Markets, investing and what matters most: Quarter in review Q2 2024

The Private Investment Counsel team reviews market performance during the second quarter of the year, looking at how the Compass Portfolio and ATBIS Pools have performed.

The beginning of 2024 mirrored the end of 2023, with markets rising amid speculation of a potential decrease in US inflation and subsequent interest rate cuts from the Federal Reserve (Fed). However, similar to the previous year, these expectations remained unmet as core inflation fell slightly but remained above 3%, and the Fed maintained steady interest rates.

US stocks—measured by the S&P 500—reached a series of record highs in the first half of the year. The yield on the benchmark 10-year US Treasury bond approached 5% in the spring before retreating. The Fed kept the federal funds rate at 5.25% through June, the highest level in over two decades, citing efforts to cool persistently high inflation. Meanwhile, the European Central Bank and the Bank of Canada cut rates for the first time since 2020. US core inflation was 3.4% in May, a multi-year low but still above the Fed's 2% target. However, it moved in the desired direction, albeit slowly, with only one rate cut anticipated before the end of the year.

Against this backdrop, Canadian stocks rallied 4.38% (measured by the S&P/TSX Composite), and US stocks extended a bull market that began in late 2022, with the S&P 500 index gaining 14.6% through June 14 and achieving new all-time highs. The robust rally in the technology sector that began in 2023 continued into the new year. The tech-heavy Nasdaq, which gained 44.6% last year, rose 18.1% this year compared to the S&P 500's 14.6% gain. Nvidia continued to be a significant driver of gains in the tech sector through the end of May due to strong demand for chips used in advanced AI applications. However, expecting Nvidia and other major tech stocks to outperform the broader market consistently requires them to exceed market expectations further. See our past article, The Magnificent 7, for more colour.

Global stock markets also reached multi-year highs, with the MSCI All Country World Index rising 10.6% through mid-June. Developed international stocks, as represented by the MSCI World ex USA Index, gained 4.4%, while emerging markets stocks, as represented by the MSCI Emerging Markets Index, rose 6.4%.

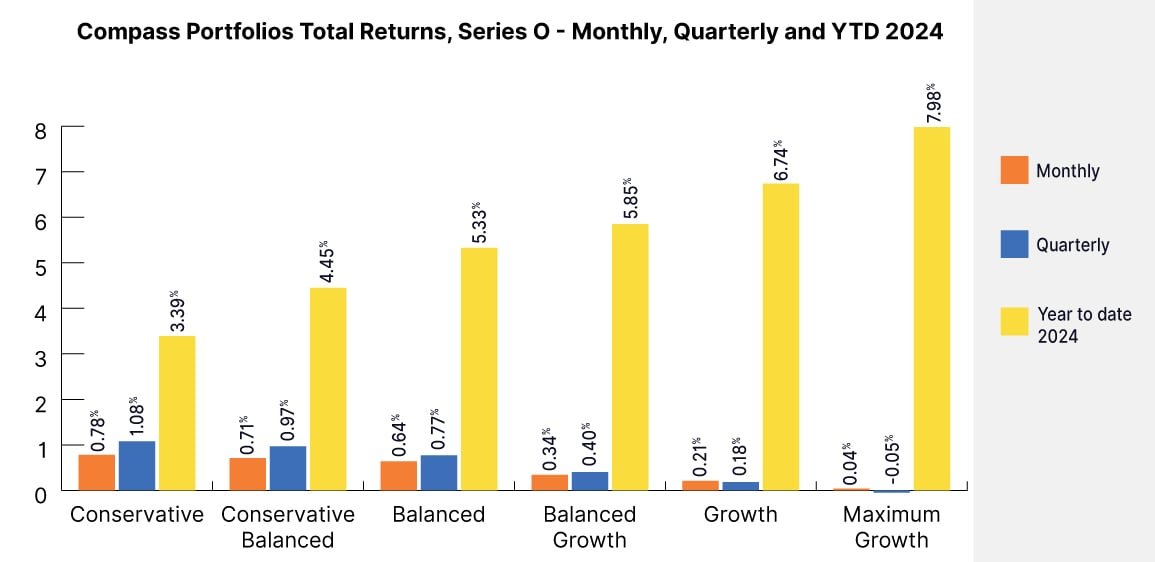

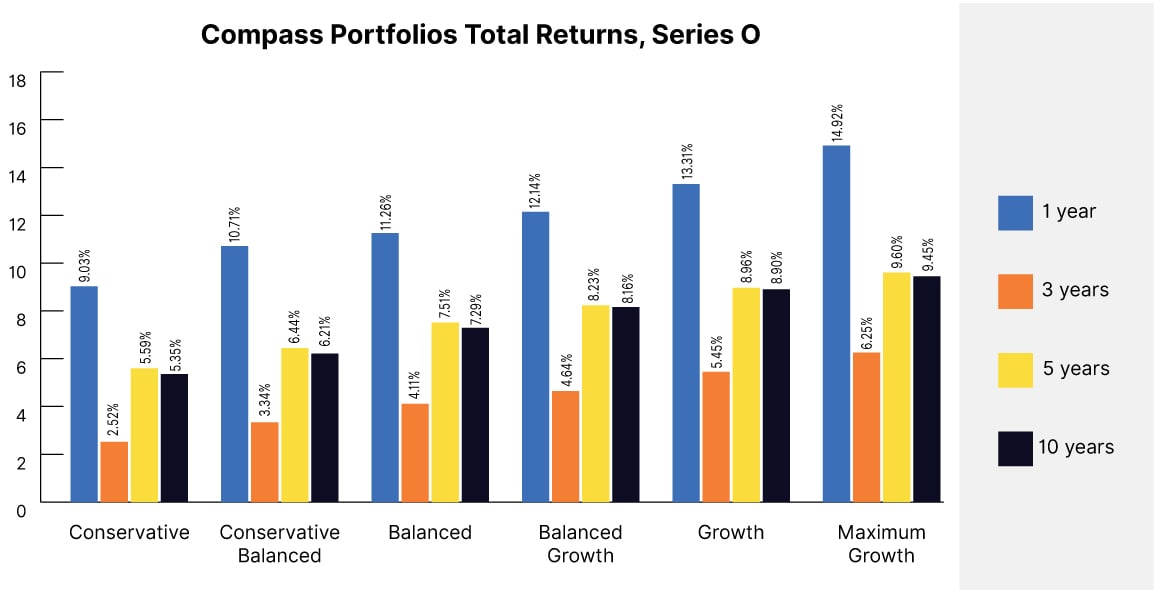

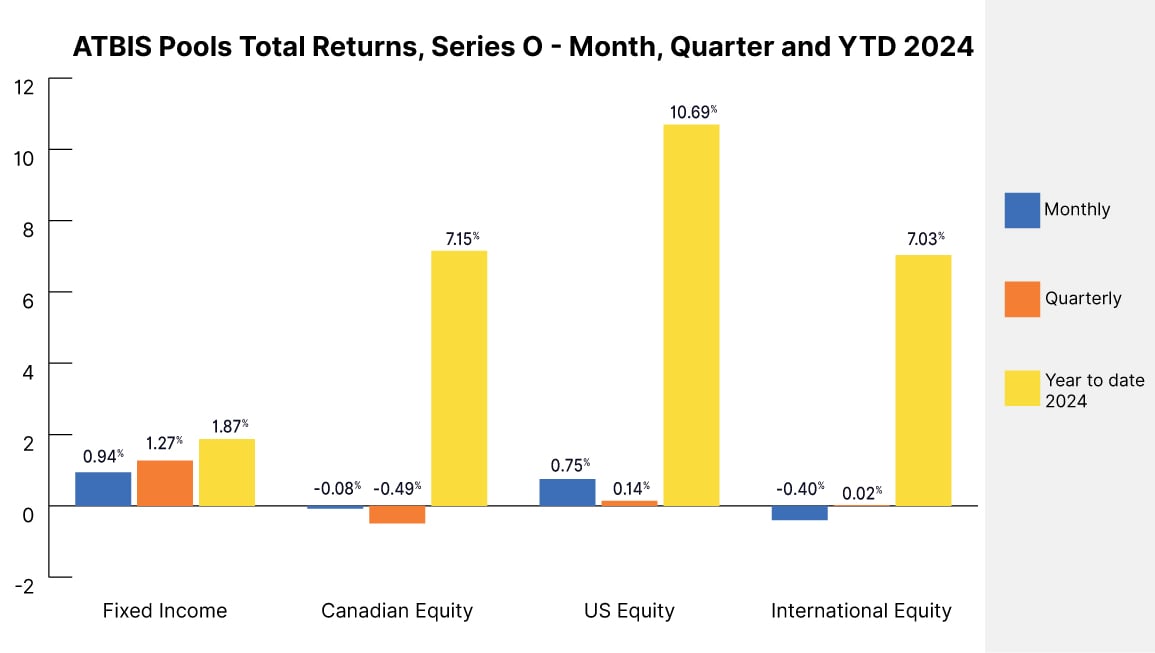

How our funds strategies performed

Source: ATB Investment Management

Portfolio positioning

For more insight on the markets, their performance, and how our Compass and ATBIS Pool funds have been affected, please refer to our Portfolio Managers Commentary found here.

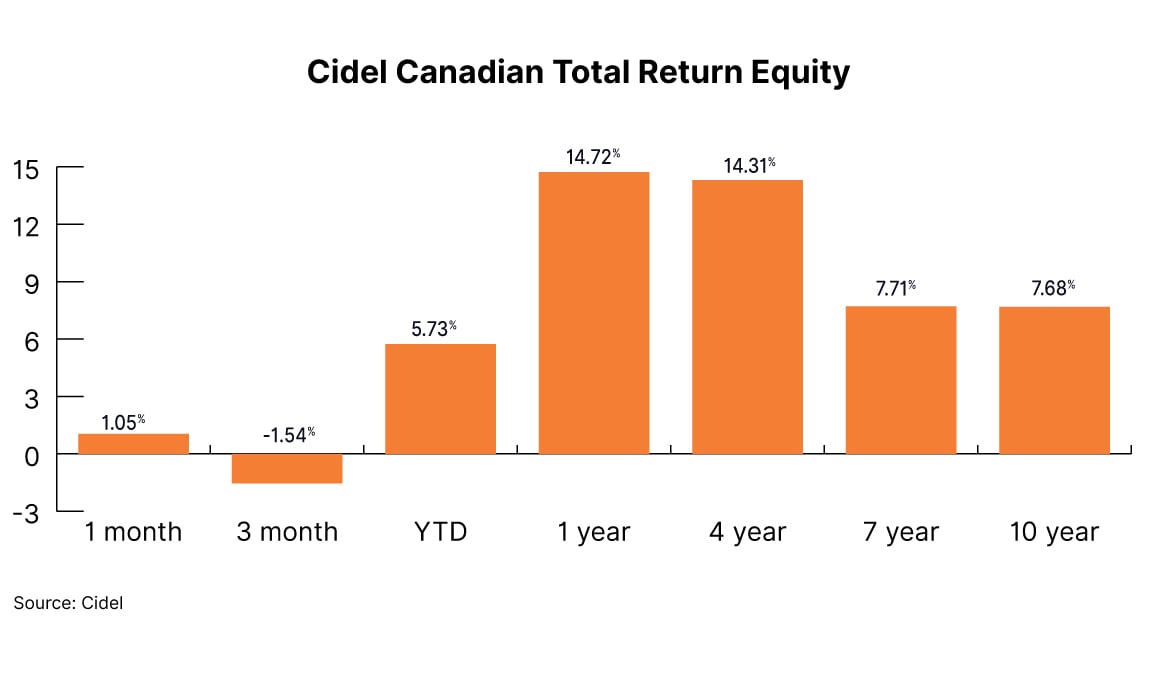

Sub-advisor spotlight: Cidel

Cidel is one of ATB Investment Management sub-advisors which focus on Canadian large-cap equities. Cidel’s investment strategy focuses on resilient, high-quality businesses that consistently grow their cash flow and are acquired at attractive valuations. They look for four core attributes to determine these quality companies:

- Sustainably competitive advantage

- Financial strength

- High return on capital with growth opportunities

- Predictability.

With the Canadian economy currently grinding under the pressure of higher interest rates and inflation, owning high-quality businesses is beneficial for limiting downside.

Cidel's historical performance record has shown:

- Downside protection, should the economy weaken further

- Compelling absolute and relative performance in a 'normal' market

- Strong absolute performance should a roaring bull market emerge.

These foundational values lead to a high-conviction portfolio of 30-40 Canadian equities.

This report has been prepared by ATB Investment Management Inc. (ATBIM). ATBIM is registered as a portfolio manager across various Canadian securities commissions, with the Alberta Securities Commission (ASC) being its principal regulator. ATBIM is also registered as an investment fund manager and manages the ATB Funds, Compass Portfolios and the ATBIS Pools. ATBIM is a wholly owned subsidiary of ATB Financial and is a licensed user of the registered trademark ATB Wealth.

The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that may reduce returns. Unit values of mutual funds will fluctuate and past performance may not be repeated. Mutual Funds are not insured by the Canada Deposit Insurance Corporation, nor guaranteed by ATBIM, ATB Securities Inc. (ATBSI), ATB Financial, the province of Alberta, any other government or any government agency. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Read the fund offering documents provided before investing. The Compass Portfolios and ATBIS Pools include investments in other mutual funds. Information on these mutual funds, including the prospectus, is available on the internet at www.sedar.com.

Past performance is not indicative of future results. Opinions, estimates, and projections contained herein are subject to change without notice and ATBIM does not undertake to provide updated information should a change occur. This information has been compiled or arrived at from sources believed reliable but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. ATB Financial, ATBIM and ATBSI do not accept any liability whatsoever for any losses arising from the use of this report or its contents.

This report is not, and should not be construed as an offer to sell or a solicitation of an offer to buy any investment. This report may not be reproduced in whole or in part; referred to in any manner whatsoever; nor may the information, opinions, and conclusions contained herein be referred to without the prior written consent of ATBIM.