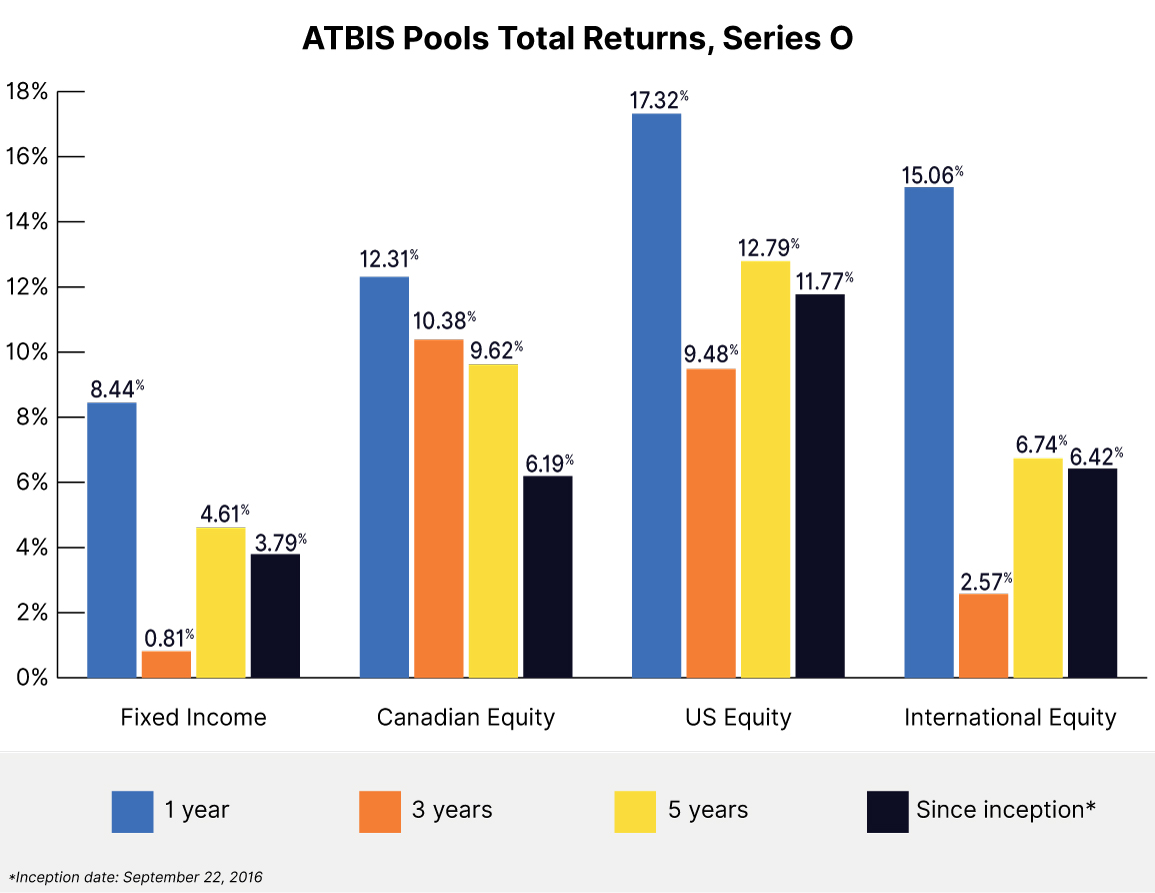

All of our funds saw positive performance over the fourth quarter of 2023. Total returns for the six Compass Portfolios ranged from 6.33% to 8.81% and from 5.75% to 8.58% for the ATBIS Pools. Further details can be found in the Q4 2023 ATBIM Portfolio Manager Commentary.

Source: ATB Investment Management Inc.

Sub-advisor spotlight:

ATB Investment Management employs a diverse set of sub-advisors to construct their Compass Funds, aiming to incorporate optimal strategies for each asset class. This approach is designed to diversify expertise and perspectives within the Compass Portfolios. This strategy resembles the practices of ATB’s Private Investment Counsel team, where a focus on proper balance and customization ensures that client portfolios are tailored to individual needs.

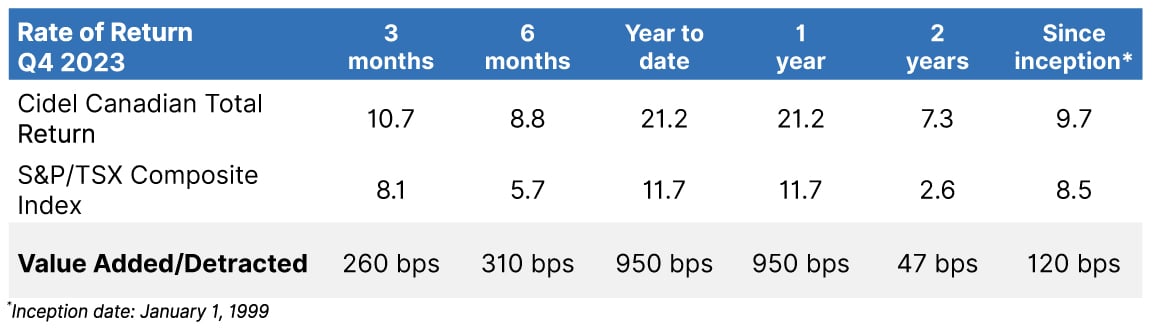

Cidel is a global asset manager based in Toronto, Ontario, with a satellite office in Calgary. The firm, predominantly employee-owned, has over five decades of experience and manages assets exceeding $7 billion. Their investment approach centres on choosing companies with sustainable cash flows, strong balance sheets and high profitability.

ATBIM partners with Cidel to manage a part of the Canadian Equity in the Compass Portfolio and the ATBIS Pools. Cidel’s Canadian Equity Total Return strategy follows a core quality style, emphasizing dividend growth. The strategy employs a bottom-up, fundamental approach, focusing on individual company fundamentals rather than macroeconomic trends. The portfolio consists of 30 to 40 individual equities with a position target of 2% to 4%, with a maximum weight of 6% for any single position. The strategy seeks companies with a market capitalization exceeding $500 million, screens for expected dividend growth of 2%, and avoids highly cyclical equities, favouring those with sustainable cash flows and revenue. This process has added value for ATBIM and our clients since being added to the Compass Portfolios and the ATBIS pools in November 2019. Inside the Compass Portfolios, Cidel accounts for approximately 1.5% to 6.3% of the Conservative to Max Growth Mandate and 20% in the Canadian ATBIS pool. The portfolio posted a total return of 10.7% in the fourth quarter and 21.2% year to date, outperforming the S&P/TSX index total return by 2.6% and 9.5%, respectively. The top five contributors were Constellation Software, Open Text, Royal Bank, Colliers International, and Restaurant Brands.

Conclusion

In 2023, both stocks and bonds bounced back from the challenges faced in 2022. All the Compass Portfolios ended the year with double-digit returns (except for the ATBIS Fixed Income Pool), and more than half the returns were in November and December. Despite the market's volatility, it is a good reminder that staying invested is more crucial than attempting to time the markets. The unpredictability of short-term fluctuations underscores the importance of a long-term investment approach. Those investors who stayed invested were rewarded for doing so. The focus is on the resilience of staying invested over time rather than reacting to short-term market fluctuations.

For your interest

Take a look at how the market has acted and reacted in Bear markets here.

***

Investors who are able to stay calm and keep their emotions under control, realize their investments potential.

Read the article here.

***

A year in review: Several charts highlighting key events or themes of 2023.

1 US Energy Information Administration

2 The Conference Board and Bank of Canada

3 https://awealthofcommonsense.com/2024/01/new-all-time-highs-after-a-bear-market/

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.