Missing the 10 best days in the stock market

ATB Wealth’s “Navigating Market Uncertainty” event took place on Wednesday, November 6, 2024, where a guest panel from ATB Investment Management engaged with clients to share perspectives on current market conditions and answer questions about investment strategies and the performance of the Compass Portfolios and ATBIS Pools.

NOTE: All data referenced in this document was updated on or before November 6, 2024

At a recent client event, held on November 6th, Ian Filderman, President of ATB Investment Management (ATBIM), Joe Wong, Senior Portfolio Manager, and Alex Richards, Associate Portfolio Manager engaged in lively discussions and answered client questions on a variety of subjects. These topics included:

- The importance of a long-term investment strategy, particularly for those not currently invested.

- Post-US election market volatility, and the potential impact on markets and investment portfolios.

- Finding opportunities across various geographical markets with a strategic tilt towards undervalued markets.

- Foreign rate exposure and management strategies within the Compass Portfolios and ATBIS Pools (the "Funds").

- The impact of rising and falling interest rates on investors and the Funds.

"Time in the market," not "timing the market."

In the 24 hours after the US presidential election, the markets, as represented by the S&P 500, were highly volatile and saw a 2.53% positive return, bringing year-to-date performance to 23.40%. How does that impact clients who are not invested in the markets?

Long-term investing benefits often outweigh short-term market fluctuations. ATBIM’s portfolio managers stress that consistent investing over time, such as through dollar-cost averaging, can help investors benefit from compounding returns and reduce the impact of market volatility.

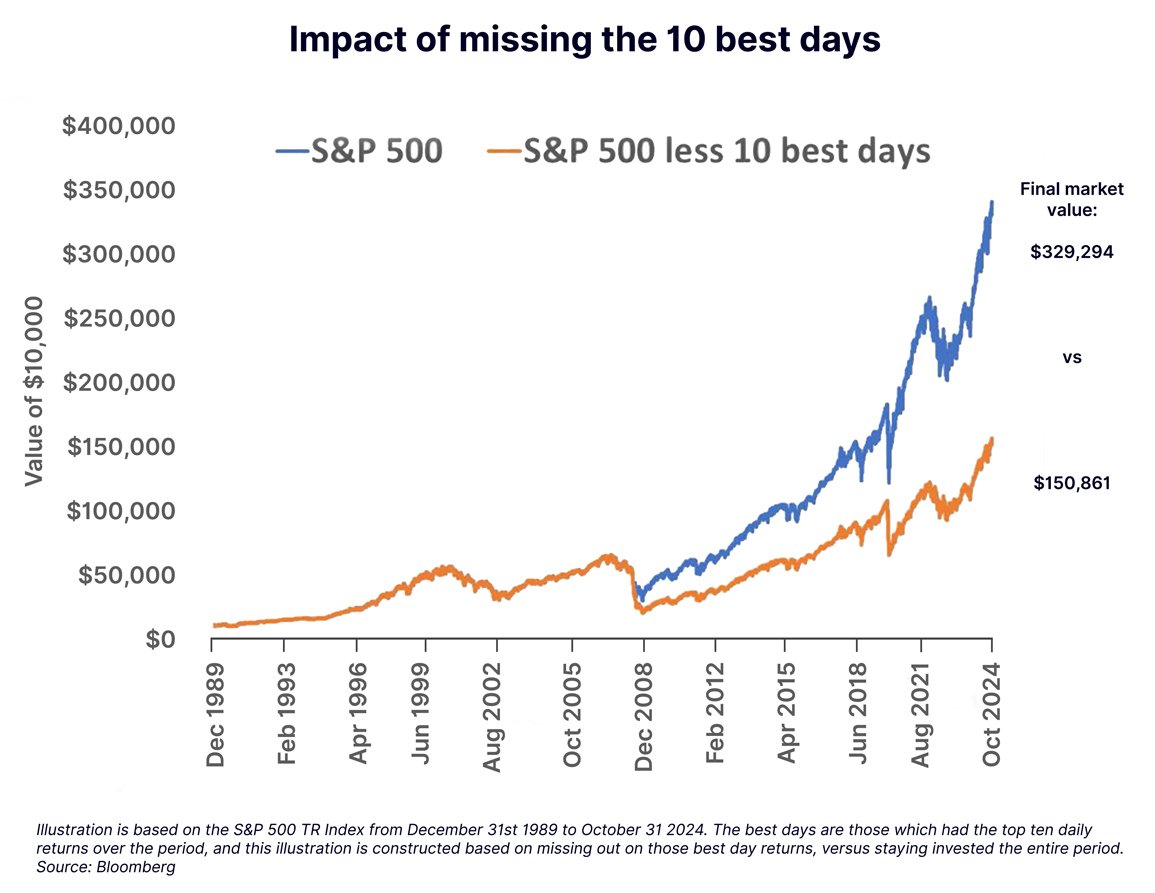

This chart illustrates the compounding effect of staying invested and the stock market's potential for long-term growth. Missing just the ten best days of the S&P 500 since the beginning of the 1990s had a significant impact on returns. Certainly, you may not miss all of the ten best days, but this demonstrates the difficulty of timing the market, and how staying invested versus trying to time the market produces a better outcome.

The key factor is "time in the market," not "timing the market." If you're not currently invested, consulting with a financial advisor can provide guidance on investment strategies.

Post-election impact on the market

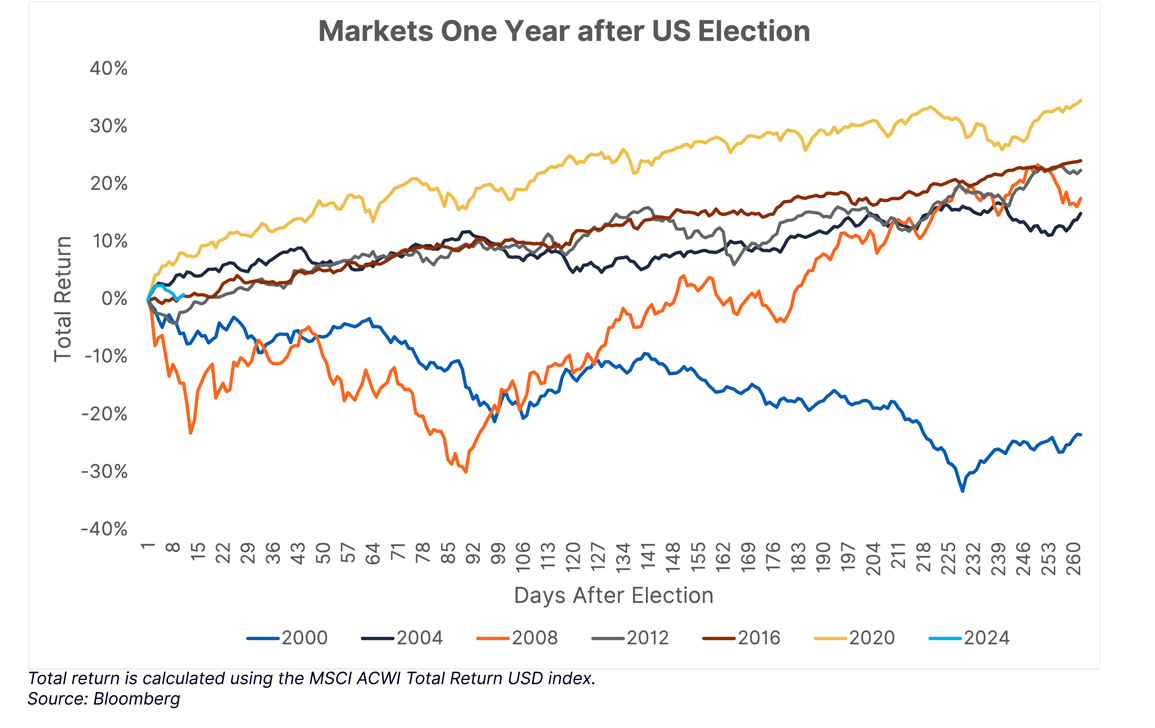

Partisan politics often evoke strong emotions and can feel like they will have an enormous impact on markets. In reality, their impact on long-term investment strategies is relatively minimal. While political events and rhetoric may create short-term market volatility, they seldom have a lasting effect on well-diversified portfolios.

Focusing on the specific risks and opportunities within individual companies is more important than worrying about broad market trends caused by politics. Evaluating a company’s financial stability, competitive advantages, and management team is more likely to drive positive results. This in turn shows that the health and growth of businesses drive long-term market performance, not political affiliations.

Clients asked how specific sectors like oil and gas, agriculture, and healthcare will fare as a result of the incoming administration.

Ultimately, it depends on the policies that they implement. At a glance, it should be beneficial for domestic firms, as they will likely lean towards fewer regulations. This would benefit energy companies through lower costs of production, and healthcare through lower barriers to having drugs and products approved. For agriculture, it is less clear, as inciting a trade war could lead to unintended consequences. An example would be where China used to import 40% soybeans from the US and now import only 18% as a result of the tariffs applied during the previous Trump administration, leading to US farmers having to find new buyers. Other policies could be beneficial for agriculture, again likely through fewer regulations, but the bottom line is that it will depend on what is implemented and to what extent.

In case you missed it, we published an article on our thoughts of how the incoming administration’s proposed policies may impact the economy and the markets here.

The world economy and our Funds

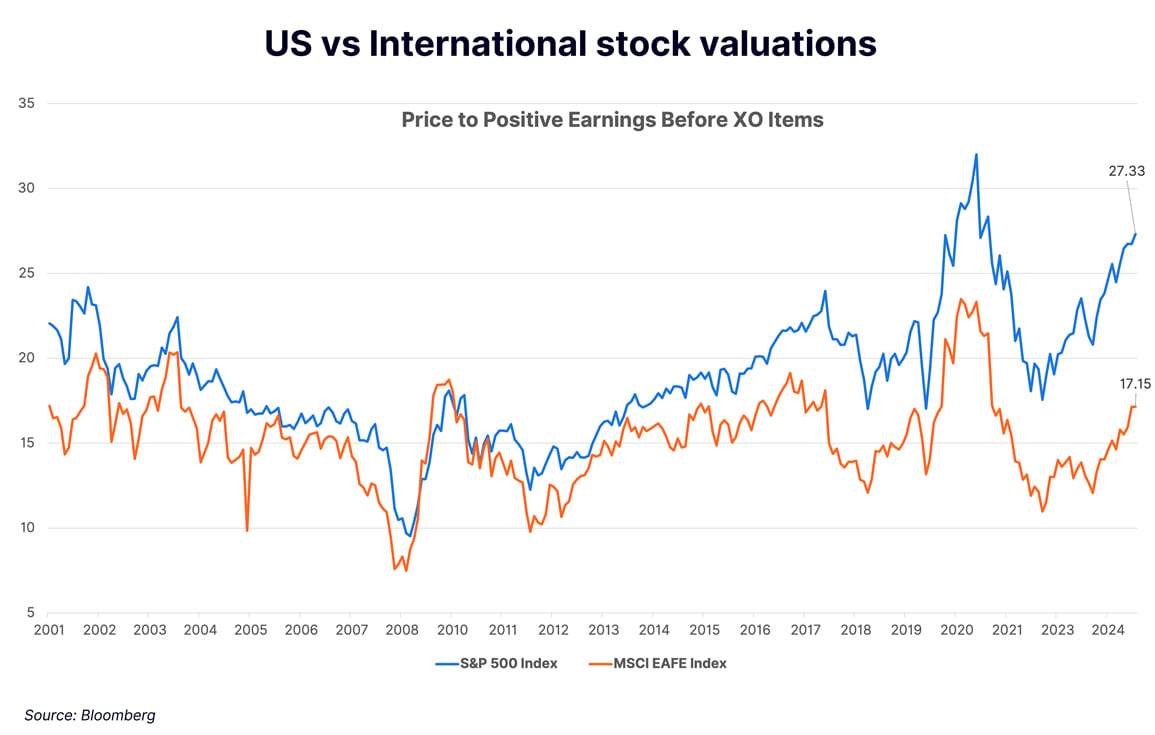

Our portfolio management team remains committed to finding investment opportunities in geographical markets we believe to be undervalued, aiming to enhance returns. While we continue to invest in all developed equity markets, we are strategically tilting our portfolios with the intent to diversify our clients’ investments and generate sustainable long-term value, rather than speculating on market trends or betting against specific geographical regions. One ratio that is used to gauge relative value is the price-to-equity ratio, which essentially is a measure of how much is paid for every dollar of earnings. Looking at international equities compared to US markets, this metric along with others indicates a possible opportunity in international markets, as they are the most undervalued they have been on a relative basis since 2001.

Global investment strategy and foreign exchange rate exposure

There is inherent volatility in the currency markets, especially considering the Canadian dollar’s range-bound behaviour against the US dollar. This volatility can impact both fixed income investments and equity holdings. We typically implement hedging strategies to mitigate currency risk for our fixed income holdings, focusing on the return from the investment itself and not the currency. We aim to optimize the Funds’ overall performance by carefully managing currency exposure.

Interest rates implications on investors and our Funds

Central banks are committed to controlling inflation and preventing future spikes. Canadian inflation is expected to remain close to the 2% target in the near term, assuming no major geopolitical and financial events. Short-term interest rates are likely to follow central bank cutting cycles, but the mid and longer end of the yield curve are uncertain. Economic growth in the US could lead to higher inflation expectations, pushing mid and longer yields higher.

The current yield curve presents a unique opportunity as it offers potential benefits to active fixed income investors. The Funds are well-positioned to capitalize on credit opportunities where they become available through our fixed income sub-advisor. At the same time, we maintain a fixed income positioning that is expected to continue to benefit from anticipated yield movements. Our strategy emphasizes the importance of maintaining a balanced and diversified portfolio, and the excellent partnerships we hold with our sub-advisors, to work towards enhancing returns and helping our clients achieve their financial goals.

Client questions

Economic and market outlook

How might the US dollar's reserve currency status be affected by its debt?

Over the past two decades, the US dollar’s dominance as the primary reserve currency has gradually waned, according to International Monetary Fund (IMF) data. This decline has been met with an increase in non-traditional currencies such as the Canadian dollar and the Chinese renminbi (RMB). The increasing prominence of these currencies reflects the ease with which transactions can be conducted using them and the growth of global trade. The debt-to-GDP ratio of a country is not the sole factor of reserve currency status. Japan’s experience offers a case in point. Despite their debt levels increasing significantly, with a debt-to-GDP ratio exceeding 100% since the mid-2000’s, the yen’s reserve status has remained stable. The bottom line is that debt likely plays a limited role in determining reserve currency status in currencies that account for a significant portion of global trade, are recognizable, are easy to trade, and are subject to minimal restrictions.

Which sectors or asset classes offer better portfolio returns in the current environment?

Keeping a well diversified portfolio is essential in all times, regardless of the economic environment. The diversification of a portfolio can help to balance out downturns in certain markets, while taking advantage of upturns in others. It is very difficult to time the market, as we had mentioned earlier, so a focus on finding relative value, while ignoring market fluctuations is key.

Investment strategies

How can investors hedge against inflation and currency fluctuations?

For investors, hedging against currency fluctuations is a difficult task, and is best left to specific circumstances. Within a portfolio, specific asset classes such as foreign bonds are appropriate to hedge, as interest rate parity generally holds, and currency fluctuations can easily wipe out the return on yield. The Canadian dollar can have some specific circumstances where it is beneficial to hedge, as already noted. One of the best hedges against inflation is to stay invested, as equity markets act as a long-term hedge against inflation and long-term holding periods typically reduce currency impact. Certainly there are other hedges against inflation such as commodities, but trading those require extensive expertise.

What are the pros and cons of investing in specific assets like farmland, cryptocurrency, and Canadian dividend stocks?

Investing in specific assets can have a time and place, but it is important to consider them in the context of your overall portfolio, which is best assessed by your advisor. Some assets may have longer investment time frames that exceed your specific time horizons, while others may have liquidity limitations which are also incompatible with your specific situation. For some, the pros of one asset might even be a con for another.

How does ATB manage portfolios considering foreign investment limits?

These limits will be on a case-by-case basis, and should be discussed with an advisor to customize the portfolio to those individual needs. The Funds do not currently have any limits other than what is set out by its investment policy, and we construct and maintain the asset mix based on those.

Why does ATB not invest solely in the S&P 500?

ATBIM’s investment philosophy and process revolves around building well diversified portfolios that are able to deliver risk-adjusted returns. As such, investing in one market does not fit, as there are other markets and asset classes with different return profiles that can add value to the portfolios. The S&P 500 has certainly performed very well as of late, but this has not always been the case. For example, during the 10-year period from 1998 to 2008, the S&P 500 returned an annualized 2.1% in CAD terms, whereas the TSX returned an annualized 9.4%.

Artificial Intelligence

What is ATB's investment philosophy and approach to using AI in portfolio management?

We are certainly open to AI, and how AI could help us be more efficient in our processes and assist us identify opportunities among other benefits. We would use it with caution, however, as AI is still in its infancy, and any output still requires thorough verification.

Read our article on how the investment industry leverages AI here.

Are there investment opportunities related to AI or emerging markets within ATB's offerings?

While we do not have separate specific mandates for AI and emerging markets, there are various exposures to these areas within our Funds, for example, companies such as Microsoft for AI and Tencent for emerging markets. We trust our sub-advisors to identify such opportunities as they arise. Mawer Investment Management, one of our sub-advisors, does have an allocation to emerging markets within its international mandate, which is in our Funds where appropriate.

Conclusion: Seizing the Opportunities

By adopting a diligent and long-term investment approach, and resisting the temptation to engage in market timing, you will position yourself to harness the full potential of your investments. Embracing the principles of diversification is another key. By allocating your investments across various asset classes, sectors, and geographies, you will be better equipped to navigate market uncertainties. Your financial advisor can provide you with personalized guidance based on your unique financial goals and risk tolerance.

Remember, consistency, discipline, and unwavering belief in the market's long-term potential are the keys to making it possible.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a Portfolio Manager across various Canadian securities commissions with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an Investment Fund Manager who manages the ATB Funds. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice, and ATBIM does not undertake to provide updated information should a change occur. The information in this document has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATB Securities Inc. do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

The material in this document is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any investment. This document may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.